Are you shorting the bounce or waiting for confirmation?Japan’s Q1 GDP came in worse than expected: -0.2% QoQ (-0.7% annualized). Weak consumption, soft exports, and a fading external boost despite a weak yen isn't a great combo for Asia’s largest export economy.

The Nikkei 225 reacted immediately, and the H4 chart is starting to reflect deeper structural pressure.

🔍 Technical Outlook:

- Price reversed from the high of 38,745.

- Price is testing the 50 SMA and could enter the Ichimoku cloud.

- The cloud is signalling a twist, which could be a sign of momentum fading and the trend weakening or reversing.

📊 Projection:

If the price closes below the 50 SMA and breaks through the cloud, further downside could be expected, with the target levels at

- 36,800 (last consolidation zone), and

- 35,570 (38.2% fibonacci retracement level and 200 SMA).

Alternatively, if the bulls defend the cloud, we could see the price climb to the resistance level of 40,500

This is a classic macro meets technicals moment. A weak data print is lining up against the possibility of a technical rollover.

Japan

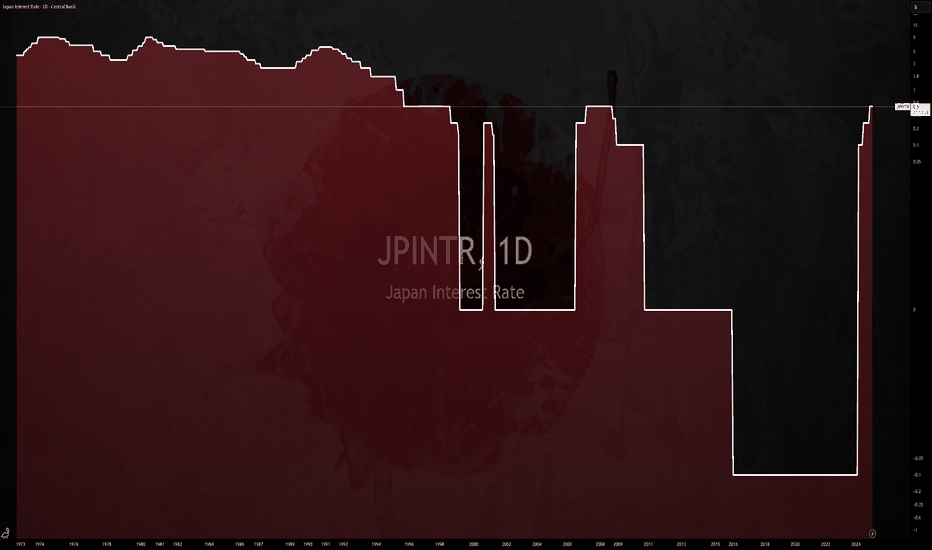

JAPAN IS DOOMED!It's been 30 years since the Central Bank of Japan has maintained ECONOMICS:JPINTR near or even below 0% - WTF!

In combination with weak (or negative) GDP growth rates in the same period, the Japanese Government seems to be in a debt death spiral which will likely come to an end soon. See ECONOMICS:JPGDP and ECONOMICS:JPGDG

Default is inevitable!

$JPINTR -BoJ Holds Rates but Cuts GDP Growth Outlook (May/2025)ECONOMICS:JPINTR

May/2025

source: Bank of Japan

-The Bank of Japan (BoJ) kept its key short-term interest rate at 0.5% during its May meeting, in line with expectations.

The unanimous decision came amid growing concerns over the impact of U.S. tariffs.

In its quarterly outlook, the BoJ slashed its FY 2025 GDP growth forecast to 0.5%, from January’s estimate of 1.0%.

The growth outlook for FY 2026 was also lowered to 0.7% from the prior forecast of 1.0%.

Haven play: Long yen back in focusAmid growing uncertainty surrounding U.S. equities and the US dollar, investors could be returning to a traditional defensive strategy: going long on the Japanese yen.

While some analysts believe the recent yen rally is not yet overstretched, the International Monetary Fund (IMF) has noted that Japan’s central bank is likely to push back the timing of further interest rate hikes, a factor that could limit the yen's potential to strengthen further. As such, we are looking at the support level of 140.00 and the bearish-yen sentiment seen today, and the potential resistance at 144.80.

Up next: a scheduled meeting between Japan’s Finance Minister Kato and U.S. Treasury Secretary Bessent later this week.

(JASMY) jasmy "sectioned macd - wave phase"As seen between the purple lines are the phases of the MACD with no overlap between each of the purple lines. The final bottom phase(5) was reached at which point the price rose to an astonishing 75%. Not sure if these purple lines will be of much use from here on out. I may delete them at some point.

(JASMY) jasmy "cycle-phase-wave"According to an enhanced MACD indicator that follows three layers of information I found the peak MACD green to line up with the yellow lines on the chart that are assigned with the next alternative colored line to be aligned with the most recent improvement in the otherwise losing price for the last months of time. Although an elliott wave is not seen I figured it would be possible to create a measurement like wave using an indicator to guide where those points should be.

NIKKEI Long From A Massive Support! Buy!

Hello,Traders!

NIKKEI stock index has

Lost almost 27% from the ATH

Which means it is clearly oversold

And the index is about to retest

A massive horizontal support level

Of 30,000 which is a great spot

For going long on the index

And even if the support gets

Broken I would still hold the

Position expecting a rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BULLISH RSI DIVERGENCE ON NINTENDO? SWITCH 2 RELEASE DATE BELOW!Nintendo (NTDOY), the Kyoto based home entertainment company known for games like Mario, recently announced the release date of its new video game console: the Nintendo Switch 2. According to Nintendo they hope to have the system released by June 5th 2025 for customers. A bullish divergence has formed on the 1 hour chart. Will this provide investors with a bullish opportunity, or will Trump Tariff's keep this stock's costs from rising?

Disclaimer: Not financial advice.

Six conviction trades for 2025: seize the new market narrativeWhile developed economies have shifted to easing policies, opening the way for a broadening of the market away from technology mega stocks, the economic outlook remains uncertain. The violent reaction to DeepSeek’s launch early in the year clearly highlights the nervousness of markets and their ultra concentration. In the first few weeks of the year, the Trump administration has also been implementing its agenda at breakneck speed, leading to heightened uncertainties around trade frictions, inflation dynamics, and geopolitical upheaval. In that context, it is important to rethink investment positionings that may have worked in 2024, acknowledging the potential for volatility and numerous changes of directions.

In this uncertain environment, WisdomTree’s research team presents its six highest-conviction investment ideas for 2025.

1. Can the Magnificent Seven dominate for a third year in a row?

Few storylines have captured the investor imagination recently as much as the Magnificent Seven —a cohort of mega-cap technology stocks that propelled US equity benchmarks to remarkable gains. While these tech giants remain influential, we see scope for 2025 to become a year of ‘broadening out’.

Macro rationale

Resilience in corporate fundamentals and earnings growth: high quality growth stocks continue to be supported by strong fundamentals and growth could benefit from continued momentum after two years of domination.

Value resilience and broadening: with uncertainty increasing around the Federal Reserve’s (Fed) trajectory and inflationary pressures created by potential tariffs, value stocks may benefit and offer some diversification. Energy and Financials should also benefit from a wave of deregulation under the new Trump regime.

The case for a value/growth barbell strategy in US equities: a barbell strategy between US large cap quality Growth and US large cap Value equities leverages complementary strengths to navigate 2025. This approach allows investors to:

Capitalise on the Value factor’s extreme discount to Growth.

Enable investors to capture opportunities across market cycles.

Create a balance between growth potential and valuation-driven safety.

2. Unlocking value in Japan

Japan’s economic transformation story continues to gain traction as the country moves beyond four decades of stagnant nominal growth and sporadic deflationary episodes. While 2024 was the best year for Japanese equities since 1989, we believe that the Japanese renaissance still has further room to run.

Macro rationale

Resilience in corporate fundamentals and earnings growth: high quality growth stocks continue to be supported by strong fundamentals and growth could benefit from continued momentum after two years of domination.

Favourable currency tailwinds: the yen’s multi-year weakness augments the competitiveness of Japanese exporters, fuelling strong earnings from overseas revenue. Stable core inflation (outside of food) and talks about bond purchases by the Bank of Japan (BOJ) indicate that the BOJ will prevent the yen from appreciating too much.

Earnings and tariffs: Corporate earnings growth remains very strong after 2 years of improvement, and our analysis shows that the market is underreacting to those fundamentals. Furthermore, Japan may be able to secure a tariff carve-out from the US, leading to strengthening competitive positioning versus Europe and China.

3. A Trump card for emerging markets small caps

Emerging markets (EM) have struggled over the past decade, underweighted by many global investors and burned by repeated episodes of dollar strength, trade frictions, and slower growth in China. However, the narrative is a lot more positive going into 2025.

Macro rationale

An EM comeback: with the Federal Reserve maintaining an accommodative stance on monetary policy, China unleashing coordinated fiscal and monetary stimulus, and a wave of EM sovereign ratings upgrades, tailwinds have been picking up strongly for emerging markets.

But some clouds remain on the horizon: unfortunately, the Trump administration’s focus on a strong dollar and tariffs could slow down the recovery.

EM smalls caps as the solution: EM small caps typically derive a larger share of revenues from their home countries, insulating them somewhat from US tariffs or the dollar ‘s strength. In a scenario where the global trade outlook remains uncertain, these domestically oriented firms can thrive on internal consumer growth, as rising middle-class demographics in markets like India, Indonesia, and parts of Latin America continue to drive local consumer demand.

4. Cybersecurity at the crossroads of AI, geopolitical tensions, and quantum computing

The first few weeks of 2025 saw a resurgence of software stocks, with cybersecurity companies jumping in front of semiconductors or AI stocks. Continued corporate and government spending, as well as the imperative to protect the AI revolution, position cybersecurity for robust growth in 2025.

Macro rationale

AI’s security gap: rapid AI adoption brings higher data volumes and more software vulnerabilities, forcing enterprises to bolster their cyber defences. We expect a wave of spending on next-generation cloud solutions, zero-trust architecture, and quantum-proof encryption.

Elevated geopolitical risks: heightened tensions—from continuing conflicts and new trade disputes—translate into more frequent state-sponsored cyber-attacks. This, in turn, drives increased defence budgets and corporate vigilance.

US deregulation: since the US election, software companies have benefitted from deregulation expectations. Cybersecurity, cloud, and blockchain posted some of the strongest thematic gains in the first few weeks of the year.

5. Precious potential: silver’s breakout moment

While gold often steals the headlines, silver has quietly staged a meaningful rally, underpinned by both safe-haven demand and its essential role in green technologies, such as solar photovoltaics. 2025 could be silver’s ‘catch-up’ year.

Macro rationale

Haven meets industrial: silver exhibits a unique duality—part precious metal and part industrial commodity. If risk aversion flares, silver typically follows gold upward. If global growth holds steady, silver benefits from manufacturing demand. Countries worldwide, led by China and the US, are rapidly expanding solar capacity. Newer solar cell technology requires even higher silver content, providing a price tailwind.

Gold correlation: geopolitical tensions and looser monetary policy are offering gold new tailwinds, and silver will also benefit from the catch-up effect.

Limited supply growth: silver’s byproduct nature makes supply tight, as mining companies are not incentivised to expand production simply for silver alone. This supply-demand imbalance supports a more bullish price outlook.

6. Institutional adoption of digital assets is redefining multi-asset portfolios

After navigating a series of regulatory speed bumps, digital assets, led by bitcoin, have entered 2025 with growing mainstream acceptance. Key catalysts have included the expansion of physical bitcoin exchange-traded product (ETP) listings across major exchanges and the gradual emergence of regulatory frameworks that remove operational frictions. We believe most multi-asset portfolios remain structurally under-allocated to cryptocurrencies as a neutral position in digital assets (as illustrated by the market portfolio) should be around 1.5%.

Macro rationale

Portfolio diversification: bitcoin’s correlation to equities and bonds is low, providing a diversification benefit. Even small allocations have, historically, improved risk-adjusted returns.

Institutional inflows: pension funds, endowments, and sovereign wealth funds are steadily warming to digital assets, pointing to a rising tide of flows. As coverage by mainstream analysts grows, digital assets are increasingly viewed through the lens of asset class fundamentals rather than speculation alone.

Technological leaps: alongside bitcoin, developments in Ethereum scaling, stablecoins for global payments, and the tokenisation of real-world assets are reshaping how capital markets function. The resulting network effects may boost confidence in the broader crypto ecosystem.

Conclusion

In an environment that may reward conviction and flexibility, these six investment ideas offer distinct avenues to harness the opportunities emerging in 2025. Whether you seek cyclical upside, defensive yield, or secular growth themes, we believe these high-conviction calls exemplify WisdomTree’s mission: delivering innovative, research-driven solutions in a world of constant change.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

$JPIRYY -Japan's Inflation Rate (February/2025)ECONOMICS:JPIRYY

February/2025

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan fell to 3.7% in February 2025 from a 2-year high of 4.0% in the prior month, amid a sharp slowdown in prices of electricity (9.0% vs 18.0% in January )and gas (3.4% vs 6.8%) following the government's reinstatement of energy subsidies.

Also, food prices rose slightly slower after hitting a 15-month high in January (7.6% vs 7.8%).

Further, inflation eased for healthcare (1.7% vs. 1.8%), recreation (2.1% vs. 2.6%), and miscellaneous items (1.1% vs. 1.4%).

At the same time, education costs continued to fall (-1.1% vs. -1.1%).

In contrast, inflation remained steady for housing (at 0.8%) and clothing (at 2.8%), while accelerating for transport (2.4% vs. 2.0%) and furniture and household items (4.0% vs. 3.4%), and bouncing back for communications (0.1% vs. -0.3%).

The core inflation rate dropped to 3.0% from January's 19-month top of 3.2%, above forecasts of 2.9%.

Monthly, the CPI dropped 0.1%, the first fall since September, after a 0.5% gain in January.

$JPINTR -Japan's Interest Rates (March/2025)ECONOMICS:JPINTR

March/2025

source: Bank of Japan

-The Bank of Japan (BoJ) kept its key short-term interest rate at around 0.5% during its March meeting, maintaining it at its highest level since 2008 and in line with market expectations.

The unanimous decision followed the central bank’s third rate hike in January and came before the U.S. Federal Reserve’s rate announcement.

The board took a cautious stance, focusing on assessing the impact of rising global economic risks on Japan’s fragile recovery.

The BoJ pointed to ongoing uncertainties in the domestic economic outlook amid higher U.S. tariffs and headwinds from overseas conditions.

While the Japanese economy had recovered moderately, some weaknesses remained.

Private consumption continued to grow, helped by wage hikes, even as cost pressures persisted.

However, exports and industrial output were mostly flat.

Inflation ranged between 3.0% and 3.5% yearly, driven by higher service prices.

Inflation expectations increased moderately, with underlying CPI projected to rise gradually.

(JASMY) jasmycoinDGT pattern indicator featuring elliott waves. Green diamond is major oversold, green triangles is minor oversold, same for peaks only circles and so on. I'm seeing a lot of oversold signals in cryptocurrency using this indicator, including Ethereum, the blockchain Jasmy is run on as a layer 2 token IoT company.

(JASMY) JASMY "that sux"Jasmy losing like there is no tomorrow. The Elliott Wave prospects of Jasmy seem to have fallen through. The December price was what I wanted to believe was a peak of Elliott Wave patterns with two more to follow only slightly lower but this prolonged down angle on the chart is a bummer.

QUICK LOOK AT A FEW INDICATORS AND INTEREST IN A SERIES?Quick overview testing out the upload from a browser on a ethernet connection computer vs wifi with the desktop downloaded app. Do you find value in this and want to make a regular series? Contact me if so and follow. Esp if your a developer and want to add some videos to your products, free, locked or paid. Im game. Platforms, customization and breaking down analytics is the life. Its what i enjoy and maybe you will too!

Thank you All,

DrawDownKing CME_MINI:ES1!

World-wide Bull Markets StartingI just wanted to share some of the major markets outside the US are starting major bull markets. Especially we should highlight Japan and the Nikkei is set to break and run from it's 1989 all time high. UK's FTSE is also also breaking above the range it's been in for almost the last 30 years. It's quite exciting! I would expect China to eventually follow suit and break it's two decade long range.

Good luck!

$JPIRYY -Japan's Inflation Rate (CPI)ECONOMICS:JPIRYY 4%

(January/2025)

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan climbed to 4.0% in January 2025 from 3.6% in the prior month, marking the highest reading since January 2023.

Food prices rose at the steepest pace in 15 months (7.8% vs 6.4% in December), with fresh vegetables and fresh food contributing the most to the upturn.

Further, electricity prices (18.0% vs 18.7%) and gas cost (6.8% vs 7.8%) remained elevated with the absence of energy subsidies since May 2024.

Additional upward pressure also came from housing (0.8% vs 0.8%), clothing (2.8% vs 2.9%), transport (2.0% vs 1.1%), furniture and household items (3.4% vs 3.0%), healthcare (1.8% vs 1.7%), recreation (2.6% vs 4.0%), and miscellaneous items (1.4% vs 1.1%).

In contrast, prices continued to fall for communication (-0.3% vs -2.1%) and education (-1.1% vs -1.0%).

The core inflation rate rose to a 19-month high of 3.2%, up from 3.0% in December and topping consensus of 3.1%.

Monthly, the CPI increased by 0.5%, after December's 14-month top of 0.6% rise.

Why Morgan Stanley and MUFG back JPY? Morgan Stanley and MUFG both see the Japanese yen as the strongest G10 currency in 2025. They expect it to gain value as U.S. interest rates fall and Japan’s central bank raises its own.

On the daily chart, USD/JPY oscillators are still away from being in the oversold zone, suggesting that the path of least resistance could to the downside.

MUFG predicts further yen gains, especially against the euro, and has set a target of 150 for EUR/JPY, down from 157.

Morgan Stanley also favors the Australian dollar. Meanwhile they believe the New Zealand dollar will appreciate but underperform the Australian dollar due to a weaker domestic outlook.