JPMorgan Chase Reports Earnings Today, Topping Q1 EstimatesShares of JPMorgan Chase (NYSE: NYSE:JPM ) are currently up 3% in Friday's premarket session as the asset tops Q1 estimates.

The company reported better-than-expected fiscal first-quarter results as big banks kicked off the new earnings season.

The banking giant reported earnings per share (EPS) of $5.07 on revenue of $45.31 billion, each up from $4.44 and $41.93 billion, respectively, a year ago. According to estimates compiled by Visible Alpha, some analysts had expected $4.64 and $43.55 billion. It generated $23.4 billion in net interest income (NII), above the $23.00 billion consensus.

Shares of JPMorgan were up 3% immediately following the release of Friday's report. They entered the day down roughly 5% year-to-date but up about 16% in the last 12 months.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," JPMorgan CEO Jamie Dimon said. "As always, we hope for the best but prepare the Firm for a wide range of scenarios."

Dimon wrote in his annual letter to shareholders this week that he expected the Trump administration's tariffs "will slow down growth."

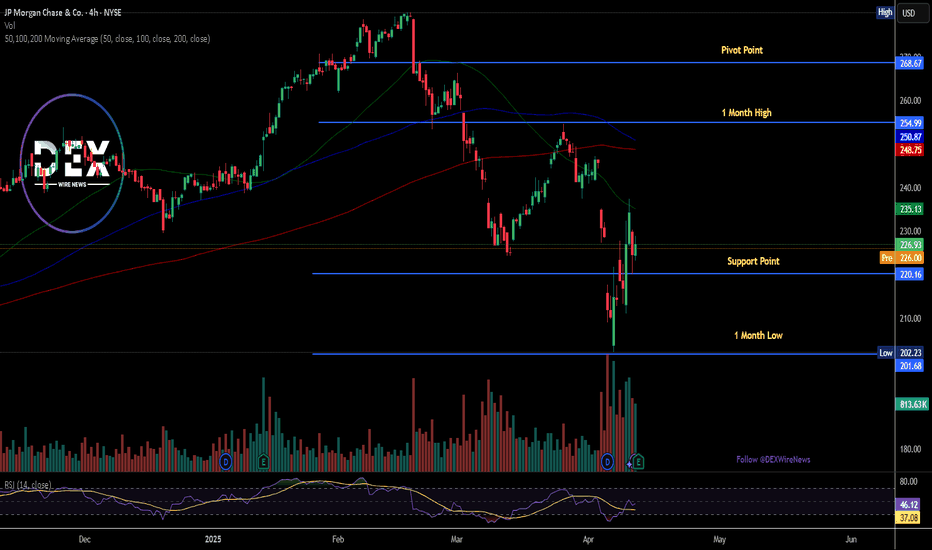

technical Outlook

As of the time of writing, NYSE:JPM shares are already up 1.5% with the asset trading above the support point. A break above the 1-month high pivot could set the course for a bullish campaign eyeing the $260- $280 region.

With the last close RSI at 46, NYSE:JPM shares has more room to capitalize on the dip and make a comeback prior the earnings beat.

Jpmshort

JPM - 10% to 20% Dip IncomingDISCLAIMER: This is not trade advice. This is for educational & entertainment purposes only to demonstrate how I am looking to be involved with this market. Trading involves significant risk, do your own due diligence.

A concerning sign for JPM bulls triggered today. We saw the DPO & CCI divergence confirmed. Price targets to the downside of this confirmation imply a 10% to 20% dip is coming for JPM.

See you down there.

JPM JPMorgan Chase Options Ahead of EarningsIf you haven`t sold JPM here:

or bought it here:

Then analyzing the options chain of JPM JPMorgan Chase prior to the earnings report this week,

I would consider purchasing the 145usd strike price Calls with

an expiration date of 2023-7-21,

for a premium of approximately $4.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

JPM JPMorgan Chase & Co. Options Ahead Of EarningsIf you haven`t sold JPM here:

Then looking at the JPM JPMorgan Chase & Co. options chain ahead of earnings , I would buy the FWB:124 strike price Puts with

2023-4-14 expiration date for about

$1.35 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

JP Morgan Bank will have a big crashJB Morgan Bank will collapse we are already at the beginning of a financial global crisis and it will be affect even on stock prices and we may see stocks fall by 90-95% of current prices. The gold is the only one safest in this next collapse. Even Bitcoin will not survive this collapse and will be pricely affected significantly and can see it on 1k or lower, so be careful and prepare new liquidity to enter

JPM JPMorgan Chase Options Ahead of EarningsLooking at the JPM JPMorgan Chase options chain, i would buy the $135 strike price Puts with

2023-6-16 expiration date for about

$7.90 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

JPM JPMorgan Chase & Co. Options Ahead Of EarningsIf you haven`t sold JPM after the profit fall:

Then you should know that looking at the JPM JPMorgan Chase options chain, i would buy the $104 strike price Puts with

2022-10-14 expiration date for about

$2.09 premium.

Looking forward to read your opinion about it.

JPM options ahead of earningsIf you haven`t shorted JPM after the Q1 results:

then ahead of Q2 earnings I would buy the following JPMorgan Chase & Co. (JPM) puts:

2023-1-20 expiration date

$113.19 entry price (approximatively)

$90 strike price

$3.15 premium/share

Looking forward to read your opinion about it.