IS

Bitcoin: Potential Bearish Divergence TargetsCoinSavvy here with a price update on Bitcoin . Things have changed, and I want to update my analysis and my trade game plan. I have exited my Bitcoin position as it closed multiple 4-hour candles below $8400 (see “Bitcoin: Higher Time Frame Breakout Series – Daily” linked at the bottom of the page) for my setup there. I had entered in around $7400 ever since the 3-day chart told me to enter when it closed above the 200-day sma (see “Bitcoin: Another HUGE Move is Brewing!” linked at the bottom) for my setup there.

Now that we had a giant rejection at $9,000 I want to gather some information in case things turn over for real here. Tonight, Bitcoin closed the daily, 2-day and 3-day candle around $8275 but more importantly it put in a low right at $8,000. If we tick back down below $8,000 with these new candles, then that would be considered a local top which would print out some pretty nasty bearish divergence on these time frames with the RSI as we have higher highs on price action with lower levels on the RSI .

When it comes to bearish divergence I have been seeing price tend to come back down to its 21 ema (bold white) so I marked these levels on this 3 day chart of Bitcoin with horizontals. Below are the levels and where they correspond to the other time frames.

Daily - $7,850

This is where the 21 ema is on the daily

2 Day - $7,100

This is where the 21 ema is on the 2 day

3 day - $6,600

This is where the 21 ema is on the 3 day

These targets are not able to be used until we actually tick past $8,000 and most likely want to wait for an hourly or 2 hour to close below that level which would indicate that this is a local top and now we have divergence to deal with.

Bullish case :

If this does not play out (quite yet) so if we start closing 4 hours above $8,400 soon then we must switch around the game plan to bulls business as usual as that would indicate that this overall bull trend upwards not quite done yet, however it is really starting to look like things are ready to turn around with all the medium time frame indicators turning bearish and the higher time frames starting to turn around. I have my eyes on something else at the moment (shorting the S&P ) and don't want to get too greedy with Bitcoin as it's been great to us so far so we will see what happens but I don't plan on entering a position for a while in Bitcoin as long as these divergences are playing out. Keep an eye out for both scenarios each time and it will keep you sane!

I will post something about SPY and SPXS tomorrow afternoon

Coin Savvy, signing off. Enjoy your night, enjoy the charts, and respect the technical analysis .

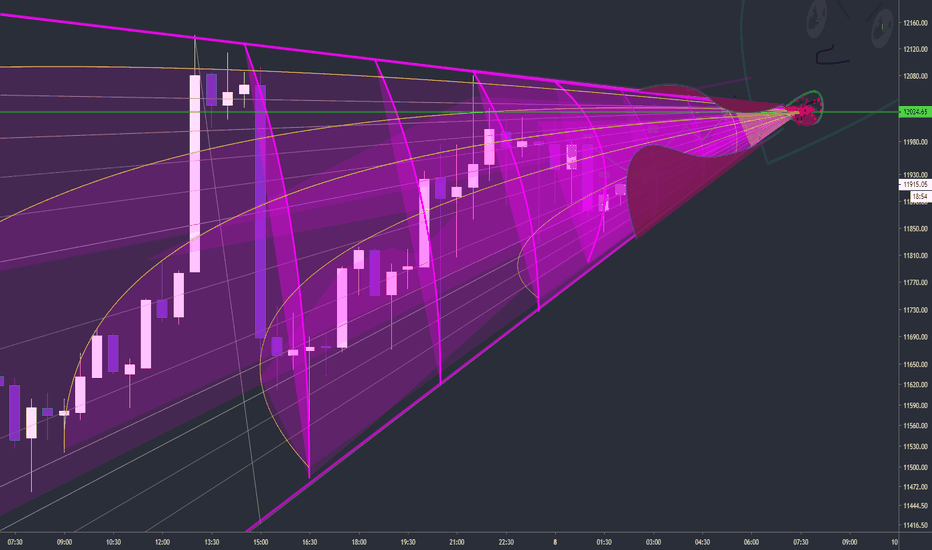

Bitcoin: Hourly Bear FlagBitcoin has increasing price with decreasing volume on it's attempt to recover from that bear move... Not what the bulls want to see, I see this next target somewhere around $7,750

This will kick off bearish divergence on the daily, 2 day and 3 day time frame whose indicators are already starting to turn over... I will post that in a separate article.

Coin Savvy, signing off. Enjoy your night, enjoy the charts, and respect the technical analysis.

ONT/BTC - updated chartIf this fib line does not hold I would expect further downside, doesn't look great for ONT here.

Blue triangle indicates the current range.

This is a log chart.

This is not financial advice. All charts shown on my page, including this one, are just for fun.

If you enjoy my ideas please give this post a like and follow my page if you would like to see future posts! :)

BCH/BTC - ready to pump (updated)BCH/BTC looks like it has great potential to pump up to the target.

I didn't like where the top of the fib channel was originally set, this makes much more sense to me.

Target: 0.0540

Bitmex Target: 0.0550

Blue triangle indicates the current range.

Green box is buy.

Red box is sell.

Blue line indicates major resistance.

Yellow line indicates t/p.

This is a log chart.

This is not financial advice. All charts shown on my page, including this one, are just for fun.

If you enjoy my ideas please give this post a like and follow my page if you would like to see future posts! :)

SP500 short approach I see more and more similarities between

2008's crisis and today. The narrative is nearly the same.

On a smaller time frame we can see an ascending wedge almost breaking out.

I'm short at 2590, expecting 2400, then

I hope for a retracement to 2700 in 2-3months, and then full short :)

What are your thoughts ?

The #BitcoinSV | $BSV rocket about to takeoff on Christmas Day!The #BitcoinSV | $BSV rocket about to takeoff on Christmas Day! We are holding MASSIVE QUANTITIES... and YOU SHOULD TOO! ...ASAP!