July06: FKLI(1D) - Midterm ABC Correction to 140x-5x in ProgressMid-term ABC Correction went as expected, see prev post from June15.

June15 - FKLI (1D) - Mid-term Correction towards 140x... 👇🏻👇🏻

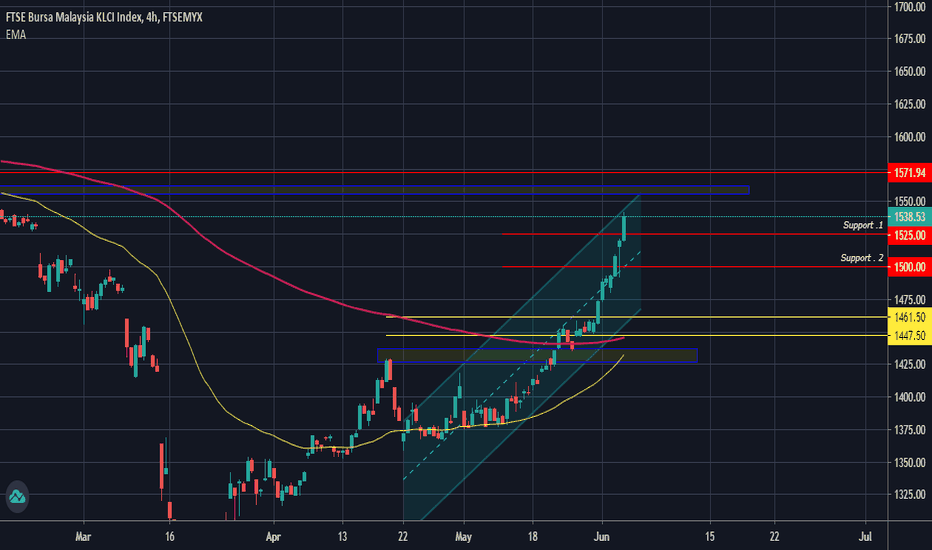

Currently, we are in waveB (see: baby blue arrow marker), which may find resistance near R1, 154x-6x.

Declining volume suggests/confirms the correctional-upwave.

I'm positional Short for FKLI, holding thru next potential down-waveC, targeting S3,S4.

Levels to Watch:

R2: ~158x

R1: 154x-6x

Major S1: 147x-149x

S2: 142x-4x

Major S3: 138x-140x

Happy Hunting! 🏹🎯

-jk-

KLSE

EFORCE Buying on retracement: WARNING: Aggressive TradePrice moving in downtrend channel

Key level (support) 0.43 respected 3 times. At point no. 3, there are anomaly indication, CO stopped the further bearish sentiment.

huge volume on recent CS indicates interest in demand increases.

ride the trend when channel breaks + CS close above recent LH.

#riskfirst

Potential Entry : 0.435-0.455

Risk : break Key Level (candle close)

KLCI Indeks Menjunam Ke Paras 1400.11| 29th June 2020| Edisi BMSetelah harga pasaran KLCI tidak berjaya menembus harga 1600.00, investor telah mula hilang semangat. Ramai di antara investor telah pun close profit pada harga

tersebut kerana di katakan terlalu tinggi dan harga pasaran yang mahal, ada juga investor yang tidak perasan perkara ini berlaku yang membuat ramai investor

membeli pada paras harga yang hampai pada 1600.00.

Saya telah menjangkakan perkara ini berlaku dengan membuat anggaran matematika pada harga 1570.00. Akan tetapi harga telah pun naik lagi sebanyak

30 point yang menyebabkan harga menyentuh 1600.00 atau menghampiri. Ini disebabkan oleh pembukaan market pasaran Malaysia dan sentimen yang membuak-buak

di kalangan para traders Malaysia yang memasuki trading dan meletakkan lot yg besar menerusi dagangan yang mahu mengikuti trend. Akan tetapi malangnya, harga

telah pun mencapai paaras ketepuan.

Kini pada tarikh 29th June 2020, harga KLCI tersangkut pada nilai 1488~ yang di yakini bermula daripada paras 1600.00 yang menjadi punya kepada harga maksima

1900.00. Walaupun begitu harga KLCI yang telah naik tidak berjaya hingga 1600.00, trend KLCI masih lagi menunjukkan pada keadaan lorongan jitu ke dasar. Masih lagi

mengekalkan keadaan bearishnya.

Selagi tidak nampak harga membuat paras kedudukan rendah yang tertinggi, selagi itu trend masih kekal pada lorongan jitu ke dasar.

Pada pendapat saya, harga support akan di tentukan pada 1400.00. Sehubungan dengan itu, saya memerhatikan harga 1400.00 berada dalam keadaan kunci keuntungan.

Sekian. W'salam.

Untuk maklumat lanjut tentang bursa saham, boleh menghubungi saya di laman ini.

Booking kelas dagangan akan di adakan seperti biasa di laman sesawang saya di profil.

Selamat maju jaya.

Yang Ikhlas,

Zezu Zaza

2048

Bottoms UPSometimes, when your life is too routine and the things you are exposed to are more or less the same, you become complacent. Go to work, come home, cook dinner, play games, sleep. Repeat and rinse.

In trading/investment, it can be the same as well. If you stick to your own local markets, the companies that are very familiar with (strong brand name, you are the customers for years, good review, etc), then you might missed out good opportunities.

Good opportunities such as markets in Thailand, Korea, Japan and Malaysia. For STI (SG market), it has only rebound from the bottom of 23 March around 22%. If you do some research, reading the news, etc you would know that these markets are faring better than STI.

They went up on average 43% from the bottom. Why wouldn't one want to make more money given the same time frame? Risks?

Unless you are venturing into the stocks in these countries which your broker might charge for a higher commission and custody fee, you are better off looking at the ETFs in these countries.

KLSE index (Malaysia) is EWM ETF

Japan index is Nikkei 225 index (futures) which most platforms will have or EWJ ETF

SET index (Thailand) is THD ETF

KOSPI index (Korea) is EWF ETF

Please do your own due diligence as the above is an example only. There are many ETFs that invest in these countries that offer different components mix and expenses. You want to look for one that offers the lowest .

I remain cautiously bullish on Asia markets now that the various countries are slowly reopening their economies and businesses are coming back as well. The consumers would still have to accept some inconvenience like putting on masks, keeping a social distance, no dine in at food outlets,etc. Other than that, being able to resume back to their pre-Covid 19 days is liberating for many who find staying at home stressful and suffocating.

Again, this chart is not exhaustive as comparing all available tradeable Asian countries would make the charts looks confusing. So , feel free to make your own index and/or ETFs comparison and decide if investing outside of your country is worthwhile, offering you a better ROI, etc.

The economy well managed. The Malaysian government make it happen. Even NASDAQ report has given a good credit for KLSE.

Malaysia is one of a big rubber producer in the world. With advantages of rubber plantations, Malaysia have a good cash flow in rubber market, the demand is coming from all the world. Demand of plastic gloves and health care supplies are high due to pandemic Covid-19, beside that Malaysian digital, multimedia and technology company are also giving the good impact. The economy impact will be boost up with the new injection and reopen domestic economy.

KLSE has get trough all the hard resistances, and still far to go. From the monthly chart view, the market price still in bearish. But in weekly and daily chart, a healthy recovery is seen in this Q3 . Crucial resistance is still need to break.

The "marubozu" Candlestick is roaring..Overall momentum remains strong, underpinned by “marubozu” candlestick pattern. Expected the index will test the psychological resistance in the near term.

Due to Malaysia Government is struggling to fight back the economy, in Q3 is seen a little bit of hope to recover back for a short period.

MCO cause a heavier impact ?Expected a weak consumer sentiment and prolonged social distancing measures to hinder sales recovery in the near-term. The trend is really bearish to me..

For those are like to shorting, this new month beginning is the ideal moment. If you find my article and analyze help you please like, follow and comment if you have any idea. Thanks.

Have your cake and eat it !Can we possibly have the cake and eat it at the same time ? I mean is there such thing as best of both world ?

If you understand the intermarket relationship between forex, stocks, commodities, etc , then there are pockets of opportunities available.

For example, those who stay in Singapore (SG) will know that SGDMYR is historically on a bullish trend. Based on the chart, we can exchange for 3.06 Ringgit (MYR) with 1 Sing dollar (SGD).

Like the recent stock meltdown of more than 30% globally, Malaysia stock market has presented those who use SGD an unparalleled advantage. Technically speaking , due to the exchange rate, we are using lesser SGD to buy MYR. So, as the stock price falls, we can buy more lots than before.

And if the KLSE index rose say 10%, you are getting more Ringgit back in your account.

That probably explains why many Singaporeans love to go to Malaysia to do shopping on the weekends, some even invest in the properties there as well.

Now, you can have your cake and eat it at the same time. Go enjoy !

Elsoft - LongA bullish flag pattern appeared, as we can see on the chart.

First TP : 0.74 (previous resistant point)

If price break 0.74 with high volume,

Second TP : 0.8.

First support : 0.66

second support : 0.62

Can cut loss at either 1st or 2nd support level.

No buy or sell call was given. Buy at own risk :)

The New Hustles For this market. The Bullish is really hard for this market, but today the resistance has been broken. And I hope that this resistance will be her supports to continue the journey to the uptrend channel.

Foresee, the new month is coming.. so I expected that a new candle will be appear. Cross finger, that the candle will be the three white soldiers.

QL is the Champion.MARKET WATCH :

The food demand is really getting high in Malaysia. Not like OIL demand, when locking down, the streets are empty.

I'm positive with this market of food will not drop easily. For those are like to invest in, put wisely and control your own risk.

Forecast the market will try harder to fight the weekly high / weekly resistance. Due to no other resistance, this can easily make a new high.

-END-

DJI - Shortfulfilled bearish setup -

triple top with decrease volume and weaker momentum.

Following the weekly pivot point,

first target - 22400

second target - 21500

third target - 20500

KRONO - 0.670 is key resistance levelKRONO - 13/05/2020

- Bullish ascending channel pattern

- MACD & RSI are bullish

- If 0.670 resistance is able to break, it is likely to go up to 0.805

- The lower trendline of ascending channel serves as immediate support level

Like & Follow:

1. FB page - BullBearBursa

2. Instagram - bullbearbursa_

3. Etoro - BullbearbursaFB