COFFEE FUTURES (KC1!) DailyThe Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. The Djinn Indicators work on all charts, for any asset category and in all time frames.

Dates in the future with the greatest probability for a price high or price low.

KC1!

COFFEE FUTURES (KC1!) WeeklyThe Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. The Djinn Indicators work on all charts, for any asset category and in all time frames.

Dates in the future with the greatest probability for a price high or price low.

COFFEE FUTURES (KC1!) MonthlyThe Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. The Djinn Indicators work on all charts, for any asset category and in all time frames.

Dates in the future with the greatest probability for a price high or price low.

COFFEE FUTURES (KC1!) Catching Bearish Wave

Coffee is retesting the broken support of bearish flag formation.

taking into consideration the current fundamental sentiment and positive yesterday's reaction on a trendline,

I believe that this week we can expect a bearish continuation to retest current higher low 103.0 and current low 98.0

good luck!

please, support the idea with like and comment! thank you

COFFEE FUTURES (KC1!): Entering Sell Zone

Coffee reached an important zone of confluence:

1. We have a strong structure resistance on the left

2. Completed harmonic abcd pattern

3. Fib.extension and retracement confluence.

4. Bearish sentiment from the beginning of the year

The price may drop at least to 114.0 level.

Please, support the idea with like! thank you!

COFFEE FUTURES (KC1!): 15-Year Low Ahead

I am not a coffee trader but we rarely see a trading opportunity like that so I want to show it to you!)

if we look far left on a weekly timeframe, we can notice with you that 87 level was tested 15 years ago last time.

It looks like sellers are willing to push the market to that level and I think that the reaction will be lit.

I believe that a huge amount of buying pending orders is placed within the underlined area.

So if you are a futures trader, pay close attention to coffee futures and be prepared.

good luck!

LONG KC!1 / Coffee Futures til year end 2019Fundamentals seem to be aligning up just perfectly (BRL strength coming up, current cyclical low yield year, solid to steadily growing global demand etc.),

all the while the until-recently uber bearish chart already started to brighten significantly - to me at least!

Reasons enough for a cautiously bullish view of things.. and for me to open a small position :P

Tell me what yall think!

Coffee: Boom. Roasted!This is an excerpt from the Parallax Weekly premium report originally published July 15, 2019.

"The net-positioning in coffee has surged, and the percentile metric is not suggesting it’s extremely overdone even though the one-year z-score is well above 2.

The problem now is that coffee prices have declined from $116 to $106 with net-longs still in charge. There is uncertainty surrounding frost that effected the Brazilian crop. Contingent on crop damage estimates, record production expectations into 2020 and price/net-positioning divergences, the bearish case for coffee @ 96 is created."

Coffee, Another buying opportunityAn absence of frost risk & speedy Brazilian harvest helped major correction in recent days. Positive news for bull is that ICE monitored inventories are continuously dropping. Brazilian real also seems strong on charts, further good for Coffee bulls. Presence of 100 as psychological level along with 99 as fib support, Its worth buying 99-100 region for quick bounce.

Coffee perfectly placed for rebuying Taking support at daily kijunsen which coincide with 50% retracement of current rally, you would never like to miss a buy. In a bull run RSI at 50 needs to give support and it almost kissed that level. Re buying here can provide quick profits towards 100 and recent high. Fundamentally, Brazilian Real rallied big after we spotted bottom against USD at 4.10 . Coffee supplies still abundant.

Looking at topping formation in USD/BRL, Coffee seems to explodeWhile USD/BRL short term indicators giving clear signal of correction to downside, Coffee touches its horizontal support. Trading at dirt cheap price and taking support, price seems to explode upside for quick trade opportunity. Brazilian real seems to get strength after falling as low as 4.12 against USD yesterday, which will push coffee prices up. Technically areas to watch are 91.20 & 94. Near 91.20, 20sma coincide with daily kijunsen giving tough resistance since many days. once crossed focus will shift 94 to 95 region(horizontal resistance confluence with 50sma) .

Cyclical sell pattern on Coffee. Long term short opportunity.This is a pattern that is being repeated over and over again though the decades. Coffee reaches a peak within 280 - 340 on a parabolic rise, then starts to decline less aggressively on Lower Highs, and bottoms within 42.00 - 50.45. That's Coffee's market cycle and since 1974 we've had three, currently being near the end of the third, as we are just before the final aggressive bearish leg

For those who are willing to short the market, there is a roughly 45% profit opportunity on a 2 year horizon until it bottom near 50.45 again.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

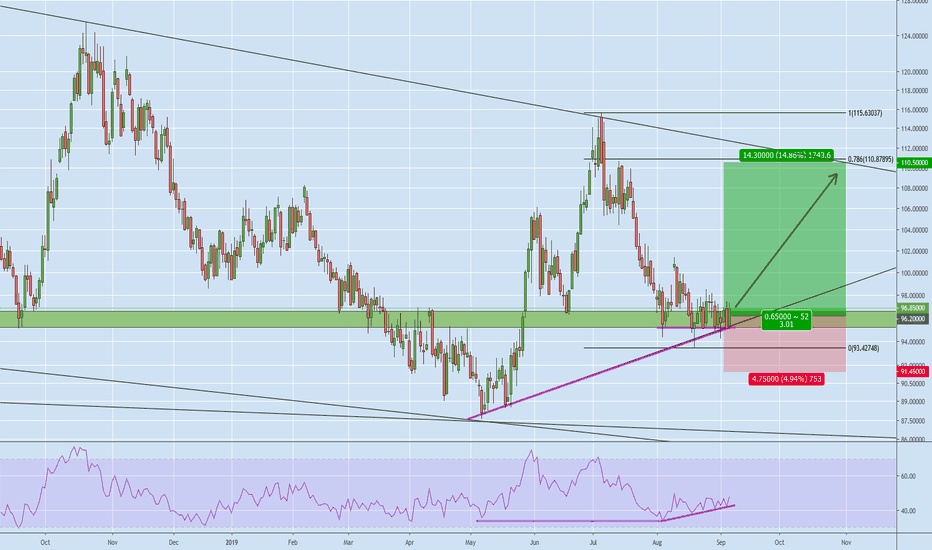

US Coffee Long Position Idea - Opinion KC1!Hi there. This is a recent analysis for an undervalued commodity which is US Coffee KC1!. As you see from the weekly chart Coffee price reached the bottom bollinger band, after this price movement it is expected to bounce again for the median of 20 weeks of bollinger at targets the price of 101,5$. This signal is also confirmed from RSI which is at oversold price level of 40. +DI from ADX is also at oversold level which is going to change over time and give a solid buy signal. This bounce might be helped from the highly demand in this specific commodity which is beloved worldwide.

**This is not an investment advice, it is only for educational purpose**

Invest with safety.

Coffee reaches accumulation levelsCoffee is trading near multi year horizontal support of 95 cents. While excessive supply and falling Brazilian real crushed the prices, there is ray of hope ahead. With price almost reaching 95 level which seems safe accumulation level, there can be gains in coming months. Farmers in Brazil are reducing coffee cultivation area will lead reduction in inventories in coming months. Price hovering near critical long term support risk to reward is very low for investing in coffee for some months.

Please feel free to leave comments and get in touch with us on:

Twitter: bit.ly/2o9ItrA

Youtube: bit.ly/2Nh8sbE

Tradingview: bit.ly/2PCbed1

Happy Trading!

Team Bitbloxx