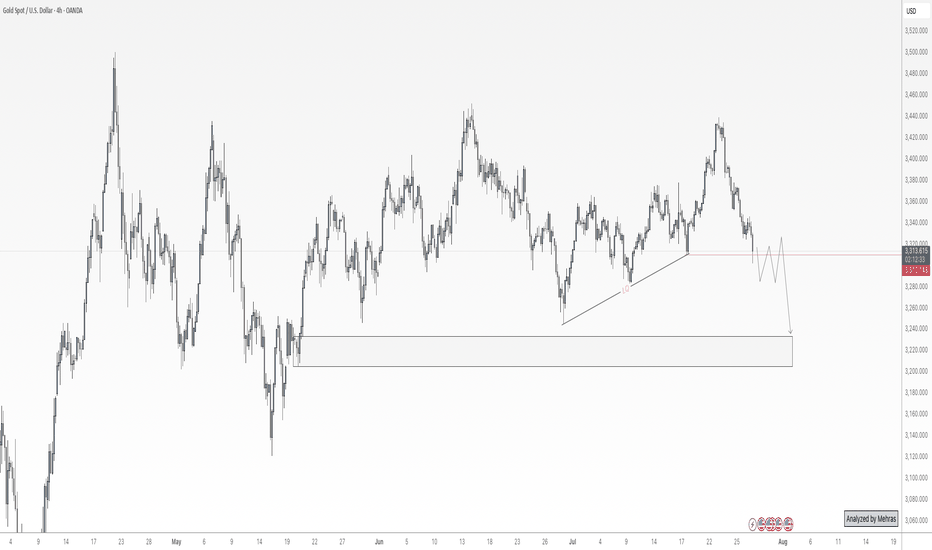

Gold at a Crossroads: $100 Drop Ahead or New All-Time High?Gold is now sitting at a critical decision zone near the $3300 level — a key bank-level area. If we see a daily candle close below this level, I anticipate a minimum drop of 1,000 pips, with the first major support around the $3220–$3200 range. The $3200 level is extremely significant, and I’ll discuss its importance more in future updates if necessary.

On the flip side, if buyers step in and we get a daily close above $3300, I still believe it’s too early to jump into longs. The selling pressure remains quite obvious, and we’ve already seen multiple failed attempts to push beyond this level toward the $3500 all-time high. That tells me the orders at this level might be exhausted.

Personally, I’ll only consider a long position if we get at least a clean 4-hour candle close above $3350.

It’s going to be an exciting week ahead with high-impact data releases including ADP, Core PCE, the Federal Funds Rate — and most importantly, Friday’s NFP.

📌 Stay tuned for updates throughout the week!

Disclaimer: This is not financial advice. Just my personal opinion!!!

Interestrate

US30Y Bullish ideaThis is a potential idea of the 30 year bond yield potentially having movement to the upside. We have already reached into a daily volume imbalance and weekly volume imbalance. We also have a monthly order block that is acting as support combined with our volume imbalance levels. We also have relative strength with the US30Y against the US10Y and US5Y. Could be a potential idea to look for bullish ideas with the the fact that we are in a potential point were we could have a Quarterly shift.

*Targeting

A move to the upside were we have buyside liquidity and the 4H fair value gap.

ORAS Stock Fundamental AnalysisORAS trend was neutral between the support line 266.851 and the resistance line 291.935, the trend was down by 0.14%. The stock rose, and broke the first support line to reach the second support line 267.905, then the third support line 268.432. It's expected to keep rising till reaching the resistance line 290.144, then 290.671, because of the CBE's decision about cutting the interest rate by 2.25% which will have a positive impact on corporates because according to the current reasons behind the economic activity decreasing interest rate will lead to decreasing the cost of borrowing which will decrease the cost of production and will increase the corporates' profit and their monetary value. On the other side, this will decrease the products' price and individuals will have a higher will to diversify their investment beside increasing their purchasing power as well.

$USINTR -U.S Interest Rates ECONOMICS:USINTR

(January 2025)

source: Federal Reserve

-The Fed kept the funds rate steady at the 4.25%-4.5% range as expected, pausing its rate-cutting cycle after three consecutive reductions in 2024.

The Fed showed more optimism about the labor market and noted that inflation remains somewhat elevated, removing the reference to ongoing progress toward the 2% target.

The Fed also said the economic outlook is uncertain, and is attentive to the risks to both sides of its dual mandate.

Dollar begins to rebound after NFP data

The Fed's possibility of making another jumbo cut quickly faded following September's NFP report, which renewed confidence in the US job market. According to CME FedWatch, the likelihood of a 50bp cut at the November FOMC has dropped from 36.8% to 0%, while the probability of a 25bp cut has surged to 88.8%. It's worth noting that the likelihood of a rate freeze has risen from 0% to 11.2%. Due to this, the dollar bounced back swiftly as expectations grew that the Fed's dovish stance would not persist.

DXY quickly breached the trendline and climbed above the 102.50 level. The price holds above both EMAs, sending out an apparent bullish signal. If DXY sustains support above both EMAs, the price could gain upward momentum toward the 103.30 resistance. Conversely, if DXY breaks the 101.60 support, where EMA21 coincides, the price may fall further to 101.10.

Fed’s Rate Decision to Set the Tone for Stocks, Gold and CryptoOfficials at the central bank are staying tight-lipped over the magnitude of the interest rate cut. What we know so far: there will be one. What we don’t know: is it going to be 25bps or 50bps?

Federal Reserve Chairman Jay Powell (or JPow if you’re a cool kid) is most likely having a hard time sleeping these days. Lurking in the near distance, September 18 to be precise, is a decision he should make that has the power to slosh trillions of dollars across global markets.

Stock valuations, crypto prices and the glow of gold all hinge on a single figure — the US interest rate ( USINTR ). Major central banks are on the move to unwind their restrictive monetary policies, especially when it comes to global interest rates . Investors have been trying to run ahead of the interest rate decision and position their portfolios to accommodate both a small casual trim to borrowing costs but also a bigger, juicier slash.

Clashing opinions over the size of the interest rate reduction have been swaying the financial markets in recent weeks. Fed officials haven’t sent out any comms regarding that question so markets do what they do best — speculate.

According to the FedWatch tool by CME Group, at the end of this week, investors were nearly even in their expectations for the upcoming interest rate cut with 55% calling for a 25bps (basis points) cut and 45% rooting for the fuller treatment of 50bps.

In any case, this would be the Federal Reserve’s first cut to borrowing costs in more than four years. The benchmark rate in the US is currently sitting at a 23-year high of 5.5% — a level that has stayed flat since July.

After a series of reports pointing to a wobbling economy — and on the back of mostly receding inflation — the central banking clique issued its uplifting guidance at their previous meeting, saying rates are about to go down when they meet again. But what they didn’t say — because they’re data dependent — is how much.

A 25bps cut to interest rates would most likely be already priced in across the spectrum. Stocks, the US dollar, gold and even cryptocurrency are now acting as if this level of rate cut is factored in. Moreover, some investors might even be disappointed to see a rate cut of that casual magnitude. Buy the rumor, sell the news, maybe?

A 50bps cut to interest rates could bring some needed fuel for the next leg up in stocks, gold and crypto. And, on the flip side, knock the dollar’s valuation.

Lower interest rates make money more affordable, enticing investors, businesses and consumers to get more cash out of the bank and spend more freely on big-ticket purchases. Obviously, investors shove the cash into various markets. Businesses expand operations and build new products. And consumers, well, they buy the new iPhone 16 and jam what's left in meme stocks ?

Perhaps even more importantly, lower interest rates help steer the economy, keeping it on an upward trajectory. Liquidity improves, because there’s more money flowing in the system, and valuations of public and private assets usually increase.

Take gold ( XAU/USD ), for example. Gold hit an all-time high Friday morning, pumping above $2,570 per ounce . Driving the gains was the relationship between gold and the prospects of lower rates, which make bullion more appealing because they reduce the opportunity cost of holding a non-yielding asset. At the same time, the US dollar loses some of its allure because the reduction in rates triggers a lower yield on dollar deposits.

Bitcoin ( BTC/USD ) is another interest -ing candidate to join the rate interplay. The OG token has been increasingly correlated to macroeconomic factors and the rate decision is already seen impacting its price in a positive way.

Stocks have been in choppy trading mode over the past couple of months largely due to the looming uncertainty about the looming rate-setting meeting.

So what do you think it’s going to be — 25bps or 50bps? And how would it affect financial markets? Shoot your thoughts below!

TBT is a buy rate cuts likely are stalled LONGTBT is an inverse 20 year Treasury Bill ETF. At present, the Iran Israeli conflict threatens a

regional conflict to include the Red Sea and the Easter Mediterranean where oil tankers must

navigate to move oil from producer to consumer. Oil price escalation could go hand and hand

with geopolitical escalations. Oil and its derivatives are a primary driver of inflation in the

US. Inflation has been sticky and forcing the fed's ambitions to cut rate to be paused. The

Middle East escalation may make matters worse overall. Federal spending ( aid to Israel for

instance) is also a driver of inflation. The budget fight in DC is front and center. I see this

as good cause, to continue to take adds to my TBT position whenever I can find a dip worth

the discount as a further hedge against a correction in the equities markets which could come

on the horizon. Granted a dip of 2-3% from the ATHs is not much but when it hits 10% or more

and the VIX/UXXY continue to rise, there will be impetus in a hurry to hedge positions or close

them with more urgency. For for TBT, I believe that more is better.

Differentiate between rate cut and low interest rateNo important economic data from US this week, only trade balance and initial claims to observe on Tue and Thu respectively.

US stock market continued decline on Fri, following weakening labor market conditions and earnings from big tech companies last week.

In expectations of rate cut, big shots are reducing portfolios. The situation may last until we actually see the first rate cut in the cycle and longer.

The rise in stocks is usually associated with low interest rate, I would expect the adjustment in S&P to continue along the path of rate cut. So investors should differentiate between rate cut action and low interest rate, which are presented as two distinguished market conditions.

Focus on Buying Opportunities and Key Event AlertThis week, I’m focusing on buying opportunities more than shorting. Here's a key level and some important advice if you’re trading Japanese Yen related pairs.

Current Overview:

- Key Level for Buying:

1. Support Level: 153.45

2. What to Do: Wait for a Magic Candle Confirmation at this level to enter a buy position.

Important Event Alert:

- Date: 31 July

- Event: Bank of Japan (BOJ) Interest Rate Decision

- Impact: Whether the BOJ increases the Japan Interest Rate or not, it will significantly affect the Japanese Yen movement.

Strategy:

1. Magic Candle Confirmation: At 153.45, wait for this confirmation before entering a buy position.

2. Managing Running Trades:

- 50 Pips Profit : If you have a running profit of 50 pips or more, consider shifting your stops to entry to protect yourself from undesirable surprises.

- Less Than 50 Pips Profit: Start planning your trade move before the BOJ announcement.

Key Considerations:

- Exiting Trades Before Announcement: Decide if you’re comfortable exiting your trades before the Bank Rates announcement, even if the market moves significantly in your favour.

- Holding Through Announcement: Alternatively, consider the risk of holding through the announcement and how you’d manage your trade based on the market reaction to the BOJ decision.

Final Thoughts:

Be cautious and plan your trades carefully this week. Whether you choose to protect your profits or take a risk on the BOJ announcement, make sure you’re prepared for any outcome.

What’s your plan for this week? Are you focusing on buying opportunities or do you have a different strategy? Share your thoughts and strategies below!

Happy trading, everyone! 🚀

GBPUSD - OFFICIAL BANK RATE RELEASE 20 JUNEI would expect a temporary bullish after the news from BOE interest rate.

Based on my sole opinions, there might be no changes from the forecast of 5.25% due to UK inflation rate is under control.

Based on price action, I have created a new dealing range from Tuesday 18 June - Low to yesterday High. For the Pound to be bullish , I want to see that price draw liquidity below the 0.5 range.

At the extreme, price may reach around 0.25 range.

Price expected to rise gradually to draw liquidity on yesterday highs and into H4 FVG.

If this is played out, I would expect a bearish outcome.

Turtle soup strategy.

BITCOIN: Interest Rate Unchanged - What's next?The interest rate remains unchanged while the BTCUSD price is struggling at a trend resistance.

The Fixed Range Volume Profile confirms the strong resistance at $69.5k.

BTC is now aiming for lower highs (confirmed today) and lower lows, with the next short-term support being located at $64k.

My short position is open.

Cheers,

Ares

ETH - Bow and Arrow Trade!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 ETH has been overall bullish, trading above the rising trendline marked in blue.

After rejecting the $4,000 - $4,100 resistance zone, ETH is undergoing a correction phase and it is currently hovering around the $3,500 round number.

If the $3,500 is broken downward, a deeper bearish correction towards the $3,100 demand zone would be expected.

🏹 The highlighted blue circle is a strong area to look for trend-following buy setups as it is the intersection of the green demand zone and blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As ETH approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

CPI & FOMC JUNE 12th Massive day for BTC, crypto and the broader markets as CPI and FOMC take place in a time where BTC has taken a dive back towards the range MIDPOINT.

Both CPI & FOMC are forecast to be non movers, with 3.4% and 5.5% respectively. Last month CPI was the catalyst for the move from 0.25 to range high, however some of that hard work has been undone in recent days.

I would like to see the same kind of move but this time from the MIDPOINT which often provides a better starting point to a move. What we don't want to see if BTC is to keep bullish HTF momentum is lingering around the midpoint level with a view to target range lows yet again. Buyers need to come in fast before momentum is lost.

With sentiment so low but price constantly knocking at the door of ATH, ETF's being approved leading to institutional investment, mining rewards halved and a US election on the way this year. Big things are about to happen in the world of cryptocurrency and Bitcoin is the one leading the charge as it so often does.

Be greedy when others are fearful springs to mind. There is definitely fear in the market and its participants, The chart once you zoom out does not give me reason to be fearful just yet, this is a Bullrun and dips like these can be turned into wins.

Inverted Yield of 2022 Explained - Till TodayFor our housing loan, many of us, if you are in your 30s today and all the way to 70 years of age, will likely have chosen floating or short-term loan rates rather than longer-term loan rates. However, everything changed in 2022. Now, we are more likely to choose longer-term loan rates over floating rates. Why? Because today, longer-term loan rates are lower than floating rates.

This phenomenon is called an inverted yield curve.

In the 70s and 80s, there was also a period of inverted yields, and different markets moved accordingly as expected. Today, we are seeing an inverted yield once again, and the same markets are moving in a manner similar to those in the 70s and 80s.

We will do a comparison between the 70s and today’s inverted yield. Please let me know what opportunities you see after this tutorial.

2 Year Yield Futures

Ticker: 2YY

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

10 Year Yield Futures

Ticker: 10Y

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Market Analysis: XAUUSD and EGX30 Performance Market Analysis: XAUUSD and EGX30 Performance amid Liquidity Concerns, Corridor Rate Speculations, and Geopolitical Influences

Recent market observations indicate that the XAUUSD (Gold/USD) is experiencing a significant upward trend, potentially reaching new record highs. Conversely, the EGX30 index, whether evaluated in Egyptian Pounds (EGP) or USD, is currently facing substantial liquidity shortages. This disparity highlights critical trends in the local financial markets, influenced by both domestic and international factors.

Central Bank Policies and Corridor Rate Speculations:

Circulating rumors suggest that the central bank might choose to maintain the current corridor rate or possibly reduce it. Such monetary policies could have notable implications for the economy. Specifically, a reduction in the corridor rate may result in a leakage of money supply from the banking system. This excess liquidity could subsequently flow into alternative investment avenues such as the local physical gold market or the EGX30 index.

Geopolitical Influences:

Globally, geopolitical tensions have been on the rise, including ongoing conflicts in the Middle East, trade disputes between major economies like the US and China, and political instability in various regions. These issues contribute to the uncertainty in the global financial markets, often driving investors towards safe-haven assets like gold. Additionally, the fluctuations in oil prices due to geopolitical instability directly affect economies like Egypt, where energy imports constitute a significant part of national expenditure.

Historical Example: Post-2008 Financial Crisis

Context:

After the 2008 financial crisis, central banks worldwide, including the Federal Reserve in the United States, implemented significant monetary easing policies. This period saw historically low interest rates and large-scale asset purchases (quantitative easing, or QE).

Parallel Events

1. Surge in Gold Prices:

- The uncertainty in global markets and concerns about fiat currencies led to a surge in gold prices. Investors flocked to gold as a safe-haven asset amid fears of inflation and currency devaluation.

- By 2011, gold prices soared to record levels above $1,900 per ounce, reflecting a trend of increasing demand for physical gold as a hedge against economic instability and geopolitical risk.

2. Equity Market Performance:

- In emerging markets, including Egypt, stock indices like the EGX30 experienced variable performance. The liquidity injected into the financial system often bypassed stock markets in these regions, leading to periods of underperformance.

- The EGX30 index, for instance, faced challenges during certain periods post-2008 due to political instability, economic reforms, and regional geopolitical tensions, which affected investor confidence and liquidity flows into the market.

Policy Decisions:

- Central Bank Actions:

- Central banks worldwide, faced with the dual mandate of stimulating growth and controlling inflation, kept interest rates low for extended periods. The Federal Reserve, for example, maintained near-zero interest rates and continued its bond-buying program until 2014.

- In Egypt, the Central Bank of Egypt (CBE) also made critical rate decisions, including rate cuts aimed at stimulating economic activity, which had implications for liquidity distribution across different asset classes.

Impact on Markets:

- **Gold Market:**

- The policies led to increased money supply in the global economy, which, combined with economic and geopolitical uncertainty, bolstered the demand for gold. The gold market thrived as investors sought refuge from volatile stock markets and potential inflationary pressures.

- **Stock Market (EGX30):**

- The EGX30 and similar indices in emerging markets struggled with liquidity issues as investors prioritized safer or higher-yielding assets abroad or in commodities like gold.

- Any central bank decision to adjust interest rates would have a direct impact on the flow of money, often leading to short-term capital flight from equities when rates were cut, as investors searched for higher returns or more stable investments.

**Conclusion:**

The post-2008 scenario illustrates how central bank policies, particularly regarding interest rates, can lead to a reallocation of assets from stock markets to commodities like gold. The performance of the EGX30 during this period was influenced by global monetary trends, domestic economic conditions, and significant geopolitical events. This interconnectedness of liquidity, investor behavior, market performance, and geopolitical dynamics underscores the complex nature of financial markets.

🔥❤️GOLD TO 2370-2390🔥❤️❤️MY FOREX TEAM❤️

INFORMATION

Gold price continues to rise amid growing geopolitical tensions. Gold prices hit record highs above $2,350 even as rate cut bets ease. A rally in gold persisted even as technical indicators showed the yellow metal was squarely in overbought territory.

💲BUY / SELL SIGNAL UPDATES SHORTLY💲 Follow channel for regular updates

Everyone success..👍👍👍

❤️MY FOREX TEAM - Technical Analysis

Technical indicators SMA | EMA | MACD | SAR | VWAP | RSI | MARKET TREND | NEWS

❤️NOTE

Gold price soars, supported by weakening US Dollar in face of high Treasury yields.

XAU/USD was boosted by Fed Chair Powell hinting at rate cuts within the year, contingent on sustained inflation decline.

Despite a strong job market as shown by ADP data, indications of a slowdown in services activity contribute to the precious metal's gains.

❤️MONEY CAPITAL MANAGEMENT

⚡️ Only Trade With Risk Capital

⚡️ Cut Losses Short, Let Profits Run On

⚡️ Avoid Using Too Much Leverage

⚡️ Avoid Taking Too Much Heat

⚡️ Do Not Give in to Greed

⚡️ Take profit equal to 4-6% of your capital

⚡️ Stop lose equal to 2-3% of your capital

EURCHF Technical Trends and SNB Policy DynamicsLooking ahead to the upcoming week, our strategic focus centers on EURCHF, as we actively evaluate a potential buying opportunity within the 0.94600 zone. The technical analysis reveals that EURCHF has been consistently advancing in an uptrend, showcasing a noteworthy upward trajectory. Currently, the currency pair is in the midst of a correction phase, steadily approaching the critical 0.94600 support and resistance area.

Adding a numerical dimension to our assessment, let's consider the recent policy decisions by the Swiss National Bank (SNB) from December 15, 2022, to the most recent update on September 21, 2023. The SNB initiated a significant shift by setting the interest rate at -0.25% on September 22, 2022, and has since made subsequent adjustments. The recent decision last Thursday, on September 21, 2023, reflects the SNB's choice to maintain interest rates unchanged, citing a backdrop of easing inflation.

This dovish stance by the SNB not only aligns with the technical analysis pointing towards a correction in EURCHF but also sets the stage for a potential continuation of CHF weakness. The confluence of technical indicators, recent policy decisions, and numerical data heightens our interest in monitoring EURCHF for a buying opportunity. As we progress through the upcoming week, our strategic approach is to navigate and capitalize on the evolving market dynamics, leveraging the identified buying potential within the specified numerical zone.

Yield Curve Flattening. Can the Fed afford to pull the trigger??The U.S. Yield Curve (US10Y-US02Y) flattening is a textbook sign of recession. However the S&P500 (blue trend-line) keeps recovering and rising from the 2022 Inflation Crisis. At the same time, the Inflation Rate (black trend-line) may have taken a pause but is on a strong decline, while the Interest Rate (orange trend-line) is turning sideways.

The question on everyone's mind is this: "Can the Fed afford to pull the trigger and start lowering rates again?". There is no easy answer to this. Recent history on this chart shows that a rising curve along with lowering interest rates and inflation decline is correlated with Bear Cycles. Notable examples are 2007 - 2008 and 2000 - 2001. At the same time notable exception is 2020. In 1995 both Interest and Inflation rates turned sideways so the stock market extended the aggressive rally into the DotCom bubble.

In 1989 - 1990 however, the Curve flattening coincided with a non-stop drop on the Interest rate while in late 1990 Inflation also started to drop. The stock market didn't enter any Bear Cycle but insted kept rising slowly but steadily. Approximately what is taking place now. Do you think we are in a same pattern and stocks will be unfazed if the Fed starts lowering the rates?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCAD Weekly Forecast Overnight Rate | 4th June 2023Fundamental Backdrop

Overnight Rate on Wednesday is expected to maintain at 4.50%

Technical Confluences

Resistance level at 1.36374

Support level at 1.33166

Idea

If the Overnight Rate maintains at 4.50% as expected, we could see the price drop towards the support level at 1.33166.

However, if the Overnight Rate increases, we could see the price rise towards the resistance at 1.36374.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

10Y Rate - Headed HigherToday you can review the technical analysis idea on a 1W linear scale chart for 10 Year Treasury Yield (TNX).

In December 2021, I posted a chart showing that the 10Y rate was going to go much higher. I was exactly on point almost to the exact number.

Today I was reviewing the 10Y rate chart and saw the RSI formed a double bottom base with the 10Y rate ready to make another move higher. I also added in the Keltner Channel indicator which shows that when the 10Y rate is higher than the median line, there is a strong chance it touches the top of the Keltner Channel. I see the 10Y as well as other long term rates going much higher as shown in the chart.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #millionaireeconomics