Jpy225

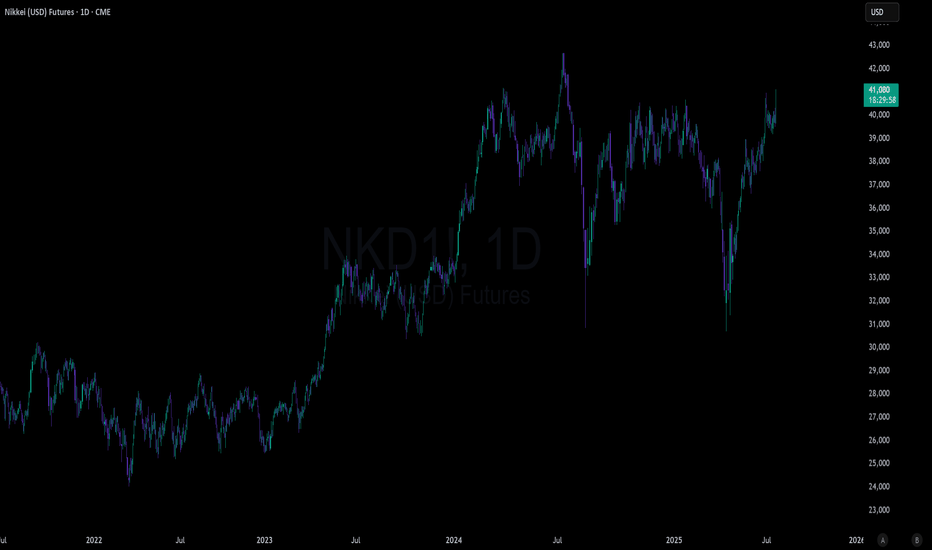

Nikkei price action forming a top?JP225USD -24h expiry

Price action looks to be forming a top.

The primary trend remains bearish.

Preferred trade is to sell into rallies.

The hourly chart technicals suggests further upside before the downtrend returns.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

We look to Sell at 38270 (stop at 38679)

Our profit targets will be 37247 and 36790

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

JP225 to see a lower correction?NIK225 - 24h expiry

We are trading at oversold extremes.

A higher correction is expected.

This is positive for sentiment and the uptrend has potential to return.

The 50% Fibonacci retracement is located at 30124 from 28893 to 31355.

Further upside is expected although we prefer to buy into dips close to the 30125 level.

We look to Buy at 30125 (stop at 29925)

Our profit targets will be 30625 and 30725

Resistance: 31410 / 32200 / 32610

Support: 30300 / 29710 / 29295

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei dips continue to attract buyers.NIK225 - 24h expiry

Selling pressure from 29249 resulted in all the initial daily gains being overturned.

The current move lower is expected to continue.

The bias is still for higher levels and we look for any dips to be limited.

The trend of higher lows is located at 28562.

Preferred trade is to buy on dips.

We look to Buy at 28805 (stop at 28665)

Our profit targets will be 29155 and 29215

Resistance: 29295 / 29710 / 30300

Support: 28505 / 27880 / 27395

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei to find sellers at market?NIK225 - 24h expiry - We look to Sell at 27545 (stop at 27635)

We are trading at overbought extremes.

This is negative for short term sentiment and we look to set shorts at good risk/reward levels for a further correction lower.

Preferred trade is to sell into rallies.

Although the anticipated move lower is corrective, it does offer ample risk/reward today.

Further downside is expected although we prefer to sell into rallies close to the 27545 level.

Our profit targets will be 27290 and 27050

Resistance: 27880 / 28505 / 29295

Support: 27395 / 27050 / 26710

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

jpy 225 index 🚨ALERT🚨 Our latest analysis has identified a major support zone for the JPY 225 currency index following the recent decision by the Bank of Japan's new governor, Kazuo Ueda, and other high-impact news events in the economy. 📊💹 With Japan's consumer price inflation hitting a fresh 41-year high in January and remaining above the 2% target for the tenth straight month, the central bank faces increasing pressure to withdraw its massive monetary stimulus. 💸💰 However, with government energy subsidies taking effect this month, experts predict that inflation will fall below the Bank of Japan's target by mid-year. 💡💼 At FX Finance Academy, our team of experts is closely monitoring this situation and has identified a short position opportunity that lines up perfectly with our channel trading support and resistance levels. Don't miss out on this chance to stay ahead of the curve and make informed trading decisions. Join us now for more expert insights!

jpy 225 index 🚀🚀🚀 The JPY225 index is on the move! 🚀🚀🚀

After dropping from 27,374, the index is approaching a major support zone at 24,700. This drop comes following the decision of the new governor of the Bank of Japan, Kazuo Ueda, and it could be a major opportunity for traders.

This move also lines up perfectly with our channel trading within support and resistance, so it's an exciting time to be in the market.

👀📈 Keep a close eye on the JPY225 index and see how price action develops. This could be a huge opportunity for traders!

#JPY225 #SupportZone #BankOfJapan #KazuoUeda #MarketWatch #Trading #InvestmentOpportunities #🚀📈

Nikkei dips continue to attract buyers.NIK225 - 24h expiry - We look to Buy at 27205 (stop at 27110)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

The hourly chart technicals suggests further downside before the uptrend returns. We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher.

Our profit targets will be 27480 and 27820

Resistance: 27400 / 27820 / 28505

Support: 27060 / 26720 / 26235

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei to find support at current low.NIK225 - 24h expiry - We look to Buy at 25690 (stop at 25570)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

A Doji style candle has been posted from the base.

Price action looks to be forming a bottom. This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

Although the anticipated move higher is corrective, it does offer ample risk/reward today.

Our profit targets will be 25990 and 26220

Resistance: 26235 / 26720 / 27060

Support: 25615 / 24830 / 24510

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Buying Nikkei at current lows.NIK225 - 20h expiry - We look to Buy at 25620 (stop at 25400)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

We are trading at oversold extremes.

This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

Previous support located at 25616.

Preferred trade is to buy on dips.

Although the anticipated move higher is corrective, it does offer ample risk/reward today.

Our profit targets will be 26245 and 26430

Resistance: 25795 / 26430 / 26830

Support: 25060 / 24500 / 24120

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Selling Nikkei into current swing highs.K225 - 21h expiry - We look to Sell at 26635 (stop at 26855)

Buying pressure from 25931 resulted in prices rejecting the dip.

The current move higher is expected to continue.

With the Ichimoku cloud resistance above we expect gains to be limited.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

Our profit targets will be 26015 and 25795

Resistance: 26435 / 26830 / 27150

Support: 25795 / 25060 / 24120

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Buying Nikkei at previous support.NIK225 - 20h expiry - We look to Buy at 27510 (stop at 27290)

Selling pressure from 28166 resulted in all the initial daily gains being overturned.

The current move lower is expected to continue.

The medium term bias remains bullish.

We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher.

Our profit targets will be 28030 and 28460

Resistance: 28460 / 29235 / 30220

Support: 27425 / 26700 / 26470

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Selling Nikkei at swing high.NIK225 - 21h expiry - We look to Sell at 27925 (stop at 28140)

Buying pressure from 27410 resulted in prices rejecting the dip.

With the Ichimoku cloud resistance above we expect gains to be limited.

Preferred trade is to sell into rallies.

Although the anticipated move lower is corrective, it does offer ample risk/reward today.

Our profit targets will be 27415 and 27110

Resistance: 27925 / 28425 / 29240

Support: 27515 / 27110 / 26610

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Nikkei to fakeout?NIK225 - 21h expiry - We look to Sell at 28455 (stop at 28650)

We are trading at overbought extremes.

A lower correction is expected.

Previous resistance located at 28339. Preferred trade is to sell into rallies.

Although the anticipated move lower is corrective, it does offer ample risk/reward today.

Our profit targets will be 27895 and 27515

Resistance: 28425 / 29240 / 30175

Support: 27925 / 27515 / 27110

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.