USD/JPY has no resistance on TuesdayThe US Dollar found support against the Japanese Yen on Tuesday morning. Namely, the lower trend line of a medium term channel up pattern provided the needed support to stop the recent short lived decline.

Moreover, during the morning hours the currency rate passed the 55-hour simple moving average’s resistance at 111.20. The SMA began to provide support shortly afterwards.

Meanwhile, the pair faces no notable resistance as far as the 111.80 level, where close by a monthly pivot point is located at.

Due to these factors combined, a surge in the upcoming trading sessions could be expected, during which the pair might gain 60 base points.

Japanese

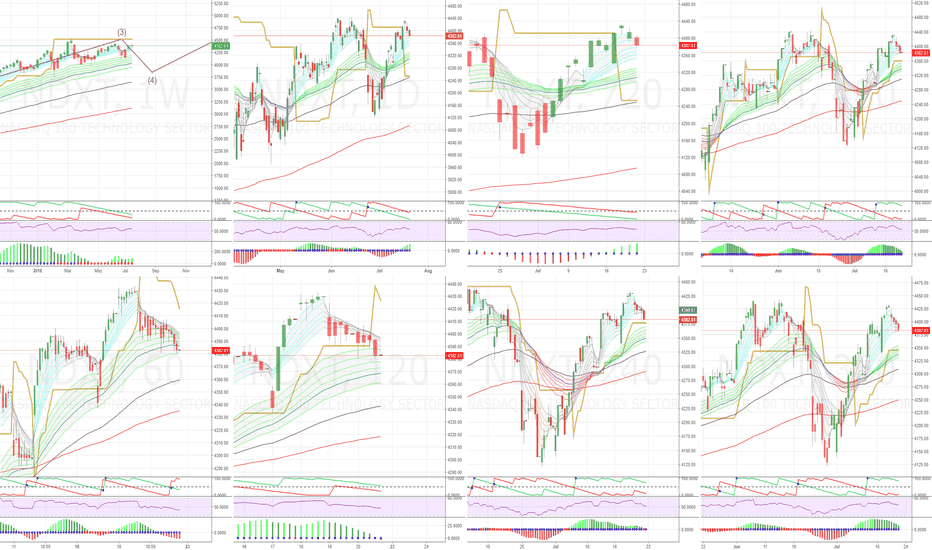

NASDAQ 100 TechI'm using this mainly to see how it influences other stock markets.

I've entered a small position size short on this based partly on experience on the 1H time frame. But that's not where the main action is.

This market tends to influence events in the Indian and Japanese stock markets.

USD/JPY daily overviewThere are almost no changes on the USD/JPY currency exchange rate’s hourly chart. Namely, the pair has traded sideways while being supported by the 55-hour SMA and being restricted from surging by the 100-hour SMA.

However, note that the 100-hour simple moving average was pierced on early morning of Friday’s trading session.

In general, the rate is set to continue trading sideways until it reaches the additional support of the 200-hour SMA and the lower trend line of the medium term ascending pattern.

USD/JPY finds support in SMAAfter booking a new high level against the Japanese Yen, the US Dollar retreated during the early hours of Monday’s trading session. However, by the middle of the day the currency exchange rate had stopped the decline.

Namely, the decline was stopped by the support of the 55-hour simple moving average near the 110.60 mark.

Moreover, the currency exchange rate was expected to surge even more in the upcoming trading sessions. The basis for this assumption is the fact that above the currency exchange rate there were no resistance levels up to the 111.30 mark.

USDJPY - watch for a bearish reversalUSDJPY is about to start a downride on daily as you see. It reached the fib arc and repeats the bearish reversal patterns from the past waves. Follow the price to complete that bearish pattern it copies from the past and once it hits the fibonacci arc, we go for a down slide. Then watch for reactions or pullbacks at Gann angles. Every Gann angle line acts as support which price has to break. We can also do Elliot wave wave count once price starts moving downwards. We take TP once Elliot wave 5 is completed! It agrees with our geometrical arc analysis on XAUUSD which is about to start a ride up. Gold and USDJPY 0.02% have negative correlation (-65.5 percent on daily), as you know. You can also short Nikkei (JPN225) as they have +78 % positive correlation. If one thing goes up the other down. Our analysis confirm this correlation.

Does double zero does not work for ethereum?Although it is an Ethernet that looks like bitcoin for a long time,

What is clearly different from other virtual currencies is that it will not quite stop at double zero.

However YPP is functioning to a certain extent and there are signs that it repeled in the vicinity several times.

It got closer, but is there a resistance of YPP this time?

1) Function as resistance

A chance of short.

Double zero 500.00 is considered to penetrate and the target is near 450.00 near the immediate lows.

If it aims a little more, it is before 433.67 in the next MPP.

2) Penetration not functioning as resistance

If it keep YPP over a certain period of time and use YPP as a support line you will get a long choice.

------------------------- ---------------------- - -

Brown thick line: Yearly Pivot Points (YPP in the text)

Light blue thick line: Monthly Pivot Points (MPP in the text)

Green thin line: Weekly Pivot Points (WePP in the text)

Indigo Line: Horizontal line or Trend line seen by weekly or monthly

Indigo fine wire: Horizontal line or Trend line seen by 4hourly or daily

Dotted dotted line: outstanding double zero

Red curve: EMA 20 close

Indigo curve: EMA 200 close

Green curve: EMA 800 close

Black curve: EMA 1600 close

x mark: Line which may not function

------------------------- ---------------------- - -

Could MPP0.99139 support?usdchf was gradually lowered from double-zero 1.0000 to YPP 0.98340 in May,

It's trying to get back to the original level unnoticed.

If it is supported by MPP 0.99139, long materials up to double-zero 1.00000 can be tested.

------------------------- ---------------------- - -

Brown thick line: Yearly Pivot Points (YPP in the text)

Light blue thick line: Monthly Pivot Points (MPP in the text)

Green thin line: Weekly Pivot Points (WePP in the text)

Indigo Line: Horizontal line or Trend line seen by weekly or monthly

Indigo fine wire: Horizontal line or Trend line seen by 4hourly or daily

Dotted dotted line: outstanding double zero

Red curve: EMA 20 close

Indigo curve: EMA 200 close

Green curve: EMA 800 close

Black curve: EMA 1600 close

------------------------- ---------------------- - -

SGD/JPY 1H Chart: Singapore Dollar bullishThe SGD/JPY exchange rate is moving in an eight month descending channel. The pair tested its bottom boundary near 79.60 late in March prior to reversing its sentiment and reaching the other boundary last week. Strong upside risks prevailed in the market on May, thus sending the pair 1.5% lower within a couple of hours.

As a result of this plunge, the Singapore Dollar breached a two-month trend-line at 82.00 and has since fallen even lower.

Technical indicators demonstrate that the pair might still move slightly lower until 80.00 in the short term, but it should pick up momentum within the following week and begin a medium-term appreciation. The pair faces a strong resistance level formed by the monthly and weekly PPs and the 200-hour SMA at 82.00.

The Singapore Dollar is likely to hinder near this area for a while, but it should afterwards pick up momentum and target 85.00.

Japanese Yen mirrors GoldWhile trading, it is worth knowing that Japanese Yen closely follows Gold, both intraday and on bigger timeframes. Both instruments mirror each other. So, XAUUSD analysis are valid for USDJPY, only in reverse order, i.e. if XAUUSD will move up a few ticks USDJPY will move down the same distance. Safe trading! The chart above demonstrates this correlation. I chose Japanese Yen Index for that, which is nearly same as USDJPY in reverse, as in USDJPY Yen is a quote currency.

EUR/JPY reveals descending patternThe common European currency passed the long term support against the Japanese Yen almost as soon, as such a move was speculated on Friday. Since then the rate has fluctuated even above the previous support and made two attempts to surge.

However, it failed and instead revealed that there is a clearly spottable descending channel pattern. The pattern was set to guide the currency rate down to the support of the weekly S1, which is located at the 131.86 level.

Although, it is likely going to occur only when the resistance of various hourly SMAs reaches the rate.

EUR/JPY acting as expectedThe recently discovered now dominant channel up pattern on the EUR/JPY currency pair’s charts has been once more confirmed. Moreover, the expected decline of Tuesday occurred exactly as forecast by our analysts.

However, let us concentrate on the future. The currency pair has surged after the confirmation of the dominant channel’s support and broken the previously active descending junior pattern. Although, the surge had ended by the middle of Wednesday, as the rate had bounced off the previous high levels.

In regards to the near future, Dukascopy analysts expect the pair to reveal a new junior ascending pattern.

CHF/JPY Bounces off strong resistanceThe Swiss Franc is a safe haven currency, where funds flock to, if there is an increase in risk in the markets. The Japanese Yen also is a safe haven currency. However, if one puts them one against another, one can not just speculate technically, but also avoid some of the fluctuations to and from risky and conservative assets.

Regarding the technical picture, the rate recently bounced off a massive resistance cluster near the 111.50 level and began a decline. During the decline the pair once more confirmed the existence of a long term channel down pattern.

Moreover, recently the rate failed to regain its losses, as it failed to pass the 111.00 mark, where the weekly S1 is located at.

EURJPYAs shown EUR/JPY moved in a downtrend since beginning of February, till it could break it up at 26 March

But it's hit the historical resistance

YUPPY try the resistance again but we expect it won't break it this time too and will back to 131.00

If YUPPY rise and break the resistance we expect it will reach 132.10

Good luck,,,

Thank you

-----------------------------------------------

Do not read and leave... Like, Comment and Follow ,,,, its' so easy :)

Weekly Analysis on Great Britain Pound / Japanese Yen: Week 13DISCLAIMER: Hi everyone, this is just a log book for me on applying everything that I have learned and continue to learn as I go along. That being said, I do not advise you to base your trading on these "ideas".

Ok, so this week I managed to make all the trading mistakes in the book. Took huge losses but somehow that fuels me up to make bigger gains and get back on track. I feel like now that I am not afraid to loose money, I have an open road ahead of me to MAKE money. So lets get an analysis going here.

Weekly:

I decided to go first with the weekly chart because I spotted an ascending channel, as seen here.

Daily:

If we take a look at the daily we see that about 2 weeks ago the price hit the bottom part of our channel, and bounced back. It has been making higher highs and lower lows, although the las higher high was at a previous resistance area of 150.155, and rejected it. Also price is not over our MA.

4HR:

Price closed this week below our MA, and rejecting a previous resistance area around the 150.155 area. But it didn't break a support area I had drawn around 147.905.

I believe that this pair will follow its structure and continue to move upwards.

USD/JPY daily overviewDue to the fluctuations caused by Jerome Powell's testimony on Tuesday, which broke all previous junior and medium scale patterns, a broader look at the USD/JPY currency exchange rate is done.

In general, the pair has revealed a long term channel up pattern in the borders of the long ago spotted dominant descending channel. In addition, there is another notable pattern. As the pair rebounded against the ascending pattern's support, it formed an up trending pattern.

Meanwhile, on Wednesday the rate was set to meet with a strong support cluster near 107.0, which would propel it to test dominant resistance near 107.80.

EUR/JPY continues to surgeThere have been minor developments in the situation on the EUR/JPY hourly chart. By the middle of Monday’s trading session the currency exchange rate had extended the surge, which began last week.

However, one development has taken place. If one compares the now observable channel up pattern, it can be noticed that it is different. There have been minor adjustments of the trend lines of the pattern. On Monday the pattern was drawn in a way, in which both trend lines have been confirmed at least twice.

The surge is likely to continue until the pair reaches a notable resistance level.

GBP/JPY 4H Chart: Pound gains groundThe highly demanded GBP/JPY currency pair has continued to surge. However, it has not occurred in the previously drawn long term channel.

Instead there have been various non-forecasted fluctuations. Although, such events are in general expected from this exchange rate. Due to that reason the Dukascopy research team has adjusted also the long term patterns.

In regards to the near future, during the review a junior channel up pattern was mapped. It is highly likely that this channel together with other support levels will force the rate through the monthly R1 and push higher.

AUD/JPY 4H Chart: Approaches dominant resistanceThe Australian Dollar is about to touch a dominant resistance line against the Japanese Yen. Most likely the move will result in a bounce off to the downside. If that scenario occurs, the latter risk management during the decline should be focused around three areas.

First area is just below the 86.00 mark. At that level the weekly PP together with the 55 and 200–period SMAs are located at.

Afterwards the 100-period SMA should be watched, which was moving steeply higher in the middle of December.

Last but not least the lower trend line of the junior channel up pattern would be strengthened by the weekly S1 at the 85.32 level.

CHF/JPY 1D Chart: About to be squeezed inThe two top risk off currencies have reached a critical level on the daily chart one against another. The pair recently bounced off the lower trend line a dominant pattern and moved to the resistance of a junior channel down.

The resistance is strengthened by various additional resistance levels near the 114.50 mark. Due to that reason a decline down in the future can be expected. However, downwards there are set to be various support levels before the pair reaches it eventual target near the 113.35 level.

At that level the dominant patterns support line is located with other weekly and monthly support levels.

GBP/JPY 4H Chart: Reveals dominant patternThe Pound continued to trade in the previously charted channel down pattern against the Japanese Yen until November 10. A rebound then broke the pattern before the rate declined down to the monthly S1 at the 148.15 mark.

The rebound from this monthly pivot level revealed the existence of a lower trend line of a possible large scale channel down pattern. However, its upper trend line has not been confirmed, as it is drawn only by using the October high level to draw a parallel line.

However, in regards to the short term, the pair is being squeezed in by various levels of significance surrounding the 149.50 mark.