JPMorgan Chase Reports Earnings Today, Topping Q1 EstimatesShares of JPMorgan Chase (NYSE: NYSE:JPM ) are currently up 3% in Friday's premarket session as the asset tops Q1 estimates.

The company reported better-than-expected fiscal first-quarter results as big banks kicked off the new earnings season.

The banking giant reported earnings per share (EPS) of $5.07 on revenue of $45.31 billion, each up from $4.44 and $41.93 billion, respectively, a year ago. According to estimates compiled by Visible Alpha, some analysts had expected $4.64 and $43.55 billion. It generated $23.4 billion in net interest income (NII), above the $23.00 billion consensus.

Shares of JPMorgan were up 3% immediately following the release of Friday's report. They entered the day down roughly 5% year-to-date but up about 16% in the last 12 months.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," JPMorgan CEO Jamie Dimon said. "As always, we hope for the best but prepare the Firm for a wide range of scenarios."

Dimon wrote in his annual letter to shareholders this week that he expected the Trump administration's tariffs "will slow down growth."

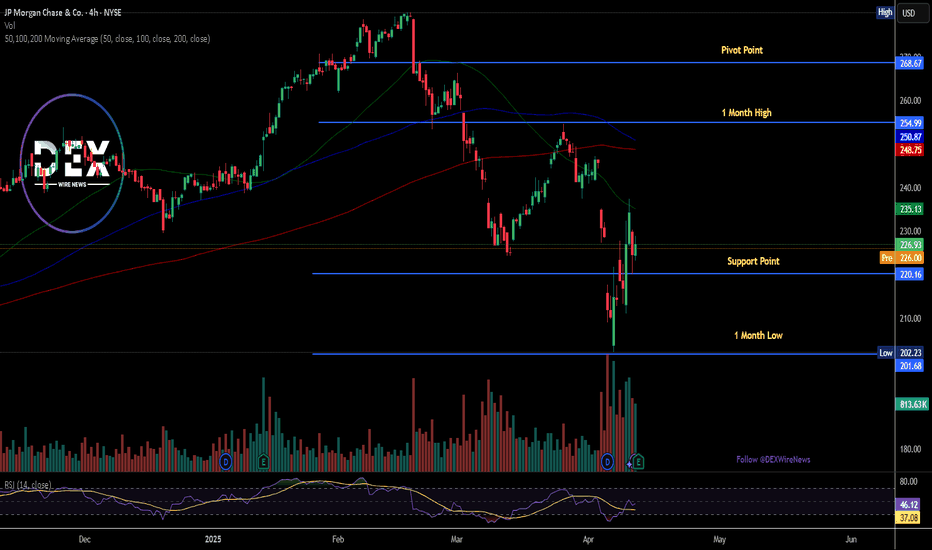

technical Outlook

As of the time of writing, NYSE:JPM shares are already up 1.5% with the asset trading above the support point. A break above the 1-month high pivot could set the course for a bullish campaign eyeing the $260- $280 region.

With the last close RSI at 46, NYSE:JPM shares has more room to capitalize on the dip and make a comeback prior the earnings beat.

Jpmorganbuy

JPM Bullish Breakout? JPMorgan Trend & Seasonal Insights In this video, we analyze JPM, JP Morgan Chase, which is currently exhibiting a strong bullish trend on the daily timeframe. The stock has consistently retraced to 50% of its previous price swings. Adding a seasonality perspective, we observe a historical pattern where the market tends to sell off into December 20th before rallying through the first or second week of January. My bias remains bullish, with a potential buy at the current price contingent on a break of structure. Please note, this is not financial advice.

JPMorgan Stock Slumps Amid Interest Income ConcernsJPMorgan Chase & Co. (NYSE: NYSE:JPM ) recently experienced a significant drop in its stock price, slumping over 7% following warnings from its President and COO, Daniel Pinto, about the bank’s net interest income (NII) outlook. As the largest U.S. bank by assets, JPMorgan's financial health is closely watched as a bellwether for the broader banking sector. Here's a deep dive into both the technical and fundamental aspects affecting JPMorgan’s stock.

Fundamental Analysis

JPMorgan's recent stock decline was triggered by Pinto’s comments that NII expectations are overly optimistic given the expected Federal Reserve rate cuts. The Fed is anticipated to lower its key policy rate by at least 25 basis points during its upcoming September meeting, initiating a potential monetary easing cycle. Lower rates are likely to compress NII, which represents the spread between what the bank earns on loans and what it pays on deposits.

Previously, JPMorgan (NYSE: NYSE:JPM ) forecasted its NII to rise to $91 billion this year, excluding its markets division. However, with the Fed’s rate cuts on the horizon, future projections have been adjusted downward. Investors are now concerned that the bank may not hit its 2025 NII target of approximately $90 billion, especially with Pinto's warning that "next year is going to be a bit more challenging."

Expense Outlook and Broader Concerns

Additionally, the analyst estimates for JPMorgan’s expenses in 2025, pegged around $94 billion, have been deemed overly optimistic by Pinto. With inflationary pressures and new investments looming, the bank’s expense base is expected to be higher than current projections. This dual concern over income and expenses has rattled investor confidence, making it JPMorgan's worst drop since June 2020.

Despite these challenges, JPMorgan’s position as a leader in gathering deposits and making loans remains strong. The bank's trading revenue is projected to be flat to slightly up year-over-year, and investment banking fees are expected to rise by about 15%, indicating resilience in other business segments. However, slowing economic growth in the U.S. and an anticipated decline in new loan yields due to rate cuts continue to cloud the outlook.

Technical Analysis

Current Price Action

As of the latest trading session, JPMorgan stock was down 5.19% in extended market trading, reflecting the broader market's nervous reaction to Pinto’s comments. The stock has been under pressure, but the Relative Strength Index (RSI) at 53 suggests that the stock isn’t yet in overbought or oversold territory, indicating a potential for reversal if sentiment shifts positively.

Key Technical Patterns

- Golden Cross Pattern: The daily chart shows a golden cross pattern formed earlier in the year, a bullish indicator where the 50-day moving average crosses above the 200-day moving average. Historically, this pattern has been associated with upward momentum, suggesting potential long-term strength despite current headwinds.

- Support and Resistance Levels: Currently, JPM is trying to establish a base around $133, which acts as a critical support level. A break below this pivot would confirm a bearish reversal pattern, potentially leading to further declines. Conversely, holding above this level could set the stage for a recovery, especially if NII concerns are tempered by unexpected positive news.

- RSI Analysis: The RSI of 53 implies that JPMorgan stock (NYSE: NYSE:JPM ) is positioned for a possible trend reversal. If buying pressure increases, the stock could move towards its next resistance levels near $145 and then $155.

- Bearish Divergence: However, caution is advised as there has been a recent bearish divergence between price and momentum indicators, which could signal further downside if investor sentiment does not improve.

Outlook and Key Considerations

JPMorgan remains fundamentally strong, with robust trading and investment banking revenues cushioning some of the expected pressure on NII. However, the market's reaction to the tempered guidance reflects broader concerns about the impact of lower rates on bank profitability.

For investors, the key takeaway is that while JPMorgan’s stock faces near-term challenges, the bank’s dominant market position, diversified revenue streams, and proactive management strategies still provide a solid foundation. Technically, a close watch on support levels and RSI dynamics will be crucial in determining the stock's short-term direction.

Conclusion

JPMorgan’s recent slump highlights the balancing act the bank must perform amid changing economic conditions. While the market’s reaction has been swift, the long-term narrative for JPMorgan remains constructive, provided the bank can navigate the expected rate cuts and maintain control over rising expenses. For traders and investors, staying informed on both the fundamental outlook and technical patterns will be essential in making well-timed decisions regarding $JPM.

Will JPM continue to rise?JPMorgan Chase - 30d expiry - We look to Buy at 150.22 (stop at 147.22)

The primary trend remains bullish.

A Doji style candle has been posted from the base.

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

Daily signals are bullish.

A break of the recent high at 150.10 should result in a further move higher.

The bias is to break to the upside.

Our profit targets will be 157.72 and 159.72

Resistance: 150.10 / 153.00 / 155.50

Support: 147.50 / 145.46 / 144.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

An opportunity to buy JPMorgan stockHi, according to my analysis of .jp morgan stock. There is a fantastic long term investment opportunity. Especially with the price breaking the resistance area at the level of 144. Likewise, the stock exited the sideways channel. We also notice a rising channel as shown in the analysis. good luck for everbody .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

JPM JPMorgan Chase Options Ahead of EarningsIf you haven`t sold JPM here:

or bought it here:

Then analyzing the options chain of JPM JPMorgan Chase prior to the earnings report this week,

I would consider purchasing the 145usd strike price Calls with

an expiration date of 2023-7-21,

for a premium of approximately $4.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

JPM to find buyers at previous swing highs?JPMorgan Chase - 30d expiry - We look to Buy at 143.33 (stop at 140.33)

The primary trend remains bullish.

This is currently an actively traded stock.

Price action continues to trade around significant highs.

Previous resistance at 144 now becomes support.

We look to buy dips.

This stock has seen good sales growth.

Our profit targets will be 150.83 and 152.83

Resistance: 149.87 / 157.00 / 163.50

Support: 147.50 / 144.00 / 142.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

JPMorganstock is breaking through the upper limit!JP Morgan stock is breaking through the upper limit!

This chart shows the weekly level candle chart of JP Morgan stock in the past two years. The graph overlays the top to bottom golden section at the end of 2021. As shown in the figure, the low point of JP Morgan stock at the end of 2022 happens to be around 3.414 points in the golden section, and the high point in November happens to be 1.618 points in the golden section. The high points in January, March, and May this year are exactly 1.382 points in the golden section! Now that JP Morgan stock has broken the upper limit, it is about to test the first wave of low points at the end of 2021 from the top to the bottom!

Trading JPM in current range.JPMorgan Chase - 30d expiry - We look to Buy at 134.65 (stop at 131.65)

We look to trade the current range.

This is currently an actively traded stock.

This stock has seen good sales growth.

The primary trend remains bullish.

Bespoke support is located at 134.50.

Our profit targets will be 142.15 and 144.15

Resistance: 141.50 / 143.37 / 144.34

Support: 138.13 / 136.50 / 134.50

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

JPM JPMorgan Chase Call OptionsIf you haven`t sold JPM here:

or here:

then you should know that JPM JPMorgan Chase seems to be most capitalized bank in the US, ready for the economic hurricane that its CEO, Jamie Dimon, predicted.

Most business and retail clients will move their funds to JPM after this bank run.

Looking at the JPM JPMorgan Chase options chain, I would buy the $140 strike price Calls with

2023-7-21 expiration date for about

$3.95 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

JPM JPMorgan Chase & Co. Options Ahead Of EarningsIf you haven`t sold JPM here:

Then looking at the JPM JPMorgan Chase & Co. options chain ahead of earnings , I would buy the FWB:124 strike price Puts with

2023-4-14 expiration date for about

$1.35 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

JPM primary trend remains bullish.JPMorgan Chase - 30d expiry - We look to Buy at 136.22 (stop at 132.88)

The primary trend remains bullish.

The stock is currently outperforming in its sector.

50 1day EMA is at 136.07.

The sequence for trading is higher highs and lows.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

We look for a temporary move lower.

Our profit targets will be 144.92 and 146.92

Resistance: 144.34 / 148.00 / 155.00

Support: 139.87 / 138.00 / 135.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

JPM JPMorgan Chase & Co. Options Ahead Of EarningsIf you haven`t sold JPM after the profit fall:

Then you should know that looking at the JPM JPMorgan Chase options chain, i would buy the $104 strike price Puts with

2022-10-14 expiration date for about

$2.09 premium.

Looking forward to read your opinion about it.

Will JPMORGAN continue climbing to historical summit?The movement of stocks is known in the past days, a strong movement in all sectors, even the financial sector knows a strong movement and among them the JPMORGAN CHASE & CO after the stock bounced from a weekly trend

The stock formed a classic triangular, and it was able to penetrate it with a respectable volume, and with a price gap.

The stock will currently try to descend towards the upper side of the triangle to retest at 105, which is a good opportunity to buy by targeting the top at 135.