After we beat the Red line it's BBIG Party TimeWill resolve in less than a week. But this is an established down trending line in a wedge for BBIG. When we break the red line we are going up and we're going to break the red line very soon.

Also there is an insane amount of FTD's next week. Their time is up.

stocksera.pythonanywhere.com

Also shares are coming out in the form of a dividend very soon to form a new company called TYDE where people will have to buy in no later than Dec 12th to be shareholders of record for the 15th.

Full disclosure - I am long on this stock, and really believe there is a real opportunity next week for GAMMA

IRNT

IRNT: NICE BASE REAADY FOR BREAKOUTIRNT :

The chart of this cyber security play does not look bad at all.

We have a long base forming after a gap down in December. Some can see a cup and handle, not perfect though.

I like it if it breaks 4.9 for a swing trade to 6.36, then maybe 10.

Stop loss at 4.20.

The sector/theme is hot right now...

Trade safe.

IRNTIronnet Inc (NYSE:IRNT) Deserves some attention going forward. Previous resistance acted as a strong support while MACD is curling up.

Buy IRNT (again) 3/11/2021 You can buy IRNT (again) target 17.03 stop loss 10.84

Money management your responsibility.

I recommend entering a maximum of 10% of the portfolio.

Good luck

Buy IRNT 26/10/2021You can buy IRNT target 13.09 stop loss 9.35

Money management your responsibility.

I recommend entering a maximum of 10% of the portfolio.

Good luck

IRNT Finding the FloorIronNet is a cyber security firm that is pretty new on the market. Despite its debut being less than three months since the time of this idea publishing it has already seen some big upward movement, followed by a quick fall back to Earth. Was this purchasing by "smart money" or retail traders chasing a quick buck? Not sure of the answer, but a search of forums will show lots of individuals have already gotten burned by this stock. Any seasoned trader knows letting excitement get the best of you means losing money. Buying high after the run up = Holding the bag on the way down.

It is unfortunate when this happens, but until sold, those loses are unrealized... and IRNT appears to have big upside potential.

This chart shows two distinguishable levels of support established in the short time the stock has been trading. Level 1, around the $11.50 mark is most important as it is being tested now. The falling price hit the breaks approaching this mark. If the level holds, I believe we can expect a return to the ATR (blue channel) and upward movement as it enters the green channel.

The next level to watch will be the resistance point established at price Level 2. A breakout of this price signals strong upward momentum, though it may not stick around long on this volatile new issue.

For the long term view, cyber security is a critical and growing industry that will only get more important over time. This means companies will keep spending more on cyber, and that is good news for IronNet.

IRNTIronnet Inc (NYSE:IRNT) stock has pulled back to $30 from $47 after a profit-taking run, providing a suitable entry point for active traders. Short-term MACD is crossing up while OBV remains at high levels. Might bounce here.

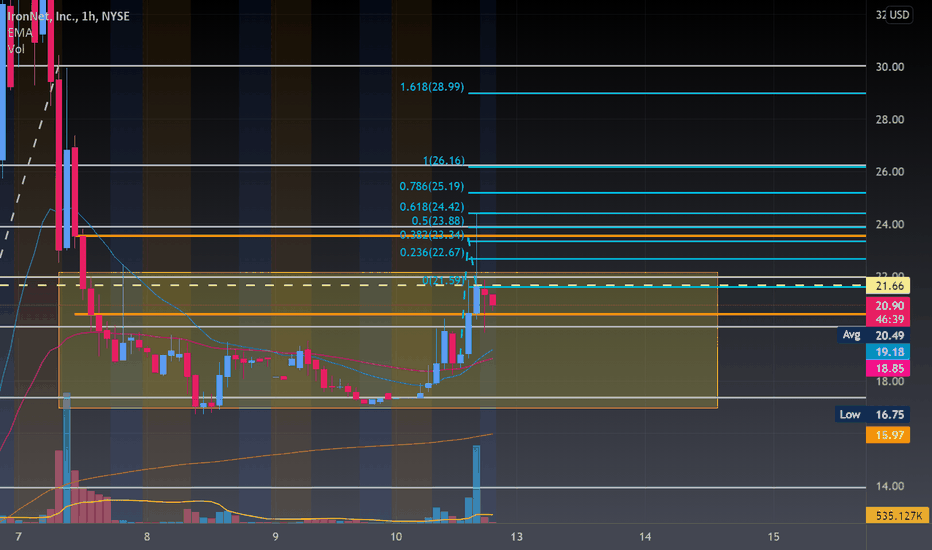

IRNT: RUG PULL OR SQUEEZEIRNT: depending on where IRNT goes in the pre-market can determine which price action

This bearish looking wedge we have formed is on top of a critical support zone.

~If 35 breaks, we can see a dip all the way to 22. Why?

~There is a gap to fill on the down. ranges 21.30-24.50. All previous gaps have fill on the down except this one.

~If IRNT does release a share offering like some are predicting it will, price will inevitably go down and could be another reason for the dip.

~If 44.50 is broken, we could see price action to 55 and maybe even 60

~Note that during hours there were no call contracts past 60 bucks (interesting though may not matter)

~WSB has had huge rallies saying this stock will squeeze like there is no tomorrow. Be ready to go up and up if another squeeze occurs and don't forget to take profit when you wanna screenshot.

DOWN DOWN DOWN (support zones):

~Note that these zone may provide resistance to a rug pull. The italicized zones will give the most fight.

~35 - 37

~30.90 - 32.55

~29.25 - 30.21

~27.20 - 28

IRNT the next SPRT???I remember my first call of SPRT at 2.6usd, when it one in top 3 most shorted stocks.

In few months it skyrocketed to 59usd the dropped to 11.8 before the merger, GREE, which also went down 22% yesterday.

IRNT seems to have the same pump characteristics.

The fiscal results are modest. Annual Recurring Revenue of $24.1 million compared to $19.5 million at the end of the same quarter last year, for a company with a Market Cap of 2.713Bil.

Sure, there is still room to grow before the big selloff, but be aware of the pump and dump pattern.

WSB has changed the strategyI have a hypothesis:

WSB must have been hit hard in the past week's flash crash in the crypto market..!

Ever since I noticed they can not do their usual Pump and Dump, or better to say Dump-Pump-Dump.

It seems they ran out of steam and now they pick smaller projects.

These companies have some mutual features:

A: less than 2 years history

B: flat for a long time with no meaningful trading volume

C: initially below 500 million market cap

Company rank based on WSB mention rank:

1- NYSE:IRNT : From 213 Million to 2.7 Billion, short interest %:0.64%

4- NASDAQ:TMC : from 370 Million to 3.7 Billion, short interest %:1.07%

5- NYSE:OPAD : from 452 Million to 2.8 Billion, short interest %: 2.4%

IRNTIronnet Inc (NYSE:IRNT) is still looking very strong. It pulled back a little at the end of the day on a small sell, but otherwise was up ticking with every buy. I expect this momentum to carry right on through to next week, where we could see $28 - $30 in rapid fashion. Keep an eye on her.

Refilled... At The IronNetGap retested and filled. Now I know the chart is a little messy but if you look close and do some DD you'll totally get it lol. But if you were to ask me I'd say $24.50 isn't far from reality according to this beautiful collage! Good luck trading.

Like, Follow, Share!

Join the community of Risk Takers with me Riskitpaid!