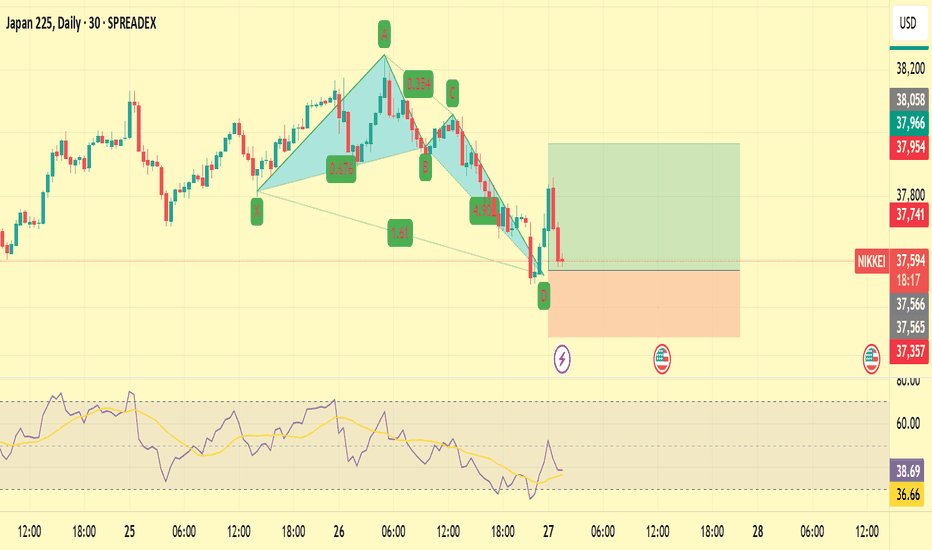

A quick long on NikkeiWarning: This is a counter trend quick trade.

JPN is in a downtrend on Daily. H4 is flat.

After last night's sell off there will be some buyers in the market looking for a deal.

We are going long based on:

1) There is a crab pattern

2) RSI divergence on M15

3) Strong support at 37500 area

Stop loss is 200+ pips and target is 400.

Jpn225long

Nikkei forming a bottom?NIK225 - 24h expiry

Daily signals for sentiment are at oversold extremes.

This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

Preferred trade is to buy on dips.

The hourly chart technicals suggests further downside before the uptrend returns.

We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher.

We look to Buy at 38080 (stop at 37643)

Our profit targets will be 39330 and 39660

Resistance: 39660 / 40720 / 42155

Support: 37705 / 36330 / 34955

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

JPN225 (The Nikkei) slowly being squeezed to the upsideTake a look at the daily chart - the flat top and an upward sloping trendline. You would agree that for the past 4 months, a slow squeeze to the upside has been happening. Price is now also above the 200dma and this gives me a bullish bias. Ideally, price being contained in the upper part of the triangle would be another factor of confluence. Another one or two bounces off the trendline will add more confirmation. The situation will become clearer in the next few days and continued build up to the bullish side will motivate me to go long with 42,400 as target.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk.

If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

JPN225: Continuation idea with explanationToday's focus: JPN225

Pattern – Continuation

Support – 35,860, 35,500

Resistance – 36,215, 36,718

Hi, and thanks for checking out today's update.

We are looking at the JPN225 today, but it's more from an educational standpoint around a continuation pattern that uses the moving averages to help qualify the setup. This setup comes from a system called the Floor Trader Method. Yes, I know floor traders most likely didn't use moving averages. But if you read it, you will see it mainly focuses on price position and retracement shape. The moving averages are there to assist in seeing the trend and qualify.

We have run over some aspects of the method and how it can be seen in today's price setup. We have also run over targets and stop points with both a higher perspective and a lower failed perspective.

It will be interesting to see if the JPN225 can retest its previous resistance and highs and set up a new fast trend.

Good trading.

SUPPLY AND DEMAND - JPN225 (2-8 Jan 2022)MN trend: upwards

W1 trend: reacting off demand zone

D1 Chart:

Wait for price to retrace to D1 Demand

H1 Entry:

Future entry zone identified

SUPPLY AND DEMAND - JPN225 (13-18 Dec 2021) MN TF

Price is holding up in Strong MN demand zone. Price will continue upwards unless it breaks off Demand

WK TF

D1 TF

Wait for price to remove D1 supply for LONG-TERM BUYS

H4 TF

For intraday BUYS, green dotted zone is the BUY zone

H1 Entry

BUY zone identified

NIKKEI225 going longTVC:NI225 is in a descending channel, but in a bigger timeframe it looks like a bullish flag to me. Besides that, it hit key Fibonacci levels rebounded from there. I am bullish until above 30000.

The fundamentals are still bullish for me as the opening-up party just begun. However expect wild swings, as the speculators tried to "price-in" the opening up with leveraged positions, so both long and short squeezes are ahead of us, so try this idea with small positions.

Nikkei 225 set for Long moveIts been a while since I published.

Ive been checking Nikkei 225 for a while. The market has moved to a long standing Bull Trend line, where its developed Bull reversal this trading week over the last two days.

With Asia session about to begin, watch for strong continuation. Yall know how JPY react. Very solid movers once a move is in play.

This current level is perfect to catch the wave, with previous High being high probability TP.

Price Action Pmlani

thePeoplesTrader

Nikkei testing major resistance, potential for a big drop!Nikkei (JPN225) is testing major resistance at 21409 (Fibonacci retracement, Fibonacci extension, descending resistance) and a strong reaction could occur from here to push prices down to major support at 20276 (Fibonacci extension, horizontal swing low support). We have to be cautious of intermediate support at 20759 (Fibonacci retracement, horizontal overlap support as price might bounce off there too).

Stochastic (89,5,3) is seeing major resistance below 97% where a corresponding reaction could occur.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

Nikkei testing major resistance, potential upcoming drop!Nikkei is testing major resistance at 22178 to 22360 where we can see strong fibonacci retracement and fibonacci extension along with horizontal overlap resistance. What is nice to see is that there are multiple stochastic reactions that has occurred at that level too.

Major support is at 21700 which is a strong fibonacci retracement, extension and overlap support.

Nikkei testing major support, watch for the break!Nikkei is testing major support at 21700 which is the 38% retracement and 61.8% extension along with a strong overlap support. Breaking this level could trigger a strong move down to 21353 ( 61.8% retracement , 100% extension, horizontal overlap support).

It's important to note that RSI has broken below our strong 50% support signalling that a potential bearish move is on the horizon.

Nikkei approaching major support, potential for bounceNikkei is approaching major support at 21700 (Fibonacci retracement, Fibonacci extension, horizontal overlap support, Ichimoku cloud support) and there is a potential for a bounce above this level towards 22360 resistance (Fibonacci retracement, horizontal overlap resistance).

RSI (55) sees strong support above 50% which is the level that would maintain our bullish bias.