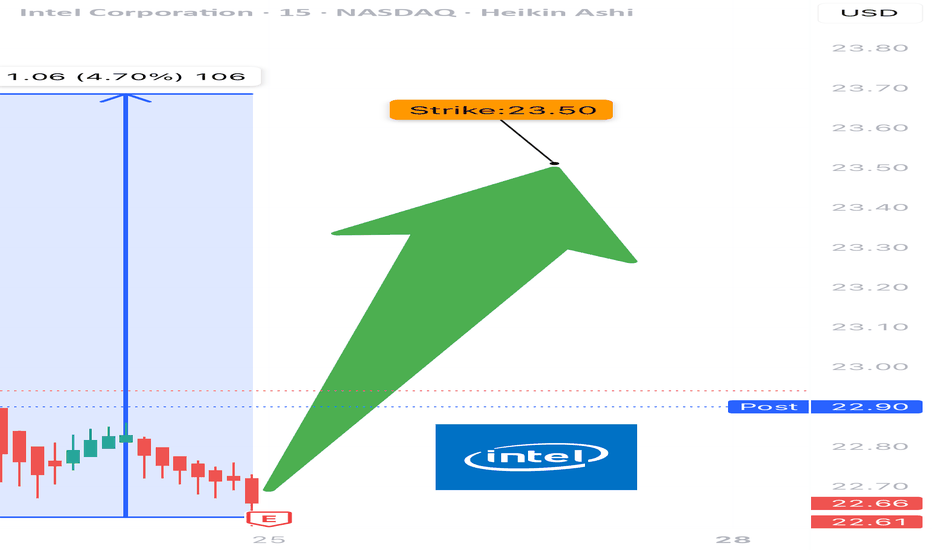

INTC EARNINGS TRADE (07/24)

🚨 INTC EARNINGS TRADE (07/24) 🚨

🎧 Earnings drop after close — here’s the high-conviction setup 📊

🧠 Key Highlights:

• 💥 Surprise Beat Rate: 88%, avg surprise = 419%

• 📉 Margins: Ugly (-36% net margin) but improving sentiment

• 📈 Volume Surge + $24 resistance test = pre-earnings drift 🚀

• 🔎 Mixed options flow → cautious bulls leaning in

• 🎯 Sector: SEMI = 🔀 rotating hard, competition vs AMD/NVDA rising

💥 TRADE SETUP

🟢 Buy INTC $23.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $1.18

🛑 Stop: $0.29

📈 Confidence: 75%

⏰ Entry: Before Earnings (Close 07/24)

📆 Earnings: Today After Market (AMC)

📊 Expected Move: 5%

⚠️ Play the earnings drift → gap up = profit. Miss = cut fast. Risk = defined. Reward = explosive.

#INTC #EarningsPlay #OptionsTrading #IntelEarnings #UnusualOptionsActivity #TechStocks #Semiconductors #TradingView #EarningsSeason #DayTrading #CallOptions

Intclong

Intel - The rally starts!Intel - NASDAQ:INTC - creates a major bottom:

(click chart above to see the in depth analysis👆🏻)

For approximately a full year, Intel has not been moving anywhere. Furthermore Intel now trades at the exact same level as it was a decade ago. However price is forming a solid bottom formation at a key support level. Thus we can expect a significant move higher.

Levels to watch: $25.0

Keep your long term vision!

Philip (BasicTrading)

Intel (INTC): Bullish Signs Emerging, Eyes on $75 ATHIntel (INTC) has started to show strong bullish signals, confirming a reversal after refusing to drop below $18. The stock has since climbed to $27, signaling renewed investor confidence and a potential breakout in the coming months.

Key Resistance Levels: The Path to $75

$30: The first critical resistance level that Intel must break to continue its bullish momentum.

$37: A key milestone that, if surpassed, would strengthen the uptrend.

$75 (All-Time High): The ultimate long-term target.

If Intel successfully breaks above $37, it could trigger a sustained rally toward its ATH of $75, potentially supported by industry advancements and stronger financial performance.

Risk Scenario: Consolidation and Potential Drop to $12

If Intel fails to break $30, it could enter a multi-year consolidation phase.

A prolonged range between $12 and $30 could play out if bullish momentum fades.

In a worst-case scenario, Intel could hunt the $12 level, creating a long-term accumulation zone before attempting another breakout.

Summary: Bullish Structure with Key Levels to Watch

Intel’s refusal to drop below $18 and its climb to $27 signal growing bullish momentum.

Break Above $30: Signals continuation to $37, then a long-term push toward $75.

Failure at $30: Could lead to a multi-year consolidation, ranging between $12 and $30.

The next few months will be crucial in determining whether Intel resumes a strong uptrend or enters a long accumulation phase before the next major breakout.

Intel ($INTC) at a Crossroads: Breakup Talks, Market PressuresIntel Corporation (NASDAQ: NASDAQ:INTC ) finds itself at a critical juncture as reports emerge about Broadcom and Taiwan Semiconductor Manufacturing Co. (TSMC) exploring potential deals that could split the storied chipmaker into two entities. This revelation comes amidst Intel’s ongoing struggles in maintaining its dominance in the semiconductor industry, intensified by leadership changes, manufacturing setbacks, and increasing market competition.

Broadcom & TSMC’s Interest in Intel

The Wall Street Journal recently reported that Intel rivals Broadcom and TSMC are each considering deals that would divide the company. Broadcom is reportedly analyzing Intel’s chip design and marketing business, with discussions about a potential bid, though any move would depend on securing a partner for Intel’s manufacturing division. Meanwhile, TSMC has expressed interest in taking control of Intel’s chip plants, potentially through an investor consortium.

The U.S. government is closely monitoring these developments, as Intel is viewed as a company of national security significance. Reports indicate that the Trump administration is unlikely to support a foreign entity operating Intel’s U.S. factories, adding an additional layer of complexity to any potential deal.

Intel was a major beneficiary of the Biden administration’s push to onshore semiconductor manufacturing, securing a $7.86 billion government subsidy. However, the company has struggled to execute its ambitious plans. Former CEO Pat Gelsinger set high expectations for Intel’s manufacturing and AI capabilities, but his failure to deliver led to lost contracts, a 60% drop in the company’s stock value in 2023, and layoffs affecting 15% of its workforce.

Technical Outlook

Intel’s stock (NASDAQ: NASDAQ:INTC ) closed last Friday’s session down 2.2%, but premarket trading on Monday shows signs of recovery with a 0.06% uptick. The technical indicators suggest that NASDAQ:INTC could be on the cusp of a bullish reversal, contingent on broader market sentiment.

The Relative Strength Index (RSI) for Intel stood at 68 on Friday. This reading positions the stock near the overbought threshold but also signals that momentum is building towards a potential breakout. Also, Intel is currently trading above key moving averages, reinforcing a bullish sentiment in the near term.

Should a pullback occur, immediate support is found at the 38.2% Fibonacci retracement level, which may serve as a demand zone for NASDAQ:INTC shares. In the event of extreme selling pressure, a drop to the one-month low of $18.50 could materialize, though such a scenario would require a significant bearish catalyst.

If bullish momentum takes hold, a breakout above resistance levels could push Intel’s stock higher, aligning with analyst expectations. The 12-month price forecast for NASDAQ:INTC stands at $25.69—an 8.86% increase from its current price.

Conclusion

Intel’s potential breakup remains speculative, but the fundamental challenges it faces underscore why such discussions are taking place. While concerns about cash flow, leadership changes, and market competition weigh on the stock, technical indicators suggest that NASDAQ:INTC may be approaching a bullish reversal.

With a critical trading week ahead, investors should monitor key support and resistance levels while staying informed about any further developments in the Broadcom and TSMC discussions. If Intel successfully capitalizes on government support and restructures its strategy, a resurgence in investor confidence could follow, pushing NASDAQ:INTC back into bullish territory.

Intel Time To Wake UpIntel, which has received a very strong reaction, I think it will now try the above prices. Especially the last 3 dips it made look good. We can also expect a rapid rise when it breaks the falling resistance. I think pullbacks will be a buying opportunity. The 29 area awaits as a serious resistance.

The Giant's Rebirth: Long-Term Prospects for INTCIn times when the market seems on the verge of falling, opportunities arise that only the most astute investors are able to recognize. We are now witnessing one of those rare moments with INTC. The events of the last few days, in which the CEO was forced to resign or be fired, mark not just a corporate reshuffle, but perhaps a historic turning point. History teaches us that such significant leadership changes are often harbingers of recovery and growth. Watching the price-to-sales drop to levels we've only seen in the darkest times of the past indicates that we may have hit bottom. This is not just a signal, it is a once-in-a-decade chance. INTC now offers us a unique opportunity for long-term investing with minimal risk. We are not talking about short speculation; this is an investment in the future of a company that is on the cusp of new growth. If we look at the patterns of past recoveries, we see that such situations often precede multi-year upturns. Looking at all aspects, I would rate this opportunity as having a tremendous probability of success. We are facing potential huge long-term profits. This is not just an investment; it is a bet on the revitalization of a company that is now at the bottom of its cycle, but with tremendous upside potential. This may be one of those rare occasions when we can buy at the very beginning of a recovery, when all market fears turn into strategic advantages for those willing to look beyond the current news.

Horban Brothers,

Alex Kostenich

Intel - Still Got Another +15% From Here!Intel ( NASDAQ:INTC ) is perfectly respecting structure:

Click chart above to see the detailed analysis👆🏻

For more than two decades, Intel has not been trading in any clear trend. We saw a lot of swings towards the upside which were eventually always followed by corrections, making Intel a very easy to trade stock. After the current retest of support, a move higher will eventually follow.

Levels to watch: $20, $27

Keep your long term vision,

Philip (BasicTrading)

Intel - Back To A Bullish Market!Intel ( NASDAQ:INTC ) perfectly rejected a major previous support:

Click chart above to see the detailed analysis👆🏻

After being cut in half multiple times over the past couple of months, Intel finally managed to reverse at a strong previous support level. However market structure is still clearly not bullish and Intel has to break above the next resistance to start creating a new overall uptrend.

Levels to watch: $26, $20

Keep your long term vision,

Philip (BasicTrading)

Intel Stock Surges Over 8% Amid Strategic ExplorationOverview:

Intel Corporation (NASDAQ: NASDAQ:INTC ) saw its stock rise more than 8% in early trading on Friday, sparking optimism among investors weary of the chipmaker’s prolonged slump. The surge followed reports that Intel is working with investment bankers to explore strategic options, including a possible business split or merger. This news arrives as the company grapples with financial setbacks and struggles to catch up with competitors like Nvidia and AMD in the AI-driven chip market.

Strategic Moves to Reignite Growth:

According to Bloomberg News, Intel (NASDAQ: NASDAQ:INTC ) is considering a range of options that could fundamentally alter its business structure. Among the possibilities is the separation of its flagship product division from its loss-making manufacturing unit, which has been a drag on overall performance. Intel’s efforts to expand its foundry services and chip production capabilities have strained its finances, prompting the company to reevaluate its investment priorities. The company is also reportedly contemplating the cancellation of some factory projects, a move that would help alleviate capital expenditures and refocus resources on more profitable ventures.

These potential changes come as Intel’s market value recently dipped below the $100 billion mark, a first in three decades. The strategic review, which involves financial advisors like Morgan Stanley, reflects Intel’s urgency to regain investor confidence and reposition itself in a competitive market increasingly dominated by rivals.

Fundamental Analysis:

Intel’s recent struggles are well-documented, with the stock plummeting nearly 60% this year alone. The downturn has been exacerbated by a disappointing earnings report in August, a decision to pause dividend payments, and a series of layoffs impacting 15% of its workforce. These challenges highlight Intel’s ongoing difficulties in executing its turnaround plan under CEO Pat Gelsinger.

Despite the headwinds, Intel’s decision to explore strategic alternatives could mark a pivotal moment for the company. A split or divestiture of underperforming units may unlock value and allow Intel to focus on core competencies, such as chip design and innovation. The company’s latest developments also coincide with Gelsinger’s commitment to launching next-gen processors like the Lunar Lake, which are expected to enhance Intel’s position in the laptop market.

However, the path to recovery won’t be easy. Intel continues to lag behind Nvidia and AMD, especially in the AI chip space, where both competitors have gained substantial market share. Nvidia’s dominance in GPUs, which are critical for AI applications, has left Intel struggling to stay relevant in an industry that is rapidly evolving.

Technical Analysis:

From a technical perspective, Intel’s stock is showing signs of a potential bullish reversal. As of this writing, the stock is trading up 9%, with a Relative Strength Index (RSI) of 45, indicating it is neither overbought nor oversold and suggesting room for additional upward momentum. The daily price chart reveals a gap-down pattern that Intel appears poised to fill, which aligns with common trading strategies that anticipate price recovery in such scenarios.

However, caution is warranted as Intel’s stock is currently trading below key moving averages, including the 50-day, 100-day, and 200-day Moving Averages (MA). This positioning underscores the stock’s ongoing challenges and serves as a reminder that while the recent rally is encouraging, the overall trend remains bearish.

Investor Sentiment and Market Impact:

Investor sentiment around Intel (NASDAQ: NASDAQ:INTC ) has been decidedly bearish for much of 2024, with many attributing the company’s decline to missed opportunities in the AI boom and operational missteps. Intel’s consideration of strategic options is seen as a proactive step to address these concerns, and the initial market reaction suggests that investors are hopeful about the potential outcomes.

Analysts note that a split or divestiture could provide Intel with much-needed focus and financial flexibility, allowing it to better navigate the competitive landscape. The company’s ability to pivot and implement these changes effectively will be crucial in determining its future trajectory.

Conclusion:

Intel’s exploration of strategic alternatives has provided a glimmer of hope for investors amid a challenging year. While the stock remains under pressure, both technically and fundamentally, the proactive steps being taken by management signal a willingness to address longstanding issues. With room for growth indicated by technical indicators and the potential for significant business restructuring, Intel’s future will largely depend on its execution of these strategic options.

For now, the market’s positive response reflects cautious optimism that Intel can turn the corner and reestablish itself as a formidable player in the semiconductor industry. Investors should keep a close watch on the upcoming board meeting in September, where Intel’s advisors are expected to present their recommendations—a pivotal moment that could shape the company’s direction for years to come.

Intel | INTC | Long at $20This is going to be purely about technical analysis since Intel NASDAQ:INTC has a 90x P/E and has not proven themselves to be a viable challenger in the semiconductor market (yet...). Bad news could continue to destroy this ticker, but without that news, there could be some recovery in the near term.

The NASDAQ:INTC chart is in an overall downward trend. However, based on a few of my selected simply moving averages (SMAs), there is some predictability around support/resistance areas. Some of my favorite setups are a nice bounce on the lowest (green) selected SMA, occurring in October 2022 for a "rip then dip" to the second lowest (blue) - which it hit now. Often, but not always (I can't stress this enough), this green to blue SMA bounce represents a very strong support area during a downward trend. The other move is a further dip to retest the green SMA, but I suspect that would come with tremendously bad news for Intel... let's hope not, though.

Currently, NASDAQ:INTC is in a personal buy zone at $20.00 based on technical analysis only. A stop has been set if it drops below the blue SMA (which is may further test).

Target #1 = $28.00

Target #2 = $32.00

Target #3 = $60.00+ (very long-term, but high-risk unless fundamentals change)

Intel - Retest, reversal and rejection!NASDAQ:INTC has been establishing a slight bullish trend over the past couple of years.

A clear trend is the basis of every profitable trade, right? Yes and no. You should primarily focus on trading trends and entering positions during such phases. But Intel is a textbook example of a range bound stock; still there are trading opportunities everywhere. Currently Intel is retesting support and is starting to reverse towards the upside. But please: Manage your risk properly.

Levels to watch: $30, $45

Keep your long term vision,

Philip - BasicTrading

Intel - Stop the bleeding!Hello Traders and Investors, today I will take a look at Intel .

--------

Explanation of my video analysis:

In the beginning of 2023 Intel stock retested a multi year long horizontal structure at the $26 level. Here Intel created bullish confirmation and took off, creating a crazy rally of +100% within a couple of months. Then we saw a false breakout towards the upside which was followed by an incredible sell off. At the moment Intel is retesting support so we might see a short term short covering rally.

--------

Keep your long term vision,

Philip (BasicTrading)

Intel - What is going on?Hello Traders and Investors, today I will take a look at Intel Corporation.

--------

Explanation of my video analysis:

In April of 2022 we saw a major break towards the downside on Intel stock which was then followed by more bearish continuation of roughly -65%. Then Intel retested a multi year long structure and created a pretty decent bullish reversal and a strong (short covering rally). At the moment Intel just rejected previous structure and is now in a massively bearish market soit is best to just wait for this volatility to calm down.

--------

Keep your long term vision,

Philip (BasicTrading)

INTC Swing Ling Aggressive Counter Trend TradeAggressive Counter Trend Trade 12

- short impulse

+ volumed T1

+ bigest volume Sp

+ weak test

+ first bullish bar closed level entry

Calculated affordable virtual stop loss

1 to 2 R/R take profit

Daily Chart Context

- short impulse

+ biggest untested volume T1

+ biggest volume Sp

Hourly Chart Context

- short impulse

+ volumed T1

+ bigest volume Sp

+ weak test

+ first bullish bar closed level entry

INTC Long Day Conservative Counter Trend Trade Conservative Counter Trend Trade 12.1

+ long impulse

- volumed expanding T2

- 1/2 correction

+ support level

+ biggest volume manipulation

+ closed above support level

Calculated affordable virtual stop loss

1 to 2 R/R take profit

Hourly Context:

- short impulse

+ volumed T1

+ bigest volume Sp

+ weak test

+ first bullish bar closed level entry

Daily Context

- short impulse

+ biggest untested volume T1

+ biggest volume Sp

Monthly Context

+ long impulse

+ SOS level

+ support level

+ 1/2 correction

Intel - Potential Trading SetupHello Traders, welcome to today's analysis of Intel.

--------

Explanation of my video analysis:

In 2017 we had a major triangle breakout on Intel which was followed by a +70% rally. Then in 2022 Intel broke major support towards the downside and reversed perfectly at a major previous structure. Since Intel is now back to a bullish market, I am just waiting for a retest of the level mentioned in the analysis and then I will be looking for long continuation setups.

--------

I will only take a trade if all the rules of my strategy are satisfied.

Let me know in the comment section below if you have any questions.

Keep your long term vision.