Kava

Kava: 5 Strong Bullish Signals, Cup & Handle, High Volume & MoreThe cup & handle pattern doesn't work at resistance. You cannot use this pattern in any meaningful way at the top of a rising trend. For the C&H to be valid, it needs to happen at the end of a downtrend, near the market bottom because this is a bullish reversal pattern.

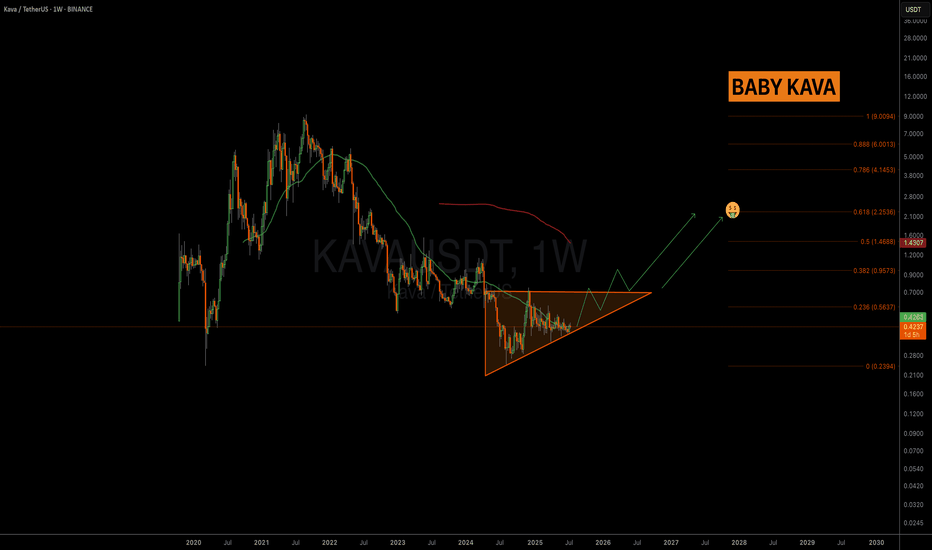

Here we have KAVAUSDT weekly up-close. August 2024 marks the lowest prices since March 2020, in more than 3.5 years. Including this strong multiple years low, we have the cup pattern forming followed by the handle. See the chart:

This is the classic cup and handle (C&H) pattern and here it is valid and can work as a reversal signal.

One signal in isolation is never enough, it needs to be coupled with 3-4 additional signals to have a strong setup. The next signal comes from the trading volume. As KAVAUSDT reached the lowest in almost 4 years, trading volume goes through the roof; the highest buy-volume ever. This is another strong signal.

We have the reversal pattern, long-term double-bottom, increasing volume, local higher low (the handle low vs the cup low) and marketwide action (the rest of the altcoins market going bullish).

There you have five signals total all supporting a change of trend. This means that soon Kava will start to grow and you know this for certain because you have the supporting data coming from the chart.

Namaste.

KAVA - We are expecting the rocket at 80%The KAVAUSDT chart shows a clear downward channel, indicating a bearish trend. However, the price is currently consolidating around the middle of the channel, creating uncertainty about the immediate direction.

Recommended signal: wait for confirmation of a breakout above the upper boundary for longs or a breakout below the lower boundary for shorts.

Is KAVA/USDT About to Explode? Major Breakout Incoming!Technical Analysis (Timeframe: 1W - Weekly)

1. Descending Triangle Breakout Setup

KAVA has been in a prolonged downtrend since 2021, forming a large descending triangle pattern. Currently, the price is nearing the apex of this formation, signaling a potential breakout in the near term.

2. Strong Accumulation Zone

A strong support base has formed between $0.24 – $0.40, which has held for over a year. This suggests significant accumulation by long-term investors at these levels.

3. Breakout Confirmation Imminent

If KAVA successfully breaks above the long-term descending trendline (yellow line), a major shift in market structure could occur, triggering a bullish rally.

4. Key Upside Targets

The following resistance levels may act as profit-taking zones if the breakout confirms:

$0.5308 – Initial minor resistance.

$0.7021 – Psychological resistance zone.

$1.1591 – Previous structural resistance.

$2.2266 – Medium-term upside target.

$5.1542 – $8.5085 – Long-term bull cycle potential targets.

5. Ideal Trading Scenario

Entry Strategy: Buy on breakout confirmation above the trendline or buy on successful retest.

Risk Management: Consider a stop-loss if price falls back below the accumulation zone (~$0.40).

🟢 Conclusion:

KAVA is approaching a critical turning point after a prolonged consolidation phase. A confirmed breakout from this pattern could initiate a strong upward trend, making it a compelling setup for swing traders and long-term investors.

📌 Note: Always apply proper risk management and wait for volume confirmation or supporting indicators before entering any trade.

#KAVA #KAVAUSDT #CryptoBreakout #AltcoinSeason #TechnicalAnalysis #CryptoChart #TradingSignals #BreakoutAlert #CryptoTrading #AltcoinAnalysis #BullishSetup #AccumulationZone

KAVAUSDT Forming a Bullish WaveKAVAUSDT is currently presenting a strong bullish wave pattern formation on the daily timeframe, hinting at a potential continuation of the upward trend. After a period of consolidation, KAVA has started to push higher with increasing bullish momentum. This movement is accompanied by solid volume, suggesting that the current wave could be the beginning of a larger impulse leg. The structure is favorable for swing traders and position traders looking to capture mid-term gains in the range of 60% to 70% or more.

From a technical perspective, the price has respected key support zones and is now forming higher highs and higher lows—a classic sign of a bullish trend in development. The overall market sentiment around KAVA is improving, and this is reflected in its rising trading volumes and increased mentions across crypto discussion platforms. If the bullish wave continues to unfold as expected, KAVA could challenge previous resistance levels and break into a new bullish phase.

KAVA also benefits from growing investor interest due to its strong fundamentals in the DeFi ecosystem. As a cross-chain DeFi platform, KAVA provides lending and stablecoin services, making it an attractive asset in a maturing crypto market. Technical indicators such as RSI and MACD are showing bullish signals, further supporting the case for a significant upside move. With volume surging and structure aligning, KAVA appears well-positioned to deliver a strong breakout rally.

Keep an eye on price levels around recent breakout zones as potential entry points. A successful retest could provide a good risk-reward setup for traders aiming to ride the bullish wave. Continued buying pressure and sustained volume would be key signs of strength in the coming days.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

KAVAUSD – Midpoint Retest with a Shot at a Daily Higher LowCOINBASE:KAVAUSD / COINBASE:KAVAUSDC

Watching KAVA here on the daily, and it’s at a key decision point that could define the next leg. We’ve got two sets of Fibonacci retracements drawn: the first from the March 2024 high to the August 2024 low, and the second from the August low to the December high. Right now, price is retesting the 50% level of the larger March–August move—aka the midpoint of the macro range—and it's still holding above the 50% retracement of the more recent August–December leg. We’re also sitting right on the 38.2% Fib of that second move, which tends to act as a key area for potential higher lows.

The idea here is simple: I’m playing for a daily higher low. We had a strong move off the December lows, followed by a healthy consolidation, and this is where bulls need to step in. Structure-wise, this is the ideal area for bulls to attempt a defense if the trend is going to continue. EMAs are curling up, and price is still holding above the 12 and 26 EMAs for now, which gives me confidence in a potential bounce.

If the Trade Goes as Planned (Bullish Case)

If buyers step in here and confirm a higher low—ideally somewhere between $0.48 and $0.50—we’d expect a continuation toward the recent high at $0.56. If that level breaks, then $0.64 becomes the next area of interest based on prior price structure and confluence with the upper Fib retracement levels. From there, we could even make a push toward the $0.74 area, where the last major rejection happened in late 2024.

A strong bounce here also sets up a potential inverse head and shoulders structure on the daily if we revisit that neckline around $0.56 again with momentum. In short, a higher low here gives the bulls the setup they need to retake trend control.

If the Trade Fails (Bearish Case)

If price fails to hold the $0.48–$0.50 region and breaks below the August–December 50% Fib level, then we’re likely heading back to the $0.44 zone. That’s where the 200-day SMA is sitting, and it’s also a major pivot from previous support. A loss of that zone opens the door to a full retrace toward $0.39 or even $0.37—last seen during the November-December basing structure.

In that case, the trend would flip neutral at best and would require a fresh base-building phase before bulls could even think about regaining momentum.

TL;DR

Thesis: Playing for a daily higher low above key Fib levels and EMAs.

Bullish Target: Reclaim $0.56 → push toward $0.64–$0.74 if momentum follows through.

Bearish Invalidator: Break below $0.48 = likely revisit of $0.44 or lower.

Not financial advice. Just sharing my thinking as I try to stack confluence and play the levels. Let’s see if this bounce gets legs.

Breaking: $KAVA Surged 10% Today Amidst A Falling Wedge KAVA the Layer-1 blockchain that combines the speed and interoperability of Cosmos with the developer power of Ethereum's native token SEED_DONKEYDAN_MARKET_CAP:KAVA urged 10% today amidst a bullish pennant.

From the first week of December, 2024 SEED_DONKEYDAN_MARKET_CAP:KAVA underwent a falling wedge pattern losing almost 50% of market value. Consequent to the bullish pennant formed, SEED_DONKEYDAN_MARKET_CAP:KAVA coin surged 10% hinting at a 36% surge to the recent high of December 4, 2024.

Kava Price Live Data

The live Kava price today is $0.539085 USD with a 24-hour trading volume of $25,133,445 USD. Kava is up 8.88% in the last 24 hours, with a live market cap of $583,750,357 USD. It has a circulating supply of 1,082,853,482 KAVA coins and the max. supply is not available.

KAVABINANCE:KAVAUSDT

KAVA / USDT

1D time frame ( wait for the price to come to buying zone)

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

KAVA is bearish (4H)KAVA has been consistently making lower highs and lower lows in the swing structure for some time.

Now, a major base has been broken, and a Flip zone has formed. There are also liquidity pools below the chart, which we have marked.

From the supply zone, it can move toward the targets shown on the chart. The targets are clearly marked on the chart.

A daily candle closing above the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

TradeCityPro | KAVA: A Dive into DeFi's Cosmos Ecosystem👋 Welcome to TradeCityPro!

In this analysis, I want to discuss the KAVA coin, a notable DeFi platform in the Cosmos ecosystem, which currently ranks 129th with a market cap of $472 million.

📅 Weekly Timeframe

We are witnessing a downward trend in the weekly timeframe, where the price has been moving along a descending trend line, with the most recent bottom recorded at the $0.2872 area.

🔍 Currently, a significant price ceiling has been set at $0.6981, and the price has recently been rejected from the descending trend line, likely moving towards the support floor again.

🔼 The support at $0.2872 is crucial, and if broken, the price could set a new historical bottom. For the trend to turn bullish, confirmation will come after breaking the trend line and surpassing the resistance at $1.1434.

📊 Volume divergence has been observed with the trend for some time now, but this divergence has yet to impact the trend, which continues to persist.

📅 Daily Timeframe

In the daily timeframe, we can observe the price movement in greater detail.

⚡️ As you can see, after reaching $0.7197, a corrective phase began, and currently, at the 0.618 Fibonacci level, a significant support has formed, overlapping with the $0.4118 area, creating a Potential Reversal Zone (PRZ).

✅ If the support at $0.4118 is breached, we might witness the next downward leg of the price, which could extend to the 0.786 Fibonacci level, and in case of increased downward momentum, the next target could be at $0.2925.

🛒 On the other hand, for a long-term long position, you could enter upon breaking the trigger at $0.5577, holding the position towards a target of $0.7179. The main trigger for spot buying is also $0.7179, but it is better to get the spot trigger confirmation from this coin’s Bitcoin pair.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

KAVA/USDT 300% Growth PotentialKAVA is one of the few coins that held exceptionally well during the recent market manipulation. While most cryptos printed new lower lows, KAVA/USDT formed a solid double bottom around the psychological support at $0.40.

From a technical perspective, this setup suggests strong upside potential. If the support holds, we could see a significant bullish breakout in the coming months. I wouldn't be surprised if the price skyrockets by 300% over the next three months.

Are you bullish on KAVA?

KAVA/USDT Trading ScenarioThe asset's price, like most altcoins, has undergone a significant correction and is currently trading near its local low. However, despite the decline in quotations, the market is experiencing a noticeable increase in trading volumes, indicating strong demand from buyers. A confident absorption of supply during the downturn suggests potential interest in KAVA from large players.

From a volume analysis perspective, the price is within the Point of Control range, reflecting the highest trading volume in the current price corridor. This confirms substantial market participant interest and the formation of a liquidity zone, which may act as support if consolidation continues. If volumes continue to rise and the price holds above key levels, this could signal a trend reversal and the development of an upward momentum.

Will #KAVA Reverse or Continue its Downward Move? Key LevelsYello Paradisers! Is #KAVAUSDT on the verge of a decisive breakout, or are we about to witness a major rejection that could spell trouble for bulls? Let’s break down the #Kava setup:

💎#KAVA is at a critical juncture. The price is currently hovering around $0.498, stuck beneath a descending resistance that has been capping bullish momentum. For a convincing breakout to materialize, #KAVAUSD must close decisively above the resistance zone at $0.58-$0.60. If this happens, the next targets are set at $0.750, and potentially, the major resistance zone will be near $0.85.

💎The supply zone between $0.58-$0.60 remains a hurdle. Failure to clear this resistance could trigger a rejection, leading to a pullback towards the strong support zone at $0.437-$0.372. This level has proven reliable in the past, offering a base for bulls to reload.

💎If the price closes below $0.372, the bullish setup will be invalidated. In this scenario, #KAVA could test lower support levels, potentially heading toward $0.30 or even lower. A breakdown here would confirm that sellers are in control, leaving bulls sidelined for now.

💎You need to watch for a breakout above the resistance at $0.58-$0.60, supported by strong volume. Without it, any breakout attempt could be a fakeout. Similarly, if a rejection happens, keep an eye on the demand zones—volume will confirm whether buyers are stepping in or if sellers are driving the trend further down.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

#KAVA/USDT#KAVA

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.5360

Entry price 0.5460

First target 0.5636

Second target 0.5832

Third target 0.6067

KAVAUSDT: Short-Term Bounce or Long-Term Opportunity?KAVAUSDT: Short-Term Bounce or Long-Term Opportunity? 🚀

Traders, let’s talk about KAVAUSDT, a coin making waves in the market right now! With a whopping %477 daily volume spike and significant CDV data pointing to heavy buyer activity, this is one setup you don’t want to ignore.

Here’s the breakdown:

Short-Term Blue Box: Found using precise CDV data, this zone is perfect for a quick bounce trade. Timing and precision will be key!

Long-Term Blue Box: This level acts as a safety net during a potential market crash. But let me be clear: I’m not waiting for it. With current data showing strong accumulation, the first zone looks very promising.

Why this matters: CDV analysis reveals a surge in buy activity, signaling that smart money is stepping in. Combine that with the volume explosion, and we’ve got a high-conviction play here.

Risk Management Tip: Be cautious but confident. Set clear stops, and don’t let greed cloud your judgment.

Your next move? Analyze the zones, plan your entries, and let the data guide you. What’s your take on KAVA? Boost, comment, and follow to stay ahead in the market!

Let me tell you, folks, this is amazing. Nobody does analysis like I do. Believe me. If this helps you, don't forget to boost and comment! It’s a big deal, motivates me to share even more winning insights with you. Tremendous insights.

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here’s the list, long list, great list, of some of my previous incredible analyses. Each one, a winner:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!