10Y Rate - Headed HigherToday you can review the technical analysis idea on a 1W linear scale chart for 10 Year Treasury Yield (TNX).

In December 2021, I posted a chart showing that the 10Y rate was going to go much higher. I was exactly on point almost to the exact number.

Today I was reviewing the 10Y rate chart and saw the RSI formed a double bottom base with the 10Y rate ready to make another move higher. I also added in the Keltner Channel indicator which shows that when the 10Y rate is higher than the median line, there is a strong chance it touches the top of the Keltner Channel. I see the 10Y as well as other long term rates going much higher as shown in the chart.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #millionaireeconomics

Interestrates

All eyes on Fed's Interest Rate~~**Repost from Dec 14th 2022 since the original post disappeared**

Though the CPI figures released last night were lower than expected, if you look one by one, you will notice that the price of services (Core Services) has not yet decreased, but food and oil prices have.

TVC:GOLD

As a result, let's keep our eyes on the Federal Reserve's interest rate announcement in upcoming hours, which many agencies, including Oxford Economics, Bloomberg, Forex Factory, and Trading Economics, expect to be 0.5%.

If the Fed remains concerned and interest rates rise more than expected (0.5%), gold will take another ride up the hill tonight. If not, we should brace ourselves for a trip to Death Valley.

Let's prepare for a ride~~

FOMC Economic Projections Effect on GoldOANDA:XAUUSD

**Repost from Dec 14th 2022 since the original post disappeared**

Hello all TradingView speculators,

In my opinion, I think there was an overreaction from the market's participation on the CPI numbers that was announced to be lower than expected. In addition to this, some technical indicators are showing us some signals to be careful on the buy side from bearish divergence signal between the price and RSI on 4H timeframe. This indication does not mean that the trend will reverse immediately but it indicates that the current trend has chances of stopping and turn into either sideway or downtrend in short term.

Based on the current price level, Risk to Reward Ratio seems to be in favor of the bears. However, I would wait to see the price action in 1H timeframe tries to test 1815 first and if it fails then I believe that follow sell position after this price action fails to go above 1815 and if price makes a lower low below 1804 can be a worthy trade

FOMC Rates Decision and the Effect on Gold**Repost from Dec 13th 2022 since the original post disappeared**

Economic indicators from the past month indicate that the price of services is the key factor that helps prevent a rapid decline in inflation , although the price of goods had already dropped considerably and the labor market remained strong, showing no signs of slowing down the inflation rate.

ECONOMICS:USCPMI

In the graph above, one of the key economic indicators, the ISM Service Sector Index for the month of November, accelerated to 56.5, above the forecasted rate of 53.5 and the previous month's level of 54.4. Despite the rise in interest rates from the FED, the ISM indicated that the services sector is still going strong, correlating with the positive outcome in labor market data.

FOMC Rates Decision 15 December 2022

Previous = 3.75-4.00% - Prediction from Bloomberg, OE, Forex Factory, Trading Economics = 4.25-4.50%

Bloomberg, Oxford Economics, the Forex Factory, and Trading Economics predict that the Federal Reserve's interest rate will rise by 0.50%. The market forecast for the highest interest rate as of December 9, 2022 is 4.75-5.00% in May 2023, with a gradual decrease beginning in the third quarter of 2023.

However, because the services sector has been performing well, the FED's interest rate cut may come later than expected by the market. Thus, from a fundamental standpoint, the USD is expected to continue appreciating, albeit not as strongly as in recent months. On the other hand, the gold price is expected to fall.

THE IMPACT OF INTEREST RATES ON FOREX MARKETHello again! Interest rates can have a significant impact on the forex market , as they can affect the demand for and supply of different currencies. In general, higher interest rates tend to attract foreign investment and increase the demand for a currency, as investors can earn a higher return on their investments. This can lead to an appreciation of the currency in the foreign exchange market.

On the other hand, lower interest rates may discourage foreign investment and reduce the demand for a currency, leading to a depreciation of the currency in the forex market.

Interest rates can also affect the attractiveness of a country's assets, such as stocks and bonds, which can in turn affect the demand for its currency. For example, if a country has high interest rates, its assets may be more attractive to foreign investors, leading to an increase in demand for the country's currency.

In addition to the interest rate level, the direction and pace of change in interest rates can also affect the forex market. If a central bank is expected to increase interest rates in the near future, it may lead to an appreciation of the currency, as investors anticipate higher returns on their investments. On the other hand, if a central bank is expected to lower interest rates, it may lead to a depreciation of the currency.

Overall, the relationship between interest rates and the forex market is complex and can be influenced by a variety of factors, including economic conditions, inflation expectations, and global market conditions.

ECONOMIC CYCLE & INTEREST RATESHello traders and future traders! The state of an economy can be either growing or shrinking. When an economy is growing, it typically leads to improved conditions for individuals and businesses. Conversely, when an economy is shrinking or experiencing a recession, it can have negative consequences. The central bank works to maintain a stable level of inflation and support moderate economic growth through the management of interest rates.

What is an economic cycle?

An economic cycle refers to the fluctuations or ups and downs in economic activity over a period of time. These cycles are typically characterized by periods of economic growth and expansion, followed by periods of contraction or recession. Economic cycles are often measured by changes in gross domestic product (GDP) and other economic indicators, such as employment, consumer spending, and business investment.

Economic cycles can be caused by a variety of factors, including changes in monetary and fiscal policy, shifts in consumer and business confidence, and changes in global economic conditions. Economic cycles can also be influenced by external events, such as natural disasters or political instability.

Understanding economic cycles is important for businesses, governments, and individuals, as it helps them anticipate and prepare for changes in the economy and make informed decisions about investment, hiring, and other economic activities.

How is an economic cycle related to interest rates?

Interest rates can be an important factor in the economic cycle . During a period of economic expansion, demand for credit typically increases, as businesses and consumers borrow money to make investments and purchases. As a result, interest rates may rise to control the demand for credit and prevent the economy from overheating. Higher interest rates can also encourage saving, which can help to balance out the increased spending that often occurs during an economic expansion.

On the other hand, during a period of economic contraction or recession, demand for credit tends to decline, as businesses and consumers become more cautious about borrowing and spending. In response, central banks may lower interest rates to stimulate demand for credit and encourage economic activity. Lower interest rates can also make borrowing cheaper and more attractive, which can help to boost spending and support economic growth.

Overall, the relationship between interest rates and the economic cycle can be complex and dynamic, and the direction and magnitude of changes in interest rates can depend on a variety of factors, including economic conditions, inflation expectations, and the goals and objectives of central banks and other policy makers.

I hope you leant something new today!

Sells on EURUSD The important news has passed and now it’s time for new trades.

Yesterday we saw another rise on EURUSD and a sharp reversal.

This gives an opportunity for sells with stop above 1,0735.

The goal is to reverse the H1 trend and head towards parity.

Breakouts of the previous levels will give us a confirmation of this movement .

The Cantillon Effect And The Working ClassThe Cantillon effect is an economic phenomenon that

disproportionately affects the working class. It's named after the 18th century French economist Richard Cantillon, who first studied the differences in income distribution between the wealthiest and poorest parts of society. In this blog post, we'll be exploring how the Cantillon effect works, and how it impacts the working class. Keep reading to learn more.

Introduction to the Cantillon Effect

The Cantillon Effect is an economic concept that explains how money creation benefits those at the beginning of the money supply chain and harms those at the end. It is an example of how the economy is rigged to work in favor of some, while leaving others behind. The new money created gives those at the top access to resources before new money reaches everyone else. They use this new money to purchase assets, goods, and services before prices increase. This furthers a cycle of wealth inequality, since those with new money get wealthier faster than those without. Understanding the Cantillon Effect is essential for anyone looking to create a more equitable and prosperous economy for all.

It is an example of how the economy is designed to favor those with access to monetary policy decisions, such as banks and large corporations. This means wages for everyday workers remain stagnant while those at the top, with influence and resources, reap the rewards of increased wages and greater purchasing power. So while wages may stay the same, prices of goods and services are constantly increasing - ensuring more money flows to those in charge. The result is an economy that is severely rigged in favor of those who have access to the levers of power, leaving everyday workers struggling to make ends meet.

This effect can be seen in the widening wealth gap between the wealthy and poor, as well as the increasing income inequality in many countries around the world Additionally, the economy is heavily biased towards the wealthy, as evidenced by the massive corporate tax cuts and government bailouts that are disproportionally directed to large businesses and the affluent. This allows them to systematically hoard money while wages stagnate and regular people struggle to make ends meet. The result is an unfair system that benefits a small number of people while impoverishing countless others. It's time we take action and make sure the economy works for everyone, regardless of wealth and privilege.

Analyzing the Distributional Impact of the Cantillon Effect

The Cantillon Effect is the redistribution of wealth from lower to upper income brackets through inflation and other economic policies. It works like a hidden tax on earnings, taking purchasing power away from lower-income communities and giving it back to the wealthy through an ever-widening economic gap. This uneven playing field is created by policies such as high interest rates and quantitative easing that are designed to benefit those with investments and business interests. By implementing these strategies, the government is essentially rigging the game in favor of those with earnings and investments, while leaving those with less earnings behind. This creates an unbalanced economy that works for some, but not for others.

It can be seen as a regressive tax, as it disproportionately impacts lower-income individuals and families more than those with higher incomes. This is an effort to explain how the economy is rigged to work for some and not others. Without a basic understanding of how the economic processes are designed, those of lower income are at a disadvantage since they lack the resources necessary to make their voices heard in the power structures that determine economic outcomes. Income inequality has widened across the country, leaving many people feeling like they don't have a fair chance to succeed in today's economy. Unfortunately, this rigged system works against those who are already at a disadvantage due to limited resources and opportunity.

By analyzing the distributional impacts of this effect, we can gain a better understanding of how the economy is rigged to benefit some and not others Finally, it is clear that the working class has been severely affected by the fact that the economy is designed to work for some and not others. Through analyzing the distributional impacts of this effect, we can gain a better understanding of how the system is rigged and how to address it. It is essential that working people have access to fair, equitable economic opportunities and that we work together to ensure that this system is working for everyone.

Who Benefits from the Cantillon Effect?

The Cantillon Effect is a phenomenon that benefits those with access to new money before it reaches the general population. This is especially true when it comes to working class people, who usually struggle to keep their heads above water. Through this effect, individuals and businesses that are among the first to receive new money from a central bank’s stimulus package can benefit significantly before the working class ever sees any of it. This means the working class is essentially locked out of the opportunity to utilize new money to its full potential, essentially rigging the economy in favor of those with access to new money first.

Historically, this has been the wealthy elite, who are able to use their money and influence to acquire more resources faster than others. This unequal system creates losers and winners, with those who have access to more money and resources having an undeniable advantage over those who don't. The result is an economy that works in favor of the wealthy elite, leaving the rest of us struggling for scraps. Not only does this create a gap between the ‘haves’ and ‘have-nots’, but it also limits economic opportunities as resources become increasingly concentrated in fewer hands. It’s clear that this system of economic inequality needs to be addressed in order to create a fairer economy that works for everyone.

The Cantillon Effect is a major factor in income inequality, as those with the most money are able to benefit from price changes before everyone else does

Next, it is important to recognize that the losers in the economic rig are those without easy access to capital or privileged information. The Cantillon Effect is a prime example of how those with the most money can benefit from capital before everyone else does and this serves to create an even larger gap in income inequality. It is within our power to change this system that so unfairly works for some and not others and it is worth fighting for a system where everyone has an equal chance at success.

The Working Class and Its Inequitable Access to Resources

The working class, particularly low-income and minority groups, often lack access to resources such as quality education and healthcare, leading to economic instability and inequality. This lack of access to resources, combined with less job security and decreased wages, creates a working environment that prevents working class people from achieving economic stability and success. To make matters worse, many working class individuals are also hindered by government policies that have been crafted to favor the wealthy. This is why the current economy is often referred to as "rigged," working for some while leaving others behind. It is our collective responsibility to ensure the working class has equal access to the same resources as wealthier individuals so they can create a more financially secure future.

This is compounded by the unequal distribution of wealth amongst different classes, as those in the upper classes have more resources to acquire and increase their wealth. While it may appear that winners consistently come out on top, the reality is that their success is heavily influenced by the economic systems that are designed to work in their favor. For example, wealthy individuals can access tax incentives and investments which are not available to those with lower incomes. Furthermore, those with more money can influence the outcome of legislation, creating more winners and, unfortunately, more losers. It's a rigged system that keeps people in different financial classes divided and ensures that some individuals have access to more opportunities than others.

In order to fix this injustice, policies should be enacted that support and empower those of lower income levels so that they can gain access to the same opportunities and resources available to the wealthy few Also, earnings should be made more equitable by instituting a better minimum wage, reducing earnings inequality and providing more training, education and job opportunities. These policies have the potential to create a more level playing field in the economy where individuals of all income levels have the same chances of success, which will ultimately benefit everyone.

How Governments Are Failing to Redress Inequality

Governments around the world are failing to implement policies that would promote economic equality and reduce inequality. This is especially tragic, considering working class families are the ones that suffer the most. The way our economy is currently set up, working class individuals lack the opportunity to ever rise up and gain economic security. Those with money, however, can benefit from tax breaks, investment opportunities, and other benefits that are often denied to working-class citizens. This blatant injustice needs to be addressed in order for working-class families to have a chance at achieving a comfortable financial future.

This includes inadequate levels of taxation for wealthy individuals, as well as failing to enact taxes on capital gains and other investments. To add to this, inflation plays a vital role in how the economy is rigged in favor of the wealthy. Through inflation, the value of money decreases, making it harder for people to stay afloat and even harder for those with less money to maintain their standard of living. As inflation continues to devalue money, those at the top are able to remain wealthier than those who are not as fortunate.

Furthermore, governments often favor large corporations through generous subsidies and tax breaks which further exacerbate the divide between the haves and the have-nots However, recessions are the most apparent example of how the economy is rigged to benefit some and not others. During recessions, large corporations are more likely to receive bailouts while those on the margins of society, who often have no savings or access to credit, face increasing unemployment, poverty and homelessness. Furthermore, governments often favor large corporations through generous subsidies and tax breaks which further exacerbate the divide between the haves and the have-nots. It's clear that our economic system is still broken and needs fundamental reform in order to create a fairer environment where everyone can prosper.

Moving Forward: Proposals for Change We need to address underlying issues in the economy such as inequality, corporate monopolies, and the lack of opportunities for those with lower incomes in order to create a fairer working environment for all. The working class are particularly affected by the power imbalances that exist in the economy, where their wages and working conditions can be heavily impacted by large corporations. This is further exacerbated by an unjust taxation system that favor's those in higher socioeconomic positions, creating even more inequality and unfairness. If we aim to create a just economy where all have an equal chance to succeed, we must address these issues head-on. Only then can we create a more equitable system that truly works for everyone.

We should focus on creating fair and equitable policies that are beneficial to everyone, regardless of income or background. Unfortunately, the current economic system is often designed to benefit those who already have money and new wealth creation opportunities. This means those with economic privilege and access to new money often continue to be the primary beneficiaries of financial resources, leaving those without money excluded from participating in new economic projects. With new policies and regulations that prioritize economic inclusion and justice, more people can benefit from new money creation opportunities, creating a more equitable economy.

We need to invest in education, job training, and other initiatives that help those at risk of being marginalized by the current economic system Additionally, inflation is another factor that works against those with lower incomes. As inflation rises, their money is worth less and less, making it difficult for them to afford even the most basic necessities. To combat this, policy changes need to be made to ensure inflation does not adversely affect those with lower incomes. We also need to invest in education, job training, and other initiatives that help those at risk of being marginalized by the current economic system. Only then can we create a fair and equitable economy that works for everyone.

In conclusion, the Cantillon effect is a complicated economic phenomenon that impacts the working class more than any other part of society, and results in a widening gap between the wealthiest and poorest individuals. It's important for us to understand this phenomenon and its implications, so that we can work towards more equitable economic policies in order to create a fairer and more prosperous society for all.

Articles sourced for this paper

Mainstream economists generally confine the discussion of the Richard Cantillon Effect to redistribution of wealth that occurs with a rise in the quantity of money. The Cantillon effect is the unequal shift in relative prices that results from changes in the money supply, which was first described by the 18th-century economist Richard Cantillon (who inspired political economists such as Adam Smith and David Ricardo).

The basic thrust of Richard Cantillons extensive analysis is that changes in money lead to changes in relative prices, which alter productive plans and lead to different fixed investment patterns, so that the new money changes the real economy, with winners and losers. In The Essay, the economist Richard Cantillon describes the economic phenomenon of changes in relative prices across various parts of the economy in response to changes in money supply. The Cantillon effect refers to an unequal distribution of the new money supply throughout the economy, which leads to different rates of growth in different parts of the economy.

The basic contours of the Cantillon effect, namely, some individuals having more purchasing power while others having less, are still at work in the same economy, if money creation channels allow them to do so. Cantons best-known idea, the eponymous Cantillon effect, describes the effects of the creation of money on the relative prices and inequality in wealth in society. In comparison, the Cantillon effect, the neglected classic theory on how money allocation affects personal wealth, is among the inequities of our present-day society. The Cantillon effect claims that the first recipients of new supplies of money are given an arbitrage opportunity, the ability to spend the money before prices rise. Changing the supply of money in the economy in order to manipulate relative price levels does not really change anything over the long term. In fact, even price-stabilized economies need injections of money to counteract deflationary effects from economic growth.

They are seeing asset prices rise, but prices are still falling across the rest of the economy, because that is happening just seconds after the Federal Reserve is clearly bloating up the money supply. Specific parties get the chance to spend the new paper money on goods and assets that do not have prices reflecting an increased money supply. In the modern economic context, Cantillons theory implies that banks and major institutional investors get access first to new supplies of money, invest them to earn returns, e.g., on stock markets or various risky financial products, and drive up the prices of assets in which they invest. Because the terms inflation and deflation refer to broad, economy-wide changes in prices, the name biflation is a bit misleading, since it does not necessarily refer to any increases or declines in the overall price level, but rather to changes in relative prices caused by changes in the supply of money and credit in various markets.

Cantillons own analysis also does not appear to incorporate Austrians own inescapable characteristics of booms and busts associated with the emergence of new money into credit markets; for Cantillon, all new money has a similar redistributive, unequal impact, regardless of whether it is spent in real economies or is introduced into the credit markets, which lowers interest rates.

Cited Sources

www.investopedia.com 0

www.spencertom.com 1

river.com 2

fee.org 3

mises.org 4

phemex.com 5

www.aier.org 6

www.promarket.org 7

cointelegraph.com 8

6 Reasons why the gold price will drop with interest rate hikes The FOMC announced another 50bps (0.50%) Interest Rate increase to 4.50% which has lead to short term downside for gold as an initial reaction.

The question for many remains.

Why does gold drop when interest rates rise?

There are a number of reasons, but here are the top 5…

#1: Investors look elsewhere

Higher interest rates can make other investments, such as fixed investment assets and bonds, more attractive to investors. Gold investors will then sell their gold holdings and take advantage of higher interest rate yielding assets. This can lead to investors moving their money out of gold, which can lead to a drop in price.

#2: Stronger U.S Dollar

A higher U.S dollar can lead to gold being more expensive for investors who use other currencies to buy it. This can lead to a drop in demand for gold, which brings the price lower.

#3: Higher borrowing costs

When interest rates rise, this increases the costs of borrowing for business and consumers. They now need to pay more to borrow money to fund their operations. This can hamper the economic activity and drop the demand for buying stocks, precious metals and other investments.

#4: Higher yields on gold-mining companies bonds

Fixed investment gold bonds may seem more attractive than holding and investing in gold itself. This leads to a drop in gold mining stocks which essentially helps with the drop in gold.

#5: More supply less demand

With the factors I mentioned above, with investors leaving gold this increases the supply of the metal and decreases the demand. This leads to a drop in the gold price.

#6: Uncertainty floods the markets

When interest rates go up, this leads to uncertainty in financial markets (where gold is no exception). Investors feel the uncertainty and become worried for the economy. This can lead to a decrease in demand for gold and a drop in its price.

These are all speculations in theory with why the gold price may drop with an increase in interest rates. We notice that the markets don’t always play according…

Since the May 2022 Gold has moved in a sideways consolidation pattern. And this means, we can see the price continue in the range. Until we actually see a break up or down, the analysis in the medium term is sideways. We’ll be watching this carefully.

Follow for more trading and fundamentals tips and analyses from the info I've learnt over the last 20 years as a trader.

Trade well, live free.

Timon

MATI Trader

Higher interest rates can also lead to higher yields on gold-mining companies' bonds, which can make these bonds more attractive to investors. This can lead to a decrease in demand for gold-mining stocks and a drop in the price of gold.

Higher interest rates can also increase the opportunity cost of holding gold, as the metal does not generate any income or interest. This can make investors less likely to hold onto gold as a long-term investment.

Gold is often seen as a hedge against inflation, and higher interest rates can signal that the central bank is trying to keep inflation in check. This can reduce the perceived need for gold as a hedge and lead to a drop in its price.

AW 10YR\INTEREST RATES ANALYSIS - Coiling Up for Higher Rates...In this video I explain my long-term view on 10 Year Bond Yields also known as Interest Rates.

If there is one view of mine that has stood the test of time it is my view of this chart.

My timing couldn't be better if what I talk about in this video comes to pass.

It appears that we have just completed what appears to be the first wave of the upcoming 5-Wave move for Wave E.

This pattern has been unfolding since at least 1100AD and it still hasn't completed yet.

It provides so many clues as to what is coming in the not-so-distant future.

There is no better time to learn how the waves operate in these psychology driven markets.

Remember to use Disciplined Money Management Principles to ensure longevity as a trader.

If you don't know the long term pattern shouldn't you be doing your research instead of just following the crowd?

Just remember: I am not a financial adviser; I suggest using this only as a guide. Always do your own research.

EURUSD before ECBThird day in a row of extremely important news. Yesterday the FED raised interest rate by another 0,5%, let’s see ECB’s decision.

There are no selling grounds based on the reaction from the zone and it is possible to see higher values.

Bare in mind that the press conference is 30 minutes after the announcement of the interest rate.

Strong Spy long/short opportunity brewing up. (Smart Money)We are close to breaking out of this box like pattern. I have located strong supply zones along with other things indicating that we are heading here as we wait for interest rates. If we go to this 420 zone than we shall most likely sell off to lower 410-400ish area after all the rally hype has died down to consolidate here. look out, big moves brewing up!

5 Reasons why Interest Rate hikes causes markets to fall - FOMC We had the CPI come our better than expected (7.1%) versus 7.3% expected.

This means finally inflation is decelerating at an accelerating rate which is good for the markets.

However, today with the FOMC they are expecting a 50 bps hike or 0.5% rise.

Just a reminder in simple terms

Interest rates is the amount of money (expressed as a %) that a lender charges a borrower for the use of their money.

The interest rate is the percentage of the money you borrowed that you have to pay back as a fee.

Now there are a few reasons why interest rate hikes can cause global markets to fall including.

1. Better places to invest in

Investors take their money out of stocks and financial assets and into banks where the potential return is higher.

2. Strong economy

When interest rates rise it tells is the economy is improving and getting stronger. This can lead to higher inflation expectations.

3. Expensive for businesses

When interest rates rise, it makes the borrowing more expensive for businesses. This is based on the borrowing of buildings, assets and equipment. They now need to pay a higher rate to finance their debt.

4. Better for bonds and fixed investments

Again, investors want a better ROI. They will take money out of the financial markets and more into bonds and other fixed-income investments.

5. Higher US Dollar

Higher Interest rates often lead to a stronger dollar. U.S Exports become less competitive which hurts many multi-national companies. and less attractive for U.S stocks.

Hope that helps. Save this so you have an idea on how Interest Rates move the markets. Follow for more daily tips. Thanks for the support.

Trade well, live free.

Timon

MATI Trader

EURUSD before FED CPI news passed yesterday, but the interest rate decision is today.

This is the most important news and we will see reaction of all assets.

Expectations to rise have been met. We’re now monitoring for reversal grounds.

Another rise and leaving a rejection wick will be the best possible option.

And let’s not forget that the ECB’s interest rate decision is due tomorrow.

EURUSD before CPIToday’s the first important news this week.

If you don’t trade aggressively just wait for the news to pass and then look for good entries.

We’re looking at possible H1 trend reversal from the resistance zone. And we’re also expecting pullback from the zone which to confirm the entry point.

Rejection wicks in both directions are possible, that’s why pre entries are not recommended.

The Inflation of the 1980s Tells the Same Story: Pivot=DeclineI have heard both sides: 1) Historically, the Fed pivot will result in a decline in equities because they are pivoting in response to negative economic data which drags on equities, and 2) this time is different, negative economic data is positive for equites because it means inflation is on its way down.

When people reference the former, for whatever reason, they don't take a look at the effective Fed Funds Rate in the high inflationary period of the late 1970's and early 80's and compare the Fed's pivot to equities. In the chart shown, you can see that once Volcker, the Chairman of the Fed, finally took a steadfast position against inflation and rose rates violently, inflation began to cool. Both in part of this raise in rates and the public's belief that Volcker had no intention of letting up, ridding the public of inflationary expectations.

If you look at the charts, you can see that as inflation rose so did the markets. But as Volcker stamped his foot and pushed rates up, inflation began to cool. USIRRY, the third chart down, shows this. Equities began to decline due to this restrictive economic environment and belief the Volcker would not let up.

Notice that, as a result, unemployment (bottom chart) began to rise. This had no positive impact on equities, contrary to what some might think because it would indicate inflation was being taken care of. Instead, the U.S. entered a recession and equities continued to decline. It was only once the Fed stopped lowering rates, unemployment peaked, and inflation neared their target rate did equities bottom.

It is not fair to compare equities and pivots to the Great Recession or the .com Bubble, yet even in historical inflationary periods the same story plays out: the markets bottom well after the Fed pivots

However, this time could be different in that Powell showed no hesitation in attacking inflation and destroying inflationary expectations. He has taken a direct lesson from history. As a result, unemployment could potentially peak faster than expected, inflation could decrease faster than expected, and equities could bottom faster than expected. I believe today's outcome will be similar to that of the early 80's, but that outcome will happen much, much faster. The markets have not bottomed in my opinion, but I expect them to in mid-late 2023.

It's always best to keep equity exposure to avoid missing the bottom.

Because you never know .

InTheMoney

Elliott Wave Review Ahead Of US CPI Data On EUR, NZD and BitcoinWe have a busy week ahead, with plenty of important data for the interest rates policy in US, UK and EU. We have US CPI already tomorrow, which will be interesting data as speculators will put their bets on FOMC decision which is scheduled a day later. From an Elliott wave perspective, I will focus on EURUSD and KIWI which can offer nice buying opportunities on a pullback.

I will also look at bitcoin.

Trade well,

Grega

Week full with newsThere's a lot of impactful news coming this week.

They start as early as tomorrow with the CPI, in the coming days we will see the interest rates from the FED and the ECB!

Before the news, any trades will be risky.

We will be watching for another rise to the resistance zone and trend reversal.

Large fluctuations are possible during the news, so entries will be sought upon confirmation.

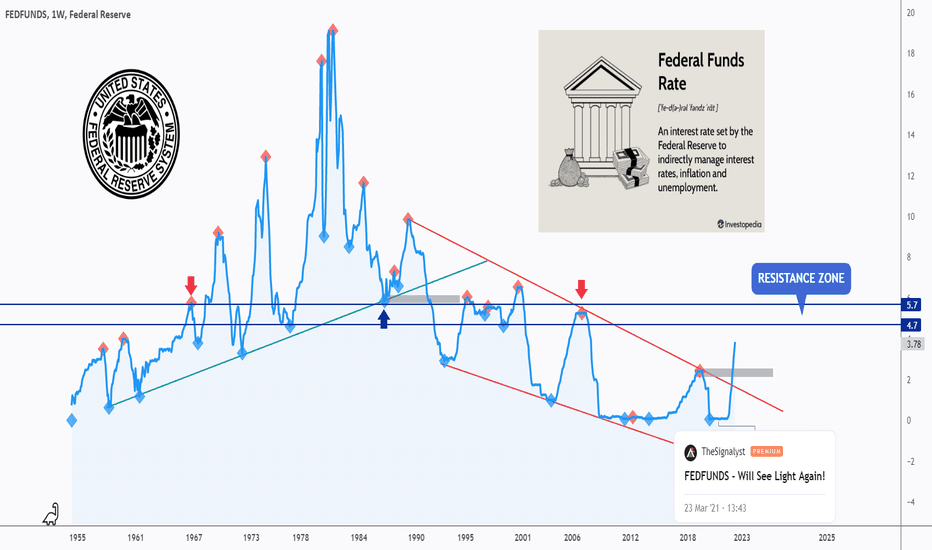

All Eyes On Fed Funds Rate 🏛Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

I am not a fundamental expert (nor an economist) but I found FEDFUNDS chart really interesting!

I never thought that basic technical analysis tools can also be applied to such economic instruments!

As per my last analysis (attached on the chart) FEDFUNDS traded higher and broke the red wedge pattern upward.

Now we are technically bullish, expecting big impulse movements to push price higher, and small bearish correction movements.

We all know that Federal Reserve will most probably increase the interest rates by another 50 basis points (0.5%) next week (on Wednesday)

By adding another 0.5% , FEDFUNDS will be approaching a strong resistance zone in blue (4.7% - 5.7%) which might hold the price down for a bearish correction to start and push price lower till the previous high in gray again.

It would be interesting to hear your thoughts on this one.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Rise on EURUSD We have been looking at selling opportunities on EURUSD for several days but the movement is not being confirmed.

This means that we are going to see another rise before the trend reversal.

The most important news for the market right now is expected next week and there will be great movements.

The low risky option is not to trade until the news has passed or new confirmation is received.

The aggressive opportunities are for rise towards 1,063 before the news.

GBP/JPY Potential 380 pip sell setup!we have seen a nice transition for price respecting the daily support level , still lover timeframe we see price doing a full retracement of the 100% fib level, and got a nice rejection of it.

we shall see a nice continuation to toward side, go with the downward momentum and if we see price breaking the upside then the setup becomes invalid

follow me for more breakdown