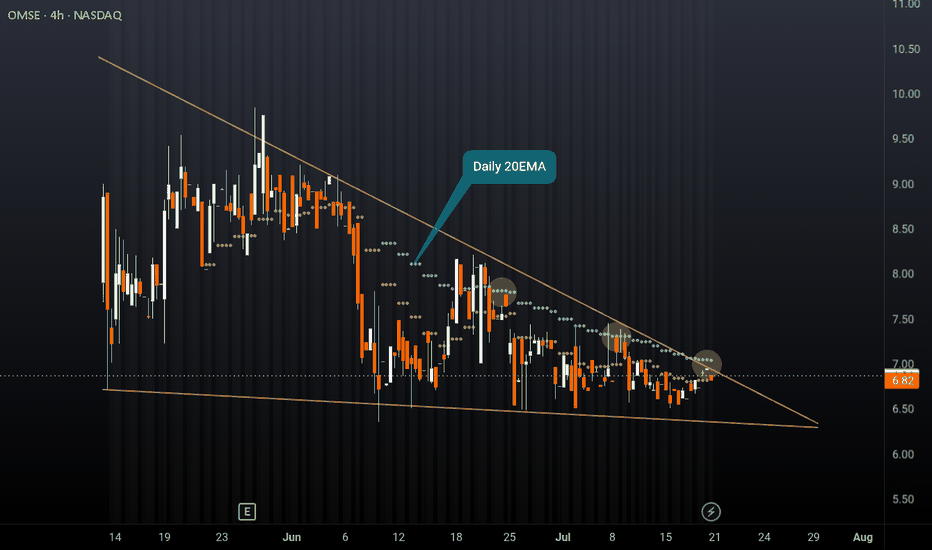

OMSE falling wedge after IPONeutral on OMSE, another relatively new ticker. Similar to my previous post on DVLT, this ticker is fundamentally strong but stuck in a falling wedge after IPO. Price is struggling to break the daily 20EMA (overlayed on this 4H chart) and has rejected multiple times. The company has strong financials, take the time to do some DD, however this pattern could break to the downside and hit new lows before we see any type of rally given the weakness in this sector at the moment. Set alerts and watch the price action play out, or don't bet your rent money on any direction if entering a position.

I'm just a cat not a financial advisor.

IPO

PALANTIR REMAINS YOUR TRADING GOAL, DOUBLING IN PRICE IN 2025In the Faraway Kingdom... In the Thirtieth Realm....

Somewhere in another Galaxy.. in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas .

1️⃣ What was your best trade this year?

2️⃣ What is your trading goal for 2025?

Here's what we answered:

1️⃣ What was your best trade this year?

- Surely Palantir NASDAQ:PLTR 💖

I followed Palantir all the year since January, 2024, from $16 per share, watch here .

Current result is 5X, to $80 per share.

Also I added more Palantir after SP500 Index inclusion in September 2024 watch here .

Current result is 2.6X, from $30 to $80 per share.

2️⃣ What is your trading goal for 2025?

- Once again, surely Palantir NASDAQ:PLTR 💖

It's gone 7 months or so... (Wow... 7 months really? 😸😸😸)

Let see what's happened next at the main graph of Palantir stock, to LEARN WHY PALANTIR REMAINS THE TRADING GOAL, DOUBLING IN PRICE IN 2025...

Palantir stock remains an attractive trading goal for several compelling reasons rooted in its strong market performance, innovative technology, and robust growth prospects, particularly in the artificial intelligence (AI) sector.

1. Exceptional Stock Performance and Momentum.

Palantir Technologies has been one of the best-performing stocks in 2025, surging over 80% in the first half of the year alone, vastly outperforming the S&P 500’s modest 5.5% gain. The stock recently hit all-time highs around $149, reflecting a nearly 400% increase year-over-year, underscoring its strong momentum and investor enthusiasm. This surge positions Palantir as a top AI stock to watch, attracting both retail and institutional investors, including conservative entities like the Czech National Bank.

2. Leadership in AI and Data Analytics.

Palantir is not just a data analytics company; it has transformed into a major AI software provider with its Artificial Intelligence Platform (AIP). This platform extends beyond government contracts into commercial sectors such as healthcare, energy, and automotive, fueling significant revenue growth. The company reported a 39% revenue increase to $883.9 million in Q1 2025, driven largely by AI adoption. Its AI platform is gaining traction globally, with many companies rapidly adopting Palantir’s software through short training bootcamps, demonstrating scalable and fast integration.

3. Strong Government and Commercial Contracts.

Palantir’s roots in government intelligence and defense continue to be a significant revenue driver. The U.S. government division alone generated $373 million in Q1 2025, with overall government revenue up 45% year-over-year. Strategic partnerships, such as with Accenture to streamline federal operations and projects like the U.S. Navy’s ‘Warp Speed for Warships,’ highlight Palantir’s expanding footprint in critical government sectors. Simultaneously, the commercial segment is booming, with revenue soaring 71% to $255 million in Q1 and projected to reach $1.178 billion in 2025.

4. Financial Health and Growth Outlook.

Palantir’s financials are strengthening, with no debt and adjusted free cash flow more than doubling to $370.4 million in the recent quarter. Analysts forecast the company’s revenue to exceed $3.5 billion in 2025, up from $2.23 billion the previous year, and project potential revenue of $7 billion by 2028. Operating margins are improving, with a recent quarter reporting a 26% margin, the highest in company history. This solid financial foundation supports further investment in AI innovation and market expansion.

5. Market Position and Competitive Edge.

While Palantir competes with tech giants like Microsoft, Amazon, and Google in the AI and data analytics space, it has carved out a unique niche with its specialized government contracts and AI-driven software solutions. Its ability to integrate complex datasets for real-world operational use distinguishes it from competitors, fostering a loyal investor base and a "cult-like" following among retail investors.

6. High Valuation Reflects Growth Expectations.

Despite a high price-to-earnings ratio (PE around 621), reflecting elevated expectations, many analysts remain optimistic about Palantir’s long-term potential due to its rapid growth and expanding AI capabilities. The company’s market capitalization has soared above $330 billion, surpassing many established corporations, signaling strong market confidence.

7. Palantir stock is a compelling trading goal because it combines robust growth, cutting-edge AI technology, strong government and commercial contracts, and solid financial health.

8. In conclusion, Palantir remarkable stock performance and strategic positioning in the booming AI sector make it a promising investment for traders seeking exposure to transformative technology with significant upside potential.

9. ...and yet, Palantir performance since inception (It ultimately went public on the New York Stock Exchange through a direct public offering on September 30, 2020) is better, rather then Bitcoin.

--

Best wishes,

@PandorraResearch Team 😎

MAMATA - Head & Shoulder patternComment below what you observe in the chart.

All details are given on chart for educational purpose only. If you like the analyses please do share it with your friends, like and follow me for more such interesting charts.

Disc - Am not a SEBI registered analyst. Please do your own analyses before taking position. Details provided on chart is only for educational purposes and not a trading recommendation

What’s Next for PROSTARM Investors...?Prostarm has decisively broken its all-time high. Since its IPO on June 3rd, it has successfully surpassed the major resistance level of 126 and is holding strong above it. We should take advantage of this opportunity and establish a long position on the retest of the 126 level.

Buying CRCL after IPO — expecting a strong move like SEZLCRCL just hit the market after its IPO and is already showing signs of strength. This setup reminds me a lot of SEZL — after it went public, we saw a strong consolidation phase followed by a confident rally.

Right now, CRCL looks like it’s building a solid base. I'm starting to buy around current levels, expecting demand to grow. As long as the structure holds and buyers stay active, I see a good chance for continuation to the upside.

New IPOs like this often attract attention, and I’m treating it as an early opportunity. Same playbook as SEZL — patience and positioning.

ETOR : Entry after IPOKind of social trading platform.

Etoro Platform also uses artificial intelligence.

I researched that it also allows trading of crypto assets.

$10B SPAC initiative canceled in 2022.

We re approaching mid 2025 .

Current market cap: around $5-5.3B.

Ground for progress may be present in good market conditions.

While institutions bought at $52, individuals were most likely able to buy above $70.

This was a great misfortune.

Very high opening of the IPO caused sharp sales, but holding for the medium term may be beneficial.As I briefly mentioned above, parameters that will bring momentum to stock may occur.

Constantly looking at the screen so much in such instruments can create a huge sense of panic and failure.

Target price: 90.00 - 94.00

Stop: 50.00

Amount: 1/3 of your portfolio's financial technology stocks ( e.g)

Risk - Reward Ratio > 2.80

Regards.

$5020.T ENEOS HOLDINGS: REVENUE GROWTH, MAJOR IPO ENEOS HOLDINGS: REVENUE GROWTH, MAJOR IPO & DECARBONIZATION STRATEGY

1/8

Big News: Eneos Holdings ($5020.T) reported ¥14.97T revenue for FY 2024 (+9.8% YoY) thanks to higher oil prices & solid refining demand. They’ve also announced a massive JX Advanced Metals ($JXAM) IPO worth up to ¥460B—Japan’s largest in 7 years! 🏭💥

2/8 – EARNINGS SNAPSHOT

• FY Net Income: ¥320.5B (↓12% YoY) due to rising costs & green investments 🌱⚡️

• Q3 Net Income: ¥85.4B (+3% QoQ) on cost optimization + refining margin boost

• Dividend: ¥22/share—they’re not skimping on shareholder returns 💹💰

3/8 – SIGNIFICANT FINANCIAL EVENTS

• JXAM IPO coming Mar 19, 2025—selling 50.1–58% stake

• Could raise $2.6– SEED_TVCODER77_ETHBTCDATA:3B —funding Eneos’ decarbonization pivot & fueling shareholder value 🚀

• Market reacted positively (+1% in Eneos stock), while broader Japanese market stayed flat ⚖️

4/8 – SECTOR COMPARISON

• Valuation: P/E ~8.5 vs. global oil refiners (~10.2) & metals (~12.1) 🔎

• Revenue Growth: +9.8% outpacing Shell (6.2%) & ExxonMobil NYSE:XOM (7.8%), but below BHP (12.4%)

• Undervalued? P/B ~0.9 vs. sector avg. 1.3, EV/EBITDA 6.8 vs. peers at 7.5. Looks attractive! 🔥

5/8 – RISK FACTORS

• Oil Price Volatility: Refining margins can flip on a dime ⛽️💥

• Geopolitical Tensions: Japan relies heavily on energy imports 🌏

• Energy Transition Costs: ¥150B budget for renewables—major capex needed ♻️🔋

• JXAM IPO Execution: A poor market reception = potential stock hit ⚠️

6/8 – REGULATORY & DECARBONIZATION

• Japan targets net-zero by 2050—Eneos faces higher compliance costs 🌐

• Carbon capture & hydrogen investments: Could future-proof Eneos, but short-term margins may tighten 🤖⚡️

7/8 – SWOT HIGHLIGHTS

• Strengths: Diversified (refining + metals + renewables), top-tier Japanese refiner 🏆

• Weaknesses: Profit margin (2.1%) lags peers, heavy capex for transition 😬

• Opportunities: JXAM IPO frees capital; renewables & hydrogen for growth 🌱💡

• Threats: Shift away from fossil fuels, market skepticism 🚫⚡️

8/8 Where do you see Eneos in 2025?

1️⃣ Bullish—Decarbonization + IPO = huge upside! 🐂

2️⃣ Cautiously Optimistic—Valuation looks good, but risks are real 🤔

3️⃣ Bearish—Oil refining can’t outrun global transitions 🐻

Vote below! 🗳️👇

NEST - CUP WITH HANDLEPosition Update: February 6, 2025

Key factors :

1. Low-risk entry point.

2. Very clear bases with VCP characteristics.

3. Has gone through its majority line of supply.

4. Moving on its own drummer, the stock price increased while the market crashing down.

5. High relative strength stock.

6. Volume dries up as less supply coming to the market.

7. The breakout was confirmed with a huge surge in volume.

Considerations : The current market environment remains challenging, with broader indices showing uncertain and inconsistent behavior. It is very few stocks that setting up decent bases.

I’d like to see if it can hold up and follow through from here.

IPO : US IPO ETFAfter suffering a brutal bearish phase from 2021 to 2022 when the ETF ‘IPO’ suffered a 70% drawdown the ETF is recently having a renaissance. ETF has been having a comeback since 2024. It has recovered almost 80% from its lows. The recent weakness in the market has pushed it below 100 day SMA in the weekly charts.

TTAN ServiceTitan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TTAN ServiceTitan prior to the earnings report this week,

I would consider purchasing the 130usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NEST (VCP - 7W 8/3 3T)Position Update: December 6, 2024

Key factors:

1. Low-risk entry point.

2. A first proper and buyable base after an IPO.

3. Has gone through its majority line of supply.

4. Moving on its own drummer, the stock went up +96% while the index remains the same spot.

5. High relative strength stock.

6. Volume dries up as less supply coming to the market.

7. The breakout was confirmed with a notable surge in volume

Considerations: The current market environment remains challenging, with broader indices showing uncertain and inconsistent behavior, failing to sustain a bullish trend.

This is a quintessential VCP with clear contractions and a defined entry point. I’d like to see if it can hold up and follow through from here.