JUP/USDT Retests Key Support! Bounce Incoming or Breakdown Ahead📉 Complete Technical Analysis:

The JUP/USDT pair is currently showing a critical price action after breaking out from a medium-term descending trendline (yellow diagonal line). However, the price is now retesting a major demand zone around $0.4200–$0.4574.

📌 Pattern Identified:

Descending Trendline Breakout: Price successfully broke above a long-standing bearish trendline.

Retest of Breakout Zone: The current move is a classic retest, often seen before a trend reversal continuation.

Strong Demand Zone: The yellow zone ($0.4200–$0.4574) has historically served as a strong accumulation and bounce area.

---

📈 Bullish Scenario:

If the price holds and bounces from the $0.4200–$0.4574 zone, bullish momentum could resume with upside targets:

Short-term target: $0.6089

Next resistances: $0.7213 – $0.8075

A confirmed higher low above support would strengthen the bullish structure.

---

📉 Bearish Scenario:

If the price breaks down below $0.4200, bearish pressure could return, leading to further downside.

Potential decline toward deeper support levels around $0.35–$0.30.

Breakdown with increasing volume would confirm seller dominance.

---

🎯 Key Levels to Watch:

Support Zone: $0.4200 – $0.4574 (Critical Retest Area)

Immediate Resistance: $0.4883, $0.6089

Major Resistance Levels: $0.7213, $0.8075, $1.1158, up to $1.6576

---

🧠 Conclusion:

JUP/USDT is currently at a crucial decision point. The reaction at this support zone will define whether the breakout holds or fails. Traders should watch this level closely for confirmation of the next major move.

#JUPUSDT #CryptoAnalysis #AltcoinUpdate #TechnicalAnalysis #CryptoBreakout #SupportAndResistance #TradingView #Cryptocurrency #ChartPattern #BullishSetup #BearishCase

JUP

TradeCityPro | JUP Eyes Breakout as Altseason Momentum Builds👋 Welcome to TradeCity Pro!

In this analysis, I want to review the JUP coin for you. It’s one of the projects in the Solana ecosystem, currently ranked 59 on CoinMarketCap with a market cap of $1.65 billion.

📅 Daily Timeframe

On the daily timeframe, this coin is currently sitting below a very important resistance zone at 0.6312. This is a strong resistance area and serves as the main trigger for a trend reversal in this coin.

✔️ The main support floor for JUP is located at 0.3409, a level price has tested twice before. Now it has returned to 0.6312, and we can see increased market volume at this level, which indicates tension between buyers and sellers.

✨ A breakout of 0.6312 would be a good trigger for a long position, and I plan to open a long if this level breaks. This could potentially be a long-term position with a high risk-to-reward ratio.

🔔 The next major resistance zones are at 0.7858 and 1.1435, which we can use as targets for this position.

🔽 If the price gets rejected from the top and moves down, breaking 0.4186 and 0.3409, we can look to open a short position.

🧩 The break of 0.3409 would confirm the start of a downtrend, and it's one of the key zones where I’ll definitely look to hold a short position if it breaks.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

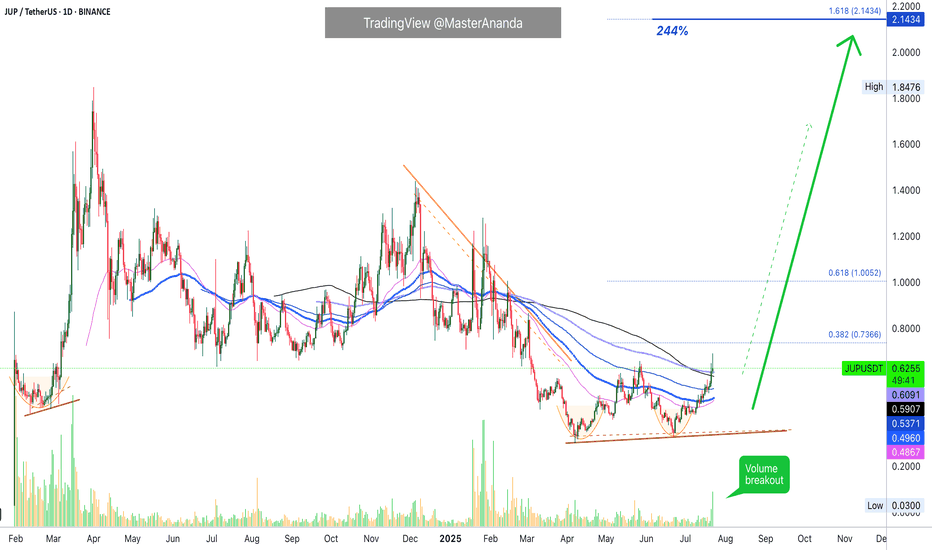

Jupiter & The Exponential Moving Averages · Volume BreakoutFirst I looked at a pair and it was struggling to move past certain long-term EMAs. Then I opened up Jupiter, JUPUSDT, and I can see it moving forward... This is a bullish development.

Just today a multiplicity of bullish signals came together. JUPUSDT broke above its May 2025 high. Hitting the highest price since March, almost 5 months ago.

After a higher low 22-June, JUPUSDT rallied and continued to gain strength. After 9-July, it started to break, one by one, all the moving averages on this chart. These levels were working as resistance.

First EMA55 was conquered after eleven days struggling below. Then EMA89 was conquered one day after, the blue dotted line on the char. Four days later the action moved above EMA144 followed by MA200 and EMA233 yesterday; today, JUPUSDT is trading above all those major levels, with the highest price in five months.

This is as good as it gets and it reveals the intensification of a newly developing bullish wave. This wave will transform into an uptrend and this uptrend will lead to a major bull-run. The bull-run will go hiiiiigh reaching a new all-time high, the end of the bullish cycle; the entire process can take anywhere between 4-6 months or 8-12 months or more. It really depends on the overall market condition, Bitcoin and how active is the project developers team. This can all work together to produce something great.

Volume is starting to rise now. This means that it is still very early in this game.

We are just entering the bullish zone. After a major high is confirm, we can see very strong exponential growth.

While at first it takes months for prices to grow 2-3 levels up, when the wave is advanced we can see several levels increase in a matter of weeks and then it keeps on intensifying until the market goes crazy and that's when you see euphoria and greed. It is still early, but it doesn't hurt to be prepared.

Keep a calm and sane mind, you will need it to maximize profits and close as many as possible successful trades.

Namaste.

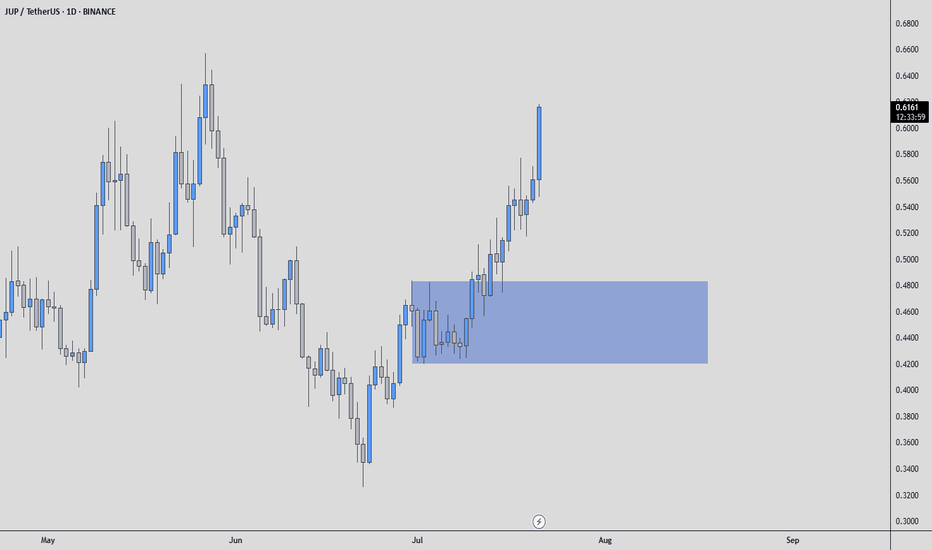

JUPUSDT: Patience Before the FeastThere are moments in the market when you can feel something building beneath the surface. For BINANCE:JUPUSDT , that feeling of something "cooking" is becoming difficult to ignore, and for good reason.

Let's look at the simple truths on the chart. First, listen to the sound. The volume is picking up, not with a frantic roar, but with a steady, deliberate rhythm. This is often the sound of patient hands accumulating positions.

Second, feel the heat. The price action is coiling, building pressure in a tightening range. This consolidation, this "cooking," is often the quiet preparation before a significant move.

Given these signs, the logic to attempt a long position is sound. But a wise trader doesn't just rush into the kitchen; they wait for the meal to be served.

The blue box on the chart represents our area of interest. It is a zone of calculated support, a logical place to consider entering a long position. We do not chase the price. We let the price come to our predefined zone.

The plan is one of patience. See if the market offers an entry in the blue box. Know your point of invalidation before you risk a single dollar.

The feast may be coming, but entry is reserved for the disciplined.

Disclaimer: This analysis is for informational purposes only and is not financial advice. Trading involves significant risk. Always conduct your own research.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

JUP/USDT – Massive Breakout Brewing? Falling Wedge Reversal🧠 Detailed Technical Analysis:

Jupiter (JUP) is currently forming a classic bullish reversal pattern – the Falling Wedge – after months of consistent downward pressure. Since December 2024, JUP has been trending inside a narrowing range of lower highs and lower lows, and it's now approaching a potential breakout zone.

📊 Pattern in Focus: Falling Wedge – A Powerful Bullish Reversal Setup

The Falling Wedge consists of a converging downtrend with declining volatility.

This pattern typically signals a loss of bearish momentum and often precedes a sharp upside breakout.

If confirmed, a breakout can lead to a strong bullish impulse wave with significant gains.

🔍 Key Levels to Watch:

✅ Major Support Zones:

$0.3018 – Historical low and critical defense level

$0.4453 – $0.4883 – Current consolidation base

🚀 Key Resistance Targets (Post-Breakout):

$0.6089 – First resistance after breakout

$0.7213 – Mid-level resistance

$0.8075 – Key breakout zone before bullish expansion

$1.1158 – $1.3701 – Primary medium-term targets

$1.4400 – All-time high and psychological resistance

🔼 Bullish Scenario (High Probability Setup):

If JUP breaks above the falling wedge resistance and clears $0.4883:

✅ A bullish rally could target $0.6089, followed by $0.7213 and $0.8075

✅ If strong momentum follows, JUP might extend gains towards $1.1158 – $1.3701

✅ Watch for breakout confirmation with high volume and potential retest of the breakout zone

🔽 Bearish Scenario (Risk to Consider):

If price gets rejected and breaks below $0.4453:

❌ Downside may resume toward $0.3600 or even retest $0.3018

❌ This could either lead to a prolonged downtrend or form a double bottom base for a future reversal

💡 Conclusion & Strategy:

JUP is at a critical technical juncture. The Falling Wedge formation is one of the most reliable bullish reversal signals.

This setup offers a great risk-reward opportunity for traders watching for a confirmed breakout.

📌 Breakout = Golden Opportunity

📌 Breakdown = Be Cautious & Reassess

Aggressive traders may look to accumulate near $0.44–$0.48 with tight stop-losses.

Conservative traders should wait for a breakout + retest for confirmation before entering.

#JUP #JUPUSDT #CryptoBreakout #FallingWedge #TechnicalAnalysis #AltcoinSetup #CryptoChart #BullishSetup#AltcoinWatch #SwingTradeSetup #CryptoStrategy

JUP Main trend. Channel. Wedge. Double bottom. 06 07 2025Logarithm. Time frame 3 days. Decline from the maximum -84% (this is not enough), but given the capitalization of 59th place, if the market is positive in the near future, then it is quite possible to reverse this cryptocurrency through a double bottom.

All long-term consolidation above with high volatility is the distribution of ladies and gentlemen. Also study the vesting of this cryptocurrency. There are less than half of the tokens on the market, and there are also pauses for 1 year, which is good.

Jupiter (JUP) is a key player in the decentralized finance (DeFi) space, especially in the Solana blockchain.

Main trend is downward. Descending channel.

Secondary trend is downward. Descending wedge.

Local trend is sideways. Potential double bottom in case of a breakout.

The price will move in the corridors of this descending channel from the dynamic lines of its support/resistance. Remember this and use it in your trading strategy, observing money management.

Local breakout zone

Understand where the zones are cheap, and where, on the contrary, the zones are expensive. If you work (tear out movements, there should be short-term or conditionally medium-term transactions, with very mundane goals) conditionally in expensive zones, then limit losses. Do not let yourself be fooled by news noise and the opinions of the majority.

#JUP/USDT#JUP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.4065, acting as strong support from which the price can rebound.

Entry price: 0.4113

First target: 0.4234

Second target: 0.4332

Third target: 0.4477

JUPUSDT Forming Falling WedgeJUPUSDT is showing strong bullish potential as it forms a classic falling wedge pattern—a technical setup often preceding significant upward price movement. This pattern, defined by a series of lower highs and lower lows converging into a narrowing channel, reflects declining bearish momentum. With price approaching the wedge's apex and volume remaining healthy, a breakout to the upside appears imminent. This setup has historically delivered solid results in crypto markets, especially when supported by strong volume and growing investor interest.

From a price action perspective, the falling wedge pattern for JUPUSDT suggests a reversal is likely on the horizon. A confirmed breakout above the descending resistance trendline could see JUPUSDT rally by 80% to 90%+, aligning with historical projections based on the pattern's depth. The coin has already begun to gain traction in the market, with increased order book activity and stronger community sentiment visible across multiple platforms.

The project behind JUPUSDT is also attracting attention from both retail and institutional investors. This interest often translates into stronger support zones and more sustainable rallies. Coupled with technical indicators like RSI divergence and rising accumulation volume, JUPUSDT seems well-positioned for a breakout that could deliver substantial returns in the short to medium term.

Traders should closely monitor resistance breakout levels and wait for confirmation via volume surges or bullish candlestick structures. JUPUSDT’s combination of pattern strength, volume profile, and market engagement makes it a compelling pick among altcoins poised for recovery and rally.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Jupiter, Mapping A 430% Bullish WaveJupiter is set to grow really strong, we agree correct?

When we agree right from the start, I can skip the technical analysis and move straight to the target. Because everybody knows JUPUSDT is set to grow really strong in the coming months.

Back in early 2024 a market bottom led to growth. A 325% bullish wave developed within 49 days. The bulk of the action happened within 33 days. We can say +100% profits every ten days, sounds good. Looks great.

We know for a fact that this pair can grow more than 300% in a single month. What if the bullish phase is stronger now, longer now... How much growth would be possible if JUPUSDT grows straight up for 3 months? What about six months?

Here I have an easy target at $2.14 with 430% profits potential. This is mid-term, within 3 months.

My ideas and believe project think see much more happening in 2025 than what I am showing on this chart. But this is the start. This is an easy 430% wave. It can start now, soon, within days but once it starts going it will keep on going non-stop until the end. Sorry, no wait; one stop before the final bull run, but the whole process can take more than six months.

Are you ready?

How are you going to maximize profits if you are one of those trading this coin?

What's your plan?

Will you buy and wait for everything to be up in order to sell? Meaning, just securing lower prices now and "let the market take care of the rest"?

Or, are you going to set up your sell orders on target, selling portions at each resistance level as prices grow?

Are you going to buy with leverage? Are you ready to lose everything if the market shakes? Are you going with 2-3X or 10-20X? I would always recommend the lower end because it is better to earn a sure 200% than lose everything looking for an uncertain 10,000%.

What you do is up to you. But here you have this chart; you know what is coming, you have the blessing of knowing ahead of time so you can plan based on your own trading style and goals.

It can be big or it can be small but we are all going to win if we approach the market with the right mindset, and if we keep risk to a minimum. Some people like high risk though and that's ok too. There is something for each and every one of us.

Jupiter will end up going much higher than what is shown on the chart.

Namaste.

Jupiter JUP price analysisThe price of OKX:JUPUSDT did not live up to the “multifaceted promises” of marketers and disappointed us...

So we will get rid of #Jup from our portfolio in the designated area.

May all the gods, headed by Zeus, help #Jupiter rises from its knees and cross the $0.80 mark at least for a while

There is nothing more to add, with such dynamics, it will be very difficult to "scrape up" #JUP to at least $1...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

JUP/USDT: Classic Inverse Head & Shoulders Breakout!🚀 JUP Inverse Head and Shoulder Breakout – 80% Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

JUP is breaking out of a textbook Inverse Head and Shoulders pattern on the 12H timeframe — signaling a strong bullish reversal after a long downtrend.

🟢 Pattern: Inverse H&S

📊 Breakout Confirmation: Neckline flipped into support

🎯 Target Zone: $1.05+

🛡️ Invalidation: Close below $0.534

Momentum is shifting, and bulls seem to be back in charge. If this pattern plays out fully, we’re looking at a potential 70%+ move from current levels.

Let the chart speak. Keep this one on your radar!

JUP Looks Bullish (4H)From the point where we placed the green arrow on the chart, it appears that the bullish phase of JUP has started in a swing structure.

This phase is a diagonal (Diametric), and it currently seems that wave G is forming. This wave is a bullish wave.

As long as the green box is maintained, the price can move toward the red box.

The closing of a daily candle below the invalidation level will invalidate this analysis.

invalidation level: 0.4322

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

$JUP is Struggling but shows signs for HOPEwtf happened to LSE:JUP

It was once heralded at the leading DEX in web3 on the premier blockchain, but dumped ~75% from ATH with only a 57% rally.

Couldn't even make a run at the 200DMA, but retesting the 50 soon.

needs to have a big dally soon above the .236 fib to test the 200DMA. A breakthrough is a strong reversal confirmation.

market cap is about 60% cheaper than BME:UNI so im liking the value here.

JUP Predicts The Future: Crypto Bull Market Certainty Level 100%Jupiter has been rising for 10 days straight. This hasn't happen since October 2024. The bullish bias has been revealed. This is a type of bullish consolidation. The action is back above the 11-March low. Yesterday's session wicked below, closed above. Bullish, bullish, bullish all across.

Jupiter is preparing for a nice jump.

Good evening my fellow Cryptocurrency special-genius trader, it gets better everyday.

What if... Right!

Do you agree? Ok!

The support/resistance dynamic is back in full view.

The continued growth is a very much strong revealing signal should be paid attention to. It works.

Signals like these are simple signals but can reveal everything, it works really good trust me.

Ten days straight moving up. There is a red candle in-between the rise but this does not nullify in any way the rise. It works. Trust me.

It is actually quite entertaining when you see the results.

Making the prediction is nothing, it is great when you see it work.

So these are the signals, simple signals and yet it works.

Watch! Jupiter (JUPUSDT) is set to grow. Deduction/conclusion arrived at based on the chart. 100% the chart even predicts political events. It has been proven many time now in the recent weeks. See this...

Major events will develop that will propel the market up. Political events, why? The charts are bullish and pointing up to massive growth. If any event is needed, the market creates it so soon these events will be public and the market grows.

The market grows because it is set to grow. It has already been decided it is already true. It only needs to show in the prices and charts.

It is like you apply for a job and you get it but you have to wait 3 months before your entry date. It is a done-deal, it is a secured deal it cannot be cancelled but you aren't still working but you know for certain. Something like this but with a higher level of certainty.

Say you have a family member 99 years old with terminal cancer and ready to go. The news are in, the data is in and everybody knows but the person is still alive. It is a done deal, it hasn't happened but will happen. Something like this. Things can be certain and yet not materialized. These things happen.

It can happen that it has been decided, it is known for a fact and sure the market will grow. Yet, it hasn't happened but this doesn't mean that it is questionable, some things can't be changed.

It can't be avoided and nobody wants to avoid it. It is the other way around, most of the majority want it to happen and it will happen. No other scenario is possible that's how the world works.

Tomorrow, it is day. Later, the night. Repeat over and over, nothing can avoid this reality from happening. Times change, it is the same.

One day it is the banks, the next day it is Crypto.

Namaste.

JUP Long Spot Trade Setup – Oversold and Approaching Key SupportJUP is showing strong signs of oversold conditions and is now approaching a major support zone ($0.22 – $0.30). This area offers a favorable risk-to-reward opportunity for a bounce if buyers step in.

📌 Trade Setup:

Entry Zone: $0.22 – $0.30

Take Profit Targets:

🥇 $0.4050

🥈 $0.4467

Stop Loss: Just below $0.20

JUP in Danger: Are We in for a Crash?JUP has been on a four-day downtrend, and it's starting to show its bearish side. The token has lost its yearly open, which was a major support level. Let’s break down the key support and resistance to see what the chart is telling us.

Support & Resistance

Resistance:

Yearly Open & Monthly Level: JUP has dropped below the yearly open at $0.8169 and the monthly level at $0.7427

Support:

Long-Term Range & Liquidity: JUP has been trading within a range for over 300 days, with a significant amount of liquidity below the low at $0.6328 from 5 July 2024.

POC: The volume profile shows the POC sitting at around $0.5, marking an attractive entry point for a long position.

Fibonacci Confluence: The 0.786 Fibonacci retracement level falls just below the key low at $0.431 (a level last seen on 12 February 2024), offering a great long trade setup.

Long Trade Opportunity:

Alarms are set, let's see if JUP drops to these key support levels. If it does, we could have a solid long setup on our hands.

Univers Of Signals | JUPLet's quickly review JUP, one of the DeFi coins, which is currently ranked 51st on CoinMarketCap with a market cap of $1.75 billion.

🔍 In the 4-hour timeframe, we are observing a very large range box from 0.6312 to 1.2542, where JUP is currently at the bottom of its box.

✨ There is also a descending channel that has been accompanying the price from the top of the box, with several touches to both the bottom and top of the box, and now it has approached the bottom of the box again.

📉 If the area of 0.6312 is breached, you can enter a short position targeting 0.5588. Entry of the RSI into the oversell zone would provide a suitable confirmation for this move.

📈 For a long position, wait until the channel is broken upwards, and in this case, with the breakout of the trigger at 0.8365, you can enter a long position.

JUPUSDT Wedge Pattern Setup 60%-65% Breakout Potential AheadJUPUSDT is currently forming a Wedge Pattern, a technical chart formation that often precedes a strong breakout. This pattern is typically characterized by converging trendlines, with the price moving within a narrowing range before a decisive move either upward or downward. For JUPUSDT, the current setup suggests that a breakout is imminent, and traders are anticipating a bullish move in the near future. With good volume backing this pattern, the likelihood of a successful breakout is high, and many investors are watching closely. The expected gain range for this breakout is 60% to 65%+, making this a prime opportunity for traders looking to capitalize on the next big move.

The Wedge Pattern often signals a period of consolidation before the price breaks out of the pattern’s upper boundary. With JUPUSDT, the volume accompanying this pattern is solid, which is a key indicator that the market is gearing up for a potential rally. As the price compresses within the wedge, the pressure builds, and once the price breaks through the resistance level, it could trigger a sharp upward move. This breakout has the potential to lead to a significant price surge, pushing JUPUSDT higher and providing traders with the opportunity to profit from the momentum.

Investors are increasingly showing interest in JUPUSDT, and the current Wedge Pattern is drawing attention as a high-potential setup. The narrowing range of the pattern suggests that volatility could increase once the breakout occurs, which often leads to strong directional movement. If JUPUSDT manages to break above the upper trendline of the wedge, it could see a significant price rally, potentially reaching the projected 60% to 65%+ gain range. The combination of solid technical indicators and growing market sentiment makes JUPUSDT one of the most promising altcoins to watch in the near term.

Traders should continue to monitor key support and resistance levels as the price action unfolds. The breakout from the wedge is the key event to watch, and timing the entry could be crucial for maximizing returns. As always, broader market sentiment can play a role in the success of this pattern, but given the strong volume and the current setup, JUPUSDT could be on the verge of a breakout that brings substantial gains to those positioned for the move.