Keyhiddenlevels

$OSUR: Strong base after a 49% decline...I think this is once again an interesting name to buy back here...I recall @timwest pointing it out in early 2016, near the very bottom before a huge rally. We were bullish on it at the right time, and I think it's the right time once again.

Fundamentals for the stock are a bit convoluted, with self diagnostic kits segment being highly competitive, and sales slumping, but the chart shows renewed interest in the stock from big buyers, given the accumulation base after a strong climb a month ago.

I would assume some interesting news is about to come out, that might be the catalyst to push it up from this base...

I'll be a buyer on signs of strength, if it breaks up from here soon.

Keeping an eye on it.

Cheers,

Ivan Labrie.

ARGT: Argentinian shares bottomed after the Primary electionsIt seems Argentinian stocks have bottomed here for now, after basing for 5 weeks, daily charts show some strength but there's risk going forward after the elections by October 27th. If the next president manages to surprise investors positively, the situation here might improve, and inflation drop down if the dollar is kept in check, and investments start flowing back to the region. I'm skeptical, but risk/reward favors being long from this zone, with a stop under the 22 handle.

The main problem remains being the need for labor reform, and reducing the influence of unions, and the enormous government spending, cutting taxes, and stopping the printing press...

Let's see how it goes.

Cheers,

Ivan Labrie.

ETHXBT: Ethereum likely to recover from here...I think the monthly downtrend might end up failing to reach its target, if $ETHBTC holds over 0.0213 it may go up rapidly in the next 13 days.

If it does, it could retest the monthly downtrend invalidation level, before the ratio has a chance to reach the bearish long term target I had outlined before. In that event, $ETHUSD may start to outperform $BTCUSD as both start to trend up once again.

Best of luck,

Ivan Labrie.

USDCNH: Sideways until the end of October?Weekly $USDCNH ended a trend recently, starting a consolidation period, as it has done since it bottomed this year like I anticipated. Upside movement in this pair is likely tied to money flowing outside of China via Hong Kong, which is also linked to money flows towards $BTCUSD to dodge capital controls possibly.

The next upswing in this pair hasn't yet confirmed, and it could take a few weeks to occur, which the last Time@Mode trend signal predicts will possibly happen by the end of October. The weekly has formed a new 8 week accumulation level up here (see cyan boxes), so it could flash a buy signal as soon as there is a rapid upside move in this timeframe, from next week onwards...

I'll keep an eye on this very critical pair, the current situation in Hong Kong is bound to create some shockwaves in the currency markets, and possibly crypto I think. Let's wait and see...I'm currently short $BTC, waiting for it to bottom, this pair might be a good indicator for that.

Cheers,

Ivan Labrie.

USDTRY: Monthly triangle forming, fundamentals favor upside$USDTRY is one pair that is likely to trend up over the long term, but it's currently stuck in a huge monthly triangle. Recent action is interesting since price sits at a confluence of 'inside trendlines', speed fan 75% retracement level and linear regression channel 2nd standard deviation, as well as retracing to the mid point of a recent 'Range Expansion' up day two bars back.

If buyers manage to keep prices over 5.6454, then it would be a sign of strength, since then the daily could start trending once again.

Problem is the swap costs in this pair makes it hard to trade into big trends with leverage, so you would be better off not trading it, but if you live in Turkey you might look into moving funds to USD if you earn income in TRY, unless support breaks down here, then you can probably hold off from doing so for the time being. It's a similar situation with the Argentinian currency, fundamentals of the country make the currency lose value over time...in a big way, because of the reckless financing of insane spending via money printing. A big problem in countries with corrupt governments like ours.

Best of luck,

Ivan Labrie.

BTCUSD: Long term trend is up, but a correction is on the way...Unless we erase last week's downside move, the trend is down for the next 10 weeks. Target is 6833, but might bottom higher (or lower). Watch the behavior here, since Bakkt and Binance.US did nothing for price, downside action is the next logical course of action. I flipped short after hedging spot holdings near 9687.5 today. We were long spot from 5300 to about 7000, and then back in a few times, until the most recent long entry near 9400.

Initially we caught upside from the very bottom but ended up underperforming since we moved to ETH instead of holding 100% BTC, causing my trading signals group to underperform holding BTC spot for the first time in many years. This situation might reverse going forward, since I'm confident in the ability of the methodology I learned from my mentor, Tim West, and my experience in this market to help navigate the waves in crypto markets profitably.

I did correctly identify the bearish trend in $ETHBTC after it was confirmed and it has moved down since. It will continue to move lower, I wouldn't reccomend holding on to any altcoin, and at this point not even $BTCUSD is safe for investors.

Best of luck,

Ivan Labrie.

BABA: New CEO at the helm, valuation isn't badI'm watching $BABA for an upside breakout of 179.88, which could trigger an explosive rally in the stock. Today wouldn't be a bad long entry here, with a wide stop at 163.96, but once the breakout happens, another trade with a stop at 171.43 can be placed...Upside targets are up to 276 in the long term.

Best of luck,

Ivan Labrie.

USOIL: Daily trend is upInteresting setup in $USOIL, the fall from the last top favored a bull run in stocks with a 6 month lag, as per @timwest's findings suggest (every time oil falls 25-30% it boosts earnings going forward). Monthly charts show accumulation supporting the market below, and daily confirms a trend by today's close. I think stocks are headed higher with oil here as well.

My bias is bullish in energy, oil, chip maker stocks, renewable energy related stocks, and the overall S&P500 index between now and the end of 2020 possibly. Let's see how it goes...Short term stop for oil is below last Friday's low, and short term targets are shown by the yellow boxes on chart.

Cheers,

Ivan Labrie.

NVDA: Position trade in place, opportunity to come...My clients and me have been long $NVDA from a couple days ago, before the big gap up and rally from yesterday.

The weekly chart now flashed a huge trend signal here, so catching any dip towards the buy zone on chart would be a great opportunity.

Valuation and positioning improved dramatically, after the bear market in this stock, so now we can look for buys with tremendous upside in the long term in it.

Leverage is quite low here, roughly 1.43x, whilst earning yield sits at 2.13% TTM. It's not too high, but the company has been growing EPS in the past 5 years by 52.5%, in the last year by 30.9%, while sales growth was in the order of 23.2% in the past 5 years. Price to sales is a bit rich here, same as the price to free cash flow ratio, but I'm not too concerned. $NVDA has been rallying widly, and the long term chart still points to further gains to be made. It also has correlated the bull and bear markets in $BTCUSD with some lag, so it seems likely to play catch up to $BTCUSD from here, considering all factors.

Best of luck,

Ivan Labrie.

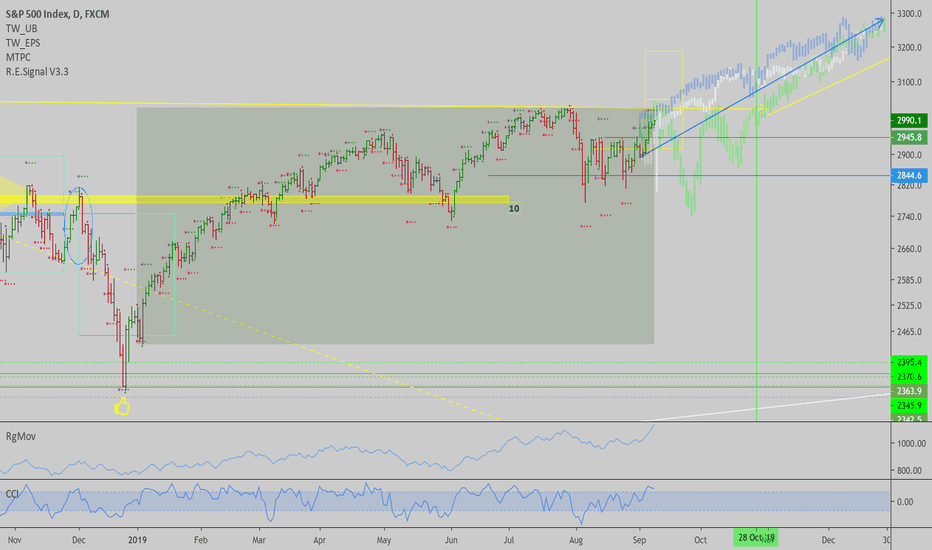

SPX: 2-Month timeframe signal will possibly trigger soon...The long term trends that were triggered on Nov 2011, Jan 2013 and Nov 2016, plotted as an overlay to the current daily chart, paint a bullish picture for $SPX and our stocks portfolio as a whole. The long term chart is about to confirm a rally, like how it did back then on those 3 occasions. If it does, we will likely be higher by the end of the year, in the order of 13% higher for the index, give or take. Corrections along the way, could be 5 days long on average, and as much as 6.4% deep, but I don't think that will be the case, since volatility in 2011 was much higher than now, and currently distorting the average correction size significantly.

With dems having lower probability of being elected, and a trade deal being closer to becoming a reality, plus negative sentiment having peaked, with Gold and Bonds hitting long term tops possibly, and everyone absolutely hating stocks...I want to be long and let things pan out, same as we do with $BTC for a while now.

Let's see how things evolve here, price action in the short term is constructive, with the daily targets show on chart (yellow boxes).

Best of luck,

Ivan Labrie.

EURSEK: Bound to confirm a bullish signal here$EURSEK 4H chart fired an uptrend 1 bar ago, the target is where the daily would trigger a Range Expansion bar today, which would in turn trigger a larger 12 day trend, if not, tomorrow's close is likely to confirm the same trend but with a higher low, above the daily mode level, where most of the accumulation took place. The trend target is the yellow box upper border, time to reach the target is the end of the box to the right. Should hit that level in time, or sooner than expected, as long as holding above the mode box (horizontal barrier below today's low roughly).

I'm working on an automated trading strategy to apply Time@Mode rules to FX and CFDs using MT4. Current testing results are good, I have a working prototype, polishing the code to have it ready to trade with full size. Once this EA is good to go I will start a PAMM account using this strategy to trade all main 1h and 4h trends in FX pairs that have fundamental and technical trends in the intermediate to long term, but from a short term perspective.

Best of luck,

Ivan Labrie.

Argentina: Back at long term support...Risky outlook given fundamental events, but hopefully the slide stops around here. Primary election results scared investors away, and with good reason: peronists came ahead by a big amount (I call bs, election fraud...maybe).

Either way, history proves that growth is not possible without a huge overhaul of labor, social spending, huge tax rates, and the power of the union mafias dwindling.

See: www.reuters.com

The date this was known, the stock market peaked. Central bank starting taking ridiculous measures ever since, spending money they got from the IMF on futile attempts to prop the peso against the dollar. In the process, killing the stock market advance and eventually devaluating the currency over time, as it was inevitable given the lack of change of fundamentals.

I'd watch as events unfold, if things change for the better, this is a good long term opportunity, but until elections are out of the way by October it won't be certain.

Best of luck for us Argentinians...

Ivan Labrie.

BTCUSD: Liquidation likely over...I'm calling the bottom here, after all the liquidation that followed the failure of my last 3-day timeframe signal, as price moved back below the stop loss @ 10986, the selling accelerated until it reached the climax an hour ago.

It's likely that the drop was caused by the Plkus Token scammers, as I was discussing with a client of mine. They are chinese and most likely sold BTC and other coins for USDT to sell the coins for cash in Russia.

I'm long from 9700, added some margin here.

Best of luck,

Ivan Labrie.

BTCUSD: 3D Timeframe signal confirmed...If we hold up from here, and don't go below 10769, we will likely hit one of the targets shown by the blue arrows on chart.

$Bitcoin is acting strong, showing signs that the long term 2-Month timeframe signal is still calling the shots. Over time, price may go as high as $280000 by late 2020, if it doesn't go back below 6481.

Bullish fundamentals are being front ran for a long time, since price started basing near 3500, after bottoming in December 2018. Expectations of institutional money coming to $BTC paired with the intrinsic bullish qualities of monetary policy and POW secured blockchain, which allow us to have a digital gold alternative, a store of wealth and a tool to avoid money controls, among other things...A major disrupting force, considering the huge amount of money that travels between borders and to tax havens, just to name one use case of the tech...

Libra was named by many as a bullish catalyst for $BTC -wrongly-, but it's now clear governments can't stop Bitcoin, unlike it. The accumulation base that started way ahead of the Libra news had nothing to do with it, clearly.

Do your due diligence, regarding safe guarding your coins, but, don't miss out on this buying opportunity.

Cheers,

Ivan Labrie.

$SPY: Market bottomed a day ago...The long term trend is up until 2021, the intermediate term trend in the 2 month timeframe is about to confirm a new bull market like the one that came after Trump's election in 2016...Interestingly the top of this trend will be at the same time the yearly trend ends. The move that came out of the 1998-2011 consolidation will technically last until 2021. There's a huge amount of trends in different markets with the same time duration, all ending by 2021. Not sure what to make of it, but I'm sure we will see a big move in stocks and $BTCUSD, between now and then. I'd err on the bullish side.

The return of stocks vs bonds makes stocks too attractive in the long term, with yields dropping to negative everywhere, there's no other place for money to go, once US treasury bonds yield 0% after inflation as well. For now, yield differential made UST attractive for foreigners, but that might change if rates drop further. Maybe we go back to QE?

For now, the logical thing to do seems to be buying quality names, low debt, high earnings yield stocks, and own some $BTC.

Best of luck,

Ivan Labrie.

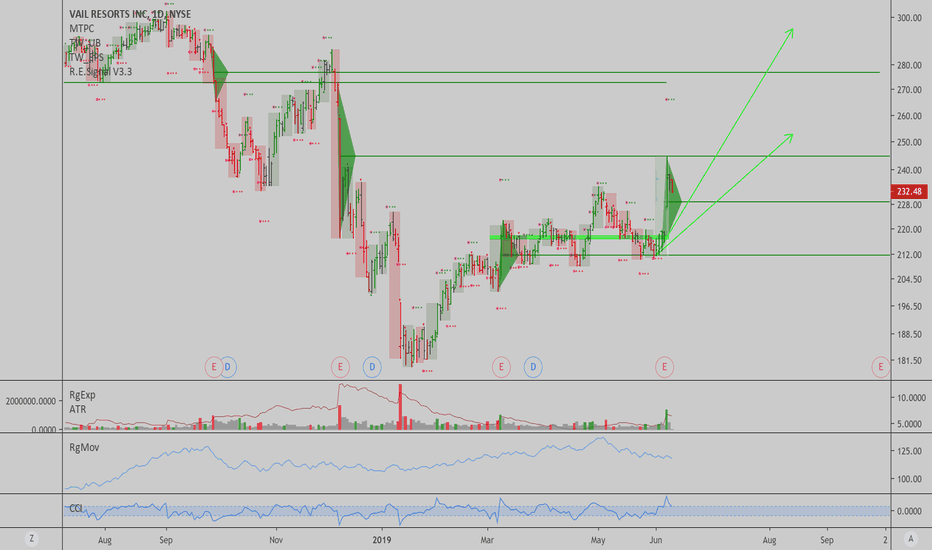

MTN: Vail Resorts has a nice weekly trend...I like the chart here, $MTN has some nice upside potential, both from a technical and valuation stand point.

As long as prices don't slide below $216, we can expect a 10 week rally from here, reaching prices as high as $295 possibly.

Best of luck,

Ivan Labrie.

XAUUSD: Weekly target exceeded, 2M trend activeGold surged and moved past the first weekly target, but there's time left until the week starting on August 19th, to move higher. The 2 month per bar timeframe shows the clearest trend signal, which is the one calling the shots it seems, in the big picture. The targets are on chart, in blue, as long as we hold over 1276.51, for the next 24 months, Gold can rally higher and higher, towards 1588, at the very least. This makes any daily or weekly oversold situation and interesting buy entry, once it's clear sellers are exhausted after any short term decline.

RgMov in the long term chart broke the all time high reached in 2011 in $XAUUSD, this is a really significant strength signal, and I think this might be the start of an even larger trend in gold, so I'm keen on buying big into it during July-August, if we do retrace.

Gold mining and physical gold ETFs will be extremely profitable to long once we get the next retrace. I'll be watching attentively...My clients will get the best possible long entry, with the highest risk/reward and win rate once I'm confident we have it.

Cheers,

Ivan Labrie.

TTGT: Strong relative strength and good growth potential...The chart here is very interesting in $TTGT, I think it can rally explosively from here onwards.

There's an active yearly trend that aims for lofty targets, with target #1 being quite realistically within reach during 2020.

I'm long here, looking to ride the trend from here onwards.

Cheers,

Ivan Labrie.