Silver Miners pop, down and then launchI feel a flash crash coming on, similar to Covid - wouldn't surprise me if Birdflu was the catalyst (see my NASDAQ:GILD idea). The patterns line up exactly the same. You can't see it with this picture, but tons of my indicators are going off -which I will post below. Silver Miners will exit the ascending triangle this go around as the commodity supercycle takes off. Could silver miners go a little more up then down? Absolutely, but miners are sensitive to market rallys and poundings like other stocks (see the pandemic in March 2020 on the chart).

JDST

Junior Miners will take some time off soon I see a repeat of March 2020 happening but with birdflu (check out my silver miners AMEX:SILJ thread where the fractal looks better).

Within 5 months, miners had a 42% gain, but within that time period there were 2 huge drops and 3 huge gains:

1. $46-$20 (56% loss) in 2 weeks (June-July)

2. $20-$40 (100% gain) in 4 weeks (July-August)

3. $40-$50 (25% gain) in 4 weeks (August-September)

4. $50-$42 (15% loss) in 4 weeks (September-October)

5. $42-$65 (55% gain) in 6 weeks (October-Mid November)

We'll want to target events 1, 2 and 5. OTM puts and calls on AMEX:NUGT , AMEX:JNUG and AMEX:AGQ will be the way to go on this assuming some exogenous event doesn't take down our markets (hack, EMP etc.), and IV is affordable. 1 will be moderately expensive because of hitting the top (unless it grinds slowly sideways dragging IV down with it). 2 could be pretty expensive. 5 should be highly affordable after a slow walk up and down for 2 months.

I will also be keeping a close eye on several junior miners like NYSE:EXK and one pharmaceutical company NASDAQ:GILD (check those threads also)

2XBEAR JUNIOR MINERS LOOKING GOOD FROM HERE!It's time for precious metals to take a cooler.

I noticed AMEX:JDST 's options for $5 is off the chart compared to other months. I bought calls for .20 for $5 strike price in September. I anticipating these going to 2.00 by then which is 1000% return.

I also think AMEX:DUST is worthy of buying at these levels too - except they don't have miners, but I see a 500% return for this stock by the fall.

I will also link to some supportive ideas following this post.

2XBEAR MINERS LOOKING GOOD FROM HERE!It's time for precious metals to take a cooler.

I noticed JDST's options for $5 is off the chart compared to other months. I bought calls for .20 for $5 strike price in September. I anticipating these going to 2.00 by then which is 1000% return.

I also think DUST is worthy of buying at these levels too - except they don't have miners, but I see a 500% return for this stock by the fall.

I will also link to some supportive ideas following this post.

XAUUSD ratio to DXY is falling SHORTThis ratio is in a widening falling channel perhaps a megaphone.

This is indicative over increasing volatility over a period of several months.

Gold could reverse and uptrend but for the time being the trend is down

with increased volatility.

I see forex spot gold long trades when price is low in the channel and

short trades when it is in the upper portion of the channel with the stop losses

just outside the channel. Stock trades in leveraged junior miners is another

consideration.

GOLD INVERSE EFTs -Time to go long GOLD 3X ( JNUG / JDST )AMEX:JNUG

This chart analysis would serve as a guide to a swing trader or investor

seeking or continuing trades in the 3x gold EFTs JNUG and JDST.

Bu setting up the ratio between the two over time, pivot points

can serve as a reference to buy one and sell the other or initial

position.

The chart shows the JNUG price for May 2022, April 2021 and August 2020

while presently the JNUG completed a pivot low with a signal

from the RSI swing indicator. Since three weeks ago, the price

is rising albeit with weekly green Doji candles.

The MACD, a lagging indicator, shows an impending K/D

crossover under the histogram.

All in all, ow may be the time to take a trade-in JNUG, which

has risen by 20% in an ascending channel over the past three

weeks.

monitoring 2hr bull flag set up notice the 2 previous bearish cypher patterns. The 1st pattern of the (X) leg appears to be acting as support. I'm looking for gold to get above the 2nd bearish cypher pattern, and Test its X leg for support. If it hold then Im looking for gold to breakout again above $1800 and retest $1840-$1850 area

The AD earlier this morning showed me an ascending triangle to $1840 area. I'm monitoring and do a position

LABU LEVERAGED BIOTECH ETFThis Daily Chart plots LABU to LABD ratios over time. LABU is 3X Leveraged ETF of a variety of biotechnology

stocks while LABD is the inverse.

By plotting the ratio of LABU to LABD, what can be found is the precise end of the LABU downtrend (LABD uptrend)

and reversal into LABU uptrend ( LABD downtrend).

In this case, the reversal occurred about June 17th while the SPY reached its current market bottom.

This type of analysis can be used to make trade decisions regarding a contrasting pair of stocks or forex pairs.

It makes the decisions more informed. IF going down to a 1H or 4H timeframe, the accuracies will be higher

and the pivots more frequent also making potential profits higher.

This can be used with other ETF inverses such as

GUST /DRIP

BOIL /KOLD

JDST / JNUG

YINN / YANG

SOXL/ SOXS

FAZ / FAS

TMF /TMV

By setting up all of these also with alerts such as ratio decreasing or ration increasing

a trader with very little time to trade and diversify and automate his/her trading

resulting in risk stratification and mitigation and economy of time.

The AD is showing me a bullish butterfly pattern 2hrThe weekly price action of the S&P 500 is also showing a bullish butterfly pattern. however, for this price action to continue, the lower time frame also must establish the same pattern. In addition, naturally a rejection from B leg, forms a base, and potentially leading us into a high probably cup and handle breakout.

I like to trade the money flow, as it first gives me pattern recognition which I have to later confirm w/ price action ...

not trading or financial advice.

Disclosure im long spxl

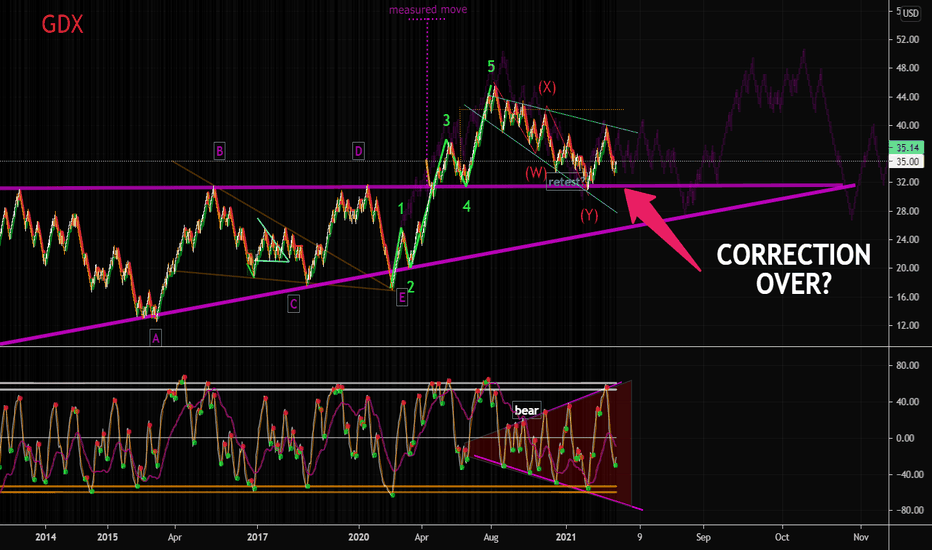

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

JDST D4: BUY/HOLD setup +150% gains BULLS(SL/TP)(NEW)Why get subbed to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

-no useless junk on my charts

-BEFORE/AFTER reviews

JDST D4: BUY/HOLD setup +150% gains BULLS(SL/TP)(NEW)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

Tagged as LONG as I expect more upside.

🔸 Summary and potential trade setup

::: JDST 4days/candle chart review

::: setup still valid as of right now

::: accumulation in progress

::: Reddit gamblers silver squeeze failed

::: expecting gold DUMP

::: JDST should gain value next few weeks

::: TP BULLS is +150% gains

::: strong chart expecting pump

::: BUY/HOLD and get paid

::: BULLS should reign supreme

::: recommend to BUY/HOLD

::: recommended strategy: BUY/HOLD

::: TP BULLS +150% gains

::: SWING trade setup do not expect

::: fast/miracle overnights gains here

::: good luck traders

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment short-term: BULLS

::: Sentiment outlook mid-term: BULLS

RISK DISCLAIMER:

Trading Crypto, Futures , Forex, CFDs and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use tight stop loss.

XAU A lot of confluence here on the bottom trend line of my leading diagonal & the bottom trend line from the March 2020 lows, so much bearish sentiment in XAU currently & also $DXY seem about done with the push. On top of all that yields seem ready to drop, we could have a nice set up for XAU to at least retest the ATH's & breaking that opens the door for $2400.

Miners seem all about done & also they r so bloody wrecked that if I had extra $$$$ I would load up on those gold miner stocks IMO. Anyway just my thoughts guy always DYOR. Good Luck!

JDST D4: BUY/HOLD setup +70% gains BULLS(SL/TP)(UPDATED)Why get subbed to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

-no useless junk on my charts

-BEFORE/AFTER reviews

JDST D4: BUY/HOLD setup +70% gains BULLS(SL/TP)(NEW)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

Tagged as LONG as I expect more upside.

🔸 Summary and potential trade setup

::: JDST 4days/candle chart review

::: setup still valid as of right now

::: accumulation in progress

::: Reddit gamblers silver squeeze failed

::: expecting gold DUMP

::: JDST should gain value next few weeks

::: TP BULLS is +150% gains

::: strong chart expecting pump

::: BUY/HOLD and get paid

::: BULLS should reign supreme

::: recommend to BUY/HOLD

::: recommended strategy: BUY/HOLD

::: TP BULLS +150% gains

::: SWING trade setup do not expect

::: fast/miracle overnights gains here

::: good luck traders

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment short-term: BULLS

::: Sentiment outlook mid-term: BULLS

JDST D4: BUY/HOLD setup +150% gains BULLS(SL/TP)(NEW)Why get subbed to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

-no useless junk on my charts

-BEFORE/AFTER reviews

JDST D4: BUY/HOLD setup +70% gains BULLS(SL/TP)(NEW)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

Tagged as LONG as I expect more upside.

🔸 Summary and potential trade setup

::: JDST 4days/candle chart review

::: accumulation in progress

::: Reddit gamblers silver squeeze failed

::: expecting gold DUMP

::: JDST should gain value next few weeks

::: TP BULLS is +150% gains

::: strong chart expecting pump

::: BUY/HOLD and get paid

::: BULLS should reign supreme

::: recommend to BUY/HOLD

::: recommended strategy: BUY/HOLD

::: TP BULLS +150% gains

::: SWING trade setup do not expect

::: fast/miracle overnights gains here

::: good luck traders

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9 /Combo update: N/A

::: Sentiment short-term: BULLS

::: Sentiment outlook mid-term: BULLS

GDX I'VE BEEN WAITING FOR THIS$nugt $dust $gdxj $jnug $jdst $slv $gld

Renko is not playable in published ideas so I'll update this chart. My last post got little attention and I've been warning people about a sudden drop in gold, silver, miners. We're setting up a new buying opportunity but how low does it go? I would like to see GDX between 28-32. Hold fast.