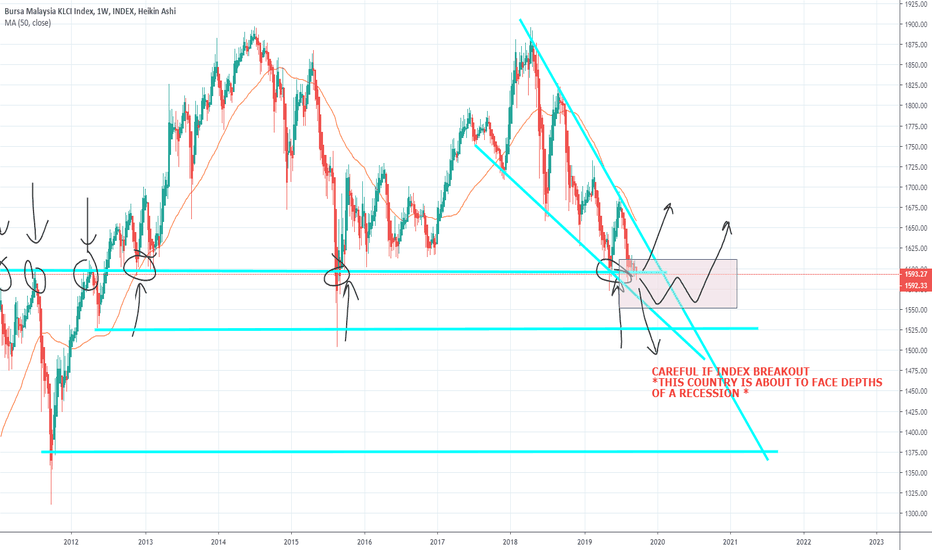

KLSE

AirAsia "Now everyone can 'Buy'". Updated View On AirAsia (6 FEB 2020)

It has never been that dirt cheap.

Now we are seeing minor resilient acts from the bulls' side.

If the bull movement stays, we shall see massive short-covering rally soon.

Too late to short, Now everyone can buy lah.

AirAsia Boleh!

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Al-Radjhi Stock Perfect Time To LongOne of the best of my stock which I made tons of money is Al-Radjhi Stock. The price already started to bullish. It is a perfect time to purchase it this 2020 in the beginning of the year. This stock will rise up above SAR80. I am strongly believe this stock will go up in the future.

Confirmation on uptrend, Bullish GartleyWith a few confirmations on the daily & weekly chart EMAs crossing, we can confirm that the trend has changed,

and we would most likely see it hit first TP 0.27, second TP 0.30.

Another confirmation signal is by using XABCD patterns, it has form a Bullish Gartley.

Trend : Bullish

Entry Opportunity for Boilermerch (0168.kl)Observation:

a) Market Stages:

- Stock is currently in the beginning of Stage 2 (Mark-Up).

b) Trend Line:

- Price traded sideways nearly 4 weeks before moving up, turning Resistance into Support.

c) Price & Volume:

- Price spread is small with very low volume during its sideway move.

- High vol. came when it broke the Resistance, currently turning it into support.

Based on observation, currently price is making a pullback with low volume.

Every trade is 50-50 since no one can predict market movement.

If entry is made, my trading plan would be as follows:

Entry Price: 63.5 sen

Stop Loss: 59.5 sen

Profit Target: 67.0 sen

KLSE WILL REVERSAL SOON?? WHEN BULLISH ENGULFING??IM WAITING FOR ANOTHER BULLISH ENGULFING.

BUT SPOTTED SPINNING TOP CS?? REVERSAL WILL HAPPEN SOON ??

ALSO MONITOR OF MACD INDI, CROSS LINE(IN CIRCLE)

..Support Tun M:. ;)

IF THE REVERSAL HAPPENED, EXPECTING MANY COUNTER WILL PROFIT.. MORE MONEY TO COME

HSS Engineering Kembali Lagi? (0185.kl)Pemerhatian:

a) Peringkat Pasaran:

- Harga berada pada awal tahap Stage 2 (Mark-Up).

b) Trend Line:

- Harga telah melepasi Downtrend (pertengahan Jul - pertengahan Sep'19).

- Harga disokong pada aras 75.5sen sebelum ia melonjak naik.

c) Harga & Volume:

- Walaupun terdapat tanda-tanda SOW, namun harga masih tetap disokong kuat.

- Terdapat satu cucian (19 Sep) dan satu percubaan (24 Sep) sebelum harga mula mendaki naik.

Berdasarkan pemerhatian diatas, saya akan trade saham ini. Walaubagaimanapun, perlu diingatkan bahawa setiap trading adalah 50-50 dan perlunya ada Trading Plan untuk kita ikuti.

Boleh lihat posting saya sebelum ini mengenai HSS Engineering.

Get ready for Khee San (6203.kl)!!- Khee San has been on a Downtrend for sometime before starting to move up early of this month.

- Price went out of the Downtrend and starting to move above previous Resistance.

- At the time of writing, we can see that after the last up move, the price spread is now narrow with volume decreasing.

- Based on experience, the price is ready to move up.

- Do bear in mind that trading is 50-50. So, always have your Trading Plan in place.

- Let's see how the price fares in the next few bars.

How high can Frontken (0128.kl) go?- Frontken has been on an Uptrend for some time. I did write about it months ago (click on the link below).

- In the recent chart, we see that the price is trying to break Resistance @ RM1.67.

- At the time of writing, we see an LC breaking through this Resistance at its 3rd attempt.

- If this is a genuine break, volume must be high and price will then do a pullback just above the Resistance line.

- One should not trade based on emotions. Let's wait and see the progress after few days.

Similar pattern in UEM Sunrise (5148.kl)?Current chart pattern in UEM Sunrise last night is similar to Gadang (click link below).

- Price was on downtrend before being supported at RM0.655.

- It then move up and now hovering above 20MA.

- There are 2 possibilities:

a) If price hovers above RM0.69 with decreasing volume, we can expect price to move up.

b) If price breaks RM0.69, it means market is not ready to move up and may move sideways. Advise to monitor from the sideline.

- If it break the support at RM0.655, then the Downtrend continues.

Let's see how the price movement in the next few bars.

Opportunity in Gadang (9261.kl)?Gadang has a good background in the last 4 weeks.

- Price moving sideways with minimal spread and volume is low.

- It has Sp, followed by a few Test with low volume.

- Price went up few bars before went down in the last bar. Assuming this is a pullback, we need to the see the price movement and volume.

- If pullback succeed, may consider entry at the following:

Entry: 0.725

Stop Loss: 0.71

- We may take partial profit at 0.78 (Resistance line).

BONIA SHORTBonia has been on a downtrend for a very long time. Bonia has recently broken out of the trendline. However, it seems as if price is about to break lower. Price has already broken ascending support level, and hit resistance level of 27.5 cents. Price will most probably retest trendline at 30 cents, before continuing down to 24.5 cents, then maybe 20.5 cents. If price breaksthrough that support level, it may hit 17 cents.