Klci

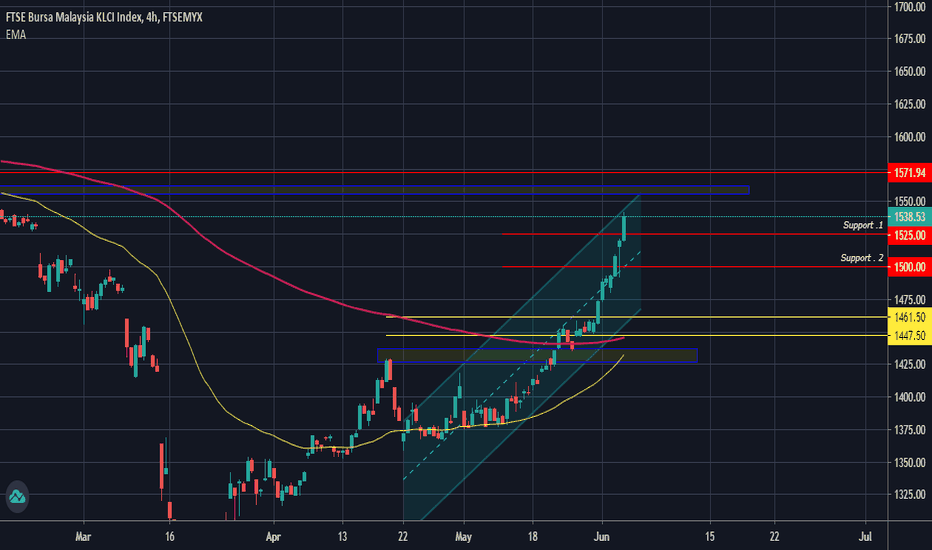

July06: FKLI(1D) - Midterm ABC Correction to 140x-5x in ProgressMid-term ABC Correction went as expected, see prev post from June15.

June15 - FKLI (1D) - Mid-term Correction towards 140x... 👇🏻👇🏻

Currently, we are in waveB (see: baby blue arrow marker), which may find resistance near R1, 154x-6x.

Declining volume suggests/confirms the correctional-upwave.

I'm positional Short for FKLI, holding thru next potential down-waveC, targeting S3,S4.

Levels to Watch:

R2: ~158x

R1: 154x-6x

Major S1: 147x-149x

S2: 142x-4x

Major S3: 138x-140x

Happy Hunting! 🏹🎯

-jk-

KLCI Indeks Menjunam Ke Paras 1400.11| 29th June 2020| Edisi BMSetelah harga pasaran KLCI tidak berjaya menembus harga 1600.00, investor telah mula hilang semangat. Ramai di antara investor telah pun close profit pada harga

tersebut kerana di katakan terlalu tinggi dan harga pasaran yang mahal, ada juga investor yang tidak perasan perkara ini berlaku yang membuat ramai investor

membeli pada paras harga yang hampai pada 1600.00.

Saya telah menjangkakan perkara ini berlaku dengan membuat anggaran matematika pada harga 1570.00. Akan tetapi harga telah pun naik lagi sebanyak

30 point yang menyebabkan harga menyentuh 1600.00 atau menghampiri. Ini disebabkan oleh pembukaan market pasaran Malaysia dan sentimen yang membuak-buak

di kalangan para traders Malaysia yang memasuki trading dan meletakkan lot yg besar menerusi dagangan yang mahu mengikuti trend. Akan tetapi malangnya, harga

telah pun mencapai paaras ketepuan.

Kini pada tarikh 29th June 2020, harga KLCI tersangkut pada nilai 1488~ yang di yakini bermula daripada paras 1600.00 yang menjadi punya kepada harga maksima

1900.00. Walaupun begitu harga KLCI yang telah naik tidak berjaya hingga 1600.00, trend KLCI masih lagi menunjukkan pada keadaan lorongan jitu ke dasar. Masih lagi

mengekalkan keadaan bearishnya.

Selagi tidak nampak harga membuat paras kedudukan rendah yang tertinggi, selagi itu trend masih kekal pada lorongan jitu ke dasar.

Pada pendapat saya, harga support akan di tentukan pada 1400.00. Sehubungan dengan itu, saya memerhatikan harga 1400.00 berada dalam keadaan kunci keuntungan.

Sekian. W'salam.

Untuk maklumat lanjut tentang bursa saham, boleh menghubungi saya di laman ini.

Booking kelas dagangan akan di adakan seperti biasa di laman sesawang saya di profil.

Selamat maju jaya.

Yang Ikhlas,

Zezu Zaza

2048

Trading Plan 6/2020 - HartaMy first entry 12.30

Breakout Re-Entry Upon Short term Resistance & Fib 1.618 Res.

Stop Loss 10% , which should not happen as thee are 2 gap res, upon breaking means selling power strong

Momentum growing

Also has to take into consideration of KLCI recent gap resistance, which now coincides with Harta resistance

Disclaimer: This is only a sharing of how I analyse & plan my trade.

Trading Plan 6/2020 - TMUptrend Breakout

This is a fairly Easy one, even though there is a short term diamond pattern formed & a short term resistance at 4.5, overall it is on a uptrend.

Enter on a small position if less faith, with a stop loss set at -5%

Disclaimer: This is only a sharing of how I analyse & plan my trade.

Trading Plan 6/2020 - RevenueStrategy Uptrend Breakout & Inverted HnS Breakout Entry

Volume and momentum are building up

Exit Plan:

Noticeable there is a gap support,with fib support of 0.618, with 2 major past resistance/support, therefore my interpretation would be it is a strong support(which should not break).

i will exit at 7% loss

Disclaimer: This is only a sharing of how I analyse & plan my trade.

Trading Plan 6/2020 - PentaStrategy Uptrend Breakout Entry

I usually enter with 10% of my portfolio, then ride the trend.

Graph set up is a nice uptrend and momentum is building up, with a Inverse HnS forming

Exit Plan:

Noticeable there are 2 gap support , therefore my interpretation would be , they are strong support(which should not break), this is the kind of case I would exit at 5%, and 10% loss again

(Usually I exit at 7 - 10% loss)

Disclaimer: This is only a sharing of how I analyse & plan my trade.

The "marubozu" Candlestick is roaring..Overall momentum remains strong, underpinned by “marubozu” candlestick pattern. Expected the index will test the psychological resistance in the near term.

Due to Malaysia Government is struggling to fight back the economy, in Q3 is seen a little bit of hope to recover back for a short period.

Ke mana arah tuju KLCI?INDEX KLCI UPDATE 1 MAY 2020

KLCI telah rebound dari point area 1212 sejak Perintah Kawalan Pergerakan di laksanakan. Persoalannya kemanakah arah tuju KLCI?

Pendapat peribadi saya, KLCI telah melepasi phsycolgy point 1400 dan telah menutupi gap yag di lakukan sebelum ini. Apa yang bakal berlaku pada bulan May? saya menjangkakan index bakal melakukan sedikit lagi kenaikan sehingga paras 1470 - 1505, sekiranya paras 1500 berjaya di kekalkan berkemungkinan index akan terus melakukan kenaikan. Walaubagaimanapun, saya melihat index akan mula Uturn melakukan kejatuhan pada range 1470 - 1505 menghala ke area point 800+.

*Perhatian!!!

Kajian yang di tunjukkan adalah pendapat peribadi sahaja, tidak ada kena mengena dengan arahan jual mahupun beli sesuatu saham. Segala perubahan boleh berlaku mengikut situasi semasa market.

#KLCI

#IbrahimZohari

#IndependentTraders

BURSA MALAYSIA RECOVERYAfter a very long term bearish since 2018, we can see now KLCI starts to recover. We can expect the price will move up to 16% to find a previous supply zone. However, the price still retest at demand zone and might be a good opportunity to buy the index at discounted price.

p/s: the index correlated with stock market so we can start to build our watchlist to filter which stock can be potential to buy at lower price.

{SWC} FBM KLCI/Malaysia 30, Closing Bell (real) 14th Apr 2020 Thank you for your continued support! :)

FTSE Bursa Malaysia KLCI closed higher 15.63 points at 1.15% today.

I just noticed the previous idea was titled wrongly because I referenced my PC's time at midnight.

Asian indices were generally in the green today as China released better than expected trade data. The FBM KLCI staged a breakout at the 1360 region short term resistance and pressed onward to the 1370 region of resistance. As this was recent high on 9th Apr (1371), some volatility is expected from potential profit taking. The KLCI retraced a few points but managed to close just barely above 1371 for a technical breakout. For reference, the high on 13th March was 1369.

Bullish targets for the short term include 1383 and 1403. The 1402-1404 region should be more important given it is the junction of both hourly and 15 minutes Fibonacci extensions. For the medium term, the region around low of 12th March confluences with the MA on daily chart making 1420 a key potential resistance to take note.

Short term support remains at the 1353 region, while the key Fibonacci levels between 1371 and 1353 have potential for forming new supports. 1317 still stands as the more medium term support region.

Stay safe, everyone :)

{SWC} FBM KLCI/Malaysia 30, Closing Bell 14th Apr 2020Thank you for your continued support! :)

This Monday, the FBM KLCI main index closed 0.11% or 1.47 points lower. HKEX is closed for Easter Monday, and the US markets don't open until at night XD. Overall, KLCI was in sideway movement today.

The bears teased the 1350-1353 region, but a quick support was found as the KLCI touched today's lowest point at 1352.78, leaving a long lower shadow on the candle. On the 15 minutes chart, we further project a series of intraday fibonacci key levels and found that the 38% at 1359.78 was putting up some resistance as the KLCI tried to move higher in the afternon. Will the 1350-1353 support hold next time?

Stay safe, everyone :)

KLCI Heading To 1405.37 Before Trump| 15th April 2020Looking to the price daily chart, the price is about to breakout the 1370.00 which is the key before the price going to 1400.00. I am holding the buying position today as the price of value RSI showing up before the previous value. The confirmation also has been develop after the candlestick eating all the price previous day.

Ringgit has strengten against the dollar this week. You might want to see those article as per below if you haven't read so.

www.thestar.com.my

I am closely watching and monitor the trump administration. The trump statement made on the 'shortly' is very dangerous to the KLCI. After the news that he only know when is the time to re-open the US economy, perhaps not now the KLCI is in safe mode to 1405.37 if the G7 meeting is not in favour. I am targeting the KLCI to 1405.37 before close the target profit.

www.marketwatch.com

www.cnbc.com

For malaysian traders, I want you guys to read all these article that i have provided. Please subscribe to my telegram if you wish to trade with me or asking me a question regarding the trading. I know many of malaysian traders need help towards the trading. Please contact me if you need answer to your trading. I am opening a study group to regroup company of traders around the malaysia. I also do coaching if you guys seriously want to be a serious traders for full time or part time trading job aspect. Invest at the knowledge first before you make investment towards the trading before you loss money on your pension money or business money. Trading is a serious things and not can be played by gambling. Invest in knowledge first so that you can make a living forever and trade with confident so that you can see your bigger picture of the trade.

Thank you.

Regards,

Zezu Zaza

2048