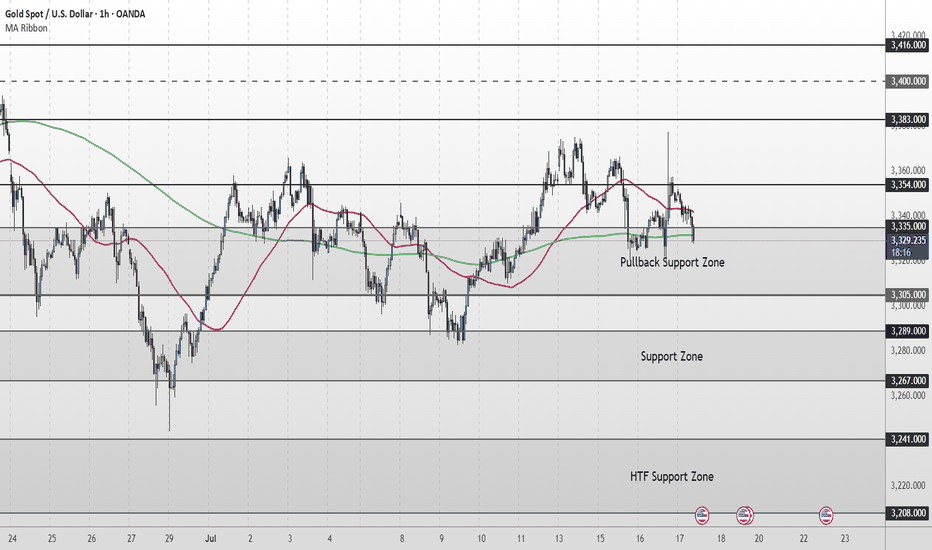

Gold Short Term OutlookYesterday, gold staged a strong rally, pushing up toward 3,377, which was followed by a strong rejection. Price has pulled back sharply and is now testing the Pullback Zone once again.

Currently trading around 3,329, price is caught between the 50MA overhead acting as dynamic resistance and the 200MA below offering dynamic support.

For the bullish structure to regain momentum, we need to see a clean break and hold back above 3,354. This would reopen the path toward 3,383 and 3,400, with 3,416 as a higher‑timeframe target.

If buyers fail to defend the Pullback Support Zone, and price breaks decisively below 3,305, attention shifts to the Support Zone (3,289–3,267). A deeper selloff could then expose the HTF Support Zone (3,241–3,208).

📌 Key Levels to Watch

Resistance:

‣ 3,354

‣ 3,383

‣ 3,400

‣ 3,416

Support:

‣ 3,335

‣ 3,305

‣ 3,289

‣ 3,267

‣ 3,241

🔎 Fundamental Focus – High‑Impact U.S. Data Today

A packed U.S. calendar could drive volatility:

📌Core Retail Sales m/m and Retail Sales m/m

📌Unemployment Claims

📌Philly Fed Manufacturing Index

These red‑folder releases can create sharp intraday swings.

Additionally, multiple FOMC member speeches later in the session could add headline‑driven moves.

Intradaylevels

GBPCHF Potential Bearish SetupDistribution pattern with breakdown below key support suggests downside momentum.

Break above our Resistance zone will invalidate our trade setup; good idea to watch out if that happens.

- Breakdown Level: 1.08149 -1.08133

- Entry Strategy: Sell orders at BOS

- Stop Loss: Above Resistance zone

- Target Zones:

- Primary Target: Target 1 (R:R 1:2)

- Secondary Target: Target 2 (R:R 1:3)

- Extension Target: Target 3 (R:R 1:4)

Bearish/Bullish Confirmations:

🔻 Rejection candlestick patterns

🔻 Bearish Reversal patterns

🔻 Impulsive moves in line with setups directional bias

Position Management:

- Exit: Partial profits at targets

- Stop adjustment: Trail stops when target are hit

XAUUSD Sniper Outlook – July 7, 2025"Structure over noise. Patience is power. Welcome back to the battlefield."

👋 Hey traders!

After a low-volume week due to the US Independence Day holiday, we now re-enter the battlefield with structure tightening under major resistance — and with Fed commentary on the radar.

No CPI. No NFP. But don't sleep on the setups — liquidity is quietly shifting.

🧭 Here’s what we’ve got ahead:

🔔 Key Events – July 8–12:

🟡 Monday–Tuesday: BRICS Summit (geo/political exposure)

🔵 Wednesday: FOMC Minutes – potential policy clues

🔴 Thursday: Unemployment Claims + Fed speakers (Muserlian, Waller)

⚪ Friday: Federal Budget Balance

We’re likely entering a reactive environment — fueled by internal structure shifts, not major macro catalysts. Perfect for smart money setups.

🧠 HTF Structure & Bias

🔹 Daily Bias:

Price remains capped under the key daily supply 3344–3351, which rejected cleanly before the holiday. Unless that flips into support, bias remains neutral to bearish.

EMAs 5/21 are curling sideways. RSI is flattening, and structure shows fading momentum.

🔹 H4 Bias:

We’re consolidating below a CHoCH + LH series, inside premium territory. The rejection from 3344 was precise, and unless broken, pressure favors the downside.

Price is rotating between the H4 EQ and the 3325–3332 intraday OB. Momentum is slowing — watch for re-accumulation or rejection depending on reaction at key zones.

🔴 Supply Zones (Sell Scenarios)

1. 3344 – 3351

This is the Daily + H4 supply from last week. EMA alignment + FVG + liquidity sweep confluence.

Perfect sniper rejection area if price trades up and stalls. Look for M15/M30 CHoCH confirmations.

2. 3380 – 3394

Untouched H1-H4 OB in premium. Not related to CPI/NFP — just pure inducement wick potential from above. If tapped after midweek liquidity push (e.g. FOMC Minutes), watch for overreaction entries.

🟢 Demand Zones (Buy Scenarios)

1. 3325 – 3332

Last week’s discount reaction zone. H1 OB + internal CHoCH zone. If swept and protected by bullish PA (M15 BOS), this becomes the best R/R long back into 3344.

Already tested Friday, but still holds weight for Monday.

2. 3286 – 3272

H4 OB + daily demand + RSI oversold zone.

If we get a full breakdown early week, expect this area to act as a reaccumulation pocket for bulls — but only with confirmation.

⚔️ Decision Zone – 3299 – 3305

This is the weekly flip area.

If bulls defend 3305 → bullish short-term bias returns.

If 3299 fails → downside continues into 3280s.

🧠 Summary & Gameplan

🧷 No CPI. No NFP. That means cleaner technical moves — no fake news spikes, just pure structure.

Expect Monday to be reactionary (post-holiday), and Wednesday–Thursday to bring intraday setups post-FOMC minutes.

✅ If price is in premium, watch for bearish rejections at 3344/3380.

✅ If price dips into discount, wait for confirmation longs at 3325 or 3286.

✅ Stay patient in mid-range. Don’t force trades inside chop zones.

🧲 If this gave you real clarity — don’t just scroll on.

Hit the ❤️ button, smash Follow, and tell us in the comments:

👉 Which zone do you trust more — the 3325 reentry or the 3380 inducement trap?

Let the gold tribe know 👇

—

📢 Disclosure:

This analysis is based on the Trade Nation TradingView feed. I’m part of their Influencer Program and receive a monthly fee.

⚠️ Educational content only — not financial advice.

— GoldFxMinds 💛

Patience | Discipline | Fearless Execution

TWAP and Chaikin's Osc vs VWAP Orders and VWAP IndicatorThere are two primary Order Types that the Professional Side of the market use.

1. Time Weighted at Average Price, aka TWAP , is used extensively by the Dark Pool Buy Side, Derivative Developers, and Sell Side Banks of record for Buybacks for corporations.

The TWAP can be set at a penny to few pennies spread and pings and transacts on a specific TIME to PRICE. It can be set to time intervals shorter or longer. This is why the stock market is called "fully automated".

TWAP is used most of the time. It is rare for the Giant Institutions to use VWAP orders due to the May 2010 FLASH CRASH when a fundamental trader of e-minis accidentally hit the VWAP order type rather than the TWAP order type which caused a massive collapse of all stocks as VWAPs accelerate selling as volume increases.

2. Volume Weighted at Price or VWAP is ALSO an ORDER TYPE. It is primarily used by Small Funds Managers and Small Asset Managers who are independents trading their customers' investment money actively, often intraday. Volume Weighted at price ORDER TYPES are also automated and ping to trigger the order to transact as volume increases.

This is an easy, simple way for a busy small fund manager to cope with the complexity of buying and selling stocks with 10,000 share lots to 100,000 share lots. These are the NEW "whales" of the market.

Professional Traders Swing trade 1 million to 5 million or higher share-lot sizes. The size of the orders of the professional trader has increased significantly in the past decade.

All of you need to be aware of the market participants on the professional side as they control 80% of the 1 trillion dollars that exchange hands daily on the US Markets.

Using Chaikin's Oscillator is ideal for tracking the Dark Pool Buy Side who create the bottoms. This excellent indicator analyzes all 3 data sets: price, volume and time. Thus, it can signal early that the Dark Pools have slowly started to accumulate over time and the runs down will turn into a bottom and then pro traders will nudge price to inspire VWAP orders from the Smaller funds managers.

The VWAP INDICATOR is excellent for tracking the smaller funds managers' trading activity and it ALSO has price, volume, and time in the formula. So this is great for those of you who need an indicator for following smaller funds activity as these smaller funds VWAP orders trigger more and more volume and then runs that can move up or down for several days.

TradingView has an awesome group of indicators to use. You should customize your indicators to which market participant groups you wish to track so that you can be ready and in a position before the big runs up or down.

Trade Wisely,

Martha Stokes CMT

Intraday Levels for Nasdaq 100 Futures - 01/06/2025This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/19/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/18/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/17/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/16/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/13/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/12/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/09/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Selling can continue in INDHOTEL after closing below 678.5 Today selling intensity in INDHOTEL was very high so it can continue tomorrow,

Its already trading at support zone, if we see followup selling tomorrow then next support is far away from the current price and can give good profit if price test next support level.

Note: Its just an analysis, wait for the price to confirm.

Disclaimer: Always follow risk to reward, this is the only key to success in market, no matter how much good a trade is looking we never know the future.

Reversal Descending Triangle pattern in GODREJCPGODREJ CONSUMER PRODUCTS LTD

Key highlights: 💡⚡

📈 On 1 Day Time Frame Stock Showing Reversal of Descending Triangle Pattern.

📈 It can give movement upto the Reversal Final target of Above 1251+.

📈 There have chances of breakout of Resistance level too.

📈 After breakout of Resistance level this stock can gives strong upside rally upto Above 1370+.

📈 Can Go Long in this stock by placing a stop loss Below 1150-.

Descending Triangle pattern breakout in UPLUPL LTD

Key highlights: 💡⚡

✅On 1 Day Time Frame Stock Showing Breakout of Descending Triangle Pattern.

✅Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 531+.

✅Can Go Long in this Stock by placing a stop loss below 452-.

[INTRADAY] #BANKNIFTY PE & CE Levels(22/03/2024) Today will be gap up opening in BANKNIFTY. After opening if banknifty sustain above 46550 level then possible upside rally of 400-500 points upto 46950 level & this rally can extend another points if market gives breakout 47050 level in todays session.Any Major downside only expected in case banknifty starts trading below 46450 level to 46050 level.also possible reversal downside 46950 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(11/03/2024) Today will be gap down opening in BANKNIFTY. After opening if banknifty start trading below 47950 level then possible downside rally of 400-500 points upto 47550 Level & this rally can entend another 400 points if market gives breakdown 47450 level in todays session.Any Major upside only expected in case banknifty starts trading above 48050 level.Also possible reversal upside 47550 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(26/02/2024) Today will be gap down opening in BANKNIFTY. After opening if banknifty start trading below 46950 level then possible downside rally of 400-500 points upto 46550 Level & this rally can extend another 400 points if market gives breakdown 46450 level in todays session.Any Major upside only expected in case banknifty starts trading above 47050 level.

#NIFTY Intraday Support and Resistance Levels -23/02/2024Nifty will be gap up opening in today's session. After opening nifty sustain above 22240 level and then possible upside rally up to 22360 level in today's session. in case nifty trades below 22200 level then the downside target can go up to the 22080 level.

#NIFTY Intraday Support and Resistance Levels -21/02/2024Nifty will be gap up opening in today's session. After opening nifty sustain above 22230 level and then possible upside rally up to 22350 level in today's session. in case nifty trades below 22180 level then the downside target can go up to the 22060 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(20/02/2024) Today will be gap down opening in BANKNIFTY. After opening if banknifty start trading below 46450 level then possible downside rally of 400-500 points upto 46050 Level & this rally can extend another 400 points if market gives breakdown 45950 level in todays session.Any Major upside only expected in case banknifty starts trading above 46550 level.

Uptrend Channel pattern breakout in TATACOMMTATA COMMUNICATION LTD

Key highlights: 💡⚡

✅On 1Hour Time Frame Stock Showing Breakout of Uptrend Channel Pattern.

✅Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 1810+.

✅Can Go Long in this stock by placing a stop loss below 1754-.