GOLD H1 Update: Bullish Outlook BUY DIPS by ProjectSyndicate🏆 Gold Market Highlights (March 2025)

📊 Technical Outlook

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2925/2950 USD

🔸Price Target BULLS: 3050 USD - 3100 USD

📈 Historic Milestone Achieved

🏅 Gold Futures Surpass $3,000

🔥 Gold prices hit an all-time high, closing above $3,000 ATH

🚀 Major breakout in the precious metals market!

📊 Analyst Perspectives

🔮 Continued Bullish Sentiment

📉 Both Wall Street & Main Street expect further gains beyond $3,000.

💡 Analysts see upside momentum continuing in the coming weeks.

🌍 Market Dynamics

⚡ Factors Driving the Rally

🌎 Global trade tensions & geopolitical risks pushing investors toward gold.

📌 Safe-haven demand surging amid uncertainty.

⏳ Historical Context

📜 Comparisons to the 1980 Bull Run

🔄 Parallels drawn between the current rally and the historic 1980 surge.

❓ Can gold repeat history and extend its gains even further?

🏦 Global Demand Trends

🇨🇳 China’s Record Gold ETF Inflows

📈 Massive inflows into gold ETFs in China, signaling strong demand.

💰 Jewelry demand expected to stabilize as the economy recovers.

🏦 Investor Behavior

🎯 Increased Attention Amid Uncertainty

🏛️ Investors shifting focus to gold as a hedge against economic instability.

💎 Gold’s safe-haven status reaffirmed, attracting more institutional buyers.

📢 Final Takeaway:

🔹 Gold is shining brighter than ever! 🌟

🔹 Expect volatility, but long-term outlook remains bullish. 💹

🔹 Keep an eye on key resistance & support levels. 🔍

J-DXY

GBP/USD MONTHLY TREND UPDATE!

📈 Elliott Wave Perspective: The pair is following a corrective ABC structure, and we might be heading toward Wave (C) completion in the next months!

🔍 Key Insights:

✅ Wave (A) Completed—Now in a corrective Wave (B) 📉

✅ Potential Wave (C) Upside Target: ~1.80 📊🚀

✅ Major Resistance Zone 🟡: Watch for price reaction

💡 Will GBP/USD push higher toward the resistance zone, or is another correction needed first? Share your thoughts below! 👇

#Forex #GBPUSD #ElliottWave #MarketAnalysis #GreenFireForex

DOLLAR TREND REVERSAL?

📉 The DXY has reached a key demand zone—is this the perfect buying opportunity? Liquidity grab & reversal incoming? 📊🔄

🔍 Market Insights:

✅ Support Zone: 102.28 - 102.96 🟡

✅ Bullish Bounce Expected 📈—Targeting 105.42 - 106.13 🎯

✅ Smart Money Accumulation? Watch for a liquidity sweep & strong upside! 🚀

💬 What’s your take? Drop your analysis in the comments! Let’s trade smart together! 🔥📊

#Forex #DXY #USDollar #Trading #MarketAnalysis #GreenFireForex

DXY Will Move Higher! Long!

Here is our detailed technical review for DXY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 103.733.

The above observations make me that the market will inevitably achieve 104.118 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD UPDATED Strategic Outlook 2025: 0.9000 PT BEARS 📉 **EUR/USD Weekly Outlook Update**

🔹 **Downtrend Intact**: The **EUR/USD** downtrend has been well-defined since **2009**, and a recent **strong rejection** after a period of distribution confirms bearish momentum.

🔹 **Technical Target 🎯**:

- **Short-term Outlook**: EUR/USD is set to hit **0.95** by **summer 2025**.

- **Year-End Projection**: Expected to end **2025 at 0.9000**.

- **Upside Cap**: Limited to **1.13** at most in 2025.

🔹 **Key Reasons for Further Decline** 📉:

- **Strong USD (DXY Strength) 💪**

- **Firm U.S. Political Leadership 🇺🇸** vs. **Weak EU Leadership 🇪🇺**

- **Fragile Eurozone Economy 🏦**

## 📊 **Why the Eurozone is Set for Further Decline**

🔻 **Slow Economic Growth ⏳**

- The **Eurozone's economy** is growing at a sluggish pace compared to other regions.

- **Weak domestic demand**, **low productivity growth**, and **high export dependency** on slower-growing markets (e.g., China 🇨🇳) weigh on investor confidence and euro demand.

🔻 **Demographic Challenges 👴📉**

- Aging populations in **Germany, Italy, and Spain** reduce the labor force.

- Higher pressure on **social services & pension systems** slows long-term growth potential.

🔻 **High Energy Prices & Inflation 🔥📊**

- The **energy crisis** (exacerbated by the Russia-Ukraine war 🇷🇺🇺🇦) raises business costs.

- **Inflation remains high**, limiting the **ECB’s ability** to stimulate growth without worsening price pressures.

🔻 **Geopolitical Tensions & Economic Risks ⚠️🌍**

- The **Ukraine war & energy disruptions** hit Europe harder than other regions.

- **Reliance on Russian energy** led to severe **supply shocks**, further weakening the eurozone economy.

🔻 **Eurozone Structural Issues 🏗️❌**

- Economic **imbalances between member states** (Germany & France strong, Italy & Greece weak).

- **Common monetary policy** limits individual governments’ ability to react to crises.

- **High debt burdens** in weaker economies drag down overall performance.

🔻 **Tight Fiscal Policies 💰🚫**

- **EU fiscal rules** restrict deficit spending, limiting government stimulus efforts.

- **Lack of fiscal unity** prevents stronger coordinated responses to economic downturns.

📌 **Bottom Line for EUR/USD Traders**

✅ The **downtrend remains dominant** 📉.

✅ **Technical & fundamental** factors favor a **weaker euro**.

✅ Expect further declines **toward 0.95 by summer & 0.90 by year-end**.

✅ Limited upside beyond **1.05** in 2025.

🚀 **Stay updated & trade wisely!** 💹

Weekly Market Analysis - 16th March 2025 (DXY, NZD, ES, BTC)This is weekly market analysis of a few pairs (DXY, NZD, ES, BTC).

I haven't done one of these in a while, but here it is!

I would have done more pairs but the video was already 30 minutes long and I went into more teaching rather than pure analysis.

I hope you found it insightful to your own trading, because what I teach is the truth of the market regardless of whatever specific strategy you use for trading.

Anything can make money in the markets, but of course, risk management and discipline rule all.

- R2F Trading

EUR/USD - Looking for a long entry Hey,

I am looking at a long entry on the EUR/USD. We have recently seen the price break the major 1.05 to the topside once again, thanks to the tariff war which has weakened the DXY.

I am looking at entering long on the two set ups as presented on the chart. The physiological 1.075 level and the intraday 1.0683 level as support.

The price is now showing overbought on the 1D timeframe RSI & MACD, and evidently we are seeing less buying pressure at these current levels.

I will be looking for a strong confirmation at either of these levels before entering long. Preferably a wick below either level with the daily close above.

I expect this to play out before end of March.

$DXY IdeaFor the DXY, on the monthly chart, we remain in a consolidation bias, as the price is trapped within a range formed by two FVGs. However, when analyzing the yearly candles, we notice a macro bearish bias, since the 2025 candle has swept the 2024 high and is now targeting the annual lows.

Since we trade intraday, it is essential to analyze other timeframes to confirm a trading bias. On the weekly chart, we observe that last week's candle swept the previous week's low and closed within the range, indicating a potential correction. This makes sense, as the DXY has extended significantly in recent weeks and is currently discounted, which may lead the price to a premium zone before resuming its downtrend, in line with our macro bias.

Additionally, based on the economic calendar, there is a possibility that the weekly low will be formed on Monday, which could create an opportunity for a counter-trend trade at the beginning of the week. However, this type of trade carries high risk, requiring caution and confirmation before entry.

For this week, we are looking for bullish opportunities up to equilibrium or until the price shows resistance to continue rising. However, this initial outlook will only be confirmed as price action develops throughout the week.

It is also important to note that this will be a challenging week, due to a lack of significant news events and a Federal Reserve speech on interest rates, which could significantly impact the market and increase volatility.

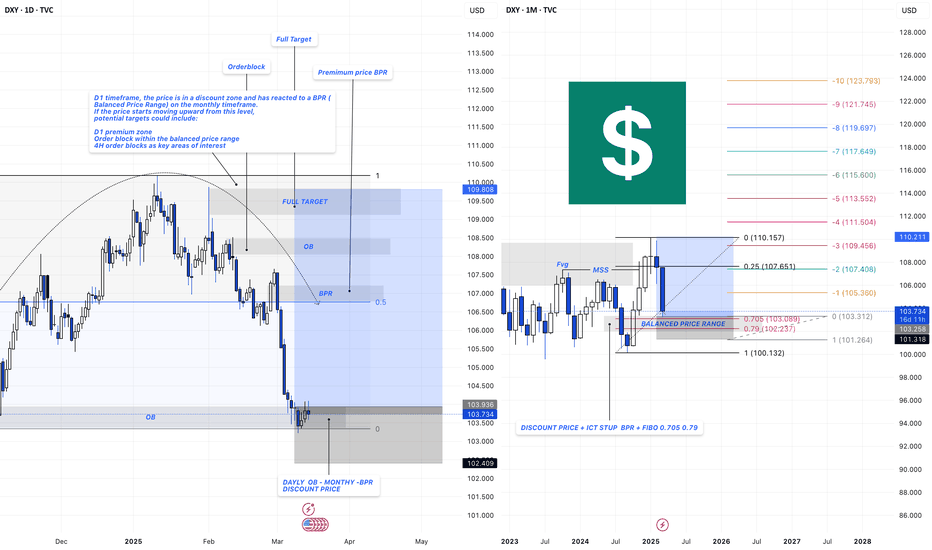

DXY Analysis – Key Market Structure Levels📌 D1 Timeframe:

- The price is currently in a discount zone and has reacted to a Balanced Price Range (BPR) on the monthly timeframe .

- If bullish momentum builds from this level, potential targets include:

- D1 premium zone

- Order block within the balanced price range

- 4H order blocks as key areas of interest

📌 Monthly Timeframe Confluence:

- The Balanced Price Range (BPR) aligns with ICT Stup , Fibonacci 0.705 - 0.79 retracement levels , and key liquidity areas.

- If price holds above discount levels , we may see a move towards the 110.157 target zone .

🔍 Market Outlook:

Short-term bullish bias as long as discount levels hold. Price action confirmation is needed before considering entries.

⚠ Risk Warning: Trading involves a high level of risk and may not be suitable for all investors. Always do your own research and manage your risk accordingly.

✅ If you find this analysis useful, don’t forget to subscribe and hit the "Boost" button to support the page!

Why EURUSD is still Bullish? Detailed Fundaments and technicals EURUSD is showing strong bullish momentum, currently trading around 1.087 and bouncing as predicted. The pair has respected key support levels, confirming the continuation of the **uptrend**. With increasing buying pressure, we anticipate further upside movement toward the main target of 1.1200. The **bullish structure remains intact**, and if this momentum sustains, eurusd could soon hit the projected target.

From a technical perspective, the pair has formed a solid base near recent support, aligning with key **fibonacci retracement levels** and previous demand zones. A break above **1.0900 psychological resistance** will add further confirmation to the bullish bias, leading to a potential rally toward **1.1000 and beyond**. Traders should look for volume confirmation and price action signals for additional entry opportunities.

On the fundamental side, the **us dollar is facing slight weakness**, primarily due to shifting Federal Reserve expectations and lower bond yields. Meanwhile, **eurozone economic data** has shown resilience, supporting the euro’s strength. If risk sentiment remains positive and economic conditions continue improving, eurusd could maintain its bullish trajectory and test higher resistance levels.

Overall, eurusd is still in a bullish phase, and with strong buying momentum, the price is on track to reach the **1.1200 target**. Traders should monitor key levels and market sentiment for potential breakout confirmations.

Dollar Index (DXY): Bullish Reversal is Coming?!

Dollar Index is stuck on a key daily horizontal support.

Analyzing the intraday time frames, I spotted an inverted head & shoulders

pattern on a 4H.

Its neckline breakout will be an important event that will signify a bullish reversal.

The index will continue recovering then.

Alternatively, a bearish breakout of the underlined blue support

will push the prices lower.

❤️Please, support my work with like, thank you!❤️

EUR/USD on high time frame

"Hello traders, focusing on EUR/USD on high time frames, the price has reached a strong ORDER BLOCK area weekly and is showing signs of potential reversal. Considering the price action during the Asian session on Monday, this might present a good opportunity for a short position. My initial take profit target is 1.078. Upon reaching this zone, I will analyze the price further and provide updates on the next potential movement."

If you need further refinement or have any specific questions, feel free to ask!

$DXY: Dollar Strength or Dollar Dip?(1/9)

Good afternoon, everyone! 🌞 DXY: Dollar Strength or Dollar Dip?

With the DXY at 103.732, is the dollar flexing its muscles or ready to stumble? Let’s break it down! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: 103.732 as of Mar 14, 2025 💰

• Recent Move: Near recent levels, down from 110.18 peak (web data) 📏

• Sector Trend: Forex markets volatile, with trade and policy shifts 🌟

It’s a wild ride—dollar’s dancing on the edge! ⚙️

(3/9) – MARKET POSITION 📈

• Role: Measures USD vs. euro, yen, pound, and more 🏆

• Influence: Drives forex and commodity prices globally ⏰

• Trend: Balancing U.S. policy and global demand, per data 🎯

King of currencies, but not without challengers! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Trade Tensions: U.S.-China tariff talks ongoing, per data 🌍

• Rate Cut Bets: Markets eyeing Fed moves, per posts on X 📋

• Market Reaction: Holding steady at 103.732 amid mixed signals 💡

Navigating a storm of global pressures! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Rate Cuts: Could weaken dollar if Fed acts, per X sentiment 🔍

• Trade Wars: Tariffs disrupting supply chains, per data 📉

• Global Growth: Slowdowns hitting demand for USD ❄️

It’s a tightrope—risks aplenty! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Reserve Status: USD’s global dominance holds firm 🥇

• U.S. Economy: Still a powerhouse, supporting dollar value 📊

• Safe Haven: Attracts flows in uncertain times, per trends 🔧

Got muscle to flex when it counts! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Vulnerable to rate cuts, trade spats 📉

• Opportunities: Strong U.S. data could lift it higher, per outlook 📈

Can it hold the line or break out? 🤔

(8/9) – POLL TIME! 📢

DXY at 103.732—your take? 🗳️

• Bullish: 105+ soon, dollar rallies 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: 100 looms, dollar dips 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

The DXY’s 103.732 shows it’s steady but tested 📈. Trade wars and Fed moves could swing it either way—dips are our DCA gold 💰. Buy low, ride high—time’s the key! Gem or bust?

EURUSD MY VIEW DAILY TIME FRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

We do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

EUR/USD: Insights and Tactics from My Perspective.Last week, the US Dollar experienced significant downward pressure due to discouraging macroeconomic data coupled with US President Donald Trump's tariff strategies, which raised concerns about a possible economic decline in the United States. As I compose this article, the dollar stands at around 103.710, and it appears poised to approach one of the two Demand Weekly Areas marked on the chart (link included below), where a pullback could trigger a shift in market dynamics.

Data released by the US Bureau of Labor Statistics indicated that Nonfarm Payrolls grew by 151,000 in February, falling short of the projected 160,000 increase. Moreover, the Unemployment Rate slightly rose to 4.1%, up from January's 4%. Additionally, annual wage inflation decreased to 4%, down from 4.9% in the prior period.

Meanwhile, the EUR/USD pair has taken advantage of the dollar's decline, currently trading at 1.08490 as I write this, with the rate moving closer to one of the established Supply Areas. For further clarity, the Futures 6E1 chart provides additional context, as seen in the link below.

Looking ahead, the US economic calendar is set to include the Consumer Price Index (CPI) for February, which will be released on Wednesday.

As I anticipate this upcoming economic data, my approach for the EUR/USD involves waiting for the price to reach one of the identified supply zones. I plan to observe how the DXY behaves as it concurrently approaches the Demand area, keeping an eye out for potential reactions at these crucial levels before formulating any trading strategies.

✅ Please share your thoughts about EURUSD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Gold long-time analysis, bull run is coming.The possibility of a global recession

Successive increase in interest rates in all economies of the world and imposing costs on economies.

Political tensions (Ukraine/Taiwan/Iran)

Printing money without backing(just see USM2 chart).

Inefficiency of the crypto market.

GBP/USD Channel Breakout (14.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2890

2nd Support – 1.2862

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

AUDUSD BUY NOW 120 PipsLooking at the monthly charts, it seems like we've hit a key level where the price has bounced back up nicely. This indicates a shift in the overall trend, making it look like there's potential for some upward movement. Since the DXY (which tracks the strength of the dollar) is weakening, we might be able to ride this wave up and take advantage of the positive momentum in the market. It’s all about following the trend and going with the flow!

Risk to reward is very lovely

Follow me for your support

Thank You