$AAPL: Bubble popped...again?I'm short $AAPL here, I think it is at risk if tensions escalate further with China, after $NVDA and $AMD were banned from exporing sensitive AI related gear to China. The chart shows a weekly down trend has popped and a monthly decline can confirm on close if it stays down long enough. Downside is substantial, as seen on chart, the last weekly trend hit the target, before staging a rapid relief rally following the expiration of the trend. I identified the bottom when Goldman Sachs cut their target for $AAPL downgrading it before an epic rally ensued. They have a pretty good inverse track record historically in this regard.

Best of luck if taking this trade,

Cheers,

Ivan Labrie.

Keyhiddenlevels

$TLT: Preparing to buy when safeI am monitoring bonds here, as we are approaching the target of a weekly down trend signal that fired recently, while the monthly timeframe trend is about to reach its end. By the end of September, the odds of a reversal in bonds will be very high, while equities are looking like they could crash lower from here possibly, and we could get inflation to come down, likely due to the effect of recessionary forces at play thanks to Powell's hawkishness. Since the Federal Reserve is hell bent on killing inflation hiking rates, and the data they use won't make them worry about this course of action until it's likely too late, odds of something breaking badly here are substantial. As such, I'm eager to spot the bottom in $TLT / $ZROZ to invest. We have a decent enough juncture here, where it starts making sense to pay attention to reversal cues in multiple timeframes and monitor signals closely to go long big time when confirmed.

Best of luck,

Ivan Labrie.

$MSFT: Monthly trend could reverse...1st time this happens ever since the trend turned bullish in 2012 for $MSFT. By the end of the month, we will get confirmation of a potential bear market trend starting to gain traction here.

Investors had a tremendous 10 year run ever since but it appears to be over.

Best of luck!

Ivan Labrie.

$NQ_F: Looks like a weekly uptrend could triggerIf prices hold up during next week, equities can stage a substantially strong weekly advance. The same pattern is visible in $ES_F and $SPY overall, and also crypto. We might have seen a long lasting major low set in stone in markets across the board. Prices of oil have come down more than 30% since the top 6 months ago, this gives equities a boost over time with a 3-6-9 month lag to reap the fruits of the lower cost of energy as a tailwind for the economy going forward (as depicted in @timwest's publication on the subject, see related ideas).

People had reached peak pessimism lately, and even though meme stock gamblers still are around, I believe they might not represent a significant contrarian signal for the broad market but rather simply be the latest incarnation of the penny stock gamblers and pump and dump forum users of old, as a new generation of traders joins the market. Over time we will know more but I suspect this is a meaningful juncture longer term and we should all be paying VERY close attention to the developments in energy, the war in Ukraine, China and the fate of Xi's leadership and zero COVID, renewables and EV adoption and monetary policy of course.

Going forward we have various headwinds as well, potential increase of labor costs if deglobalization/reshoring takes place, higher than target sustained inflation rates and gradually higher bond yields after being suppressed for years in a world in a state of lull for a decade, etc.

I like the idea of focusing on a few core themes and managing risk in concentrated bets to milk said themes in the event of a rally, so my positioning is spread across a small list of individual names, rather than index products. Although it's interesting to track developments in index charts as well.

Best of luck!

Ivan Labrie.

$ETHUSDT: Merge incoming, uptrend in the daily$ETHUSDT is interesting, I've been bullish relatively vs Bitcoin for a while, but got out of my latest attempt at riding the pair trade in minor loss of 0.15% yesterday. I had secured some gains since my last publications before, and tried buying back after a dip. See related ideas for the last post. There is a lingering chance of forming a monthly uptrend in $ETHBTC, so I do like the idea of having some $ETHUSD exposure (although smaller than my Bitcoin long given the higher volatility and risk).

Fundamental events are interesting, as we approach the timeline for the Merge of the Beacon chain (secured by POS ) and the old chain secured by POW, which will occur at some point between now and the next 9 days give or take. Following this change, issuance of Ethereum will go down dramatically as most people know, and given the changes introduced with EIP1559, could eventually even become deflationary over time as fees are burnt at a greater rate than coins are created. Staking can result in an APR of 4.5-7% potentially, which might make it attractive if inflation rates come down over time. For price to form a long term uptrend, a larger than 10 month bar signal must fire, which isn't yet doable, but depending on how things evolve, could be achievable after October. Just a low probability scenario for now, but given the low risk of buying down here vs potential upside in that scenario, is something that I'd evaluate over time. As more and more data points confirm we are safe to hold, we can let the trade run and capture a big trend landing us huge reward to risk multiples. Hence my interest in being relatively early with buying strength after big declines, when people are not as interested as at the peak euphoria we had in April 2021 or in Dec 2021.

Let's see how it evolves, owning $ETH spot with say 5% of your capital might be a good decision here. Be wary of the average price level at which people staked coins a while back, that level can act as supply and slow down or even reverse any advance, if price were to test it next.

Best of luck!

Ivan Labrie.

$NVDA: Short it, the death of GPU mining is a nice catalystThe chart here looks perfect for a short in $NVDA, and as a bonus we have #Ethereum transitioning to Proof of Stake for transaction validation, which together with high electricity prices will make GPU mining go extinct overall. I'm short, as part of my long/short stocks portfolio. The other shorts are crypto currently, which are likely the riskiest of all risk on assets, and might act as a nice hedge for other stock longs.

The trend is clear from a technical stand point, and we have many macro headwinds, so I can see the stock plummeting even if index charts stay sideways or not go down as much.

Cheers,

Ivan Labrie.

$BTCUSD: Weekly uptrend signal...We now have a weekly uptrend signal in Bitcoin suggesting a rally to $28k is possible here...I was skeptical with this possibility but there's a similar rally in various risk assets, and we even had some strange sentiment signals lately (Pomp removed laser eyes from his Twitter profile). Everyone hates this rally, at least among my close circle, which is interesting as well.

I'm long, since risk is small, with an invalidation a bit below 20k. Don't risk more than 1-5% in any trade.

Cheers,

Ivan Labrie.

$ETHBTC: Bullish in the weekly chartWeekly trend has now turned up in the $ETHBTC ratio, while the bearish trend in the daily failed to hit target and was completely erased. It seems buying into the merge event is driving the ratio higher here. I can see the 0.092 target zone being hit quickly here, while you may also qualify to receive some free coins if there is a fork (you can see how much it's worth using the $ETHWUSD or $ETHWBTC symbol from Bitfinex). Coincidentally, there's a bullish time@mode trend signal in the $ETHWUSD and $ETHWBTC charts that just flashed today, as this signal in $ETHBTC triggered in the weekly. Might be an interesting move.

Best of luck if buying.

Cheers,

Ivan Labrie.

$ETHBTC: Ethereum peaked...short it.The pre merge enthusiasm caused a big rally in both the ratio and dollar charts, both charts just flashed a short signal in the daily chart with very tight stops and big reward to risk, with open ended downside if it keeps trending down after the 1st range target is hit here. I'm long $SPY vs a long $BITI position as a pair trade currently, but will also add an Ethereum short as well. (probably ok to do a naked short or own puts)

Best of luck!

Ivan Labrie.

$LCID: Short it to $0...cash burning like there's no tomorrow.I'm shorting $LCID here, nice weekly setup, downside targets are $9-10, and up to $1-2 by December 2nd or sooner. I'm long puts to ride this move, since the stock is hard to borrow.

Worth a shot, you could also consider a portfolio where you long the relatively safe EV names vs shorts in EV startups that are burning cash and unprofitable, which will likely continue to pay off (long $TSLA, $F, $RIVN maybe, vs shorts in $NKLA, $LCID, $ARVL, $FFIE, $FSR, etc)

$FTTBTC: Pair trade setup...I think we can go long $FTTUSD against a same size short in $BTCUSD, the ratio chart shows there's 95% upside with 5% risk give or take, historically, in bear markets, exchange tokens have done well vs Bitcoin (like $BNBBTC did in the prior bear market back in 2018-2020). It might be worth a punt here...Betting on Sam might be a decent gamble, relatively vs Bitcoin at least. You can stake your $FTT as well, while you hold the $BTCUSD short, but need enough collateral to not be at risk. The bearish case in $BTCUSD might still be valid, judging by the action today, which erased yesterday's up bar. It's worth a shot.

Best of luck,

Ivan Labrie.

$BTCUSD: Weekly trend confirms on close...We have an interesting situation, crypto related stocks and altcoins have rallied far more than $Bitcoin has so far, and now the weekly chart is flashing what could be a big buy signal in the mid to long term. I'm personally skeptical of sentiment, since it seems a bit confusing given what I observe (anecdotal) but the macro backdrop and technical chart give a cue to go long here, risking a 10% drop to make between 17% and 57% within the next 4 weeks.

Overall, most setups in weekly charts are similar, and point to a risk on rally until late Sep to early Oct. Markets will be watching labor related data and inflation prints to try to assess what the Federal Reserve will do by Sep FOMC. Inflation could start to come down given the drop in commodities and the demand destruction effect of high mortgage rates and high oil prices affecting the economy broadly. (which likely kickstarted the decline we are seeing since the top in commodities). A lot of the 'stagflation bros' and similarly aligned perma bear types who have been gloating at the bottom and calling bulls stupid as markets came back up, are expecting the latest NFP report to be an indication of persistent high inflation but there could be deflationary cross currents that might not be on the spotlight now (like potential increase of labor force participation given that the people who expected to retire from crypto and stonk gains got totally destroyed at the depths of the decline and will need to get a job, as well as the demand destruction in commodities and lack of stimulus in China). I think such people are biased, and decided to stay wrong given their rigid thinking rather than act based on data to verify the validity of a thesis with new data points, as they should be. I strive to do 'post-pattern' verification of technical setup expectations and fundamental predictions to stay right, after a thesis of mine generates some positive PNL over time. This is the best way to manage risk and achieve good returns in trends.

In the case of #Bitcoin, it's hard to give it a role as a portfolio diversifier, but it's an interesting asset class to trade speculatively based on technical analysis to manage risk and generate positive reward to risk trades over time. I would never advocate hodling it, as there is no substance other than some potential use cases that could remain viable at any price due to the mining game theory which Satoshi brilliantly laid out. I do like the potential in Lightning network for scaling over time, but that is not going to bring demand by itself magically and is still not here yet. So this remains a tactical trade.

Best of luck gentlemen!

Cheers,

Ivan Labrie.

#AUDNZD: Keep an eye on the basing pattern here...The weekly down trend signal in $AUDNZD expires next week, this means a potential reversal can be setting up. At the same time, the daily chart is basing and can flash a bullish signal in a day or more. I'll be watching this pair closely in the coming days, after today's close in particular. The recent bout of #NZD strength courtesy of RNBZ's hawkishness has droven the cross pair too far in my opinion and is bound to mean revert substantially, as we recover from peak pessimism when it comes to Australia and China...

Cheers,

Ivan Labrie.

$WKHS: interesting junctureI will list a series of facts, which make me think we can gamble a small amount of money on a long shot trade entry in $WKHS:

The new climate spending bill includes items that could benefit EV names, and there could be renewed interest in names that could end up landing the deal with the United States Postal Service to provide them with vans. www.bloomberg.com

cathiesark.com Cathie Woods sold. Bullish.

Long term mode retested, after the prior long term bullish trend signal peaked at the target as per my forecast published here ages ago, it has come all the way down and it's basing, could be a bottom in the making, as we had 13 months elapse since the expiration of the last monthly trend, which was at the end of June, weekly trend turned up since and monthly put on a strong candle, with a range expansion move signaling strength.

I'm long, small 1% position as a 'long shot' trade. Potential reward to risk is interesting, but worst I can lose is 1% if it goes to $0. (that's what I call a 'long shot')

Let's see how it goes, my other positions here are $TSLA, $F and a small bet in $RIVN as well.

Cheers,

Ivan Labrie.

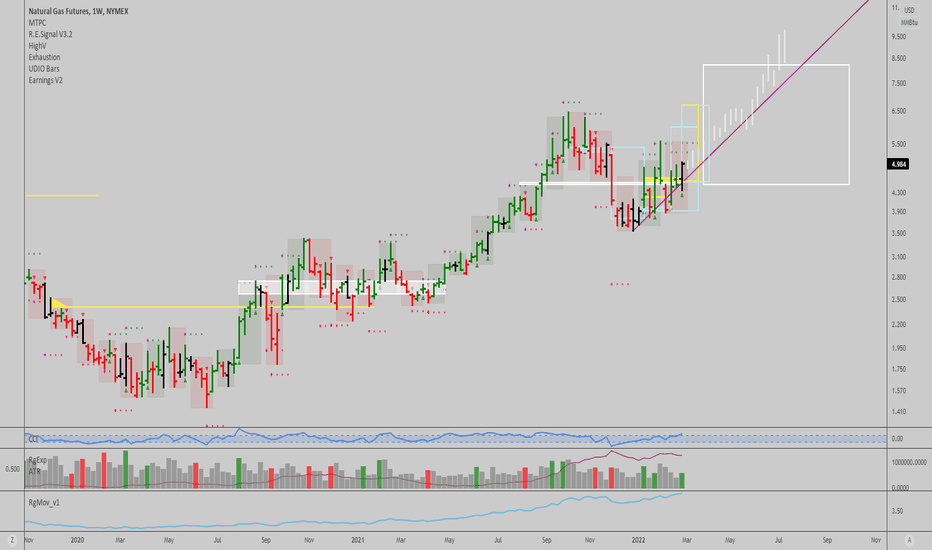

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.

GBP/USD: Sterling Pound will follow the correlation with EuroI will explain very well this way, because Sterling Pound stil in this downside and the correlation with Euro bad news it's high that will impact the worth in GBP.

So, I see that we could to short GBP/USD only wait my exact key to watch $1.1924 USD, and then look how the price action will react in that zone. This it's a good opportunity to look away.

I will update this par.

I suggest to put an alarm in the $1.1920 USD, because we would to watch if the price will retest and confirm a bearish signal using price action

Good Luck!!!

$TSLA: Held the S&P500 inclusion level$TSLA has a bottom signal in the daily here, I'm long as of yesterday, time and price target is shown in yellow. Until the next earnings report, price might glide higher. Considering the $TWTR merger, risk of Elon needing to sell more shares is a scary but not impossible bearish catalyst that could rain in the bull's parade soon. Partnering with a PE firm would be a safer bet for $TSLA shareholder's cardiac health, but it's not yet clear what route Elon will go with yet. Earnings might not look too great this quarter, considering Elon's recent sayings about new factories still being a source of losses for the company (clearly gonna be a negative factor until they produce at full capacity, not a demand problem yet). Also have to factor in risk from recent down time in Shanghai due to lock downs and potential impact of the economy on sales with rising inflation and fuel prices affecting consumers. This last point might be what Elon talked about when referring to the economy being at risk of entering a recession soon. I'm sure that if a recession occurs, $TSLA might stay sideways or go lower over time until the market bottoms. To be safe, I'll only trade the stock in the short term. I don't see a huge reward to risk trade in long term exposure to the stock here, all things considered. Long term technical targets are all reached, and price has formed a bearish trend signal in the weekly/biweekly/monthly timeframes, with only the daily trend reversing now.

Best of luck,

Ivan Labrie.

$AMZN: Down trend slowing down...There's a possibility of further downside for $AMZN over time, but currently, price action and the drop in commodities suggest that $AMZN is likely to go higher for a while.

Until the next FOMC meeting, market participants might bet on a Fed pivot taking place sooner rather than later, given the drop in commodities suggesting inflation might be under control already.

I personally think what comes after it is a recession, particularly if the Fed stays in the same hawkish course for longer...For now I'm out of bearish positions and went long using options in a few select names, as well as stock positions in names like $TWTR and $TSLA, etc.

Upside here is good, see the yellow boxes for time and price targets in the immediate short term. What comes after this relief rally until mid to late July is to be seen. Will know more when we get there.

Best of luck!

Cheers,

Ivan Labrie.

#Bitcoin: Trend is down in the daily chartSoon the weekly and monthly can flash a signal, aligning with the 2 month timeframe forecast, for the end of a trend by the end of April 2022, which I had anticipated back in July 2020. The last time we had this pattern was in December 2017, right before a fall from 20k to 3k over the course of 1 year. The monthly trend could turn down, and if so, predicts a move down until September 2022, with targets @ 23k and 13k. We also need to factor the support level @ the start of the 2-Month trend around 9k. It's clear markets topped, and $BTCUSD acts like one more risk asset, whenever liquidity suffers, it goes down. Valuations across the board had reached astronomical levels, and essentially, liquidity and money supply weren't enough to support them were investors to take profits in their unrealized gains...

I suggest hedging or buying long dated OTM puts against crypto holdings if you're long, or just going to cash, this is going to hurt.

Best of luck,

Ivan Labrie.

$SOYB / $ZS_F: Weekly and monthly trends are upSoybeans have been consolidating and shorts have been hitting the same level near the invasion day highs for 3 months give or take, today price broke out and confirmed a weekly trend signal. The monthly timeframe indicates beans can rally until October 2022, so, getting lower timeframes to turn bullish again presents us with a massive reward to risk long opportunity here. I bot July futures / $SOYB calls today, aiming to capture the move shown in the continuous chart here. If you want you can join the trade when beans futures open tonight, keep in mind you will need to roll the position to the next contract month 8 calendar days before the expiration date give or take (you'll see volume is high on that day), or, to make it simpler, buy the Nov 18 $31 strike $SOYB calls. If you buy futures, calculate risking a drop under last week's low, if you buy options, calculate risking 1-5% of your capital in call premium. Over time we might be able to bet on higher strikes as well, or trade around the position in shorter term timeframes (often good to delta hedge calls with 15m setups on the short side if you're good at scalping, then use proceeds to add to the call position for increased exposure without increasing risk).

Best of luck!

Cheers,

Ivan Labrie.

$XAUUSD: Huge reward to risk bottom signal...$I'm long PMs as of today, Silver and Gold acting strong after a weekly down trend expired recently. As per my long term yearly chart data, both $XAUUSD and $XAGUSD show long term uptrend signals active and are attractive to rejoin that potential scenario being oversold into support, while short term charts progressively turn bullish from daily upwards. Weekly had a signal which will expire next week and implies a potential mean reversion move towards $1927+ within the span of 6 weeks or less. The daily timeframe turned bullish today, reversing the recent weakness seen since March 8th when metals peaked. Select gold and silver mining stocks look very appealing with low valuations once again ($GFI, $SBSW, $PAAS, $AU, as well as $SCCO and $FCX to name a few).

Decent opportunity to go long with low risk vs potential upside in the case of a stagflationary scenario or a scenario where real rates stop going up or come down over time. which seems likely given demographics and fundamentals. For instance, the adoption of renewable energy and electric vehicles to resolve climate change and potentially address the energy crisis at hand could serve as a tailwind for precious and base metals and mining stocks in general. Long term investments can be done with funds that we can afford to lose or see cut in half to hold for long as necessary to let this trend play out, the trend in $XAUUSD is also a great short term trade, from where we can hold long exposure with big size, while risking small given the tight stop that is possible here at the signal invalidation. Long term positions are better done with physical gold and silver ETFs and/or mining stocks to buy metals in the ground, rather than dealing with futures or CFDs and their carry.

Best of luck!

Cheers,

Ivan Labrie.

$DEFI is toast: nice short...I think we are likely to see a massive move down in DeFi names, the contract issued by FTX is a nice way of riding the eventual move down, which can be magnified if we get some large protocol issue, or some unexpected black swan event causing a cascading decline of epic size as a gigantic levered bubble bursts. It is likely the best short in crypto, to profit from the bear market we are in.

Best of luck if going short.

Cheers,

Ivan Labrie.

$BTCUSD: Daily uptrend signal...Potentially a relief rally in a long term bear market...Weekly trend hit target, monthly trend is still down and equities could top after a relief rally. I'm long $BTCUSD here, aiming for a move back to the range of the Ukraine invasion day, give or take. Time@Mode trend in the daily turned up, so if the base here holds up, we will go higher. A lot of pessimism got me optimistic lately, everyone on Crypto Twitter was going on about the decoupling of $Bitcoin vs $SPX, citing the last couple days relative performance as a really bearish cue. In my opinion, it was short sighted to look at it and discard historical data since Bitcoin topped. I compared it vs $ARKK and $SPY and $QQQ, and it's clear to me that overall, the correlation remains. I figured out it would catch up to where equities were, and go higher with them for a couple weeks here.

The market seems to be pricing in a potential Fed pivot by Sept, and until we get to the next FOMC meeting, nothing can easily stop the bulls here...If sellers stop selling, we can easily glide higher due to short covering, since everyone was so negative. As a cherry on top, we had Jim Chanos going public about his short thesis for $COIN, which came after the stock formed a bullish base and Time@Mode signal. Considering his awful timing with $TSLA, and the various bearish CT influencers (like the infamous Maren, who made a bearish call based on the horoscope or some insane bs) I find the long trade an easy low risk bet here. Set stops sligthly below the yellow box (daily uptrend mode, where most of the trading took place since basing after the bottom).

I've covered shorts across the board, and bot back Soybeans, and some stocks, since last week, and now am long $Bitcoin again, let's see how this goes, we may have some time to rally here. Soybeans and oil can go higher for longer than risk assets and Bitcoin, and might end up affecting equities negatively due to inflation data getting worse, specially if we hear about the Fed's resolve to hike, and get people to give up on the Fed pivot hopium theory.

Best of luck,

Ivan Labrie.