Jpy

USDJPY Outlook – Bearish Continuation or Bullish Reversal??In this analysis, I'm breaking down the USDJPY structure starting from the 4H to identify the overall market direction (Bearish/Sells), then zooming into the 1H to fine-tune potential trade setups.

On the 4H timeframe, we’re assessing whether the recent bearish momentum is likely to continue or if price action is showing early signs of a bullish reversal. The LOW created at 141.800 level is our first target IF we continue to sell as its creating that LowerLow.

IF price closes bullish above 142.500, I will switch sides and look for potential buys.

On the 1H timeframe, I’m watching for a bullish liquidity sweep below141.888, followed by a clear break of structure to the upside on the 15m or 1H for more confirmation. That would indicate smart money accumulation and a potential shift in market sentiment—giving me confirmation to start looking for long setups.

🚀 Give me a boost and follow for upcoming $niper entries this week! 🦇🔥

CMCMARKETS:USDJPY

Bullish bounce off pullback support?USD/JPY is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 140.84

1st Support: 137.22

1st Resistance: 144.98

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off major support level?USD/JPY is falling towards the support level which is a pullback support that lines up with the 78.6% Fibonacci projection and could bounce from this level to our take profit.

Entry: 140.82

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci projection.

Stop loss: 137.37

Why we like it:

There is a pullback support level that is slightly above the 100% Fibonacci projection.

Take profit: 144.77

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

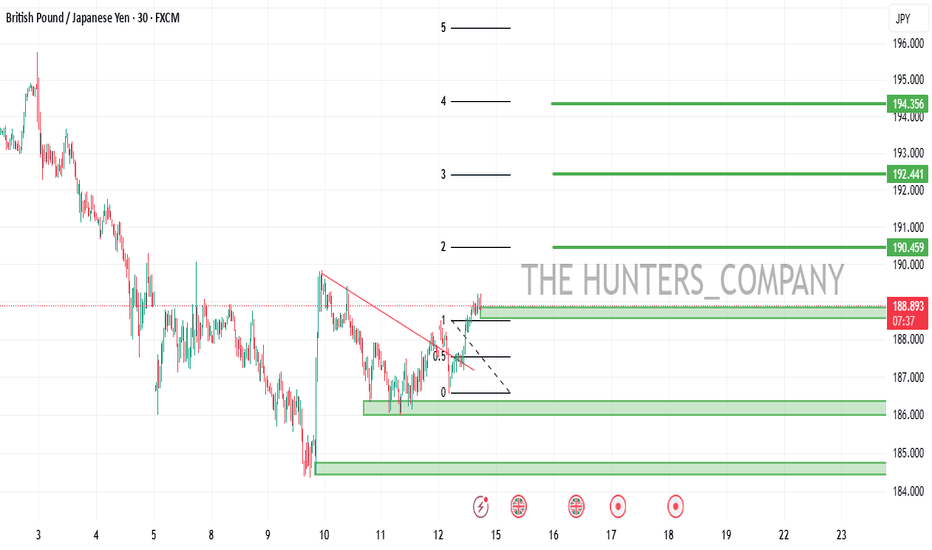

GBPJPY Potential DownsidesHey Traders, in today's trading session we are monitoring GBPJPY for a selling opportunity around 189.600 zone, GBPJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 189.600 support and resistance area.

Trade safe, Joe.

AUDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring AUDJPY for a selling opportunity around 91.800 zone, AUDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 91.800 support and resistance area.

Trade safe, Joe.

NZDJPY is Approaching The Daily TrendHey Traders, in today's trading session we are monitoring NZDJPY for a selling opportunity around 86.000 zone, NZDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 86.000 support and resistance area.

Trade safe, Joe.

CADJPY is perhaps the best sell signal long-term.The CADJPY pair has broken marginally below its 1W MA200 (orange trend-line) in recent weeks and turned sideways. This took place on the latest 1W MA50 (blue trend-line) rejection on January 13 2025. As long as the market remains below it, the long-term trend-line will be bearish.

The current 1W MA200 consolidation is in fact similar to what followed after the last major long-term rejection in December 2014. As you can see on the chart, we are on similar trading patterns as August - September 2015. Even the 1W RSI sequences among the two fractals are identical, starting off strong Bearish Divergencies that basically were an early signal for the 2015 - 2016 sell-off and possibly now the 2025 - 2026 sell-off.

As a result, we are bearish on this pair, expecting a 85.000 Target on high probabilities and a 2nd at 75.000 on lower, which is the 14-year Support Zone.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/JPY(20250417)Today's AnalysisMarket news:

U.S. import prices fell 0.1% in March from the previous month, the first month-on-month decline since September last year.

Technical analysis:

Today's buying and selling boundaries:

143.10

Support and resistance levels:

144.08

143.72

143.48

142.72

142.48

142.11

Trading strategy:

If the price breaks through 143.10, consider buying, the first target price is 143.48

If the price breaks through 142.72, consider selling, the first target price is 142.48

Bullish bounce?EUR/JPY is falling towards the pivot which acts as an overlap support and could bounce to the 1st resistance which is also an overlap resistance.

Pivot: 160.89

1st Support: 159.93

1st Resistance: 162.23

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal?AUD/JPY is rising towards the pivot which is a pullback resistance that lines up with the 61.8% Fibonacci retracement and could reverse to the 1st support.

Pivot: 91.88

1st Support: 88.48

1st Resistance: 93.29

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?NZD/JPY is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 83.52

1st Support: 82.38

1st Resistance: 85.13

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDJPY to continue in the sequence of lower highs?NZDJPY - 24h expiry

The primary trend remains bearish.

The rally is close to a correction count on the daily chart.

The RSI is trending lower.

Bearish divergence is expected to cap gains.

Bespoke resistance is located at 84.50.

Preferred trade is to sell into rallies.

We look to Sell at 84.50 (stop at 85.15)

Our profit targets will be 81.90 and 81.50

Resistance: 85.00 / 85.50 / 86.30

Support: 83.20 / 82.25 / 81.85

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bearish drop?USD/JPY has rejected off the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 142.87

Why we like it:

There is a pullback resistance level.

Stop loss: 143.69

Why we like it:

There is a pullback resistance level that is slightly above the 23.6% Fibonacci retracement.

Take profit: 141.48

Why we like it:

There is a support level at the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURJPY Potential DownsidesHey Traders, in today's trading session we are monitoring EURJPY for a selling opportunity around 162.100 zone, EURJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 162.100 support and resistance area.

Trade safe, Joe.

USD/JPY(20250416)Today's AnalysisMarket news:

U.S. import prices fell 0.1% in March from the previous month, the first month-on-month decline since September last year.

Technical analysis:

Today's buying and selling boundaries:

143.10

Support and resistance levels

144.08

143.72

143.48

142.72

142.48

142.11

Trading strategy:

If the price breaks through 143.10, consider buying, the first target price is 143.48

If the price breaks through 142.72, consider selling, the first target price is 142.48

Setup of the Week: EURJPY Long Toward LiquidityI'm currently watching EURJPY for a potential long setup. Price is showing signs of bullish structure, and there’s a clean upside target sitting at 164.20, where equal highs rest on the weekly chart. That level also ends in a .20—an institutional number often used for stop placement—which adds confluence that price may be drawn toward it.

Why I'm Bullish

The Euro is showing strength across the board this week, supporting directional alignment.

Structure is starting to build bullish pressure, especially as price grinds upward toward liquidity.

We have weekly equal highs at 164.20, which is a clear magnet. (zoom out)

This setup is pretty straightforward: I’m anticipating that price wants to make a move toward those untouched highs. No extra complexity needed.

Recent Price Action

Looking at structure from April 9th:

Price sold off, took out a daily low, and then reversed sharply—classic manipulation and reclaim. The idea is that smart money will need to close those sell orders out if price returns to that zone.

The April 9th move down into 160 created what I believe is an institutional footprint.

This move took out liquidity, reversed hard, and left behind a zone I expect to be defended.

On Sunday’s weekly open, price quickly ran last week’s high, then reversed hard during the Tokyo session—a likely short-term trap. This tells me we might see some short-term bearish pressure before a larger move up, which is fine since I want price to return to the institutional buy zone around 160.00–160.30.

📍 Key Levels

Buy Zone: 160.00–160.30

This is where volume flooded in to drive the initial bullish manipulation move. If price returns, I expect heavy buying interest to step in.

Trap Confirmation: 162.80

During London open today, price ran a low, then reclaimed a high, and retested 162.80—another institutional level (ends in .80). That area acted as a trap and likely marked the start of the move down. We should see price stay under this move for this idea to work.

Target: 164.20

That’s the weekly equal high. Liquidity sits above there. If we return to the buy zone and bulls step in, I’ll be looking to ride the move up into that level.

Summary

I’m looking to long EURJPY on a retracement into 160.00–160.30, ideally after a stop hunt or false breakdown into that zone. The goal is to ride the volume push up toward the weekly target of 164.20, where stops likely sit from early sellers who might take a trendline break trade. If price respects the London trap at 162.80 and moves lower, I’ll be watching closely for reaction and confirmation in the buy zone.

Let me know your thoughts below or if you're watching the same levels.

Potential bullish rise?AUD/JPY has reacted off the pivot which is a pullback support and could rise to the 1st resistance which has been identified as a pullback resistance.

Pivot: 89.96

1st Support: 88.50

1st Resistance: 92.38

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Could the price reverse from here?NZD/JPY us rising towards the pivot an could reverse to the 1st support.

Pivot: 85.30

1st Support: 84.12

1st Resistance: 86.71

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bullish rise?NZD/JPY has bounced off the support level which is an overlap support and could rise from this level to our take profit.

Entry: 83.42

Why we like it:

There is an overlap support level.

Stop loss: 82.42

Why we like it:

There is a pullback support level.

Take profit: 85.16

Why we like it:

There is an overlap resistance level that aligns with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPJPY:SIGNALHello dears

Considering the heavy decline we had, you can see that buyers entered with a strong bullish spike, which is a good sign...

Now we can buy in steps on the price pullback and move with it to the specified targets, of course with capital and risk management.

*Trade safely with us*

USDJPY Is Nearing An Important Resistance Under a Strong JPYHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 144.100 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 144.100 resistance area.

Trade safe, Joe.