BTC 97K Long Target Inverse Head and ShouldersTHIS BLUE NECKLINE IS 100% THE LINE TO FOLLOW

Inverse Head And Shoulders

Active Long Target - 97,050

What To Expect?

Trump's tweets are highly volatility just like the markets so rather then trying to call the exact bottom use this for your bull / bear transition. I'm not saying when it will happen... but above the blue line bullish, below it flip bearish despite it would take a number in the 60Ks to invalidate this target.

Downside seems to be the orange support line in 73.8... but money is on 97K sooner than later and this chart staying valid.

Inverse Head and Shoulders

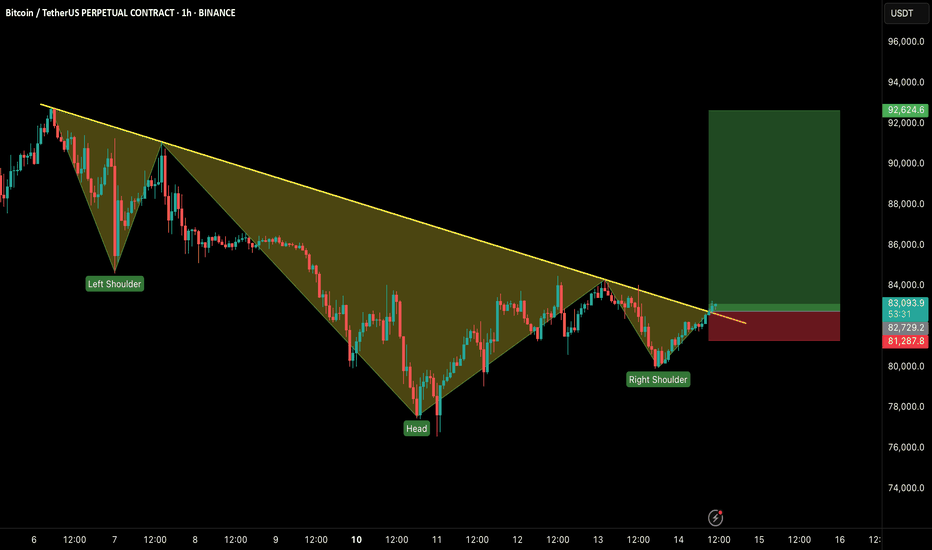

$BTC Not Out Of The Weeds Yet - Must Break $84kIf CRYPTOCAP:BTC can break back above ~$84k then we could continue to follow my OG setup (yellow) and rip,

but since PA dumped slightly below the 50WMA it technically invalidated my inverse h & s idea.

A rejection of $84k would dump us back to ~$78k to form the right shoulder (red) and complete the setup.

nonetheless, i believe we've seen the bottom 👋

BTC UPDATE: Flash Crash? Or Bullish Retest?🚀 Hey Traders! 👋

If you’re enjoying this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

📉 BTC just dropped nearly $10K in a single day, sliding from $84K to $74K amidst growing tariff tensions and broader market turmoil.

But here’s the bullish twist—this dump might just be a healthy retest.

BTC recently broke out of a strong inverse head & shoulders pattern, and what we’re seeing now looks like a classic neckline retest.

📌 Key Support: $72K

As long as BTC holds above this level, there’s no reason to panic. Once the dust settles from this bloody Monday, momentum could shift back to the upside.

🟢 This could be a golden accumulation zone—low risk, high potential reward.

❌ Invalidation Level: Weekly close below $72K

💬 What’s Your Take?

Will BTC bounce from this level, or is there more downside ahead? Drop your analysis and predictions below—let’s navigate this together and secure those gains! 💰🔥🚀

$BTC Inverse Head and Shoulders Finally FormedAnd just like that, the Death Cross has formed the right shoulder for the Inverse H & S idea I formed on March 14th

We may sit a bit more downside to retest the 50WMA at $76k for confirmation

If we get a V-shaped recovery tomorrow, this very well could be the bottom for CRYPTOCAP:BTC

$BTC Death Cross Forming Inverse H & SAs expected, CRYPTOCAP:BTC is rolling over, hopefully to form that right shoulder for the inverse h & s patter to confirm the next leg up.

This dumped is fueled by the impending death cross, which historically marks big reversals, since the cross is already priced in.

ETHUSD – Bullish Quasimodo + iH&S Breakout | Upside Targets!Ethereum (ETHUSD) has completed a textbook bullish Quasimodo pattern in confluence with an Inverse Head & Shoulders (iH&S) on the 15-minute timeframe. Price has broken out with strong bullish momentum, and the structure suggests more upside ahead.

📊 Technical Breakdown

1. Quasimodo Pattern

A well-defined Quasimodo reversal formed at the swing low, providing early signs of a bullish trend shift.

This pattern combines a higher low and reclaimed structure—offering an excellent base for trend continuation.

2. Inverse Head & Shoulders

Left Shoulder, Head, and Right Shoulder clearly structured with neckline breakout confirmed.

Breakout above neckline resulted in a 5.38% rally into minor resistance.

3. Bull Flag Formation

A short consolidation just below the recent highs resembles a bull flag, typically a continuation signal.

Breakout from the flag would trigger the next leg toward the final target.

🎯 Targets

Minimum Target: 2,121.41 — aligns with neckline projection.

Final Target: 2,229.90 — 6.27% projected move based on iH&S measured move.

📌 Trade Idea

Entry Zone: On bull flag breakout above 2,093

Stop Loss: Below 2,060 (flag low support)

TP1: 2,121

TP2: 2,229

🔎 Key Confluences

Pattern Breakouts ✅

Strong Momentum ✅

Clean Structure & Price Geometry ✅

ETH bulls have reclaimed short-term control. If momentum sustains, the upside targets are well within reach.

XRPUSD breaking upward from invh&sTarget is $3. Very likely to hit the full target based on the bullish momentum from the sec ripple appeal being ofifcially dropped. Likely to continue upward from there as well but for this current idea I only wanna focus on the inv h&s target. *not financial advice*

#BTCUSDT: BULLISH BREAKOUT IN LTF!!🚀 Hey Traders!

If you're finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

BTC is breaking out from an inverse head & shoulders pattern on the 1H timeframe, signaling strength! 📈 If it holds above the neckline, we could see a strong rally toward $90K– GETTEX:92K in the coming days! 🚀

🔹 Key Levels to Watch:

✅ Target: $90K– GETTEX:92K

❌ Invalidation: Close below $81,200

Momentum is building—can bulls take control? Let us know in the comment section.

#BTC: IS THE BULL MARKET OVER??🚀 Hey Traders!

If you're finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

Is the Bull Market Over? 🤔

The big question on everyone's mind—Has the bull market ended? My answer is NO! Let’s break it down:

📊 Technical Perspective:

As you can see in the chart, BTC recently broke out from an inverse head and shoulders pattern on the weekly timeframe. This current dip? It’s nothing but a healthy retest of the breakout ($72k-$75k). Once BTC successfully confirms this retest, we should see a strong push to the upside. Patience is key!

🌍 Fundamental Perspective:

1️⃣ Institutional Adoption: Big players like BlackRock, Fidelity, and global hedge funds continue accumulating BTC, Also adopting by some big countries like US proving confidence in the long-term trend.

2️⃣ ETF Inflows: Bitcoin Spot ETFs have seen billions in inflows—indicating that traditional finance (TradFi) is betting on BTC’s future.

3️⃣ Macroeconomics: With the Fed slowing down rate hikes, liquidity might start flowing back into risk assets, benefiting BTC and crypto as a whole.

🔍 The Key Level to Watch:

A successful bounce from the neckline of this pattern will confirm strength and could send BTC soaring to new highs!

🔥 What’s your take? Drop your thoughts in the comments, and let’s navigate this market together! 🚀💰

Gold (XAUUSD) - Inverse Head & Shoulders Breakout Setup!Hello everyone, i hope you all will be doing good in your life and your trading as well, let's discuss about Gold and it is showing a strong bullish setup with an inverse head and shoulders pattern on the 1-hour chart . This means buyers are stepping in , and a breakout above the $2,930-$2,932 neckline could push prices higher toward the next resistance at $2,954-$2,960 . A stop-loss around $2,910-$2,906 can help manage risk in case of a pullback. Watch for volume confirmation when the breakout happens—it’ll add more strength to the move!

If Gold breaks out and holds above the neckline , we could see a good upside rally as buyers take charge. But if it fails to sustain, we might see some consolidation or even a drop. Best approach? Wait for a clean breakout and retest before jumping in. Stay sharp, manage risk, and trade smart!

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

Military Metals - Possible Head & Shoulders with a 2X potential Antimony is a buzz in the mining space. Military Metals is looking to capitalize on China’s market dominance by developing new antimony mines in North America. The chart suggests that the $5 million dollar market cap exploration company could be on the verge of a 2X move. I believe that any purchase under $0.35 would be a good buy for a move up to $0.65 and possibly beyond. Good luck.

BILI Projects to $100Bilibili Inc. is a leading provider of online entertainment tailored for the youth of the People's Republic of China. The company boasts a diverse array of digital offerings, including professionally produced user-generated videos, mobile gaming experiences, and enhanced services like live streaming, occupationally created videos, audio dramas on Maoer, and comics available through Bilibili Comic. Additionally, Bilibili offers advertising solutions, IP derivatives, and various other services. The company is also involved in business and technology development, e-commerce, and the distribution of videos, comics, and games. Established in 2009, Bilibili Inc. is based in Shanghai, China.

Bilibili is currently priced at $20.81, indicating it may be undervalued according to discounted cash flow analysis, which suggests a fair value of $28.84. Although there has been notable insider selling recently, the stock remains 28% below its estimated fair value and is projected to achieve profitability within the next three years, surpassing average market growth rates. While the anticipated revenue growth of 10.2% per year is not as robust as one might hope, it still outpaces the overall US market's growth rate of 8.9%.

A 51% upside trade idea watchlist add before we moon!NASDAQ:MNMD

Inverse H&S

$10.44 BREAKOUT =🎯$12.25🎯$15.60

Called this one out a few months ago and how RFK Jr. would send the Psychedelic's Stock flying...He did just that after his inauguration. It could keep flying now with momentum!

Not financial advice

SUI | ALTS | BULLISH Chart Pattern?A bullish chart pattern is forming on SUI in the daily chart.

It should be noted that this patter is still premature - meaning that it's not yet completed and there is not yet the confirmation that we need to act on it:

Don't miss the most recent update on XRP here:

_________________________

COINBASE:SUIUSD

GBPJPY Inverse Head & Shoulders Set-UpOANDA:GBPJPY has formed the Bullish Reversal Pattern, Inverse Head & Shoulders!

Price has broken up above the Down-sloping Neckline to confirm the pattern.

Once the Break is Validated by retesting the Neckline and is Supported, the pattern could deliver a good buying opportunity around the 188.5 area to take up to the February Resistance Level and potentially further!

Fundamentally,

GBP has GDP on Thursday

**Beware of False Break creating a Bearish Trap. Watch for adequate Bullish Volume to Follow the Break and the Retest suggesting Bulls are interested!

Bitcoin to the moon?Bitcoin-Gold Ratio.

If you are going to trade with the big boys, there seems to be a good chance!

An inverse head and shoulders pattern!

What is this chart telling us? this chart is signaling a prolonged bull run (a protracted wave).

(what it might lead to) as a result: Gold could drop 80% against Bitcoin!

Remember, the market (pattern!) does not care what you think.

BTC = $ 96450

Gold = $ 2860

Feb 9, 2025

Appendix

The fat years

PYPL , PEPS, COIN | HOT STOCKSThere are a few stocks that could be good buys, and are approaching idea l buy zones.

PEPSICO VIE:PEPS

Pepsi is showing it's "annual correction" as we're finally getting close tot he apex of the correction, which may be an ideal buy zone.

PAYPAL NASDAQ:PYPL

Paypal is still on my watchlist, for great growth, further adoption and upside potential after finish of a clear bearish cycle:

COINBASE NASDAQ:COIN

Fairly recently released, coinbase could be a good buy for a long term hold. Also currently observing a pattern that can either be called an Inverse Head and Shoulders, or Cup and Handle.

________________

Inverse H&SH BTC ready to break outThis is a long term chart I have used for years, and keep adding to it. Now I see these trend lines, made a long time ago coming into play again, thee fib is from the last cycle high to low with extions to look at all .618s . BTC just hit 1.618 I see 2 or 3 maybe the 4.618 this cycle, nut haven the plan to ladder out as we get closer to areas shaded in the chart.

If this inverse h & sh in yellow breaks up then BTC measured move is to 125K the 2.0 extension, then restests along the way, but look at the old whit trend lines and see hoe btc cant touch the top as in makes this move

this is public and my handle is Chefrusty, you are welcome to use it as a guide, the indicators are hidden right now and some are paid for, but the chart is a good guide for this bull run and has been backtested for time and percetage gains, watch for sell in May and go away, anf then buy back in is Sept this year. BUT BUT BUT how different will this cycle be than the others with crypto firendly president?