When Intuition Beats the Algorithm█ When Gut Feeling Beats the Bot: How Experience Can Improve Algorithmic Trading

In today’s world of fast, data-driven trading, we often hear that algorithms and rules-based systems are the future. But what happens when you mix that with a trader’s intuition, the kind that only comes from years of watching charts and reading price action?

A recent study has some surprising results: A seasoned discretionary trader (someone who trades based on what they see and feel, not just rules) was given a basic algorithmic strategy. The twist? He could override the signals and use his instincts. The result? He turned a losing system into a winning one, big time.

█ What Was the Experiment?

Researchers Zarattini and Stamatoudis (2024) wanted to test whether a skilled trader’s experience could boost a mechanical system. They took 9,794 stock “gap up” events from 2016 to 2023, where a stock opens much higher than the day before, and let the trader pick which ones looked promising.

⚪ To make it fair:

All charts were anonymized — no names, no news, no distractions.

The trader had only the price action to guide his choices.

He could also manage open trades — adjusting stop-losses, profit targets, and position sizing based on what the price was doing.

⚪ The Trading Setup

█ What Did They Find?

The trader only selected about 18% of all the gap-ups. But those trades performed far better than the full list. Here's what stood out:

Without stop-losses, the basic strategy lost money consistently (down -0.25R after just 8 days).

With the trader involved, profits rose fast, hitting +0.80R just 4 days after entry.

Risk was tightly managed: only 0.25% of capital was risked per trade.

⚪ So what made the difference? The trader could spot things the system missed:

Strong momentum early in a move

Clean breakouts from long sideways ranges

Patterns that had real follow-through, not just random gaps

He avoided weak setups and managed trades like a pro, cutting losers, letting winners run, and trailing positions with smart stop placements.

⚪ Example

An experienced trader can quickly identify a breakaway gap, when a stock gaps up above a clear resistance level. Unlike random gaps, this setup often signals the start of a strong move. While a system might treat all gaps the same, a skilled trader knows this one has real potential.

█ What Does This Mean for You?

This research shows that trading experience still matters — a lot.

If you’re a systematic trader, adding a discretionary filter (whether it’s your own review or someone else’s) could drastically improve your results. A clean chart read can help you avoid false signals and focus only on the best setups.

If you’re a discretionary trader, this study is proof that your skills can add measurable value. With the right tools and discipline, you don’t need to throw away your instincts, you can combine them with structure and still win.

█ Key Takeaways

⚪ Gut feeling isn’t just noise, trained instincts can spot what rules miss.

⚪ Trade selection matters more than just following every signal.

⚪ Managing risk and exits well is just as important as picking good entries.

⚪ Hybrid trading, rules plus judgment — might be the most powerful combo.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Intuition

Watching for pullback in METAMETA hit a target area I had on my dowsing work for the upside. Actually, it busted it by $10, but I get that it'll pullback to around the $610 area. There may be some kind of news. I'm unsure if it's specific to META, or the entire market. This would be happening soon. Like, tomorrow. BUT, I've been very wrong before... so if it triggers short, I'd expect it to be a decent move down (over 5%). We'll see.

Swing high on QQQ?My dowsing work is suggesting today is likely a swing high in indexes and there will be a few days down from around here. The level I expect on QQQ is just under 500. I've had some numbers as far as into the 80s as well, but not expecting that this go around.

I posted my roadmap for SPY as an idea for what to expect this week, and this is playing out so far. Today would be the "look above and fail", but we need to get the fail part! If it starts, then I think the target lower is valid.

I also will mention I get the number 6. That could be price or percent. If percent it's down to 495, which makes sense. In terms of price the last swing low was at 506.... idk we'll see.

SPY dowsing roadmap for this weekI've been posting the weekly readings my dowsing has given for SPY's potential price movement the past couple months and it's really interesting.

I go week by week, but am starting to include each day of the week looking forward. I left on the chart the prior notations from those ideas I've posted & you can reference what I had versus what actually occurred.

This week is quite negative. I've had the number around $562-62 coming up for a while, & beyond that, around the $542-48 area as I recall. I don't really get any positive gain over last week's close.

We'll see what happens.

Intuition stock: NOW shortI navigate markets by using my dowsing skills, and sometimes, intuitive hits. I actually have to sit still & ask for the intuitive stocks, however, & I don't often do it - even though I've had some remarkable results.

I did take a shot this morning though & heard or received, "NOW". Unsure if it was a suggestion to be more in the moment, I cleared my mind again & still got NOW & repeatedly the number 38. I pretty much left it at that, but took a look at the chart anyway, then went on with my day. It wasn't until I decided this afternoon to ask dowsing if there's anything to it that I got really intrigued...

I asked for the most important things to know about it, and got the "crash" option, followed by, "it's a big high". So I take another look at the chart to see what the hod might have been, & then I was blown away to see it is $1037.94. That's as good as 38 to me, & this is why I'm making this idea to journal what happens because it was very clear and repeating the number 38 in my mind this morning.

I used dowsing to try for the low. I think it's about 5.7% down this week. That'll be around 976-78. And the bigger low is around $947. I asked what date that low may hit by and got a date of June 16th, but I wouldn't put too much weight in that. I can't wait to see what happens with this one. We'll see!

USO long tgt $81I do dowsing & had a date to watch for on Monday 5/5 in USO from a reading I did on 3/25 & it even suggested a swing low! Yay! I don't always get the correct info going into these dates, so I'm hoping this will get more consistent.

Anyway, there may be a spike down in USO in the near future. If so, it's a buying opportunity as my work suggests this is a longer term low that's in place. I get a target of $81, but it also did give me 84, but that's the prior high & suspect. That's why I asked a second time & got 81.

When I ask what date we may hit this target by, I get the date of July 17th, so watch what happens there.

That's all for now!

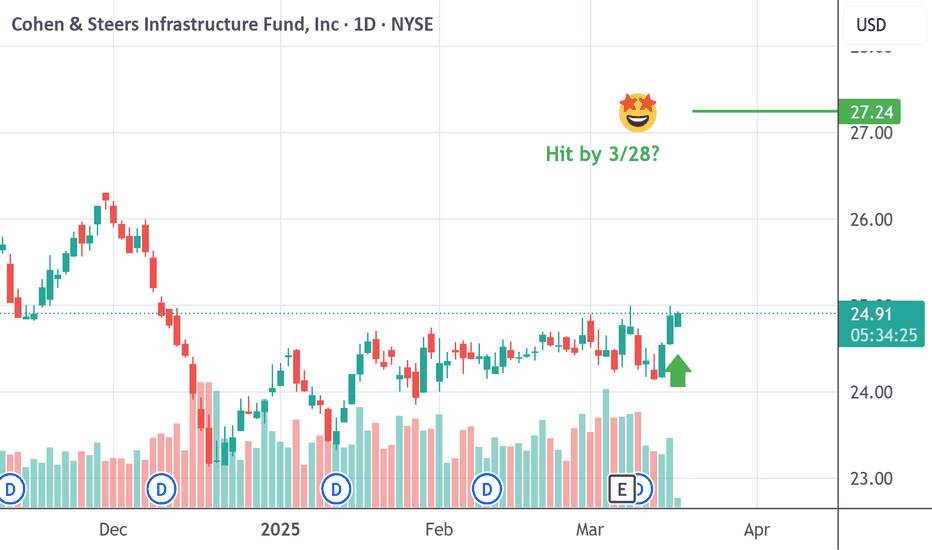

UTF up from here to 27.23ishMy dowsing suggested I ask for a stock from a screener I use. This list has many thousands of tickers & it's always interesting what I get.

This was neat because I asked what price I'm looking for BEFORE looking at the stock & the pendulum went to $26-27. So when I found it trading under $25 if felt like some validation.

There was a mention of a spike down & reversal up. Idk if that means this morning it already happened, or is yet to, but I'm pretty confident we hit the target, which is $27.23.

It shouldn't go under $24 & I asked what date we meet the target by and got March 28th.

There's no options on this fyi. We'll see how it shakes out!

Pendulum pick MTRN to $83Last night my dowsing told me to get a pendulum pick from the stock scanner. I do this from my ipad & all levels & info is from dowsing.

Anyway, I'll mention the first thing it gave me was a stock TDEC. I'm only noting this for journaling purposes. It's a weird "buffer" etf for emerging markets. Not interested, but may imply something bigger picture.

The second stock, which I changed settings on the screener to "optionable", is this MTRN. I know nothing about this stock, & I kind of like it that way so I'm not biased.

First things I get that it was going down, but will make a reversal up with the number 83. I was happy to see a number relatively close to where it's actually trading, but is down hard this today & I'm looking at 72 for a buy area. I did get the number 69, but that also could be the % down for today... and it's the prior low. Down 7% should be around $72, so watch this for a reversal and the target is 83. That also would fill a gap on the daily.

On a SPY idea I did pull a tarot card to see what it offered & it was totally relevant. This one was also really positive for just sitting back, relaxing & letting the money come. 4 of swords & 10 of pentacles if you're into it.

That's all.

Bearish energy TSLA earningsEarnings are kinda hard to read, but I totally nailed TSLA last time, so practicing here again with my dowsing.

It's all really bearish. I've already had a number around $188 come up for it, and that comes along with 185. Seems my levels get blown out by about 20 pts on TSLA, but watch out in these zones.

I suspect down 8%, but dowsing says down 17%. Advice is new 52 week low.

That's it. We'll see.

SPY short targets for this weekI expect this area to offer at least a bounce. There may be something like that on Thursday.

This is based on my dowsing work. I also left my prior idea, which was done at the beginning of the month to see how things shake out with projecting week by week with my work.

Obviously, the standout dates were very relevant. I don't get that there are any new dates to add.

Intuitively, I will say I heard the word, "floor". So where we land may be support for a bit?

We'll see. I'm still very new at intuitively hearing/receiving messages & things.

USO swing high- short tgt 65-66I asked my dowsing for the next trade to help reach my goal for the year, and it's oil/ USO. I do believe this will include oil stocks, so I may ask for dowsing to choose one from a list. If I do & get the reading done on it, I'll post it as another idea.

My latest work is pretty decent, but a work in progress. I'm really trying to determine time frames for when targets will hit so we can get the right options & mental expectation (i.e. patience) for things to develop.

The target is 65. In my mind I got 63, but I'm only sharing that because I'm also testing my own intuition more lately. The date we hit by is around April 28th.

I also have been guided to get dates from the past as an indication of what to expect, & the date given was 1/21, which was a gap down. I suspect there will be a gap down tomorrow, or at least the move down starts more aggressively. This has worked in prior ideas on TSLA & I think SPY... but can't remember.

I really am enjoying this method so far as my levels are often hit & I can just relax & allow things to happen with more faith they will. Of course, there's always the chance it's completely wrong & it is a smaller move, but we'll see.

MIRM expecting something bigThis stock was a pendulum pick (as in from dowsing) from around August. I posted an idea at the time, and it's gone up, but been consolidating. Last week or so, I decided to let my dowsing choose a stock from the fi viz screener from ALL exchanges.

There were over 9500 stock tickers & you know which one I landed on??? Yeah, MIRM again.

This is virtually impossible, & really got me fired up. I decided to check the option and that day (early last week I think) there were 1900 calls bought for next months $45 strike.

MIRM trades NO options, so this is extra interesting. And I happened to look on the day they were all purchase at once, or at least on the same day.

I will still expect the original target, though I do need to verify this still. I just can't help think something is brewing here.

NVDA support idea $108.90I do dowsing with a pendulum to get answers on what to expect in the market and stocks. I checked on NVDA today, and along with indexes soon (tomorrow) making a somewhat lasting (or longer term) low, I have a level for at least a bounce.

Tomorrow could be a big down day for stocks and indexes as I have timing for a low, but we have yet to reach targets. The $108 area has come before in NVDA, so I feel it really should be a spot to watch. The more refined level is $108.90, so it will be fun to see what happens here; and of course, I could be completely wrong & it does something else!

To catch a knife... QQQOk, I'm a little bummed I didn't make an idea sooner because my dowsing (as in with a pendulum) nailed the high on both SPY & QQQ. It is documented online, however, so I'm not making this up after the fact fyi.

I had mentioned at the time (around 2/23) 11 days to hit the lower target in SPY (I'll do an idea for it as well). Wednesday is the deadline, though I don't put a ton of faith in these things, dates typically are things to watch in my work and can be reversals.

On 2/26 I worked on what to expect for the first week in March. The message was it goes down, but there's a "scene of the crime" trade, spike down and low on... Wednesday the 5th! When I ask what does this look like, I get "v-bottom".

My dowsing now keeps repeating there will be a small move up to sell into if we get a significant move away from the 503-04 area.

I did my best to get levels, but obviously this is some woo woo kinda stuff, so it can be miraculous at times, and others a complete cluster. Definitely watch Wed. & the 468 area. Ideally, the time and price align for higher odds I'm correct. If we bounce, I'll try to find an upside target. There is also a lower target around 432, but I didn't dig into that much.

SPY timing for low Tgt $585My short idea target was hit (and blown yesterday, tho QQQ idea was almost perfect), and if you saw the last idea, I mentioned the date of the 11th was in play. This seems accurate from what I'm getting now with my dowsing work.

I am quite pumped that the timing was so good. The upside target (repeating) is around $585. When I ask what date this hits by, I get 3/25. We shall see if lightning can strike twice!

TSLA bounce baby tgt $264Well, that was quite a trip on TSLA, my lord!

My target at $242 from the last idea (TSLA big short) was blown, & I forgot I had a lower zone given from a reading (I'm a dowser) I did on 2/20 this year. I drew the range back then & suddenly price came into this huge drawing I had forgot I put on my chart. Maybe I mentioned it in the last idea, actually, but I'd have to check.

Regardless the way I get zones sometimes is I'm given a date. In this case the date was all the way back to 1/16/24. That day price was from $212-$223, so I just draw the zone & see what happens. When I asked at the time (2/20) the guidance is that TSLA would revisit those prices.

This is a long winded explanation of how I get info sometimes, and also why I think we bounce from here... besides the fact it's "due", right?!

My work in indexes was pretty super with a new breakthrough on predicting the time it will take to hit targets, which is amazing, and I'm not even going to be shy about it. We're in that time window with targets hit on indexes & dowsing repeating there's bullish energy.

Target on TSLA is $264 by the 24th of this month. Coincidentally, I have long indexes to the 25th. This is super experimental work, so let's just see what happens because I've had really good calls & then next time is horrible. Keeps me humble LOL. Go TSLA!

TSLA big short??? Tgt $242Alrighty, I've been creating a nice little track record with TSLA since just before earnings, and when I asked about it today, some different kind of energy or information came in.

I get my information from dowsing with a pendulum. You really won't find technicals at all with my work, so if you'd like a new or different perspective from the esoteric "woowoo" realm, I'm it. If you know any others who do this kind of thing and post about it, please lmk who they are.

So into tomorrow (Friday) should be pretty bullish on TSLA, however, my dowsing has pushed me about getting dates. When I did this, I noticed both dates (10/12/24 & 2/2/25) have large gaps down around that time frame. I also get that there's some kind of news - maybe this Saturday. Might Elon be too busy for TSLA??? Idk & didn't ask because I don't care. I only care what the stock is going to do & this took me a long time to do, so the fewer the questions, the better. The repeating "energy" is multi day downtrend and breakdown.

When I asked about a target I have a couple things... one thing came as a date, 1/15/2024 & suggested it revisits the price. I have seen this work in the past, so maybe. It also would clean up many gaps. That price range was $212-223 & is right in a consolidation zone.

My dowsing keeps giving me something with 42 though. This could be 42% from the next swing high, which if it makes it to $377 would take it to around $218. I let dowsing choose between the price 218 & 242 & it likes 242. Anyway, my lower targets are often blown (see last TSLA idea), but when you've already made so many points, is it a big deal??

It usually just indicates a warning zone for a reversal.

When I ask how many weeks to hit, I get 10 weeks. When I ask what month, I get May. When I ask what's most important to tell you guys, it says "a big high is coming".

We'll see. This'll be interesting!

SPY target 563I do dowsing with a pendulum on stocks and indexes, and am trying to use my intuition more, but I have a hard time sitting still. I did "tune in" for a minute to ask about SPY this morning & got the mental visual of a kind of peak and strong reversal down, and then the number 63 kept flashing at me.

After a few minutes, I realized that 562-63 is my dowsing target from after we hit the high at $613 (which I posted as a target & hit to the dollar).

So, this is to say, this work can be legit & way more than coincidence or luck.

When I had asked about when the 562 area would hit (on 2/23), my answer was 11 days. That date comes in on Thursday.

If price and time can align, results may be sublime. I seriously had to do that, but it is true & ideal if they coalesce. I do have some dates coming for Wednesday as well, so it could be off. But I have strong conviction 562-63 hits & then some kind of bounce, which I will update.

Bottom in $AMDDowsing went to AMD this morning and suggested a low in the $108 vicinity, which it gapped down to and ripped higher. I expect a somewhat extended move higher & possibly to $144.

This is all based on my dowsing (as in with a pendulum) and is always interesting to see what plays out. I did get that there could be news today or tomorrow.

The consolidating at these lows has been good, and actually, I have an old target around the 103-105/6 area based on 3 alerts that never quite got hit. So this is definitely a support as my levels are often pretty good, tho maybe not exact.

PRPL look out belowThis idea I must credit to my word generator. I do dowsing & intuitive "woowoo" readings on stocks and markets. I'm sometimes guided to penny stocks, so decided to share this one.

This name seems to be in trouble.

It may have a little bounce here off the 50 on a daily, but I get that there will be some corporate action that will hammer it, or, perhaps it's another kind of news event. My target is $.47. As in, 47 cents.

There is a date comes in around 5/13 and that is a possible low.

Of course, this could all be wrong, or partially correct and the target is wrong, but I can tell you the energy is bearish. I'll definitely keep an eye on it around the 5/13 and see if the energy is different.

Pend. Pick bullish MITT tgt $10I do dowsing, as in with a pendulum swinging to answers to my questions about the market and stocks.

So, this morning my pendulum suggested I let it pick a stock. I do this off of a stock screener on my ipad and there are literally thousands of tickers. The ticker of the day is for a REIT.

I'm not usually familiar with the names of these companies & I do not look at charts prior to asking what the direction or guidance is for them. I don't need any biases influencing results!

The energy of MITT is bullish & suggests there could be news coming. I'm starting to learn to look at the options open interest after the experience with my other idea, MIRM. There were almost NO options traded on it, yet huge open interest of 1900 calls purchased all in one day.

MITT also has some "extra" options; all on the call side.

My target is around the $10 mark. In the past these levels have hit & sometimes they simply consolidate & go higher, other times they completely reverse in a very ugly way. I get that this will make a big high, so it's possible there's then a short opportunity. I will check when we get up over $9. Options are so crazy cheap, at least for next weeks expiry.

For technicals, it tested the 200 sma today and bounced right off it. There is also an 11% dividend (according to my husband).

Good luck!

Pendulum pick Bearish WLKI've been needing to get a new pendulum pick for a bit here since MIRM & FND.

I do dowsing with a pendulum, and literally am letting my practice lead me with this idea. So I ask for something that's going to have an easy and quick move. I ask for all optionable, then let it pick which exchange. In this instance, it's NYSE.

147 pages of tickers and it says to go to page 140. Reduce down and get the stock ticker du jour, WLK.

Idk what it is, and as I've said before, I mostly don't care. I do not look at charts before this exercise, I just want to know the energy. In this case, it's very clearly down.

The suggestion is that it continues down. Then, I look at the chart... yeah, it's a clear downtrend.

There's an indication (twice) to sell rallies, which implies it can keep going up a bit. I'll be watching next Monday the 27th for a high, but it could also be that the number 27 is for price of 127.

I don't really think that's the case, but I'm being transparent about what can happen with this work.

I do get a little over a $2 move up as possible, so that $122 is another area to watch for resistance. If it's around there on Monday, that could be the swing high I'm looking for.

The date I get as an exit is July 15th. This doesn't mean it's actually legit, but I ask because wouldn't that be nice to know? So I may as well test it. I'm going to give this some time and watch for the reversal down. Then, I'll ask for the target.

TSLA earnings up 7-9%I do dowsing & intuitive work on stocks. I haven't done earnings in awhile, so trying TSLA here.

Energy is bullish. My intuition says up 7.4% (from price atm), and dowsing says to get a price, which coincidentally comes around the same price, $419-20. Of course, 420 must be hit as it was foretold in the prophecies.

It may get up over or around 9%.

I do have it as a good bet for higher, however, then bearish energy creeps in and there's mention of both selling rallies & the daily chart breaking down.

That's all for now. Good Luck!