IOTBTC

IOTA time to shortIOTA shows its weakness at IOTA/BTC chart.

We can see:

Bad cross of EMA indicator

Failed growth on 19th of May

Bear divergence at day RSI chart

ATH of LONGS at IOTBTCLONGS chart Bitfinex (!)

IOTA/BTC is going to at least double bottom, which means we will see 0.000040 soon or even lower!

Stop loss at 0.000039.

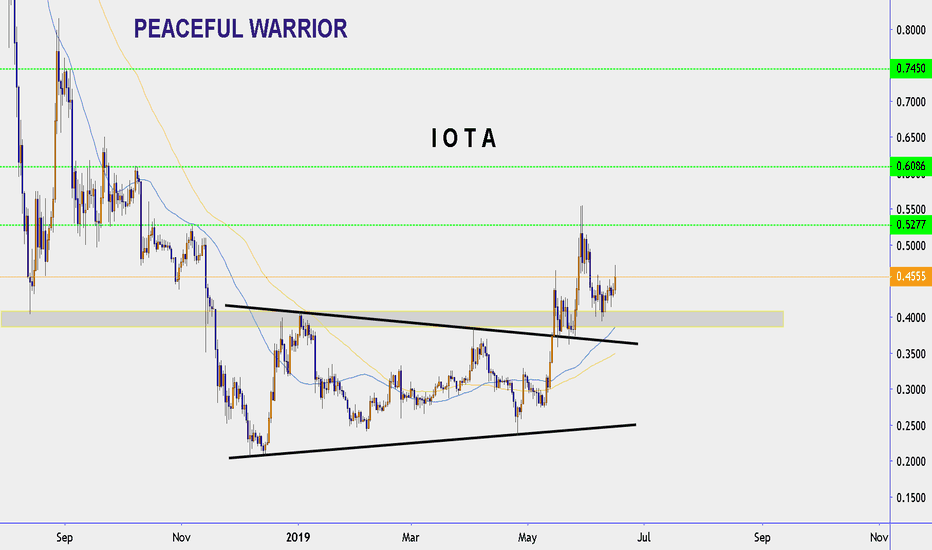

IOTA - a perfect buy level in the coming days/weeksIOTBTC looks like a perfect buy soon. It has formed a falling wedge (red). It can still go lower to the all time lows @ ~0.000043 BTC and form a double bottom. If that happens, especially within the falling wedge it is a no-brainer for me. Watch for incresing volume in the next weeks. The target might be lowered if the upper line of the orange triangle acts as a very strong resistance.

*********************************

This is not a trading advice!!!

********************************

$IOTA Supports - Short ideaLooking from here, it seems that IOTA is losing the last important support for another big fall. Black horizontal lines indicate possible purchase points. Below one, the target will be as follows. I would not go into IOTA until a clear sign of reversal, this can last for months. I'm short

IOTA - Under The Empty VoidAfter the pump caused by the news of IOTA's partnership with Jaguar Land Rover, it had since then fully retraced and fallen back down. This is highly bearish as it shows a lack of follow through and continuation from the bulls. IOTA/BTC pairing is currently showing a very decent risk to reward for bears as a breach of the recent low, which is also the all time low, will cause intense fear and a bunch of stop-loss cascade. There is no support left for IOTA, it's just a matter of when the support breaks. I believe this is a great gamble given the high r/r ratio here for shorts.

IOTA With Good News!Hello crypto friends! IOTA has seen some positive news today with the integration of Jaguar/Land Rover, which lead to a nice 15% move already.

We're currently inside an Hourly equilibrium in both USD & BTC and could still see some follow-through.

In USD we have a resistance zone of 32-33, which we'd have to clear to be able to move higher. TP would be 34 & 37.

In BTC we would already face resistance at the .65 region from the prior S&R zone. If we could pass that, .67

As always, grandpa BTC would have to be at least neutral, better bullish, for this scenario to play out. Otherwise IOT/USD has much room to correct to, 30 or even more, before it can further tighten inside that wider range. BTC is currently still in a bear flag on the 4H.

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my Crypto Analyses! I wish you a good trading! :)

Edgy is providing online education & tools only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

IOTA bottom - IOTBTC Wolfe WaveI actually drew this WW several days before it hit the low point, but didn't publish it. Oh well. In any case, if it plays out, we're looking at around 3x gain, and can use pretty tight stops at this level. Great RR trade!

The recent low is also a double bottom with the all-time-low price vs BTC since listing on Bitfinex, which just so happened to coincide with the recent IOTA news... what a coincidence!! I love how the MM's push it down to buy the absolute bottom right before releasing positive news lol. Manipulation anyone? Whatever, as long as you're on the right side of the manipulation. Exact same thing in the stock market and everywhere else. The big boys release the news at the perfect time to boost their positions.

IOTA - Hopium, Hopium, and Hopium...IOTA is looking slightly bullish on the daily timeframe as it is about to break out of the triangle. Not to mention, bulls did an amazing job defending the daily MACD cross right at the zero mark.

On the weekly timeframe, we can see the RSI making a potential inverse head and shoulders pattern. Similar to every inverse head and shoulders pattern, we must wait for the break of neckline resistance as confirmation.

Using a variety of synthetic currency pairs, we can compare the strength/weakness between IOTA and other cryptocurrencies. In this example, we will use synthetic pair IOTUSD/NEOUSD which simplifies into IOT/NEO.

There's a very visible bearish divergence in MACD, RSI, and Stochastic. There's a possibility that money from algo traders that are trading synthetic currency pairs may go into IOTA due to its temporary weakness against other cryptocurrencies. But keep in mind, this is simply a method to compare the strength/weakness between two highly correlated asset. USD value of IOTA does not necessarily have to go up in order for IOT/NEO to go down.

Using IOT/ETH pairing, we could see that we're approaching a long term support trendline with a double bottom starting to form. This further supports my point in IOT/NEO: IOTA should theoretically gain strength compared to other cryptocurrencies in the coming days or weeks.

Just like every single double bottom, a retest of the neckline is necessary. The neckline support must hold or else it would indicate that IOTA is still too weak.

Feel free to share your long-term bearish ideas, it's always good to know both sides.

A trading opportunity to buy in IOTABTCTechnical analysis:

. IOTA/BITCOIN is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00007300 to 0.00006415). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00007300)

Ending of entry zone (0.00006415)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00008020

TP2= @ 0.00008540

TP3= @ 0.00009380

TP4= @ 0.00011050

TP5= @ 0.00012950

TP6= @ 0.00014060

TP7= @ 0.00016480

TP8= @ 0.00018910

TP9= @ 0.00026760

TP10= @ 0.00031200

TP11= Free

IOTA ($IOTA) - up to 460% PPT! Long term trade.$IOTA is showing bullish divergence on daily chart.

Price reached buy zone and had been moving there for a while.

$IOTA is one of the top project in crypto space with great idea and community support.

Green - buy. Red - sell.

I do not recommend using this chart for margin trading.

It's not a financial advice.

Trade carefully and good luck!