Jnug to Gold "final drop in bound"?I am expecting gold to move into its final drop and possibly bottom in February. Then we should get a very strong move up similar to the 2016 run. I do not see the start of the bull gold market. Just a large strong C wave up to above $1400.

And miners should also make a similar move as the 2016 run. GL

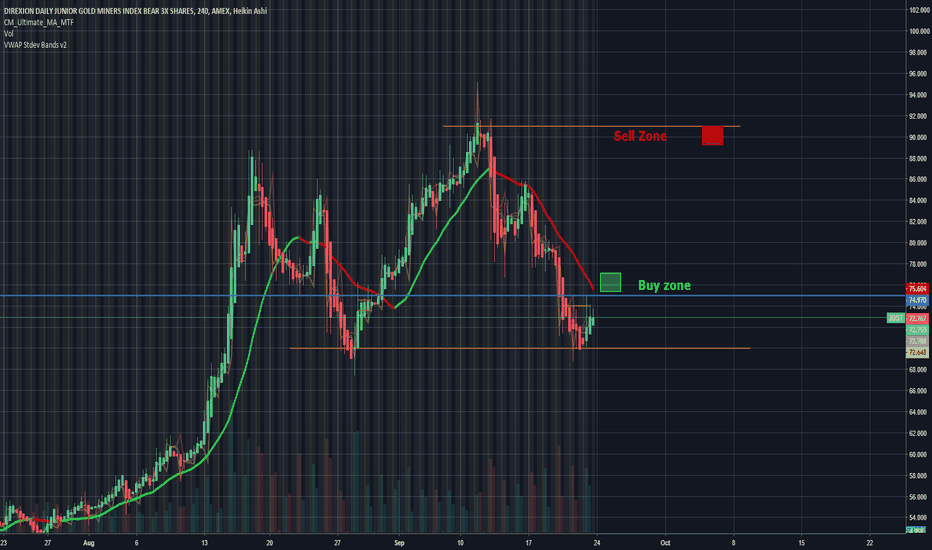

JDST

Jnug to gold Well I havnt done gold for a while now but it appears to me that a nice setup to go long is presenting itself. This ICL has been stretched but that just makes me more confident that I have a safe Jnug play here. I am not about to try to guess what kind of wave count we are in. However, If we have started our move down into the larger C wave then this move up could look like what I drew. However, It could also be the beginning of the end of the B wave which would take us higher than I drew. I will be just fine with a move back up to the 1300 range before reassessing the pattern. Jnug will do well. but I will be watching its movement along with gold to get a feel for how powerful this move will be.

Jnug chart

Silver/Gold Triple Three Pattern? HelpSpent a silly amount of time on this. Every Combo pattern seemed off until I came across this one.

Wanted to focus only on Elliot Wave Theory. I'm trying to learn more about combination structures WXY and would welcome an expert opinion if any have one.

There's some sort of double corrective structure going on here in Silver, I can just smell it. But can't put my finger on it.

I'm reaching far out on this one so it could easily get invalidated, but it corresponds nicely to what I was originally thinking would play out in Gold/Silver over the next year. It took me a very long time before I realized that we might only be half-way through this corrective period, and this is the only structure that fits given that we only have half the price action to speculate off of.

Just throwing a stray metals post out into the ether of bitcoin posts.

This is the link to the idea:

www.google.com

Gold - approaching decision phase slowlyBlue box will be deciding factor for Gold in long run. I don't think this recession Gold is going to go up, unless it breaks the trend. In the last 3 recessions (1990, 2001, 2008-9) only the 2001 recession saw a gold rise, and even that was not too impressive. On a longer time span, there have been only 4 instances in the last 100 years where gold rose prominently and would have been a great investment.

Watch for blue trend lines. Longer trend lines in red. 2018 year end to 2019 first quarter would be deciding factor for new trend of Gold.

The tale of Gold & Silver ratioJust buy physical Silver here, and close your chart.

Come back in 5 years and flip your silver to gold. Repeat that process by flipping back to gold once the ratio hits 80 again,

I'snt it easy? You've just found yourself a trading strategy for the rest of your lives.

You dont have to trade a lot to achieve the same returns as the actively managed funds out there.

That's all.

-------------------------------------

Yes, I'm not even mentioning

the endless fiat that ECB, FED, BOJ could print on the next crisis.

the absurd amount of M1 money supply out there today versus gold price historically

for political risk (mainly China versus the USA)

the depleting supplies of silver versus exponential increasing demand from tech

speculative demand when those of the above happens, and none of the retail investor are even interested in silver or gold today!! Look at the sales of US mint, absolutely cratered

massive shorts by JPMorgan unwinding

why store your funds in banks knowing that they're insolvent?

why store it there when they're paying near negative interest rate which cannot even keep up with inflation?

why store it knowing that they're lending it from you for absolutely free, and lending it out to credit card gamblers at 30% interest annually

Cryptocurrencies like bitcoin, and gold, silver are of the same asset that's outside the financial system.

They're a short against tyrants in power.

Jnug to Gold "bottom was on target, now where"So we bottomed at $11.37. I was thinking somewhere between the $11.50 - $11.30 range. So that worked out well. But it appears to me that we only completed wave three down and still have to do wave 4 and 5. So wave 4 should top a little over the $14 dollar mark before dropping to a much lower low...(too early to call but maybe in the mid $8 range).

Jnug to Gold "Down"So it appears that gold is finally rolling over. Jnug is already responding. On this 4 hour (and you can check the smaller time frames) it appears that this 1st wave down is complete. You can count 5 small waves down. Don't be surprised if we get a large 61.8% to 78% Fib Pop tomorrow for wave 2. Then I would absolutely be in JDST. It is hard to pick a bottom for this move so I gave it a try with the FIB tool. If today is the end of wave one, and if we only do the 61.8% retracement up, then wave 3 should be a little longer than wave 1, and then there is wave 4 32% retracement to set up wave 5. That yellow oval is not out of the question. This market has been very tricky.

Dollar Rebound Possible Before Finding BottomDollar is still trying to find a bottom. Could move up a bit to about $92.50 before moving back down where it is likely to find a bottom around $90.10. Recent surge in gold is likely to see a correction at this time, especially if Cryptos continue to recover. Either way, dollar is likely to see a big rebound soon.

Jnug to Gold "I think I fixed my cycles"A Little while back I was using cycles to help me with great accuracy, determine when to get in and out of both Jnug and JDST. Then it appeared to have gotton a little wishy washy. Well I think I got it back. If I am correct, we should continue to drop(not in a straight line) in Jnug until around the 18th or 19th. Coincidently the 19th is the day, congress votes on the budget for the year. I do not think they will pass it the first time through with all the border and DACA issues involved. I think gold will have completed its half cycle low about that time and Jnug should also reverse with gold. At this point gold has not really given a decent half cycle pullback yet. So if that starts this week, then Jnug will drop pretty well. I drew what I believe is a channel for Jnug. Lets see if that works. There is a good chance that Jnug drops to at least the 50 DMA and possibly a little lower during that last day or two of that half cycle. The 19th happens to be a Wednesday, which is the start of the next COT report. I cant tell you how hard gold and Jnug will run after that so we will wait and see. As you can also see...there is a pretty good consistency with the red half moon cycles. About 3/4 of the way through (pink vertical line) that half moon, Jnug will drop pretty hard as that also coincides with gold DCL (black Triangle). Its not perfect but timing the market is never perfect.

Jnug to Gold "New cycle started couple weeks early"It appears that a new gold cycle started a couple weeks early this year. With the slight higher high from the consolidation, that is what appears to have happened. I am still expecting a zig zag pattern so we should start to consolidate next week back down to the multiple moving averages before pushing up to finish the E wave. RSI 10 is very overbought and there was decent selling near the end of the day. Jnug appears to want to drop but it needs gold to drop with it to help it out. There should be another rate hike in March so I see this rally ending around mid February before starting its bigger drop. My original idea for gold to drop to the trend line area fell short and is still posted for all to see. I am adjusting the cycles on the next chart. Gold needs to break out of this large wedge (for me to change my view) which should be approximately $1349 range for mid February. After that it would also need to make a higher high than last years high. So in the mean time, I will be waiting for a decent dip in gold and Jnug.

Jnug chart