Internetcomputerprotocol

Internet Computer Protocol $81 Easy Target Yields 1,450% ProfitsIf you saw the Injective chart you know what happens after a correction, a classic ABC correction. What follows a correction is a bullish impulse.

A target of $81 gives us more than 1,450% profits potential for this pair, ICPUSDT (Internet Computer Protocol).

This is a project that was damaged by the SEC's decision to label it a security, remember? The SEC today is no longer the same as back in those days. It is different now. The SEC is crypto-bullish, the SEC is friendly and whatever damage was caused will be reversed, make no mistake.

Right now ICP is moving within it's long-term accumulation zone. As the name implies, a zone that is good to buy for those focused on long-term hold. Even if you are looking at the short-term or mid-term, this right now is a great entry, great timing, the best possible prices preceding the 2025 bull market phase.

It was a while back when I first saw the possibility of the bull market extending beyond late 2025. This scenario/possibility is now becoming stronger with many projects supporting this view. The chart of many stable, long-term projects are pointing to growth leading into the first half of 2026. Q1 and Q2 2026. This would definitely be the best ever.

Will the next bull market peak in late 2025 or early 2026? Make your guess. What cannot be doubted is that we are going up next. Up, up, up. Are you prepared?

Preparation comes in the form of a plan, and lots of money injected into the market. Buy like the world is about to end. Start buying and continued buying, everything you can. You will be very happy with the results, I promise.

Thank you for reading.

Namaste.

Internet Computer (ICP)Comprehensive Analysis of ICP

Introduction

The Internet Computer Protocol (ICP) is one of the leading projects in the blockchain space, developed with the aim of creating a decentralized internet. This project enables decentralized applications (dApps) to run directly on the blockchain without relying on centralized infrastructure. Due to these features, ICP has captured the attention of developers and investors alike, showcasing significant growth potential in the future.

From a price perspective, ICP has experienced substantial volatility since its launch. It is currently trading within a medium-term ascending channel, which plays a critical role in determining its future price trend.

🔍 Current Status

At present, ICP has entered a correction phase after encountering a weekly resistance zone at $14.623 - $15.704. It is now approaching the lower boundary of its ascending channel and the key weekly support zone at $6.166 - $6.944, which are crucial for preventing further price decline.

Conversely, significant resistance levels at higher zones could limit the upward momentum of the price.

🚀 Key Levels Analysis

Support Levels:

Lower boundary of the ascending channel

Weekly support zone: $6.166 - $6.944

Resistance Levels:

Daily resistance zone: $11.089 - $11.767

Weekly resistance zone: $14.623 - $15.704

Breaking these resistance levels, accompanied by increased trading volume, could strengthen the bullish price movement.

📈 Entry Strategy and Stop Loss

First Entry Point:

When to Enter: If the price bounces off the lower boundary of the ascending channel and the gray support zone ($6.166 - $6.944), a gradual entry is recommended.

Stop Loss: Below the gray support zone at $6.

Second Entry Point:

When to Enter: If the daily resistance zone ($11.089 - $11.767) is broken, initiating a second entry is advisable.

Stop Loss: Below the gray support zone at $6.

Complementary Entry:

A breakout of the 50-level on RSI can serve as an additional confirmation signal for entry.

🎯 Price Targets

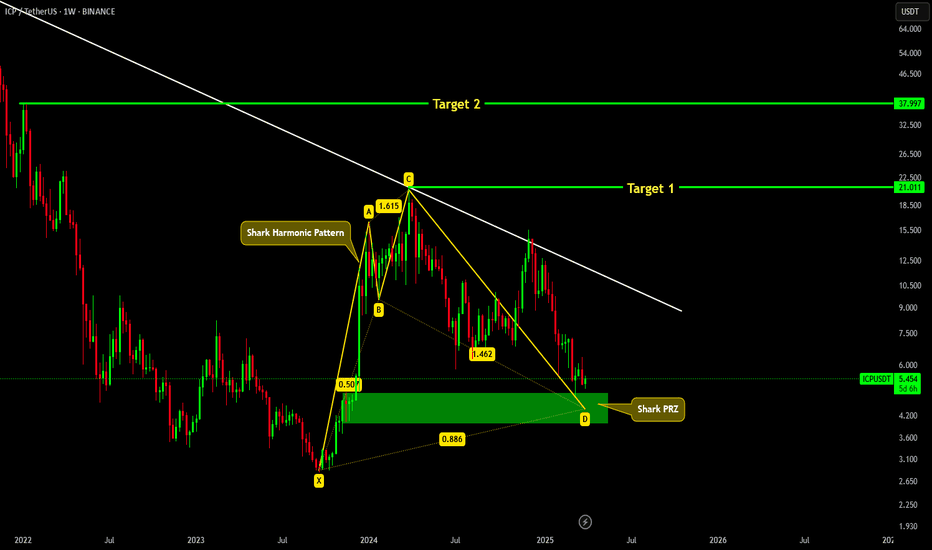

Target 1: $21.158 - $23.555

Target 2: $36.722 - $40.641

Achieving these targets requires a confirmed breakout above the weekly resistance zone ($14.623 - $15.704).

⚠️ Key Considerations

Trading Volume: Resistance breakouts must be confirmed by a significant increase in trading volume.

Risk Management: Gradual entry strategies and defined stop losses are essential for minimizing risk.

Ascending Channel: As long as the price remains above the lower boundary of the ascending channel, the medium-term uptrend remains intact.

Alternative Scenario

If the weekly support zone ($6.166 - $6.944) is broken and a candle closes below it, the price could drop further toward $4.5. In this scenario, exiting long positions is recommended.

🔗 Conclusion

The analysis indicates that ICP holds considerable growth potential. However, maintaining proper risk management and closely monitoring key support and resistance zones is crucial. Entering at support zones with a stop loss below $6 and confirming resistance breakouts with high trading volume can be a solid strategy for investment.

Internet Computer $ICPOverview:

FWB:ICP may be the best blockchain technology there is to date. We can thank (or hate) SBF for destroying this chart right out the gate, however the projects fundamentals, developments, and team have not stopped since day one. However, i do not think this bull cycle (unless extended) will be one where we see FWB:ICP 's value really shine. Not to say it wont 5-10X from where it currently is, but this is a 1-5 trillion dollar market cap project in the long term.

Price Action:

Realistically, I see FWB:ICP going as high as $80 in the mid term. We found a demand zone in the $3 area, and have now changed character. there are a few obsticales in the way of going past $80 this cycle including A bearish FVG, some major resisra some major restistance, and the supply zone at 80,.

Take Profit Structure:

Percentages represent growth of total initial investment at current price level.

TP1 - 15% - at $24.14

TP2 - 20% - at $35.39

TP3 - 25% - at $53.58

TP4 - 30% - at $71.79

Will let the last 10% ride.

ICP Under $12: Positioning for a $50 Exit by May!Picked up some BINANCE:ICPUSDT under $12 and will continue adding between $10.5-$12. My target exit is closer to $50, so this is a position trade with a plan to offload everything by May.

I decided to jump in after the retest of the reclaim range low from early 2024, with strong confluence from the moving averages. Looking forward to seeing how this plays out!

ICP at a Crossroads: Rally Ahead or Breakdown?Yello, Paradisers! Is #ICPUSDT on the verge of a major bullish continuation, or are we staring at the potential for a steep decline? Let’s examine the critical levels and what they mean for the market.

💎#ICPUSDT is at a critical juncture, and the market is keeping us on our toes. The price has been hovering near the support zone at $9.775, showing a strong probability of bullish continuation, but the story doesn’t end there.

💎Currently, the decreasing volume and RSI in overbought territory signal caution. These indicators suggest a potential pullback is likely. Our expectation? #InternetComputerProtocol is poised to retrace back to $9.775 soon. If this support holds, the chances of a bullish rally are high, making it an exciting opportunity for traders watching this zone closely.

💎However, if the price fails to maintain momentum at $9.775 and breaks below this level, the trend could shift bearish. The next key level to watch is the $8.666 support, which has proven to be reliable, respecting price action twice before. This support is critical to sustaining the broader bullish outlook.

💎But here's the risk: should the price drop below $8.666, the bullish scenario would be invalidated entirely, likely leading to a more significant downturn in ICP’s price.

As always, patience pays in trading. Don’t let FOMO guide your decisions wait for clear confirmations before taking action. Discipline and strategy are the keys to long-term success.

MyCryptoParadise

iFeel the success🌴

ICPUSD 1D Golden Cross can kickstart an amazing +250% rally!Internet Computer (ICPUSD) is about to form a Golden Cross on the 1D time-frame. The long-term prevailing pattern seems to be a Channel Up since the February 19 2023 High and November 04 2024 is a technical Higher Low.

The previous one was also formed a few weeks before a 1D Golden Cross, which kickstarted a non-stop rally to the 1.618 Fibonacci extension. The 1.382 Fib is at +250% from the current level at $32.00 and that is our current long-term Target.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ICP - a pig of a chart, but signs of secret coiling nonetheless?I'm heavily invested in ICP and most of it is locked up for a minimum of 8 years, so yes, I'm biased... I think this has got to be THE most undervalued project in all of crypto.

And so I'm perpetually disappointed with the uninspiring ICP/USD chart. What IS going on with that? Nothing to hold onto, nothing to indicate the price is coiling up, ready to spring out of its pattern and finally surprise crypto-heads the world over.

It's easy to draw a teal arrow, and the one drawn in this chart - as anyone can see - is not grounded in T/A. In fact, one could clearly make the case for a disturbing trend of ever less convincing highs (red curve) with chances of a drop down more likely than a pump up. Also, there is a lack of significant historic support, which makes trading ICP uncomfortable.

And I'm not saying that a drop is unlikely to occur. ICP has been taken on by crypto heavyweights in the past and may be pounced on again in the future. BUT, there is another way of looking at ICP and of trading it responsibly (if trading is ever responsible).

I suggest that for trading purposes, it is much better to use the ICP.D chart (first chart below) or the ICP/BTC chart (second chart below). These are very similar, but my preference goes out to the ICP.D chart which shows the history of ICP market cap dominance. This is a personal preference, related to my favourite way of calculating Fibs. The ICP.D chart has some interesting recent runs and drops that - interestingly - the ICP/BTC chart lacks. These pumps and drops allow fibs and trendlines to be drawn and also show some support by significant moving averages on the daily chart.

A triangle is the main feature (on both these charts) and we're right at the bottom, pretty close to some other support features (MAs). This makes me think that ICP IS in fact coiling up with investors in silk slippers accumulating ICP sneakily. But you can make up your own mind of course: I've always has a lively imagination.

Now, if I had even more appetite for ICP accumulation (which I don't - I'm already out on a limb) I'd consider buying the day we see some long bullish confirmation candle. With a relatively short stop to be activated in the event of a weekly close below the triangle. That'd be a neat and potentially responsible trade.

Note I've also added the weekly ICP.D chart with a crazily optimistic trendlines for peeps that are on my ICP buss... (chart at the bottom)

Estimating fair value for ICP (short, medium and long-term)Some notes on ICP’s future price potential.

I’ve been trying to get a sense for the price gains we may expect from ICP going forward. Obviously – given the mountain of innovation that the project team has already delivered – the project is greatly undervalued, but what would fair value look like?

I think a good metric to use is Market Dominance, expressed as the percentage of the total crypto market value (or top X crypto stocks) that the fully diluted market cap of ICP contributes. Currently that’s about 0.32%. Looking at historic stats of market dominance of other ‘key’ coins, this is low. TON is sitting around 0.8%, MATIC historically reached up to 1.25%, AVAX up to 1.32%, DOT up to 2.25%, SOL up to 3.6%, ADA up to 4.5%, XRP up to 30%. ETH is currently sitting at ~16%. So, in acknowledgement of the enormous amount of work and development being generated by the team in the ICP ecosystem, it’d be reasonable to expect ICP’s market dominance to significantly increase going forward. Without going crazy, I think 3-5% is achievable in the medium- to long-term.

And that’s in a rapidly growing market… bringing us to the second metric I wanted to talk about: Crypto Total Market Cap. Currently the entire crypto market is valued at ~US$2.66 Trillion. That’s approximately equal to the market cap of Apple (US$2.62 T) – one single company! So where can the crypto total market cap head to from here? Finding a reasonable ballpark may require having a look at the dot com bubble back in 1999, which topped at something like US$13 T, loosing US$5 T in value in two years. So perhaps US$7-8 T is not too silly as a short- to medium term target (considering a 2024 dollar is worth not much more than 50 cents in 1999) and perhaps double or triple that for the long-term as the crypto market gets a proper foothold in the world economy.

So where that leave us ICP hodlers? Well, if we combine the awesome potential of ICP in shaping the crypto world going forward (market dominance) and the growth in the crypto ecosystem as a whole (crypto total market cap), it may not be insane to expect ICP to increase in value by 10x in the relative short term, 25-50x in the medium term and potentially 100+x in the long term, provided the project continues the course and does become a major crypto leader. As depicted in this figure. Hodl those ICP!!

ICP/USDT preparing bullish trajectory|👀ICP analysis💎Paradisers, the #ICPUSDT pair is exhibiting interesting behavior. After encountering resistance at a significant level of $20.940, it has regained momentum near a critical support zone at $16.640. If it maintains this pace, there's a favorable chance it will surpass the previously observed resistance level.

💎 However, consider an alternative scenario: Should #INTERNETCOMPUTER fail to hold steady at this support level and slip below it, we need to adjust our strategy. We anticipate a robust recovery from slightly lower levels, specifically at a support level that has been tested twice before.

💎 In the event that the price of CRYPTOCAP:ICP dips below this pivotal area, it's prudent to reassess our approach. Our hope lies in a rebound from the subsequent support line at $15.442. Should it struggle to recover from there, further decline may be imminent. Stay vigilant and adaptable as we closely monitor developments.

Cryptolean Internet Computer ICP UpdateICP is trying to push into the bullish territory in the daily chart above $13.54.

A bullish daily candle closure above $13.54 and a sustained price action above this level will result in a move towards the key daily resistance zone of $15.27-$15.94.

An inability to sustain the price action above $13.54 will lead to (1) a dip into the daily range zone where ICP price action will be choppy and (2) a slow move to $12.06.

Bears will be more active towards $10 upon a bearsih break-out of $12.06.

Cryptolean Chainlink $ICP Update After being unable to re-claim the key resistance zone of $15.27-$15.94 and forming a double top, ICP declined sharply to $12.06, the key daily support.

A bullish reversal from $12.06 is likely, assuming we see back bullishness in Bitcoin, and will result in a move to re-test $13.54, however the price action may be slow and choppy.

A bearish break-out of $12.06 will push ICP price in the bearish territory and will increase probability of a deeper correction towards the key support zone at$9.66-$10.33 and, possibly, lower to $8.06.

Intraday Chart

The ICPUSDT 4-Hour chart is bearish and trading very close to the key intraday support zone at $10.62-$11.43.

(1) A rejection of $12.58 or (2) a bearish dip and a bullish rejection of $10.62-$11.43 will lead to a upward move towards $13.54 and, possibly, higher to $15.32.

A bullish break-out of $12.58 will push price to re-test $13.54 and possibly $14.43.

Support once read!

Thank you.

ICP → Pullback to Support Zone Over? Time to Long? Almost!ICP ran three pushes up in an ascending wedge reaching $16.33, followed by a pullback with three pushes down and a strong bull signal. Is it time to long?

How do we trade this? 🤔

A long entry could be justified here. Here's what we have in favor of the long bias; Three pushes up in a bull channel ending at $16.33, followed by three pushes down in a micro-bear channel with strong bull signal bars, and we have a good follow-through bars leading up to the price action being just above the Daily 30EMA.

What would give us maximum justification is a re-test of the Daily 30EMA as support to add probability to our long. However, I do not believe this is required to justify a long entry.

I believe we need to be conservative longing at this stage in the crypto market, which is why I only advocate for a 1:1 scalp at a lower-than-maximum position size allowed for your trading strategy. I think Bitcoin and Ethereum have a larger pullback on the horizon, but do believe the market will come up a bit before it goes down.

💡 Trade Idea 💡

Long Entry: $12.32

🟥 Stop Loss: $9.15

✅ Take Profit: $15.50

⚖️ Risk/Reward Ratio: 1:1

🔑 Key Takeaways 🔑

1. Three pushes up into an ascending wedge.

2. Micro Bear Channel forms with three pushes down.

3. Strong bull signal bars on each push down.

4. Not required, but suggested to wait for re-test of Daily 30EMA as support.

5. RSI at 57.00 and above the Moving Average, supports long bias.

💰 Trading Tip 💰

The longer a trend continues after 3 legs, the probability of that trend continuing lessens. Because of this decreased probability, we ought to reduce our risk when entering trades.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ICP Optimal Key Levels for 1900%+ Return CaptureDate: January 13, 2024

(Long term 700+ days Outlook)

Key Levels and Analysis:

ICP is currently trading near the support level of $12.871, which is crucial to hold for maintaining the bullish scenario.

The chart shows a potential risk-reward setup based on pivot projections. The conditional probable boundaries suggest a tiered approach for upside targets, with the immediate resistance at $18.171 (Boundary 1), and subsequent resistance levels at $22.818 (Boundary 2), $30.380 (Boundary 3), and further significant levels beyond.

Risk-Reward Projections:

The optimistic projection of a 1900%+ return considers a trajectory from the current price towards the uppermost conditional probable boundary at $249.957. This boundary lies within a significant pivot extension and is considered an ambitious, long-term target.

Risk management should focus on the immediate support levels. A breach below the near-term support at $5.686 could indicate a bearish reversal and serve as a trigger for stop-losses to protect against larger capital erosion.

Z-Score Probability Indicator:

The Z-Score is currently indicating a heightened level of deviation from the mean, suggesting that the price is in a highly volatile phase. This could imply that ICP is experiencing significant momentum that, if sustained, may lead to a continued uptrend.

Optimal Entry Points and Strategy:

Long Entries: Considering the potential for a high return, long positions could be considered around the key support levels, specifically if the price shows signs of bouncing from these points.

Risk Management: Given the volatility indicated by the Z-Score, a conservative approach with strict stop-losses is recommended. This mitigates the risk while maintaining exposure to the upside potential.

Furthermore interacting with the ICP Ecosystem and exploring a DeFi Delta Neutral Strategy can appealing to reduce downside longterm exposure.

Conclusion:

ICP's technical structure highlights the potential for substantial returns if the current support levels hold. Investors considering entry into ICP should monitor these key levels closely and align their risk appetite with the significant reward potential outlined by the pivot indicator projections. The market dynamics of the crypto space necessitate real-time analysis and adjustment to strategies as new information surfaces.

This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own due diligence and consult with a financial advisor before making investment decisions.

Internet Computer Protocol ($ICP) Surges 222% in a Month

Internet Computer Protocol ( CRYPTOCAP:ICP ) has recently emerged as a standout performer, capturing the attention of investors with an impressive 222% gain in the last month. The native CRYPTOCAP:ICP cryptocurrency has not only demonstrated remarkable price surges but has also climbed the ranks to become the 17th largest cryptocurrency by market capitalization, surpassing the likes of Shiba Inu (SHIB). This surge is not just a flash in the pan; it appears to be backed by a combination of ambitious decentralization goals and strong fundamentals.

Ambitious Decentralization Roadmap:

CRYPTOCAP:ICP 's ascent is not solely tied to the volatility of Bitcoin; rather, it is driven by a comprehensive set of utilities and functionalities. At the core of CRYPTOCAP:ICP 's ecosystem is the Network Nervous System (NNS), functioning as the decentralized autonomous organization (DAO) for the Internet Computer blockchain. Users can actively participate in an open, permissionless governance system by staking CRYPTOCAP:ICP utility tokens in neurons. This innovative system allows participants to vote on proposals, shaping key decisions within the protocol.

ICP's overarching goal is to transform blockchain infrastructure into a "world computer," enabling the decentralized operation of software and systems without relying on traditional IT backends. This aligns seamlessly with the broader trends of "web3," emphasizing decentralization as a cornerstone of the internet's future.

Diving into the Nitty-Gritty:

To understand the recent surge in ICP's value, it's essential to delve into the token's utilities. Beyond serving as a store of value, CRYPTOCAP:ICP holders can actively stake their tokens through the NNS, further contributing to the protocol's governance. The surge in interest is not just driven by speculative trading; it reflects a renewed enthusiasm for the internet's long-term vision and the transformative potential of blockchain technology.

Price Action and Technical Analysis:

The recent price action of ICP has been nothing short of remarkable. With a 70% surge in just the past week, ICP has outperformed expectations, even flipping Shiba Inu in market cap rankings. Chart signals, such as the constructive "U" bottom base, indicate bullish continuation potential. Crypto trader Flying High points to a positive breakout above $14 in the weekly market structure, with potential buying interest expected in the $10–11 zone during price dips.

Conclusion

As Internet Computer Protocol (ICP) continues to make waves in the cryptocurrency space, its recent price surges are not merely speculative hype. Grounded in a robust decentralization roadmap and driven by an innovative governance system, CRYPTOCAP:ICP stands at the forefront of blockchain's evolution toward becoming a "world computer." Investors and enthusiasts alike are closely watching the pivotal $20 level for confirmation of further gains, eager to see if ICP can sustain its upward trajectory and play a significant role in shaping the future of decentralized technologies.

#ICP/USDT 2D (#BinanceFutures) Big falling wedge break & retestInternet Computer seems to have found bottom on historical demand zone, RSI entered oversold territory, recovery towards 100EMA would make sense.

⚡️⚡️ #ICP/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (1x)

Amount: 9.4%

Current Price:

3.804

Entry Targets:

1) 3.390

Take-Profit Targets:

1) 6.098

Stop Targets:

1) 2.305

Published By: @Zblaba

CRYPTOCAP:ICP #ICPUSDT #InternetComputer #Dfinity #Web3

Risk/Reward= 1:2.5

Expected Profit= +79.9%

Possible Loss= -32.0%

internetcomputer.org

dfinity.org

ICP: Approaching ResistanceThe Internet Computer (ICP) technical analysis:

Trade setup : Following a bullish breakout from Falling Wedge pattern, price has reached our target of $3.50. It is now overbought (RSI ~ 70) and could pause briefly. Trends are improving but price needs to break above the 200-day moving average (~$4.16) to confirm an Uptrend.

Patterns : Falling Wedge Usually results in a bullish breakout. When price breaks the upper trend line the price is expected to trend higher. Emerging patterns (before a breakout occurs) can be traded by swing traders between the convergence lines; however, most traders should wait for a completed pattern with a breakout and then place a BUY order.

Trend : Uptrend on Short-Term basis, Neutral on Medium-Term basis and Downtrend on Long-Term basis.

Momentum is Bullish (MACD Line is above MACD Signal Line and RSI is above 55).

Support and Resistance : Nearest Support Zone is $2.87. The nearest Resistance Zone is $3.50, which it broke, then $4.50, and $5.00.

Internet Computer (ICP) formed bullish Cypher for upto 14% pumpHi dear friends, hope you are well and welcome to the new trade setup of Internet Computer (ICP) with US Dollar pair.

Our last successful trade of ICP was as below:

Now on a daily time frame, ICP has formed a bullish Cypher move for another price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.