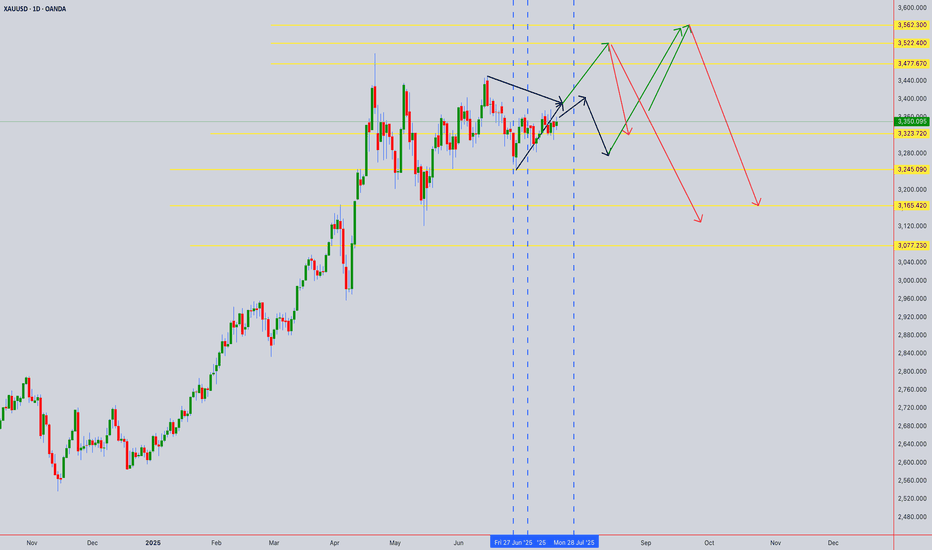

XAUUSD 24-Hour Technical Analysis Forecast - UTC+4 Current Price: $3,350.095 (Close: Friday, July 18th, 2025) UTC+4

Analysis Period : Next 24 Hours (July 21-22, 2025) UTC+4

Market Status: Weekend - Preparing for Monday Open 02:00AM 21st July 2025

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bearish (Short-term)

Key Resistance: $3,375 - $3,390

Critical Support: $3,285 - $3,300

Expected Range: $3,300 - $3,380

Volatility Level: Moderate to High

CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

Pattern: Doji-like formation at resistance zone

Significance: Indecision after testing $3,350+ levels

Volume: Moderate - no strong conviction breakout

Context: Failed to close decisively above $3,375 resistance

Expected 24H Patterns

Monday Gap: Potential gap down to $3,320-3,330 area

Reversal Patterns: Watch for hammer/doji at support levels

Continuation Signals: Break below $3,300 could trigger bearish continuation

HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

Primary Pattern: Potential Bearish Bat completing

X: $3,285 (previous low)

A: $3,390 (recent high)

B: $3,320 (61.8% retracement)

C: $3,375 (78.6% projection - current area)

D (Target): $3,300-3,285 (88.6% completion zone)

Fibonacci Levels (24H Focus)

Golden Ratio Resistance: $3,375 (current test area)

61.8% Support: $3,320

78.6% Support: $3,300

88.6% Critical Support: $3,285

Pattern Completion Probabilities

Bearish Bat Completion: 70% probability targeting $3,285-3,300

Bullish Cypher Setup: 30% if break above $3,390

ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count

Macro Structure: Wave 5 of larger impulse possibly topping

Current Sub-wave: Wave (c) of corrective structure

Mini Count: 5-wave decline from $3,390 high in progress

24-Hour Wave Projection

Wave 1: $3,390 → $3,320 (Completed)

Wave 2: $3,320 → $3,360 (Completed - 50% retrace)

Wave 3: $3,360 → $3,285 (In Progress - Target Area)

Wave 4: $3,285 → $3,310 (Projected)

Wave 5: $3,310 → $3,260 (Extended target)

Critical Levels

Wave 3 = 1.618 × Wave 1: $3,285 (Primary target)

Invalidation: Above $3,390 (Wave 2 high)

WYCKOFF THEORY - 24H PHASE

Current Market Phase

Phase Assessment: Distribution Phase C (Testing Supply)

Composite Operator Action: Testing demand at $3,350 area

Volume Analysis: Declining volume on recent rallies (bearish)

Expected 24H Wyckoff Action

Phase Transition: Moving toward Phase D (Markdown begins)

Supply Test: Failed test at $3,375 confirms distribution

Target: Initial markdown to $3,285-3,300 area

Key Wyckoff Signals (24H)

No Demand: Expected at current levels

Selling Climax: Possible if break below $3,285 with high volume

Automatic Rally: Dead cat bounce to $3,320-3,330

W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

Current Position: 3350° on Gann wheel

Next Cardinal Point: 3375° (90° angle - strong resistance)

Support Angles: 3300° (natural support), 3285° (critical angle)

Geometric Progression: $3,285 = perfect square root relationship

Time Theory - 24H Cycle

Natural Time Window: 24-hour cycle from Friday's high

Critical Time: 14:00-16:00 UTC Monday (historical turning point)

Lunar Influence: New moon phase approaching (bearish for commodities)

Angle Theory

45° Line: Currently at $3,320 (rising support)

63.75° Line: $3,285 (steep support angle)

26.25° Line: $3,375 (resistance angle)

Price Forecasting (Gann Methods)

Primary Target: $3,285 (Square root of 81²)

Secondary Target: $3,240 (Square root of 80²)

Resistance: $3,375 (Square root of 82.5²)

Time Forecasting

Turn Time 1: 06:00 UTC Monday (18 hours from Friday close)

Turn Time 2: 14:00 UTC Monday (26 hours from Friday close)

Major Turn: 22:00 UTC Monday (34 hours - Fibonacci time)

MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

Trend: Bearish momentum building

Pattern: Lower highs, lower lows since Friday high

Key Levels:

Resistance: $3,360-3,365

Support: $3,330-3,335

RSI: Approaching oversold (35-40 range)

Volume: Increasing on down moves

15-Minute Chart Analysis

Structure: Bearish flag formation

Breakdown Level: Below $3,340

Target: $3,300-3,310 (flag pole projection)

Moving Averages: Price below EMA 20 ($3,358)

MACD: Bearish crossover confirmed

30-Minute Chart Analysis

Primary Trend: Corrective phase active

Chart Pattern: Descending triangle

Apex: Around $3,335-3,340

Breakout Direction: 65% probability downward

Volume Profile: Heavy selling at $3,350-3,375

1-Hour Chart Analysis

Major Structure: ABC correction in progress

Current Position: C-wave development

Fibonacci Target: $3,285 (127.2% extension)

Bollinger Bands: Price touching lower band

Stochastic: Oversold but no divergence yet

4-Hour Chart Analysis

Macro Trend: Still bullish above $3,200

Correction Depth: 23.6% retracement maximum expected

Support Zone: $3,280-3,300 (confluences)

Resistance Zone: $3,375-3,390 (proven strong)

Ichimoku: Price approaching cloud support

TECHNICAL INDICATORS MATRIX

Momentum Indicators

RSI (4H): 42 (Neutral-Bearish)

RSI (1H): 35 (Oversold approaching)

Stochastic: %K: 28, %D: 35 (Oversold)

Williams %R: -75 (Strong oversold)

Trend Indicators

MACD (4H): Bearish crossover pending

ADX: 28 (Moderate trend strength)

Parabolic SAR: $3,365 (Sell signal if broken)

Volume Indicators

OBV: Declining (distribution pattern)

Volume Rate of Change: Negative

Accumulation/Distribution: Slight distribution

KEY SUPPORT & RESISTANCE LEVELS (24H)

Immediate Resistance Levels

R1: $3,365 (Previous support turned resistance)

R2: $3,375 (Major psychological & Gann resistance)

R3: $3,390 (Recent swing high)

R4: $3,410 (Extended resistance)

Critical Support Levels

S1: $3,330 (Immediate support)

S2: $3,300 (Psychological & Fibonacci)

S3: $3,285 (Major harmonic & Gann target)

S4: $3,260 (Extended support)

24-HOUR TRADING SCENARIOS

Scenario 1: Bearish Breakdown (60% Probability)

Trigger: Break below $3,330 with volume

Target 1: $3,300-3,310

Target 2: $3,285-3,290

Extended Target: $3,260-3,270

Stop Loss (Shorts): Above $3,370

Scenario 2: Range-Bound Consolidation (25% Probability)

Range: $3,320-3,375

Strategy: Fade extremes

Buy Zone: $3,320-3,330

Sell Zone: $3,365-3,375

Breakout Confirmation: Volume spike

Scenario 3: Bullish Reversal (15% Probability)

Trigger: Break above $3,375 with volume

Target 1: $3,390-3,400

Target 2: $3,410-3,420

Invalidation: Below $3,285

RISK FACTORS & CATALYSTS (24H)

Bearish Catalysts

US Dollar strength continuation

Risk-off sentiment from geopolitical tensions

Profit-taking ahead of weekend

Technical breakdown confirmation

Bullish Catalysts

Safe-haven demand surge

US Dollar weakness

Central bank buying speculation

Technical oversold bounce

High-Impact Events (Next 24H)

Asian market opening sentiment

US Dollar Index movement

Cryptocurrency correlation effects

Weekend gap analysis

TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M)

Strategy: Fade bounces to resistance

Entry: $3,355-3,365 area

Target: $3,335-3,340

Stop: $3,375

Risk/Reward: 1:2

For Swing Traders (1H-4H)

Primary Setup: Short on retracement

Entry Zone: $3,350-3,360

Target 1: $3,300

Target 2: $3,285

Stop Loss: $3,385

Conservative Approach

Wait for: Clear breakdown below $3,330

Entry: $3,325 (confirmation)

Target: $3,285-3,290

Stop: $3,345

CONFLUENCE FACTORS

Bearish Confluence at $3,285

Harmonic Bat pattern completion (88.6% level)

Gann Square of Nine critical angle

Elliott Wave 3 = 1.618 × Wave 1 target

Fibonacci 78.6% retracement level

Previous significant support area

Wyckoff markdown initial target

Resistance Confluence at $3,375

Gann 90-degree angle resistance

Harmonic pattern resistance

Elliott Wave corrective high

Previous breakout level

Psychological round number

FINAL 24H FORECAST SUMMARY

Expected Price Action: Controlled decline toward $3,285-3,300 support zone with potential for brief consolidation before further weakness.

Primary Targets (Downside):

First: $3,300-3,310

Second: $3,285-3,290

Extended: $3,260-3,270

Key Invalidation: Sustained break above $3,375 would shift bias bullish toward $3,390-3,410.

Risk Management: Position sizing should be conservative due to high volatility expectations and weekend gap risks.

Probability Assessment:

60% - Bearish scenario

25% - Sideways consolidation

15% - Bullish reversal

Disclaimer: This analysis is for educational purposes only. Gold trading involves substantial risk. Always use proper risk management and never risk more than you can afford to lose.

Volume profile resistance

JP

JP225 to continue in a rally?NIK225 - 24h expiry

Short term momentum is bullish.

There is no indication that the rally is coming to an end.

32240 has been pivotal.

A break of the recent high at 32240 should result in a further move higher.

The primary trend remains bullish.

We look to Buy a break of 32266 (stop at 32086)

Our profit targets will be 32716 and 32816

Resistance: 32240 / 32400 / 32600

Support: 32150 / 31900 / 31750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Sideway before moving up on UJ?On Daily chart UJ is coming to a congested zone on daily time frame,could ding dong a bit.shall see what happen next week and react accordingly.

***************************************************************************************

Hello there!

If you are keen to learn more on the technical setups,do visit my website at www.shadowingthebb.com !

If you like my analysis and it helped you ,do give me a thumbs ups on tradingview! 🙏

And if you would like to show further support for me, you can gift me some coins on tradingview! 😁

Thank you!

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

The author/producer of these content shall not and will not be responsible for any form of financial/physical/assets losses incurred from trades executed from the derived conclusion of the individual from these content shared.

Thank you, and please do your due diligence before any putting on any trades!

JP Morgan $JPM$JPM is still in bearish channel even though it is just above the 50SMA which is good sign for future trend. I would expect to hold above $115 before get in.

12 months Consensus Price Target: $111.99

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

"JP Morgan: not looking good" by ThinkingAntsOk4H Chart Explanation:

- Price broke the Ascending Trendline and the Support Zone (now Resistance).

- It went down towards the next Support Zone and bounced from there.

- We expect price to retest it and, then, face a difficult zone on the Weekly Ascending Trendline.

Weekly Vision:

Daily Vision:

Updates coming soon!

JP en pausa alcista, en zona de definiciónJP con retroceso a la zona de soporte en los 2.23/2.20 luego de no haber podido confirmar el movimiento de reversión arriba de 2.50/2.55 que trae desde máximos de Mayo del 2018.

Los indicadores marcan pausa y por ahora no hay peligro en la reversión mientras no pierda los 2.20. Logrando los 2.50 y confirmando en los 2.55, le quedará un gran alcista por delante, yendo en primera instancia hacia los 3.50/3.60.

Si pierde los 2.20, pensamos nuevamente en la fuerte posibilidad de que vaya debajo de 2.

JPMorgan - The things you used to own, now they own you.Hi, today we are going to talk about JPMorgan and its current landscape.

At JPMorgan as all bank sector of stocks, we have clear signals of the fragility of the price. The breakout of an Uptrend Line followed by an accumulation, show that the Bears are building strength, inside the weakness of the bulls and probably tend to look into the two supports highlighted above at the chart.

Thank you for reading and leave your comments if you like.

JP225USD with seats event

I was asked to analyze this pair. I did not touch on the analysis of the smaller time interval, as there are a lot of complex corrections. It will take a lot of time. But I see the future of this pair. We have completed a zigzag correction in the framework of the 4th subwave. We see the opposite bullish divergence. At the same time, we are in the momentum of a larger scale. Therefore, within the framework of the situation, we will not go below the support channel. At the same time, the breakdown of this channel will take place when the 3 big impulse ends. Quite promising, look at the sliding area. I think there is definitely long

NIKKEI ACCURATE DAILY TECHNICALSNIKKEI JPN 225

To open LONG positions for JPXJPY , it is required:

NIKKEI is targeting 23000 to form a double top before a large market correction. Indicators are approaching positive conditions on our system & a breakout has occurred to the upside territory to confirm trade entry but if the market trend continues to range this signal will become invalid. Market execution for entry, I will confirm signal once the conditions have been met.

JOIN THE TELEGRAM FOR EXCLUSIVE SIGNALS @ RSADVANTAGE

Profit expectations: 15-30 day trade length expected before hitting profit target I will post exit strategy when signal receives a exit signal.

Trading method: RSADVANTAGE Stage 5, accurate system manually forward tested over 3 years designed to stay out of ranging markets and only target strong trends suited for swing trading. This system is made of custom adaptive volume indicators and Oscillators that properly detect trends very early and provides exit signals at dynamic S/R zones once the trend has ended. // Average yearly pips gained is 40k per pair on D1 charts alone. I have provided a similar limited version of the system on Trading view to help traders visualize the strategy.