JPY/USD Weekly Chart – Bullish Triangle Breakout Pattern Forming🔍 Chart Pattern Breakdown:

The chart is showing a symmetrical triangle pattern forming on the weekly timeframe of JPY/USD (Japanese Yen vs. US Dollar). This triangle is developing after a massive multi-year downtrend, which started all the way back in 2021. Such a triangle at the bottom of a trend often signals a potential reversal or a strong trend shift.

Here's what's happening technically:

🔺 Triangle Formation (Consolidation Phase):

Lower highs and higher lows indicate a clear symmetrical triangle.

The price has been bouncing between these converging trendlines for months.

This compression is like a spring — it’s storing energy and getting ready to break out.

The triangle pattern is nearing its apex, which means a breakout is likely soon.

📉 Previous Trend Context:

Before the triangle, the market had a strong bearish move — a downtrend that brought the pair into a major weekly support zone.

This support zone (marked in light blue) around 0.0062–0.0063 has been tested and respected multiple times.

📊 Key Technical Zones:

Support Zone: 0.0062 – 0.0063 — this is where price bounced and formed the base of the triangle.

Resistance Zone / Triangle Top: Around 0.0071 – this is the upper boundary of the triangle. A breakout above this will confirm the bullish scenario.

Target Area: 0.00829 – derived from measuring the height of the triangle and projecting it from the breakout point.

Major BOS (Break of Structure): Once price breaks above the triangle and the BOS line, it confirms a shift from bearish to bullish structure.

SL Zone: Stop loss area is just below the support zone at 0.00629 to protect against false breakouts.

🔁 Retest Setup:

After the breakout, it's common to see a pullback to retest the previous resistance (now turned support). That retest often provides a high-probability entry for swing and position traders. If it happens — that’s your golden moment!

🎯 Trade Plan (Example for Education):

Entry Criteria Value/Zone

Breakout Entry Above 0.0071 (confirmed candle close)

Retest Entry 0.0069 – 0.0070 (support flip)

Stop-Loss (SL) Below 0.00629

Target (TP) 0.00829

✅ Why This Setup Matters:

Clear structure on the weekly chart.

Multi-touch points on both trendlines = strong pattern.

Support zone backing the triangle base gives extra conviction.

A breakout from such consolidation patterns often results in sharp movements.

Risk/reward ratio is highly favorable.

⚠️ Risk Management Reminder:

Always trade with a plan, use a stop-loss, and don’t jump into the breakout blindly. Volume confirmation or retest confirmation will help increase the success rate. These kinds of setups are powerful, but only when approached with discipline.

🧠 Final Thoughts:

This JPY/USD triangle on the weekly chart is a textbook example of potential bullish reversal from a major downtrend. It’s showing signs of a structural shift, supported by strong support, tightening price action, and the chance for a breakout to deliver a major upside move toward 0.00829.

If you’re a swing or position trader, keep this on your radar. Momentum is building — don’t miss the move when the breakout hits. 📈🔥

Jpyusdbuy

JPY/USD Breakout from Curve Line – Targeting Upper Resistance JPY/USD presents a classic curve bottom formation, which is a powerful technical structure indicating accumulation by smart money. It’s supported by key price action behaviors like support/resistance flips, retesting confirmation, and a well-defined target zone.

Let’s break it down piece by piece.

📉 1. Curve Formation – Accumulation Phase

The most noticeable element here is the parabolic (curve) structure formed between October 2024 and March 2025. This kind of structure often reflects a slow accumulation process:

Price dips over several months form a rounded bottom — also called a saucer pattern.

This shows institutional players are quietly accumulating, while retail traders are often trapped in sell-side positions.

As the curve matures, the volume and momentum begin to shift, signaling the beginning of a bullish breakout.

This accumulation curve is bullish by nature and becomes even more potent when followed by a breakout and retest.

🔄 2. SR Flip Zone (Support-Resistance Interchange)

One of the most critical concepts in price action is the SR flip — where old resistance turns into new support. In this case:

The yellow-shaded zone previously acted as resistance — confirmed by multiple rejections.

After the breakout, this same zone is being retested as support — a healthy technical confirmation that the market has accepted higher prices.

This flip zone is a launchpad for continuation to the upside.

📍 3. Retest Confirmation – Smart Entry Opportunity

Zooming into recent price action:

The market pulled back cleanly into the SR zone and the curve line.

The confluence of horizontal support and the curved trendline makes this an extremely strong retest zone.

Buyers stepped in with force, suggesting that demand is active at this level.

This retest is where risk-to-reward is optimized. The ideal entries usually happen when price confirms structure after a breakout — not before.

🎯 4. Target Zone – Next Bullish Objective

The next logical target is shown in the blue box above (~0.00705–0.00710). Here's why this zone is important:

It marks a previous supply/resistance area.

It aligns with psychological round numbers and past consolidation.

A measured move from the bottom of the curve also aligns with this target.

In essence, it is the profit-taking zone where the market is likely to pause or reverse temporarily.

🔎 5. Insider Supply & Central Zone – Institutional Traces

The chart labels an “Insider Supply” area at the base of the curve. This implies:

Hidden accumulation likely occurred at this level.

Institutions tend to trap retail sellers during these periods with false breakdowns.

Once they’ve loaded up, price shifts upward in a controlled fashion — exactly what has happened here.

The Central Zone is the battlefield — the area where prior indecision took place, which has now turned into a stepping stone for upward movement.

💡 Strategy Recap:

Parameter Value

Entry Retest of SR Flip (0.00680–0.00685)

Stop Loss Below curve base (~0.00670 or lower)

Target 0.00705–0.00710

R/R Ratio 1:2 or better

This strategy is technically sound, supported by structure, and has strong reward potential.

🧠 Market Psychology:

Smart money accumulates when price is quiet and sentiment is bearish.

After accumulation, a controlled markup begins, with retests engineered to confirm the breakout.

Retail traders tend to enter late or get faked out — while institutions already hold positions.

This chart is a textbook example of how professional traders operate and manage structure-based risk.

🏁 Final Thoughts:

This is a high-probability technical setup built on multiple layers of confluence:

Curve structure

SR flip

Demand zone retest

Momentum shift

If momentum continues, the 0.00710 zone is a very realistic short-term target. Traders should manage risk tightly and monitor price behavior near the upper resistance box.

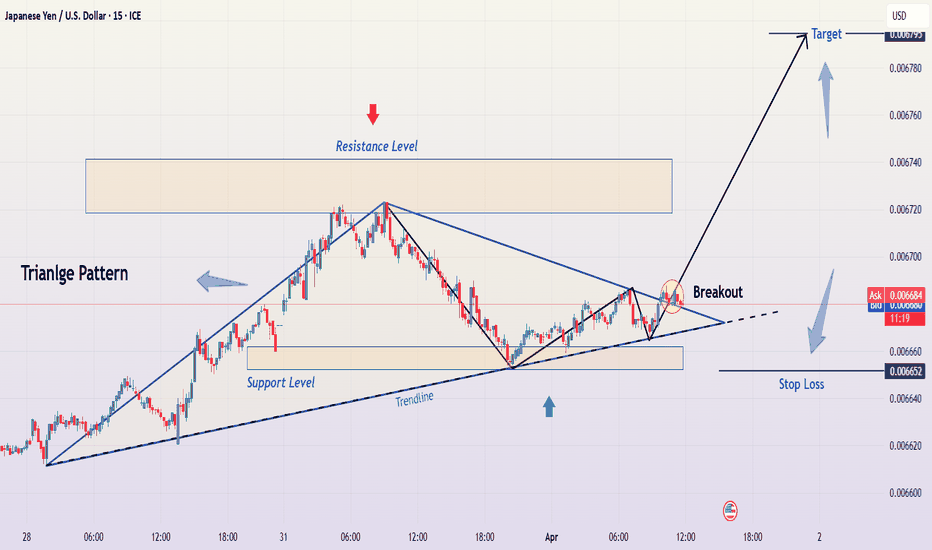

Triangle Breakout in JPY/USD – Bullish Move Ahead?This TradingView chart represents a detailed technical analysis setup for the Japanese Yen (JPY) against the U.S. Dollar (USD). The main focus of the chart is a symmetrical triangle pattern breakout, a common formation that signals potential price movement.

In this detailed breakdown, we will analyze the following aspects:

Technical Pattern: Symmetrical Triangle Formation

Support and Resistance Levels

Breakout Confirmation

Trading Setup Explanation

Risk Management Strategy

Market Expectations (Bullish & Bearish Scenarios)

Conclusion & Trading Plan

1. Technical Pattern: Symmetrical Triangle Formation

The chart showcases a symmetrical triangle, which is a continuation pattern that typically occurs in trending markets. It indicates a period of consolidation where buyers and sellers struggle for dominance, leading to an eventual breakout.

Characteristics of the Symmetrical Triangle in This Chart:

Converging Trendlines:

The upper trendline (resistance) is sloping downward, showing lower highs.

The lower trendline (support) is sloping upward, showing higher lows.

Apex Formation:

As the price moves closer to the triangle's apex, volatility decreases, creating a squeeze effect.

Breakout Possibility:

Once price reaches a critical point, a breakout is expected in either direction.

Why is This Pattern Important?

Symmetrical triangles suggest that the market is indecisive, but once a breakout occurs, it can trigger a strong price movement.

Traders wait for the breakout direction to confirm the trade before entering a position.

2. Key Support and Resistance Levels

Support and resistance levels are crucial for identifying potential entry, stop-loss, and target areas.

Resistance Level:

A horizontal resistance zone (highlighted in beige) is drawn at the top.

This zone represents historical price rejection levels, where sellers have previously stepped in.

A confirmed breakout above this level would indicate strong bullish momentum.

Support Level:

The lower support zone (marked in blue) acts as a buying interest area.

Price has bounced off this zone multiple times, confirming it as a strong support level.

A break below this zone would signal a bearish reversal.

Trendline Support:

The lower boundary of the symmetrical triangle also acts as dynamic support.

If price respects this trendline, it suggests bullish strength leading to a breakout.

3. Breakout Confirmation & Market Reaction

The most important part of the setup is the breakout, which occurs when the price successfully moves beyond the triangle's trendline resistance.

Key Observations from the Chart:

Breakout Zone:

The breakout occurs near the right edge of the triangle (circled in red).

The price breaks above the upper trendline, confirming a bullish breakout.

Confirmation Candle:

A bullish candle follows the breakout, confirming buying pressure.

Traders should wait for a retest of the trendline before entering.

Volume Consideration:

Strong breakout moves are typically accompanied by a rise in volume, increasing the likelihood of follow-through.

4. Trading Setup Explanation

This trade follows a trend-following breakout strategy, where traders capitalize on price momentum after confirmation.

Entry Point:

The ideal entry is just above the breakout candle.

Traders can also wait for a retest of the broken trendline before entering.

Stop Loss Placement:

The stop loss is placed slightly below the previous swing low at 0.006652.

This prevents excessive drawdowns in case of a false breakout.

Profit Target Calculation:

The profit target is set at 0.006795, which is calculated based on:

The height of the triangle formation projected from the breakout point.

The next major resistance level, aligning with historical price action.

5. Risk Management Strategy

Risk management is a critical component of any trading strategy. Here’s how it is applied in this setup:

Risk-to-Reward Ratio (RRR):

A good trade setup maintains an RRR of at least 2:1.

If the stop loss is 33 pips (0.000033) and the target is 112 pips (0.000112), the RRR is 3:1, making this a high-probability trade.

Position Sizing Consideration:

Risk per trade should be limited to 1-2% of the total account balance.

Leverage should be used cautiously, as breakouts can sometimes retest the breakout zone before continuing.

6. Market Expectations (Bullish & Bearish Scenarios)

Bullish Scenario (Successful Breakout):

✅ If price sustains above the breakout level, it will likely continue to rally toward the target at 0.006795.

✅ A strong bullish momentum candle would confirm further buying pressure.

✅ If volume supports the breakout, trend continuation is highly probable.

Bearish Scenario (False Breakout or Reversal):

❌ If price falls back inside the triangle, it indicates a false breakout.

❌ If price closes below 0.006652, bears take control, and price may drop further.

❌ A breakdown below the support level would shift the market sentiment bearish.

7. Conclusion & Trading Plan

This chart presents a classic symmetrical triangle breakout trade with a clear entry, stop-loss, and target strategy.

Summary of Trading Plan:

Component Details

Pattern Symmetrical Triangle

Breakout Direction Bullish

Entry Point Above the breakout confirmation candle

Stop Loss 0.006652 (below support)

Take Profit (Target) 0.006795

Risk-to-Reward Ratio Favorable (3:1)

Market Bias Bullish (if price sustains above breakout)

Final Considerations:

Always wait for confirmation before entering.

Monitor volume and price action for additional validation.

Stick to the risk management plan to minimize losses.

If executed correctly, this setup offers a high-probability trade with a strong risk-to-reward ratio, making it a profitable trading opportunity in the JPY/USD market.

JPY/USD Weekly Forecast – Falling Wedge Breakout & Bullish MoveChart Overview

This chart presents a technical analysis of the Japanese Yen (JPY) against the U.S. Dollar (USD) on a daily timeframe, published on TradingView. The setup is based on a Falling Wedge pattern, which has led to a bullish breakout, signaling a potential price rally. Let's break it down step by step.

1️⃣ Identifying the Pattern – Falling Wedge Formation

The primary pattern identified in the chart is a Falling Wedge, which is a well-known bullish reversal pattern.

Characteristics of the Falling Wedge in this Chart:

Two downward-sloping trendlines (black lines) forming a wedge shape.

Price makes lower highs and lower lows, but the distance between highs and lows gradually narrows.

The breakout occurs when price closes above the upper trendline, confirming a potential uptrend.

Key Observations:

✅ The pattern starts forming around September 2024 and continues until December 2024.

✅ A breakout occurs at the end of December 2024, confirming bullish momentum.

✅ After breaking out, the price retests the wedge's upper boundary, acting as new support before continuing upward.

2️⃣ Support & Resistance Zones – Key Price Levels

Support Level:

The support zone is marked in a beige rectangle at the bottom of the chart.

This is where buyers repeatedly stepped in, preventing further decline.

The price touched this area multiple times before reversing upwards, making it a strong demand zone.

Resistance Level:

The resistance zone is identified at the top of the chart (shaded beige area).

This level represents previous price peaks, where selling pressure was strong.

The price is expected to face some resistance when approaching this zone.

3️⃣ Trend Reversal Confirmation & Bullish Structure

After breaking out of the falling wedge, the price has started forming higher highs and higher lows, indicating an uptrend.

Key Trend Indicators:

✔ Curved blue dashed line suggests an upward trajectory, confirming a rounded bottom reversal.

✔ Price is following a trendline support, validating bullish sentiment.

✔ Momentum is strong, and buyers are in control after the breakout.

4️⃣ Trading Setup – Entry, Stop Loss & Take Profit

This analysis is structured into a trading plan with clear risk management.

📌 Entry Point (Buy Confirmation)

Entry is ideal on a retest of the breakout zone or a continuation of the bullish structure.

The recent higher low serves as a great point to confirm trend continuation.

📌 Stop-Loss Placement

Stop-loss is placed at 0.006465 (marked in blue), below the latest support.

This level ensures protection against false breakouts.

📌 Take Profit Target

The target is set at 0.007128, aligning with historical resistance.

If momentum remains strong, the price might push even higher.

5️⃣ Risk-to-Reward Ratio (RRR) & Trade Justification

Risk-to-Reward Analysis:

Stop-Loss: 0.006465 (below support)

Entry Price: Around 0.006671

Target Price: 0.007128

Risk-to-Reward Ratio: Approximately 1:2.5, meaning for every $1 risked, there's a $2.5 potential gain.

Trade Justification:

✔ Falling Wedge breakout is confirmed.

✔ Retest of broken resistance turned support gives an ideal entry.

✔ Bullish trend structure supports the upside move.

✔ Well-defined stop-loss and take-profit levels provide controlled risk exposure.

6️⃣ Final Thoughts & Conclusion

📌 This is a textbook bullish setup based on a Falling Wedge breakout. The combination of pattern breakout, trend structure, and strong support makes this a high-probability trade.

📌 Potential Risks to Watch:

If price fails to hold above stop-loss, it could indicate bullish weakness.

Major macroeconomic news or fundamental events can shift momentum.

📌 Overall Bias: ✅ Bullish towards the 0.007128 target, as long as the price remains above key support zones.

JPY/USD Technical Analysis – Bullish Breakout from Falling WedgeIntroduction

The JPY/USD chart showcases a classic falling wedge pattern, a strong bullish reversal signal. This pattern is characterized by converging downward-sloping trendlines, indicating a weakening bearish momentum. Eventually, buyers stepped in, leading to a breakout to the upside. This analysis breaks down key elements, including support and resistance zones, trendlines, trading strategy, and risk management.

1. Breakdown of the Chart Pattern

A. The Falling Wedge Formation (Bullish Reversal Pattern)

A falling wedge is a bullish technical pattern that forms when the price consolidates within two downward-sloping trendlines that converge over time. This signals that selling pressure is decreasing and a reversal may be near.

Downtrend Structure: The price was previously in a consistent downtrend, making lower highs and lower lows, which formed the wedge.

Breakout Confirmation: Once the price broke above the upper trendline, the pattern was confirmed, indicating the start of a bullish move.

Retest Possibility: Often, after a breakout, the price retests the upper trendline before continuing higher. If it holds, it strengthens the bullish outlook.

B. Key Levels Identified in the Chart

1. Support Zone (Buying Area)

The price found strong support in the 0.006291 – 0.006500 region.

Buyers stepped in, preventing the price from dropping further.

This support level coincides with the bottom of the wedge, further validating its importance.

2. Resistance Zone (Profit Target)

The 0.007100 – 0.007200 area is a major resistance level where sellers have previously dominated.

If the price reaches this level and consolidates, traders will look for either a breakout or a rejection.

A break above 0.007200 would indicate further bullish continuation.

3. Trendlines & Curve Formation

A curved trendline in the chart suggests a gradual transition from bearish to bullish momentum.

The dotted ascending trendline now acts as dynamic support, helping the price sustain its bullish move.

2. Trading Strategy & Risk Management

A. Entry Strategies

Traders have two primary ways to enter this trade:

Aggressive Entry:

Enter immediately after the breakout of the wedge.

Higher risk but captures early momentum.

Conservative Entry:

Wait for a pullback to the trendline before entering.

Lower risk as it confirms trend continuation.

B. Take Profit Targets

Primary Target: 0.007117 (Resistance level from previous highs).

Extended Target: 0.007200 (Next significant resistance).

C. Stop Loss Placement

Below the recent swing low at 0.006291 to protect against false breakouts.

Ensures a favorable risk-to-reward ratio.

3. Market Sentiment & Confirmation Signals

✅ Bullish Confirmation

Breakout from the falling wedge

Price holding above the trendline

Higher highs and higher lows formation

Increased buying volume

⚠️ Bearish Risks & Invalidations

A break below the trendline would indicate weak momentum.

If the price fails to hold support, it could reverse downward.

Low volume on the breakout could signal a fake breakout.

4. Final Thoughts

This setup provides a high-probability trading opportunity following the breakout from a falling wedge pattern. The risk-to-reward ratio is favorable, making it an ideal setup for trend-following traders. However, patience is key—waiting for a successful retest before entering can minimize risks. If the price maintains momentum, we could see a rally toward the 0.007100 – 0.007200 resistance zone in the coming weeks. 🚀

This is going to happen no matter what, LONG on JPYThis is not Instagram kids trading for 5 mints time frame, this is for people who want to hold for gold.

It will take months of holding but JPY has to go up and hit 1st target and if its break it then set a target2 as goal

My recommendation is to place 2 orders one should be closed at 1st target and the 2nd one is at 2nd target.

Bullish Falling Wedge / Inverse Head & Shoulders / Ascending TriAs the title suggests - we have a large (light blue) bullish falling wedge with break out. As we have broken out we should expect to retest previous resistance as new support. This will help form the bullish ascending triangle in yellow and also converge with the .236 fib level as added support. We also have the green inverse head and shoulders.

My entry: 107.354

SL: 107.154

TP1: 108.883 (.382 fib)

TP2:109.5 (.618 fib)

TP3: 110.53 (.786 fib)