JPY ( YEN )BASKET FORECAST Q2 W18 Y25JPY ( YEN )BASKET FORECAST Q2 W18 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

✅The JPY Basket trackS the overall strength of the JPY against a weighted average of other currencies.

✅It can be used as an indicator of YEN strength which can be a tool for analysing and potentially hedging for or against the Index.

✅ Pairs to watch - GBPJPY, USDJPY EURJPY, CADJPY, AUDJPY

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Jpy

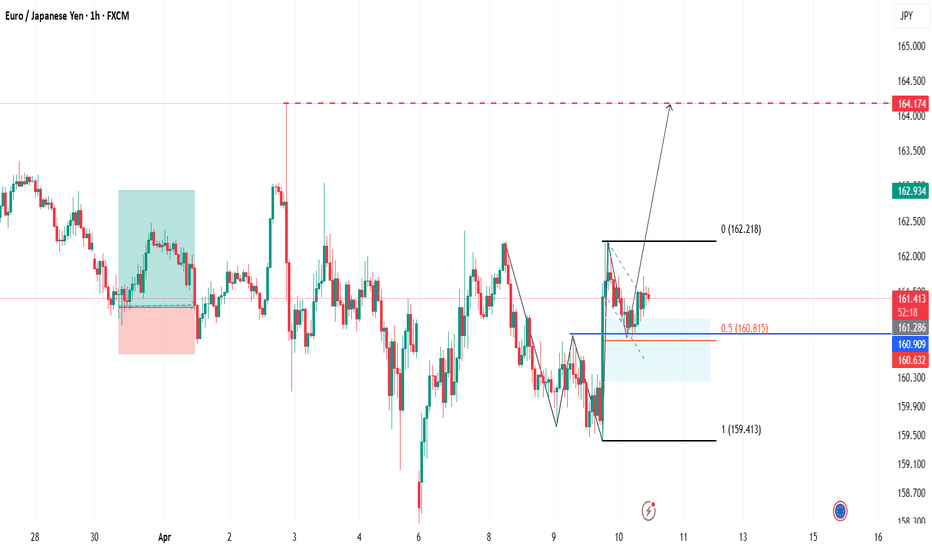

EUR/JPY Technical Outlook: Demand Zone Bounce Sets Up RallyGood Morning Traders,

Trust you are good.

Below is my analysis of the EURJPY pair.

Overview

Price is currently at 161.243, showing signs of a bullish rebound following a sharp drop. A clear bullish structure is forming, characterized by higher lows and a breakout from a recent consolidation zone. The demand zone between 160.900 and 161.100 has held strong, acting as a reliable support level.

Idea

A recent bullish impulse broke above minor resistance, followed by a healthy retracement into the demand zone—shaping a potential bullish flag or continuation pattern. This retracement aligns with the 50% Fibonacci level, providing added confluence for a continuation to the upside.

The projected target is 164.174, a level likely to contain buy-side liquidity and act as a magnet for price in the short term.

Conclusion

Despite macro uncertainty due to ongoing trade tensions, recent news of a 90-day tariff pause from Trump has eased some pressure, allowing the EUR to show resilience. As a result, EUR/JPY may continue its bullish push toward the 164.174 target. However, a break below 160.245 would invalidate this outlook.

Cheers and happy trading!

USD/JPY(20250425)Today's AnalysisMarket news:

Federal Reserve-①Hamack: If economic data is clear, the Fed may cut interest rates in June

②Waller: It will take until July to get a clearer understanding of how tariffs affect the economy. If tariffs lead to higher unemployment, interest rate cuts may be initiated. ③The Atlanta Fed GDPNow model predicts that the US GDP growth rate in the first quarter will be -2.5%. ④Kashkari: The frequent announcements from Washington have brought challenges to policymakers and everyone.

Technical analysis:

Today's buying and selling boundaries:

142.79

Support and resistance levels:

143.94

143.51

143.23

142.34

142.06

141.63

Trading strategy:

If the price breaks through 142.79, consider buying, the first target price is 143.23

If the price breaks through 142.34, consider selling, the first target price is 142.06

Bullish bounce?USD/JPY is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 141.82

1st Support: 140.15

1st Resistance: 144.52

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bullish rise?USD/JPY has reacted off the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could rise from this level to our take profit.

Entry: 142.39

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 140.91

Why we like it:

There is a pullback support level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 144.32

Why we like it:

There is a pullback resistance level that is slightly above the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

If you are trading JPY, keep an eye on the Tokyo CPIs tomorrowTomorrow, the 25th of April, we are getting the Tokyo CPI figures, which are expected to come out on the higher side. That said, we are looking at the core YoY number, which has a relatively high forecast.

Let's dig in.

FX_IDC:AUDJPY

FX_IDC:USDJPY

FX_IDC:EURJPY

FX_IDC:GBPJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

USDJPY: This Pattern Shows Global Reversal USDJPY is on the brinks to trigger global reversal to the downside

as large Head & Shoulders reversal pattern has been built on the chart

Bearish Trigger is on the Neckline breakdown

Target is on 117 (height of the Head below Neckline)

Massive drop is expected

It matches the area (blue trendline) where the breakout to upside occured

Invalidation is above the Right Shoulder

Bullish bounce off 50% Fibonacci support?USD/JPY is falling towards the pivot and could bounce to the pullback resistance.

Pivot: 141.82

1st Support: 140.15

1st Resistance: 144.52

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD/JPY(20250424)Today's AnalysisMarket News:

The United States hit a 16-month low in April. The total number of new home sales in the United States in March was an annualized to a new high since September 2024.

Technical analysis:

Today's buying and selling boundaries:

142.82

Support and resistance levels:

144.93

144.14

143.63

142.01

141.50

140.71

Trading strategy:

If the price breaks through 143.63, consider buying, the first target price is 144.14

If the price breaks through 142.82, consider selling, the first target price is 142.01

GBPJPY Potential DownsidesHey Traders, in today's trading session we are monitoring GBPJPY for a selling opportunity around 189.100 zone, GBPJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 189.100 support and resistance area.

Trade safe, Joe.

CHFJPYAt the current price level, we are near a resistance zone dating back to December/January (2024/2025) and October/November 2024. Price has been increasing from the recent support zone from February 2025. Volume looks like its gassing down on this move up. Let's see if we can retes the daily target zone before price makes a decision on how it wants to trend short term.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 141.600 zone, USDJPY is trading in downtrend and currently is in a correction phase in which it is approaching the trend at 141.600 support and resistance area.

Trade safe, Joe.

Potential bullish rise?USD/JPY is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 140.98

Why we like it:

There is a pullback support level.

Stop loss: 140.24

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci retracement.

Take profit: 142.41

Why we like it:

There is a pullback resistance level that lines up with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDJPY - Following the Bears...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈From a long-term perspective, NZDJPY has been overall bearish trading within the falling wedge pattern in red.

Moreover, the orange zone is a strong supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and supply.

📚 As per my trading style:

As #NZDJPY approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish reversal off pullback resistance?EUR/JPY is rising towards the pivot which has been identified as a pullback resistance and could drop to the 1st support.

Pivot: 163.11

1st Support: 161.32

1st Resistance: 164.01

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish rebound?CAD/JPY is falling towards the pivot which is a pullback support and could bounce to the 1st resistance which acts as a pullback resistance.

Pivot: 100.55

1st Support: 98.99

1st Resistance: 104.88

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?NZD/JPY has bounced off the support level which is an overlaps support that lines up with the 23.6% Fibonacci retracement and could rise from this level to our take profit.

Entry: 83.98

Why we like it:

There is an overlap support level that lines up with the 23.6% Fibonacci retracement.

Stop loss: 82.82

Why we like it:

There is an overlap support level that is slightly above the 50% Fibonacci retracement.

Take profit: 86.15

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY Outlook – Bearish Continuation or Bullish Reversal??In this analysis, I'm breaking down the USDJPY structure starting from the 4H to identify the overall market direction (Bearish/Sells), then zooming into the 1H to fine-tune potential trade setups.

On the 4H timeframe, we’re assessing whether the recent bearish momentum is likely to continue or if price action is showing early signs of a bullish reversal. The LOW created at 141.800 level is our first target IF we continue to sell as its creating that LowerLow.

IF price closes bullish above 142.500, I will switch sides and look for potential buys.

On the 1H timeframe, I’m watching for a bullish liquidity sweep below141.888, followed by a clear break of structure to the upside on the 15m or 1H for more confirmation. That would indicate smart money accumulation and a potential shift in market sentiment—giving me confirmation to start looking for long setups.

🚀 Give me a boost and follow for upcoming $niper entries this week! 🦇🔥

CMCMARKETS:USDJPY

Bullish bounce off pullback support?USD/JPY is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 140.84

1st Support: 137.22

1st Resistance: 144.98

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off major support level?USD/JPY is falling towards the support level which is a pullback support that lines up with the 78.6% Fibonacci projection and could bounce from this level to our take profit.

Entry: 140.82

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci projection.

Stop loss: 137.37

Why we like it:

There is a pullback support level that is slightly above the 100% Fibonacci projection.

Take profit: 144.77

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPJPY Potential DownsidesHey Traders, in today's trading session we are monitoring GBPJPY for a selling opportunity around 189.600 zone, GBPJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 189.600 support and resistance area.

Trade safe, Joe.