IPCA Laboratories – Weekly Technical Analysis 📈 IPCA Laboratories – Weekly Technical Analysis (For Study Purpose Only)

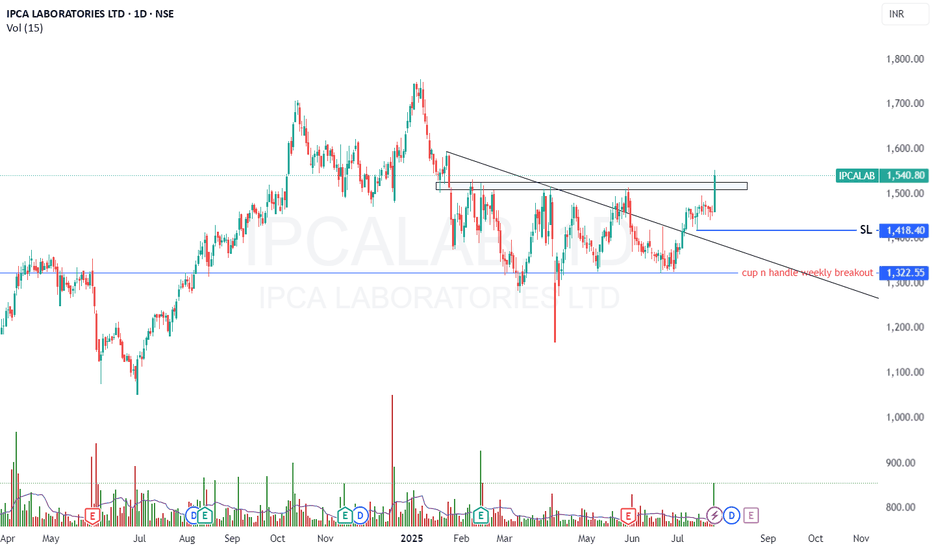

Ipca Labs has successfully completed a Cup and Handle breakout on the weekly chart, indicating a strong bullish setup after a prolonged consolidation phase.

After forming a double top and undergoing a nearly 6-month consolidation, the stock recently broke out above the neckline and range of ₹1320–₹1510, followed by a textbook retest of the breakout zone, which further strengthens the breakout's validity.

🔍 Key Technical Highlights:

✅ Pattern Formed: Weekly Cup and Handle retest and 6 month range breakout

📉 Previous Structure: Double top ➜ breakdown ➜ 6-month range consolidation

🔼 Breakout & Retest Zone: ₹1320–₹1510

✅ Retest Completed: Confirmed on weekly chart with supportive volume and price stability

🎯 Upside Targets:

Short-term: ₹1600

Medium-term: ₹1700

Long-term: New All-Time High (above ₹1750+)

🛑 Risk Management:

Stop-Loss: ₹1480 or (below retest zone)

📊 Supporting Indicators:

RSI trending upward, currently above 60 (bullish zone)

MACD crossover confirms positive momentum

Volume confirms strength during breakout

📌 Disclaimer: This analysis is for educational and study purposes only. Not a buy/sell recommendation.

Ipcalabs

Momentum Trading Picks:Pharma Stock Ipca LabThe chart presented here is a daily chart, detailing precise entry and stop-loss levels. However, upon examining the weekly chart, a breakout of the cup pattern becomes evident. The target for this pattern is determined by the depth of the cup, making it a compelling long-side investment. The projected target is approximately 700 points higher, suggesting that the price could reach the 2000 rupee level.

IPCALABIPCALAB fut breaking out of rounding/saucer pattern on an hourly/daily charts with decrease in OI suggesting shortcovering.

Risk:Reward = 1:2.5

Could be bought with mentioned stoploss & target.

Not to b missed.

Can IPCA Break the trend?Ipca Laboratories Ltd. engages in the manufacturing, marketing, research, and development of pharmaceutical products. Its products include Hydroxychloroquine Sulphate, Artemether and Lumefantrine and Acceclofenac and its combinations. The Company has 18 manufacturing units in India manufacturing API's and formulations for the world market.

Ipca Laboratories Ltd CMP 1220.75. The positive aspects of the company are Mutual Funds Increased Shareholding in Past Month, Company with Low Debt, Company with Zero Promoter Pledge and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are High PE (PE=56.6), MFs decreased their shareholding last quarter, Declining Net Cash Flow : Companies not able to generate net cash and De-growth in Revenue, Profits and Operating Profit Margin in recent results.

Entry can be taken after closing above 1225. Targets in the stock will be 1252 and 1294. The long-term target in the stock will be 1328 and 1357. Stop loss in the stock should be maintained at Closing below 1136.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Ipcalab , a pharmaceutical company Ipcalab , a pharmaceutical company, is currently positioned at its Fibonacci reversal levels, indicating a potential turning point in its price action. Following bullish signals, the stock is expected to trade within the range of 1320 to 1350. This suggests a positive sentiment among investors, with the possibility of upward momentum in the near term. Traders may monitor further price action for confirmation of this bullish trend.

IPCALAB Low Risk Big Profit IdeaAs per my analysis, 707 level was strong resistance of NSE:IPCALAB . Now resistance has been brake and sustained above 707. My idea is to take buy entry at level of 707 with stop loss of 666 (-41 Points Risk). My expected upside target would be 766 (+59) & 966 (+259 Points).

It could be jackpot idea.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

IPCA LABORATORIES : Potential Harmonic Reversal The idea here is about Ipca Laboratories:

Ipca Laboratories Ltd is a fully-integrated Indian pharmaceutical company manufacturing over 350 formulations and 80 APIs for various therapeutic segments.

1. Bullish Cypher pattern completed on a daily chart potential trend reversal expected. However, if the trend continues downward then the pattern is nullified. Out of Falling wedge trend at the moment.

2. What is Cypher Pattern? Explained in the below image:

3. Double top completed and currently looks like a Double bottom pattern under formation as per chart at the time of publishing.

4. Trading way below 20 & 200 EMA on Daily chart & between 20 & 200 EMA on a weekly chart.

5. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily, Weekly chart is Strong bearish & Strong Bullish on monthly chart.

6. RSI is at 30.37 on a Daily Chart at the time of publishing. This indicates almost oversold at the time of publishing.

7. MACD below signal line on daily chart, and converging towards signal line.

8. Hull Moving average on a daily & monthly is sell & on a weekly chart is a buy.

9. Wait for trend reversal & retest may be for long entry (short term). However, keep in watch list for the week & alert for price momentum.

Projected targets as per Cypher Pattern provided in the chart.

Stop Loss: Provided in chart as per Cypher pattern.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

IPCALAB - Bullish engulfingA bullish engulfing candle has been formed on the daily time frame suggesting a good move in the upward direct is very much possible.

There is a good consolidation zone being formed and a breach of the zone(resistance) would surely give a good upward movement in this counter.

For buying the stock should be trading above the levels of 1069 and on the other hand if prices fall below 1056 we could see support areas.

Do not look at the huge red candle as that was the stock split.

Above the zone any big buying that happens will take the price up.

All the best

Your feedback is highly appreciated

Asian paints gave easy 2% returnthings I have learnt

1. Paper trading is different than real trading

2. discipline and risk management is the only key

3. find the convenient setup according to you and work hell out of it.

CONNECT WITH ME THROUGH THE LINK IN PRICING TO JOIN THIS LONELY JOURNEY OF STOCK TRADING AND YET PROFITABLE LIKE HELL

IPCA bullish flag break out The Major pattern is the Broadening pattern which stock is following since last year October 2019, it has almost doubled from then.

but if you see from April2020, the stock was consolidating sideways forming channel pattern. So indirectly it contributed towards flag formation, it has broken upside.

Technically,

There are 2 Targets , Channel and Flag Formation

T1 = 1900

T2 = 2400 ( I can't draw the target over here beacuse of screen Limitation) Duration: 3 Months

Stoploss is below channel resistance

Strategy : get to first target, take out the profit and if price is sustain over 1900 ,take the long position.

After looking more than 90% of return from last year, T2 doesn't seems reasonable.

But Current Business scenario of IPCA favours it to some extent.

Reason : They are stronger in Biologics, Tommorow if any vaccine comes IPCA will definately contribute in "producing" it. They have something more to offer than "Hydroxy Chloroquine"

See the Volume growth from April, Product basket and intrinsic capacity favours to get over current Pandemic.