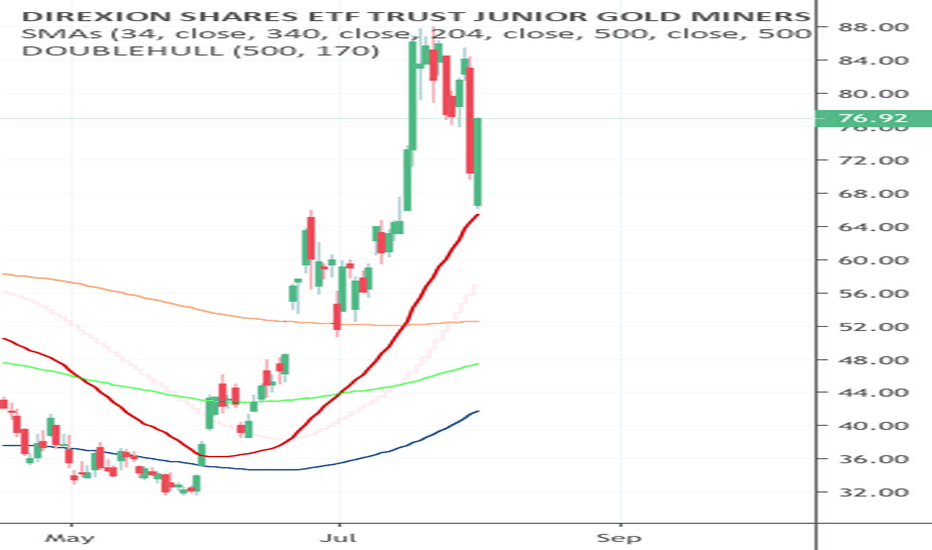

JNUG

GOLD & SILVER STOCKS ARE OVER BOUGHT! HYPE IS DRIVING THEM UPFolks, we hate to burst the bubble but...

Has anyone looked at the charts of the GOLD and SILVER stocks?

RSI, MACD and Stochastic indicators are so over bought, it is alarming and sounds the DEATH KNELL for both sectors. Anyone telling you differently has no idea what they're talking about.

To top this argument off, the big companies like GOLD and NEM are making nothing, no big profits, to run to the bank with.

Both companies recently purchased other gold producers and as of late, neither company can turn a nice profit. Look at the earnings reports...It's the truth!

In fact, GOLD barely hit estimates and revenue was down missing estimates. WHY..? ASK YOURSELF WHY? THE NUMBERS DON'T LIE!

Why are all these GOLD & SILVER companies in Canada? We've never done well with Canadian stocks because at the end of the day, most if not all turn out to be a huge scam.

Both GOLD and NEM have had plenty of time to sell gold at these record prices but yet both companies are unprofitable or making a few cents. Why is this?

We cashed out of all our GOLD & SILVER stocks today and we will not look back. Even if GOLD hits maybe 1600 to 1800, and SILVER hits $20 to $25, none of the stocks we follow are making money and from what we can see, they will continue to lose large amounts of money into the future.

Take your profits in the stocks and move into the Indexes, ProShares, SPDR's and ETF's to play it safe. Here's are several for you to research: GDXJ, JNUG, UGLD, GLD, GDXJ, UGL, GDX, DGP, BAR, GLDM, IAU, SLV

Every piece of GOLD & SILVER these companies find & produce is sold forward which means, they missed out on the record high prices as of today.

Also, where are the nice 2%, 3%, 4% and 5% dividends from all these companies if they're doing so well? Wall Street wants you to believe that because GOLD & SILVER are at record highs, GOLD & SILVER stocks should follow.

This argument is one big FRAUD AND A HUGE SCAM!

TAKE YOUR PROFITS AND DON'T LOOK BACK...WE DID TODAY...NEVER ARGUE WITH A PROFIT!!

BEST OF LUCK TO EVERYONE WITH YOUR TRADES!

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

GDX Under-Performing Gold & HUI = Miners Anticipating Lower GoldGDX is still 12% below its 2016 highs, despite Gold having already surpassed its 2016 peak of 1375 by roughly 5%.

On top of this, the GDX having more exposure to unhedged miners should result in GDX out-performing the HUI hedged senior miners in a bull market. This is not the case, as the GDX is actually under-performing the HUI. Highest probability assessment is a retest $25 GDX.

Don't be like the many people who bought the "gold to the moon" hype in summer of 2016 and bought in at the highs and then subsequently got their a$$es handed to them.

JNUG: Tip-Toeing to 350 by 2020; Over 600 by Q4 2020For many reasons I have explained clearly in my several Gold posts, Gold is expected to soar through Q4 2019 and well into 2020 and possibly 2021 as well. As we gear up for a long and long awaited bull run for Gold as a result of a strong 6 year base of an almost nothing-burger in Gold, be prepared!

One thing that is important, is that Gold will inevitably rise, but there will always be retracements. Before we get to 1500, the retracements will be stronger than once we top 1500. However, it is important not to make any major sell moves unless the movement lingers for at-least two trading sessions; never panic sell.

I expect JNUG to reach 350 no later than January 1 2020. Of course, not in a straight line as depicted, but as close to one as physically possible.

I also expect JNUG to reach 600 and beyond before 2021.

Any entry on JNUG below 90.00 is not just excellent long position - its an epic one. Don't miss the boat - buy now and hold!

- zSplit

GOLD How does it look in the Charts?Look at the RSI. Also here is an update on some charts I have done in the past. I still have a $1500 high coming and a $1300 low in gold. Atleast what the chart has given me so far. The pullback typically happens toward the end of the year. We will see. -Coach Reevs

Gold1365 Guiding Principles to Trade ABC Corrective Waves w/ RSIPlease see the chart - and remember, RSI is more important than price with respect to the completion of an ABC (i.e., if wave C's RSI exceeds wave A's RSI that is more important than wave C's price exceeding wave A's price (though typically both go together)).