Japan225 to find buyers at market price?NIK225 - 24h expiry

Price action looks to be forming a bottom.

A Doji style candle has been posted from the base.

Short term bias is mildly bullish. Preferred trade is to buy on dips.

Weekly pivot is at 37485.

We look to Buy at 37485 (stop at 37131)

Our profit targets will be 38496 and 40675

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei 225 JPN225 CFD

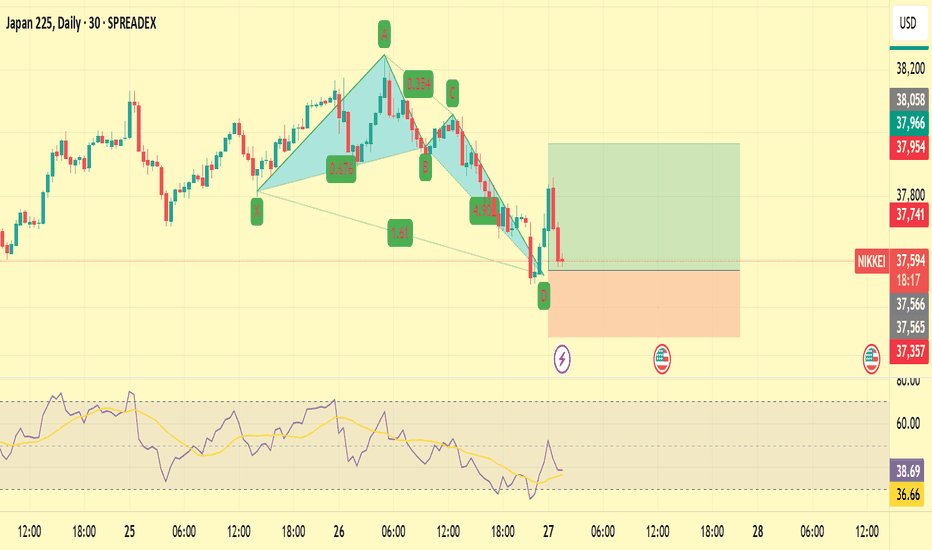

A quick long on NikkeiWarning: This is a counter trend quick trade.

JPN is in a downtrend on Daily. H4 is flat.

After last night's sell off there will be some buyers in the market looking for a deal.

We are going long based on:

1) There is a crab pattern

2) RSI divergence on M15

3) Strong support at 37500 area

Stop loss is 200+ pips and target is 400.

Nikkei price action forming a top?JP225USD -24h expiry

Price action looks to be forming a top.

The primary trend remains bearish.

Preferred trade is to sell into rallies.

The hourly chart technicals suggests further upside before the downtrend returns.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

We look to Sell at 38270 (stop at 38679)

Our profit targets will be 37247 and 36790

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

$JPIRYY -Japan's Inflation Rate (February/2025)ECONOMICS:JPIRYY

February/2025

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan fell to 3.7% in February 2025 from a 2-year high of 4.0% in the prior month, amid a sharp slowdown in prices of electricity (9.0% vs 18.0% in January )and gas (3.4% vs 6.8%) following the government's reinstatement of energy subsidies.

Also, food prices rose slightly slower after hitting a 15-month high in January (7.6% vs 7.8%).

Further, inflation eased for healthcare (1.7% vs. 1.8%), recreation (2.1% vs. 2.6%), and miscellaneous items (1.1% vs. 1.4%).

At the same time, education costs continued to fall (-1.1% vs. -1.1%).

In contrast, inflation remained steady for housing (at 0.8%) and clothing (at 2.8%), while accelerating for transport (2.4% vs. 2.0%) and furniture and household items (4.0% vs. 3.4%), and bouncing back for communications (0.1% vs. -0.3%).

The core inflation rate dropped to 3.0% from January's 19-month top of 3.2%, above forecasts of 2.9%.

Monthly, the CPI dropped 0.1%, the first fall since September, after a 0.5% gain in January.

Selling NIKKEI at 37500Happy new week everyone,

We are looking to sell NIKKEI at 37500 based on the action we see this morning.

1) It created a high last week at 37,622

2) There is lot of divergence on H1, M30, M15

3) There is a shark pattern which is not quite valid, but shows a good sign to sell.

This could be a big move downwards.

JPN225 D1 | Potential bearish reversalJPN225 is rising towards an overlap resistance and could potentially reverse off this level to drop lower.

Sell entry is at 37,727.50 which is an overlap resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 38,550.00 which is a level that sits above the 50.0% Fibonacci retracement and an overlap resistance.

Take profit is at 35,170.92 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Nikkei to continue in the downward move?JP225USD - 24h expiry

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

A higher correction is expected.

The primary trend remains bearish.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Further downside is expected although we prefer to sell into rallies close to the 37650 level.

We look to Sell at 37650 (stop at 38290)

Our profit targets will be 36000 and 34390

Resistance: 36790 / 38275 / 40675

Support: 35590 / 34390 / 32680

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei forming a bottom?NIK225 - 24h expiry

Daily signals for sentiment are at oversold extremes.

This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

Preferred trade is to buy on dips.

The hourly chart technicals suggests further downside before the uptrend returns.

We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher.

We look to Buy at 38080 (stop at 37643)

Our profit targets will be 39330 and 39660

Resistance: 39660 / 40720 / 42155

Support: 37705 / 36330 / 34955

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Buying Nikkei at 38070 for a 1:8 R:R TradeHere is why we want to trade this trade:

1) The low of last weekend is at 38050

2) There is a harmonic pattern with its stop loss at this level (patterns turn here also)

3) There is a lot of divergence now

4) Strong support at the 38000 level

This pair moves really fast so a 200 pip stop loss is imperative.

$JPIRYY -Japan's Inflation Rate (CPI)ECONOMICS:JPIRYY 4%

(January/2025)

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan climbed to 4.0% in January 2025 from 3.6% in the prior month, marking the highest reading since January 2023.

Food prices rose at the steepest pace in 15 months (7.8% vs 6.4% in December), with fresh vegetables and fresh food contributing the most to the upturn.

Further, electricity prices (18.0% vs 18.7%) and gas cost (6.8% vs 7.8%) remained elevated with the absence of energy subsidies since May 2024.

Additional upward pressure also came from housing (0.8% vs 0.8%), clothing (2.8% vs 2.9%), transport (2.0% vs 1.1%), furniture and household items (3.4% vs 3.0%), healthcare (1.8% vs 1.7%), recreation (2.6% vs 4.0%), and miscellaneous items (1.4% vs 1.1%).

In contrast, prices continued to fall for communication (-0.3% vs -2.1%) and education (-1.1% vs -1.0%).

The core inflation rate rose to a 19-month high of 3.2%, up from 3.0% in December and topping consensus of 3.1%.

Monthly, the CPI increased by 0.5%, after December's 14-month top of 0.6% rise.

Is there life in the old dog yet? Thoughts on Japan...Japan, once known for its high standard of living and expensive prices, has seen a dramatic shift. Today, Japan is often praised by travellers for its affordability, with the Yen weakened by decades of financial repression. While Japan's industrial and infrastructure standards remain high, its citizens are becoming poorer. The average monthly income has fallen sharply from $4,000 in 2012 to just $2,240, putting it on a par with countries such as Spain.

Japan's current economic policies, particularly its refusal to raise interest rates despite inflation remaining above the 2% target for over 31 months, are worrying enough. The Bank of Japan's reluctance to adjust interest rates due to Japan's high level of government debt has kept the key interest rate at just 0.25%. As a result, Japanese savers have turned to foreign currency investments, further weakening the Yen.

Currency depreciation has never led to greater competitiveness or long-term prosperity, and countries such as Argentina and Italy are examples of where such policies have failed to deliver the desired results. In contrast, countries such as Singapore, Norway and Switzerland remain at the top of global income rankings. We could also draw parallels with Germany's own departure from the "hard currency" club, as it and the wider Eurozone follow Japan's economic model.

Questions on my mind:

- Given Japan's current economic environment, how do we view on the long-term stability of the Yen?

- With Japanese wages stagnating, do we see opportunities in Japanese equities or sectors that could benefit from a weaker currency?

- How might Japan's refusal to raise interest rates affect foreign investment in the country over the next few years?

- Do you think the trend of low interest rates and currency depreciation will continue in the Eurozone and how might that affect global markets?

- In a scenario where Japan continues on this economic path, what other regions or emerging markets might offer better investment opportunities in comparison?

$JPINTR -Japan's Interest Rate (December/2024)ECONOMICS:JPINTR 3.6%

(December/2024)

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan jumped to 3.6% in December 2024 from 2.9% in the prior month, marking the highest reading since January 2023.

Food prices rose at the steepest pace in a year (6.4% vs 4.8% in November), with fresh vegetables and fresh food contributing the most to the upturn.

Further, electricity prices (18.7% vs 9.9%) and gas cost (5.6% vs 3.5%) increased at the fastest rate in four months with the absence of energy subsidies since May.

Additional upward pressure also came from housing (0.8% vs 0.9%), clothing (2.9% vs 2.6%), transport (1.1% vs 0.9%), furniture and household utensils (3.0% vs 3.7%), healthcare (1.7% vs 1.6%), recreation (4.0% vs 4.5%), and miscellaneous items (1.1% vs 1.1%).

In contrast, prices continued to fall for communication (-2.1% vs -3.0%) and education (-1.0% vs -1.0%).

The core inflation rate rose to a 16-month high of 3.0%, up from 2.7% in November and matching consensus. Monthly, the CPI increased by 0.6%, the highest figure in 14 months.

JP225/Nikkei 225 Index CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the JP225/Nikkei 225 Index CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a Bull or Bear trade at any point after the breakout.

Buy entry above 39200.0

Sell Entry below 38200.0

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 40300.0 (or) Escape Before the Target

Bearish Robbers TP 37400.0 (or) Escape Before the Target

Fundamental Outlook 📰🗞️

Current Fundamentals:

Japanese Economy: The Japanese economy is expected to grow at a moderate pace, with a forecasted GDP growth rate of 1.2% for 2023.

Monetary Policy: The Bank of Japan (BOJ) has maintained its ultra-loose monetary policy, with a negative interest rate of -0.1% and a commitment to purchase Japanese government bonds (JGBs) to keep the 10-year yield around 0%.

Inflation: Japan's inflation rate has been rising, but it remains below the BOJ's target of 2%. The current inflation rate is around 0.5%.

Trade Tensions: The ongoing trade tensions between the US and China have had a negative impact on the Japanese economy, particularly on the country's export-oriented industries.

Upcoming News:

BOJ Interest Rate Decision: The BOJ is scheduled to announce its interest rate decision on March 18, 2023. The market expects the BOJ to maintain its current monetary policy stance.

Japanese GDP Growth: The Japanese government will release its GDP growth data for Q4 2022 on March 10, 2023. The market expects the economy to have grown at a moderate pace.

US-China Trade Talks: The US and China are scheduled to resume trade talks in March 2023. A positive outcome could boost the Japanese economy and the JP225.

Bullish Factors:

BOJ's Ultra-Loose Monetary Policy: The BOJ's commitment to maintaining its ultra-loose monetary policy could continue to support the Japanese stock market.

Weakening Yen: A weakening yen could boost Japan's export-oriented industries and support the JP225.

Improving Corporate Earnings: Japanese companies have been reporting improving earnings, which could support the JP225.

Bearish Factors:

Global Economic Slowdown: A global economic slowdown could negatively impact the Japanese economy and the JP225.

Trade Tensions: Escalating trade tensions between the US and China could negatively impact the Japanese economy and the JP225.

Rising Inflation: Rising inflation could lead to higher interest rates, which could negatively impact the Japanese stock market.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

$JPIRYY -Japan Inflation Rate Highest in Near 2 YearsECONOMICS:JPIRYY 3.6%

(December/2024)

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan jumped to 3.6% in December 2024 from 2.9% in November,

marking the highest reading since January 2023 as food prices rose the most in a year.

Meanwhile, the core inflation rate climbed to a 16-month peak of 3%, in line with estimates.

Japanese inflation and BoJ rate decision coming upLet's have a look what may happen with MARKETSCOM:JAPAN225 and FX_IDC:USDJPY after we get the Japanese data on Friday.

We will be monitoring the data carefully, especially the rate decision, as it will be the first hike since July of last year.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Nikkei 225: When Will it Break Out of its Range?Chart Analysis:

The Japan 225 index remains within a clearly defined horizontal range, suggesting consolidation and indecision among market participants.

1️⃣ Key Resistance and Support Levels:

Resistance: The upper boundary near 40,236 serves as a key resistance, capping upside attempts.

Support: The lower boundary around 37,708 offers a critical level of demand, preventing deeper pullbacks.

2️⃣ Moving Averages:

The 50-day SMA (blue) at 39,018 aligns closely with the current price, acting as a pivot point within the range.

The 200-day SMA (red) at 38,706 reflects the broader bullish structure and serves as a longer-term support level.

3️⃣ Momentum Indicators:

RSI: At 53.12, reflecting neutral momentum with no immediate overbought or oversold signals.

MACD: Showing flat momentum near zero, consistent with range-bound trading conditions.

What to Watch:

A breakout above 40,236 or a breakdown below 37,708 will likely signal the next major directional move.

Watch for price action around the 50-day SMA for clues on short-term direction.

Monitor RSI and MACD for any divergence that could indicate an impending shift in momentum.

The Japan 225 is in consolidation mode, with well-defined boundaries providing traders with clear levels to monitor for potential breakout or breakdown scenarios.

-MW