Trade Like A Sniper - Episode 43 - USDSEK - (14th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing USDCOP, starting from the 3-Month chart.

If you want to learn more, check out my TradingView profile.

Krona

USDISK Outlook: New Uptrend, Key LevelsWhat is happening to Icelandic Krona? It is obvious that ISK, just as EUR, had been effected by the political and economic instabilities in Europe. ISK mirrrors EUR to a great extent. The key factor was the Russian Invasion of Ukraine and Russian attempts to intimidate EU Energy Market and overall proximity to Europe as Iceland is the member of European Economic Area. That is where most of its imports come from as well. But unlike EUR, ISK has a history of volatile past and its past volatility and instable behaviour effects the current situation. Also consider that the USDISK monthly downtrend had been broken in February 2021, long before the war and the key factor for that was COVID and decline in tourism sector (major revenue source for the governement). Revival in tourism may stabilize the krona and keep it under 150.

At the moment the major resistance is at 150. That level had been already pierced recently. The more the level is tested and pierced the less signifcant it becomes. Price is in rapid move right now and it may push higher establising a new high. Price may of course fail at 150 and the uptrend may lose steam.

Feel free to use this chart for further ISK tendency evaluations.

FOR EDUCATIONAL PURPOSES ONLY.

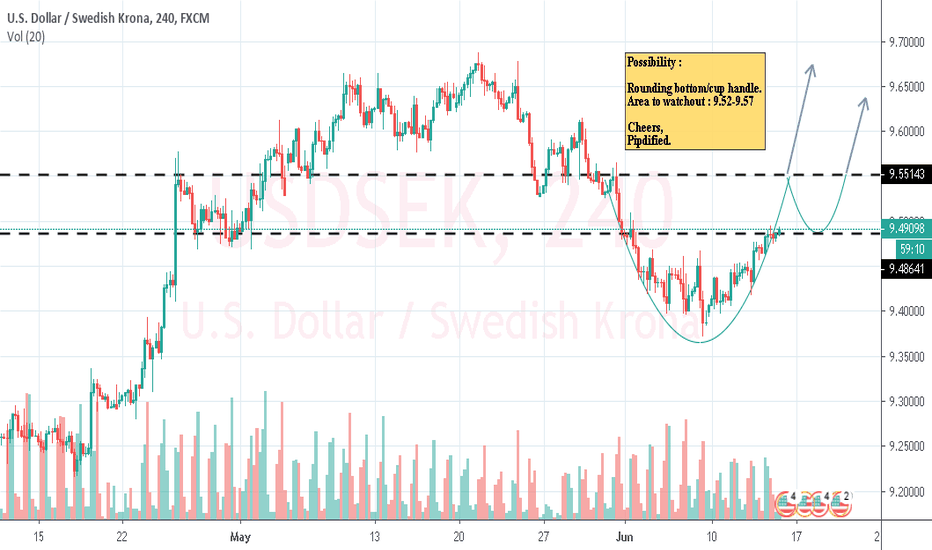

USDSEK - Let's sit & wait...USDSEK - Let's sit & wait...

Most favourite plan to do on the weekend is my weekend analysis. The market is close, going through higher TF, getting into the zone and ready to crush another week of trading!

USDSEK - Another trading pair I occasionally trade. I feel the behaviour of SEK is very interesting, i'd say I do trade relatively small on this pair but the risk/rewards are great. For now we are waiting for a break to either direction and this is a similar theme on all FX pairs I am looking at. When the market are these conditions I usually add alerts and perhaps limit orders.

Key Tip: Don't forget to follow your trade plan and if you don't have one MAKE ONE!

Trade Journal

Is the krona a new safe-haven currency?The Swedish krona is among the major currencies that are susceptible to the latest developments in East Europe alongside the Euro, and both have been a basis for market sentiment surrounding the conflict on markets and economies.

On March 7, as the third round of peace talks capped off without any breakthroughs and as energy prices surged to a 14-year high, the SEK fell to its lowest in nearly two years at almost 10 SEK per USD.

Dovish Riksbank

The Swedish central bank’s (Riksbank) recent dovish stance also weighs on the SEK. At its February monetary policy meeting, Riksbank kept interest rates at 0% and maintained the volume of its asset purchases unchanged. The decision dealt a further blow to the SEK, knocking its value by 2% shortly after the rate decision.

However, the pressure is growing on Riksbank Governor Stefan Ingves to hike rates as the central bank acknowledged the rising inflation rate as a result of higher energy prices.

Central bank peer pressure

Still, the central bank does not expect energy prices to continue to rise this year, it said in its most recent policy report, adding that inflation will likely fall back.

The central bank now expects a tightening of its policy in the second half of 2024, earlier than its previous forecast issued in November, amid peer pressure as the Bank of England recently hiked rates again to back to pre-pandemic levels, while the US Federal Reserve penciled in rate hikes at each of its remaining policy meetings this year.

Riksbank expects to raise its repurchase rate — or the interest it charges to commercial banks for short-term borrowings — to 0.06% in the first quarter of 2024 and to 0.31% by the first quarter of 2025.

Weakening SEK

In its February policy report, Riksbank acknowledged that the SEK is losing its value from its November 2021 levels based on the krona index. The central bank attributed the weakening of the krona to the rising turbulence on the financial markets.

"Variations in the Swedish krona exchange rate usually coincide with changes in risk appetite on the financial markets. In the coming years, the krona exchange rate is expected to slowly strengthen,” the central bank said.

Even before the COVID-19 pandemic, between 2013 and 2020, the SEK depreciated sharply due to lower interest rates and Riksbank’s quantitative easing. In an earlier report, the Riksbank said the depreciation of the SEK during the said seven-year period "is a puzzling phenomenon for an advanced economy” as the krona kept depreciating even when the interest differential stabilized.

Growing use as a reserve currency

Although Sweden’s economy is fairly smaller than its neighboring European countries including Germany, the UK, France and Italy, the Swedish krona has been classified as a safe haven currency for many foreign exchange watchers.

The IMF sees the SEK as the sixth non-traditional reserve currency globally next to the Australian and Canadian dollars, the Chinese renminbi, the Swiss franc, and the Korean won.

The SEK is becoming increasingly viable as a reserve currency as the US dollar’s dominance has been steadily declining over the past two decades as central banks turn to non-traditional currencies, according to a recent report by the International Monetary Fund.

The share of the US dollar in official reserve assets has decreased over the past two decades, which the IMF attributed to the increased share of non-traditional reserve currencies like the SEK, it said.

USDSEK, What to do?..If the price will fall to the level rapidly we should open scalp Buy.

But if it will approach slowly don't trade buy, it will become sell possibly.

We should get confirmation before.

The potential profit will be 3 times bigger than the risk.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

ridethepig | Remaining Short EURSEK A timely update to the EURSEK chart with 2020 flows entering into play as widely anticipated. Lets start by reviewing the concerning Macro Map in the diagram:

In the longer term, positional swings come down to a struggle between patience on the one hand and greed tendencies on the other. In this all-encompassing battle, economic strategy, though important in itself, will always need the presence of technicals in order to strive for mobility.

I am expecting sooner or later the free-fall to begin and get rid of the early dip buyers.

Good luck all those on the sell side. As usual thanks for keeping your support coming with likes, comments and etc!

ridethepig | SEK Long-Term Macro Map📍 USDSEK Long Term Macro Map

After the " Moment of Truth for SEK " flow, which was so difficult with its own inherent positional issues, the next update here should appear all too straightforward again. Of course a well planned macro flow does not have to last forever; a dollar devaluation swing which only crops up occasionally, in fact can even threaten the 6.80x support.

Some 8 candles later, the flows are following the widely mapped positional forecast. This swing has the clear fundamental advantage from the soft inherent picture in Sweden. Things have not settled down on the virus front which has become quite forgotten by many. Then of course when a second wave occurs in the Northern Hemisphere during the Winter months, the almost forgotten complacency will return, bringing a zig-zag into the initial forecast into the initial 8.20x target.

Dollar seller's last move sees the impulsive swing being instated, for the threat is now the clear advance onto the main targets. It is therefore logically and casually relevant to all G10 crosses to include the DXY maps:

At the point when this was made, Fed was seen as a deer in the headlights via Covid capitulation / flip flop and, with what immense trouble they will have now in achieving credibility after funding the Whitehouse policies in broad daylight!! Watch for the lows next week, its not quite so easy for buyers to dispose of the momentum here: if this happens we may enter into waterfall mode.

GBPSEK, What do you think? Blue or Yellow?The GBPSEK global trend is bullish but the local trend is bearish.

How do you think? Can the price bounce off the bottom borders of these channels?

Thanks for sharing your thoughts under my ideas!

I appreciate it!

Before to trade my ideas make your own analysis.

Thanks for your support!

USDSEK, Trading plan!The best places for open Buy positions will be above the Mirror Level and above the Support/Resistance Zone.

If I'll se an accurate entry point I will make an update.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

USDSEK SWING TRADE SELL IDEAThis is an idea and not a signal to sell. It is for educational and demonstration purposes only. If you enter, you trade at your own risk. Always do your own analysis to confirm you agree with any idea before trading.

With that being said,

Price reached top of ascending channel and had bearish momentum. Looking for a pullback to the trendline and continuation of sell to a key zone in the market, which is the 50% or 61.8% fib level from swing low to swing high. The trade from the pullback to the trendline is a possible 575 pips after pullback.

Trade at your own risk.

USDNOK emotional selling overreaction. Buy the dip.Emotional dumping.

People overreacting to weak inflaton figures on the usd (what a surprise bla bla bla ) whatever.

I think it could end soon.

Max target almost 3% up which is 3 ATR

Max stop loss 1 ATR down

But I aim to get out in the next 24 hours.

These are just the "max" in case something goes really wrong.

(After this strong selling I expect a strong bounce)

** Important to use small size here XD Risky.

Two possible scenariosIcelandic krona reached a critical level. It formed a classic double bottom (bullish reversal pattern) on monthly. By double bottom rules it should hit 119 (height of double bottom projected from upper double bottom neckline) pretty soon. There we also have Ichimoku cloud resistance, RSI trendline and Gann (Fibonacci) angle as you see. So 120 is critical level. Here it should turn down as future cloud is bearish. If price doesnt reverse there and breaks through RSI trendline, then its very likely to break through Kumo cloud (which is not very thick there as you see) resistance. If price hits 134 thats it, it will shoot to 193 (the height of bullish flag pole, by flag pole rules). If it turns at 120 then it will be dropping to 98-96 until 2022 from where it will shoot up anyway (or will be going in range channel btw 98-110 if Iceland's economics gets really strong). Though, I simply dont believe in Icelandic krona's stability that it will move in narrow ranges. ISK has bad history and has always been as volatile as Turkish lira. It never moved in tight ranges. So expect a bitcoinish volatility! It would be best if they would peg it to EUR or would simple "delete" it by replace it with EUR or USD.