Jpmorgan

US Banks on Fire | Revenues Soar, and So Do the ProfitsWho Needs a Recession? Banks Are Swimming in Cash!

The largest U.S. banks have reported some of their best quarterly performances in recent years, with surging trading revenues, a resurgence in dealmaking, and an overall renewal of corporate confidence playing pivotal roles. Let’s break down the key details of the results.

Market Recovery

Across the major banks, investment banking and trading activities recorded impressive performances. Goldman Sachs saw investment banking revenue increase by 24%, while Bank of America (BofA) experienced a massive 44% jump, marking its strongest quarter in three years.

The market volatility stemming from factors like the U.S. election and changing expectations around interest rates continued to fuel robust trading revenues. Morgan Stanley’s equities division, for example, reached an all-time high, while JPMorgan and Goldman Sachs enjoyed notable gains in fixed-income trading.

A surge in CEO optimism has led to an uptick in mergers and acquisitions (M&A), initial public offerings (IPOs), and private credit demand. Morgan Stanley, in particular, is seeing the largest M&A pipeline in seven years, signaling a sustained wave of dealmaking.

Mixed Results for NII

Net interest income showed varying results across the banks, but forward guidance indicates that NII will likely see moderate growth in 2025, spurred by continued loan demand and higher asset yields.

Credit Risks on the Rise

Consumer lending pressures have persisted, with JPMorgan’s charge-offs rising by 9%. Many banks are preparing for a further increase in delinquencies, particularly in credit cards.

Commercial Real Estate Challenges

While the office sector remains under stress, banks are managing their exposures cautiously and have yet to face significant shocks in this area.

Regulatory Scrutiny Continues

Citigroup lowered its 2026 profitability target as it undergoes a transformation, while Bank of America faced increased scrutiny over its anti-money laundering compliance.

Resilient U.S. Economy

Banks are reporting strong consumer spending, loan growth, and corporate profitability, which supports an optimistic outlook for earnings growth heading into 2025.

Performance Breakdown for Each Bank

JPMorgan Chase

- JPMorgan posted a record annual net income of $58.5 billion, marking an 18% increase from the previous year.

- Investment banking saw a 46% surge in revenue, driven by strong advisory and equity underwriting.

- Trading revenue climbed by 21%, led by a 20% increase in fixed-income trading.

- Despite the impressive results, JPMorgan is still facing challenges such as rising charge-offs and pressures on loan margins. CEO Jamie Dimon emphasized concerns about persistent inflation and growing geopolitical risks.

Bank of America

- BofA experienced an 11% year over year growth in revenue, reaching $25.3 billion, with net income up 112% from the previous year.

- The investment banking division saw a dramatic 44% rise in revenue, the highest in three years, thanks to strong debt and equity underwriting.

- Trading revenue grew by 10%, driven by solid performance in fixed income (up 13%) and equities (up 6%) as market volatility spurred client activity.

- BofA also reported growth in its consumer and wealth management divisions, with credit card fees and asset management showing strength. Client balances grew to $4.3 trillion, a 12% increase from the previous year.

- After several quarters of decline, BofA’s NII grew by 3%, exceeding expectations and signaling stability. The bank expects NII to continue rising through 2025, with projections of $15.7 billion per quarter by the end of the year.

Wells Fargo

- Wells Fargo’s revenue remained flat at $20.4 billion, but net income surged by 50%.

- NII declined by 8% year-over-year but is expected to rise slightly in 2025 due to higher reinvestment rates on maturing assets.

- The bank made significant progress in cost-cutting efforts, reducing non-interest expenses by 12%, thanks to workforce reductions and efficiency initiatives.

- Investment banking fees rose by 59%, benefiting from the broader market recovery and the bank’s renewed focus on its Wall Street presence.

- Wells Fargo returned $25 billion to shareholders in 2024, including a 15% dividend increase and $20 billion in stock buybacks. However, the bank continues to face regulatory constraints, notably the asset cap imposed by the Federal Reserve.

- Looking ahead to 2025, Wells Fargo anticipates modest growth in fee-based revenue, with cost discipline and efficiency gains driving improvements.

Morgan Stanley

- Morgan Stanley saw a 26% increase in revenue, reaching $16.2 billion, while net income soared by 142%.

- Equity trading revenue jumped by 51%, setting a new all-time high as market volatility sparked increased client activity, particularly in prime brokerage and risk-repositioning trades.

- Investment banking revenue grew by 25%, fueled by strong demand for debt underwriting, stock sales, and M&A activity. CEO Ted Pick noted that the M&A pipeline is the strongest in seven years, signaling a potential multi-year recovery in dealmaking.

- Morgan Stanley’s wealth management division saw $56.5 billion in net new assets, increasing total client assets to $7.9 trillion. The firm is pushing toward its goal of $10 trillion in assets under management.

- In response to growing business complexities, the firm launched a new Integrated Firm Management division to streamline services across investment banking, trading, and wealth management.

Goldman Sachs

- Goldman Sachs experienced a 23% increase in revenue, reaching $13.9 billion, while net income more than doubled, up 105%.

- Record performance in equity trading contributed to a 32% increase in revenue from this segment, as market volatility drove greater client activity.

- Investment banking revenue grew by 24%, boosted by significant gains in equity and debt underwriting.

- The firm’s asset management division saw an 8% rise in assets under management, reaching $3.1 trillion, while management fees exceeded $10 billion for the year.

- Goldman is winding down legacy balance-sheet investments but also saw a gain of $472 million from these investments in Q4. The firm’s recent launch of its Capital Solutions Group is aimed at capturing growth opportunities in private credit and alternative financing.

Citigroup

- Citigroup posted a 12% increase in revenue, reaching $19.6 billion, with non-interest revenue surging 62%.

- Fixed-income and equity markets were key drivers, growing 37% and 34%, respectively, as market volatility tied to the U.S. election boosted performance.

- Investment banking revenue climbed by 35%, supported by strong corporate debt issuance and a pickup in dealmaking activity.

- The bank unveiled a $20 billion stock repurchase program, signaling confidence in future earnings.

- Citigroup also made strides in controlling operating expenses, which declined by 2% quarter-over-quarter. However, the bank lowered its 2026 return on tangible common equity (RoTCE) guidance to 10%-11% due to the costs of its ongoing transformation.

- CEO Jane Fraser emphasized Citigroup’s long-term growth trajectory, noting improvements in credit quality and continued progress with the strategic overhaul, including the postponed IPO of Banamex, the bank’s Mexican retail unit, now expected in 2026.

Long story short

Heading into 2025, the major U.S. banks are in strong positions, buoyed by a favorable economic backdrop, continued growth in trading, and a rebound in corporate dealmaking. Despite challenges such as rising credit risks, regulatory hurdles, and potential macroeconomic uncertainties, the outlook remains positive. With a recovering IPO market, continued wealth management growth, and strong trading revenue, the banks are poised to capitalize on the renewed corporate optimism. The key question will be whether the dealmaking frenzy continues or whether uncertainties in the global economy and market dynamics could temper the rally.

JPM JPMorgan Chase & Co Options Ahead of EarningsIf you haven`t bought JPM befor the rally:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase & Co prior to the earnings report this week,

I would consider purchasing the 290usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $20.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPMorgan Forecasts Strong 60-90% Growth for Gold Mining JPMorgan Forecasts Strong 60-90% Growth for Gold Mining Sector as Gold Prices Reach Record Highs

Meta Description:

JPMorgan predicts the global gold mining industry will grow by 60% to 90% thanks to record-breaking gold prices, increasing investment demand, and stable production costs. Where are the opportunities for investors?

JPMorgan Forecasts 60-90% Growth for the Gold Mining Industry

According to the latest outlook from leading investment bank JPMorgan, the global gold mining sector is facing an exceptional growth opportunity, expected to rise by 60% to 90% in the near future. This forecast comes amid historic highs in gold prices and a strong surge in gold investment demand.

Rising Gold Prices – The Key Driver for Mining Industry Growth

JPMorgan experts note that gold prices have been setting multiple new records in global markets throughout 2024. The main factors are concerns about inflation, geopolitical instability, and continued monetary easing by major central banks. These conditions have driven investors to seek gold as a safe-haven asset.

Advantages for Gold Mining Companies

JPMorgan believes that gold mining companies will be among the biggest beneficiaries of this uptrend. With production costs remaining stable, gold companies are projected to see significant profit increases—some may even raise dividends for shareholders.

Key factors supporting the gold mining sector include:

Strong increases in international gold prices.

Consistent physical gold demand from central banks.

Growing purchases by both retail and institutional investors

Well-controlled production and mining costs.

Investment Opportunities and Potential Risks

JPMorgan recommends that investors prioritize shares in large gold mining companies with low production costs and strong financial foundations to optimize returns during this gold boom.

However, JPMorgan also warns that the gold mining sector still faces several risks, such as:

High volatility in global gold OANDA:XAUUSD prices.

Rising mining costs if energy prices fluctuate.

Legal and political risks in major gold-producing countries.

Conclusion

With a remarkable growth outlook of 60% to 90% as forecasted by JPMorgan, the gold mining industry is becoming a hotspot for global investment inflows. Still, investors should carefully consider potential risks and select the right gold companies to ensure both safety and effectiveness for their investment portfolios.

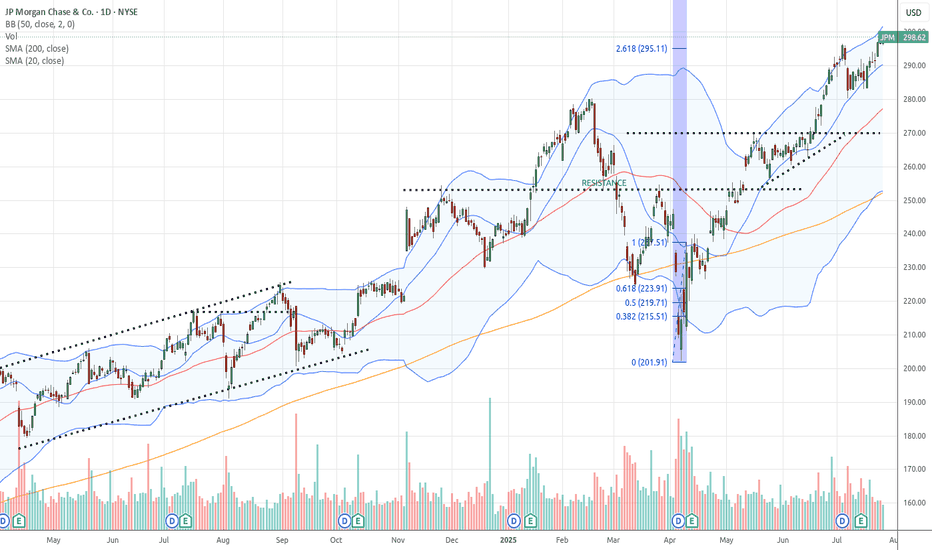

JP MORGAN's long-term bullish trend restored above the 1D MA50.JP Morgan Chase (JPM) broke above its 1D MA50 (red trend-line) last week for the first time since the first week of March and technically put an official end to the 3-month 'Trade War' correction.

This correction has technically been the Bearish Leg of the 2.5-year Channel Up. Every time the 1D MA50 broke and closed a 1W candle above it, the stock started the new Bullish Leg of the pattern. The last Bullish Leg was +6% (+48% against +42%) stronger than the previous one before the first pull-back to the 1D MA50 again.

As a result, we expect to see $310 (+54%) before this year is over.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

J.P. Morgan joins the $4K gold clubJ.P. Morgan now forecasts gold to average $3,675 per ounce by year-end and joins Goldman Sachs in projecting a move beyond $4,000 next year.

Spot gold has gained 29% year-to-date, setting 28 record highs and briefly surpassing $3,500 for the first time yesterday.

According to the bank, the main downside risk remains a sudden decline in central bank demand. Key support has potentially shifted higher, with $3,286 now seen as a potential pivot—aligned with both the 50-day moving average and the 61.8% Fibonacci retracement.

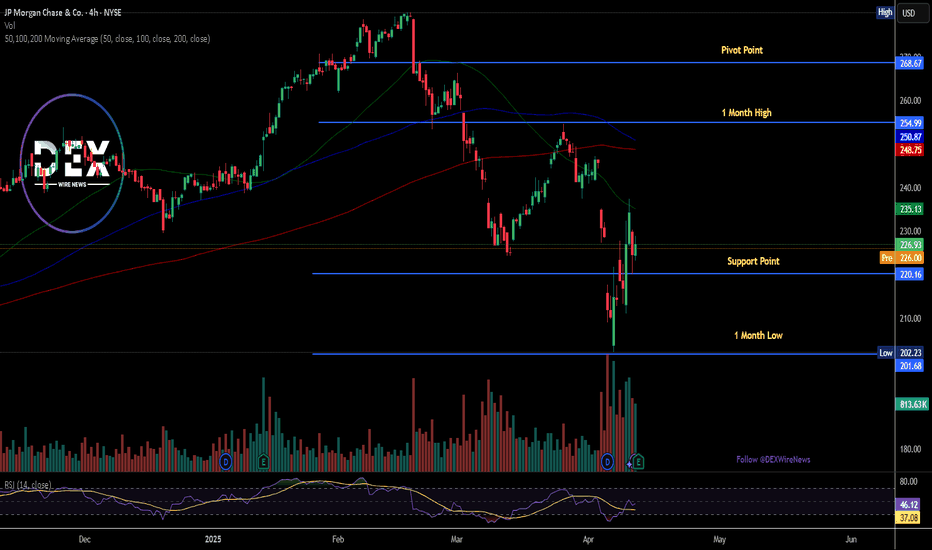

JPMorgan Chase Reports Earnings Today, Topping Q1 EstimatesShares of JPMorgan Chase (NYSE: NYSE:JPM ) are currently up 3% in Friday's premarket session as the asset tops Q1 estimates.

The company reported better-than-expected fiscal first-quarter results as big banks kicked off the new earnings season.

The banking giant reported earnings per share (EPS) of $5.07 on revenue of $45.31 billion, each up from $4.44 and $41.93 billion, respectively, a year ago. According to estimates compiled by Visible Alpha, some analysts had expected $4.64 and $43.55 billion. It generated $23.4 billion in net interest income (NII), above the $23.00 billion consensus.

Shares of JPMorgan were up 3% immediately following the release of Friday's report. They entered the day down roughly 5% year-to-date but up about 16% in the last 12 months.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," JPMorgan CEO Jamie Dimon said. "As always, we hope for the best but prepare the Firm for a wide range of scenarios."

Dimon wrote in his annual letter to shareholders this week that he expected the Trump administration's tariffs "will slow down growth."

technical Outlook

As of the time of writing, NYSE:JPM shares are already up 1.5% with the asset trading above the support point. A break above the 1-month high pivot could set the course for a bullish campaign eyeing the $260- $280 region.

With the last close RSI at 46, NYSE:JPM shares has more room to capitalize on the dip and make a comeback prior the earnings beat.

JP MORGAN won't give a better buy opportunity in 2025.Last time we looked at JP Morgan Chase (JPM) on November 27 2024 (see chart below), it gave us a clear sell signal that went straight to our $236 Target:

Now that the price rebounded not only on the 1D MA200 (orange trend-line) but also on the bottom (Higher Lows trend-line) of the long-term Channel Up, we are switching back to buying a we even got the first pull-back on the 1D MA50 (blue trend-line).

Given that the 1D RSI also rebounded from oversold (<30.00) territory like the October 27 2023 Low did, we expect a similar Bullish Leg to follow and thus our Target is $330 at the top of the Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JP MORGAN: Perfect 1W MA50 rebound targeting $350. JP Morgan is neutral both on its 1D and 1W technical outlooks (RSI = 54.173, MACD = 7.520, ADX = 32.502), suggesting that it remains inside the best buy zone for the long term. As a matter of fact, having rebounded exactly on its 1W MA50, this is the best buy opportunity since October 23rd 2023, which was the last time it hit the 1W MA50. As shown, the long term pattern is a Channel Up and every contact with the 1W MA50 has coincided with a 1W RSI test of the S1 Zone. There is no better buy entry than the current level and we can safely aim for yet another +57.76% run (TP = $350.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

JP MORGAN: Chart where we should ALWAYS operate!!

On January 15, JP Morgan presented its income statement, recording profits of $14 billion in the fourth quarter of 2024, which represents an increase of 50% compared to the same period of the previous year, and earnings per share were $4.81, compared to $9.3 billion, or $3.04 per share, a year earlier. Its shares had not stopped rising since then until last Thursday, when it began a correction phase.

--> What does it look like technically?

As always, the first thing to analyze is the medium-long term trend in its main time frames (Weekly, Daily, H4), and as can be seen in the table, it is clearly bullish (Bull). It is the chart where we should ALWAYS operate after each price pullback phase. ( AS IS HAPPENING RIGHT NOW ).

The second thing would be the STRENGTH to know if the price is still rising or is in a phase of decline. As we can see in the table, in Weekly and Daily the STRENGTH is bullish ( Bull ), but in H4 it is bearish ( Bear ), that is, the price is in a CORRECTION PHASE.

--> How far could the price fall?

Once we are clear that its TREND is bullish ( Bull ) STABLE and that in H4 the STRENGTH is bearish ( Bear ), that is, in a correction phase, what we would have to wait for is for the STRENGTH to turn bullish ( Bull ) again to end the correction and be able to enter longs again.

Knowing how far the price can fall is impossible because NO ONE KNOWS IT, but we do know the typical retracement zones using Fibonacci and supports and resistances, and so we wait for the price to reach one of them and from there start a new bullish impulse on the way to maximums.

At the moment it has reached the first Fibonacci zone (23.6%), therefore, all that is left is for the FORCE in H4 to turn bullish (Bull), because as long as the FORCE does not turn bullish (Bull), the price could continue to fall.

Important Fibonacci levels to which the price could fall:

38.2%: 261

50%: 255

61.8%: 249

Conclusion: WAIT for the graph to show us bullish FORCE (Bull) in H4 time frame.

---------------------------------------------------

When the FORCE turns bullish (Bull), I will update the analysis with the entry SET UP.

Greetings and good trading.

ETH Secondary trend. Channel. Potential triangle. 25 12 24Logarithm. Time frame 3 days.

With altcoins (overflow of profits from bitcoin, now) along with XRP this is asset #1 for pumping, the reason for this is liquidity, which is extremely necessary for large capital. The average price of 1 distribution zone is conditionally 10 thousand. These are not the maximums of the cycle.

When the price lingers in this zone and there is a massive positive news background, all L2 assets, which are now in their accumulation zones, or in retests of breakout zones, will "fly" to super pumps (this is what it is). In percentage terms, they will show an order of magnitude greater profit in their distribution zones. Remember, as a rule, such assets (low liquidity) are first pumped by an aggressive pump (to leave in parts, without regret) by a huge %, and only then is a distribution zone formed on a rollback (channel, triangle ...) (hope for a huge profit on the continuation of the pump).

This idea is a continuation of this idea (which I can't update) of a secondary trend, the goals of which have been achieved with utmost precision:

ETH/USD Secondary trend. Bullish triangle. Breakout. Target 96% 11 11 2023

It is worth noting that now in the news background: "ether is bad" , huge fake short positions for the news background. Many crypto media personalities speak negatively about the “prospects” of this very promising cryptocurrency of the “American” (Jewish) transnational financial conglomerate JPMorgan Chase (size of depository assets — $ 32.4 trillion, size of assets under administration — $ 7.7 trillion, etc.). What kind of lack of prospects can we talk about??

If they “stink” a lot to create public opinion, then there is probably an interested party in this. That is, it is worth doing everything the opposite of what they want to inspire, and as a result, tilt supply/demand in a favorable direction, which, as a rule, is always unprofitable for most market participants.

If you are an investor , then buy at any price (you can use martingale in parts, or place trigger orders for a breakthrough of important zones), and do not be interested in the opinion of the majority (meaningless market noise) and the news background (manipulation, deception). Sell in the distribution zone (time is known in advance when, 2 zones) with a huge profit, as for a liquid trading instrument.

If you are a small investor or trader , then pay attention to the L2 group of assets and ETC (big pump “stick”), and use ETH itself as an indicator of “when”.

Also, the idea shows an unlikely scenario, or rather two scenarios. Consider this in your risk management.

The idea of the main trend , published several years ago. Which, of course, is still relevant now. Everything develops organically, and extremely precisely according to plan.

ETH/USD Main trend Pump/dump cycles. Accumulation/Distribution 8 09 2022

Trend in general for clarity now.

locally this potential triangle (it doesn't exist yet) looks like this.

JPM JPMorgan Chase Options Ahead of EarningsIf you haven`t bought JPM before the breakout:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $5.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

4 Big Banks and their relation to KBEWeekly time frame....White line front runs a

change in direction...be it temporary or permanent

to long to explain...but white peak before blue peak

and things head down...if blue continues with white

or stays flat...there is little change to direction

or price just chops sideways a bit.

use other indicators to confirm...but white line can

bounce off or hug envelope channel and explain price

--------

The 4 headless horsemen of banking are next to each other...

Does something seem quite interesting among them since each is way different in area of investment...political control...money-metals exposure....MBS and the like...

So why are three pretty close to copies if you glance for more than a second or two, yet the fourth is somewhat similar but trending differently...

Just an interesting thought experiment

JP Morgan (JPM): Correction on the HorizonJP Morgan ( NYSE:JPM ) is back on our radar as the upcoming earnings season begins, with the banking sector leading the reports. We’ve analyzed JP Morgan before, and the current setup offers intriguing opportunities. Since 2023, the stock has maintained a steady upward trend that continues into 2024.

Currently, NYSE:JPM appears to be in sub-wave ((iii)) within the larger wave (3) or possibly wave 5. However, we anticipate that sub-wave ((iv)) correction is yet to occur, aligning with the broader structural narrative of the chart.

Presently, the stock is trading near a critical trendline originating from the top of sub-wave ((i)). This trendline, which has shifted from resistance to support after multiple touchpoints, now risks being broken. Should it fail, the price could fall from its current level of $243 into a range between $204 and $173. A drop to $173 would represent the maximum correction in our view, while a more realistic pullback would fall within the $204 to $188 range.

On the bullish side, the wave 5 could push up to approximately $260, a modest increase from the current price. This scenario fits within the Elliott Wave framework, anticipating a wave ((iv)) correction before the final upward moves to complete wave 5 and the larger wave (3).

2024 REVIEW MARKET STOCKS !! AND 2025 PROYECTIONS Why Stock Prices Tend to Rise Over Time

It's easy to get caught up in the ups and downs of the stock market, but zoom out, and you'll see a clear trend: stock prices generally increase over the long term. Here's why:

Economic Growth: As economies grow, so do corporate earnings. Companies expand, innovate, and become more profitable, which naturally pushes stock prices up.

Inflation: Over time, inflation erodes the value of money, but stocks can act as a hedge. As the price level increases, so do the nominal values of stocks.

Dividend Reinvestment: Many companies pay dividends, and when these dividends are reinvested into more shares, it compounds growth. This reinvestment can significantly boost the value of an investment over decades.

Market Sentiment: Optimism about the future can drive stock prices higher. When investors believe companies will do well, they're willing to pay more for stocks today.

Low Interest Rates: In recent decades, low interest rates have made borrowing cheaper for companies, fueling growth, and also made stocks more attractive than low-yield bonds or savings accounts.

Technological Advancements: Innovation leads to new industries and improves efficiency in existing ones, driving up stock values through increased productivity and new market opportunities.

JPM Bullish Breakout? JPMorgan Trend & Seasonal Insights In this video, we analyze JPM, JP Morgan Chase, which is currently exhibiting a strong bullish trend on the daily timeframe. The stock has consistently retraced to 50% of its previous price swings. Adding a seasonality perspective, we observe a historical pattern where the market tends to sell off into December 20th before rallying through the first or second week of January. My bias remains bullish, with a potential buy at the current price contingent on a break of structure. Please note, this is not financial advice.

JP MORGAN Expect a 1D MA50 correction before it turns into a buyJP Morgan Chase (JPM) posted a strong bullish leg on our last analysis (September 17, see chart below) that easily hit our $229 Target:

From a wider perspective on the 1D time-frame, the price is now right at the top of the 13-month Channel Up on an overbought 1D RSI and a 1D MACD that is about to form a Bearish Cross.

All previous Higher Highs of the pattern formed MACD Bearish Crosses and pulled back to the 1D MA50 (blue trend-line) on a minimum of -7.35% correction. Note that the 1D MA200 (orange trend-line) never broke, so as long as it holds, the long-term bullish trend is intact.

As a result, we now expect a pull-back to the 1D MA50 and a minimum of -7.35% decline puts the Target a $236.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JP Morgan Chase weekly (log)Hello commuté,

Weekly chart still in log with linear regression channels

The trend is magnificent, nothing to say it is indeed the first US bank.

The upward trend has been since 2011, it's crazy, right?

The 200-period simple average is in orange on the chart.

Make your opinion, before placing an order.

► Thank you for boosting, commenting, subscribing!