KSMUSDTPERP

#KSM/USDT#KSM

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 19.70

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 20.00

First target 20.58

Second target 20.95

Third target 21.50

#KSM/USDT#KSM

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 18.00

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 19.59

First target 20.49

Second target 21.65

Third target 23.10

#KSM/USDT Ready to go higher#KSM

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 29.50

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 30.47

First target 31.76

Second target 34.00

Third target 36.26

KSMUSDT Reversing from the BottomKSMUSDT technical analysis update

KSM's price has broken the resistance line and formed a bullish head and shoulders pattern. It is now breaking the neckline resistance and has crossed above the 100 EMA on the daily chart. We can expect a strong bullish move in the coming days.

Regards

Hexa

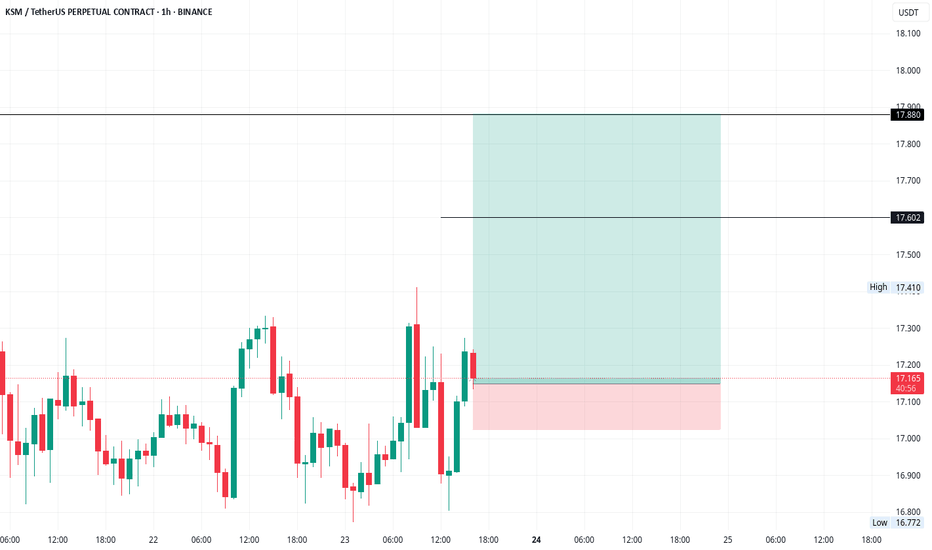

#KSM/USDT#KSM

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 16.00

We have a downtrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 18.00

First target 20.88

Second target 22.72

Third target 24.83

KSMUSDT Bouncing from Major SupportKSMUSDT Technical analysis update

KSM price has been ranging for the last 600 days, repeatedly touching and bouncing off its major support zone. Recently, the price has touched the support zone again and is now slowly bouncing from it. We can expect a bullish move from the current level.

Stop Loss : $18.00

Target: 100%-200%

#KSM/USDT#KSM

The price is moving within a descending channel pattern on the 4-hour frame, which is a retracement pattern

We have a bounce from a major support area in the color EUR at 23.00

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 22.00

First target 26.30

The second goal is 30.00

The third goal is 33.70

#KSM/USDT#KSM

We have a bearish channel pattern on a 4-hour frame, the price moves within it, adheres to its limits well, and is expected to break it upwards in a strong manner.

We have a green support area at 26.00

We have a tendency to stabilize above moving average 100

We have a downtrend on the RSI indicator that supports the price higher

Entry price is 28.30

The first goal is 30.31

The second goal is 33.14

the third goal is 36.00

Kusama (KSM) completed a setup for the next pumpHi dear friends, hope you are well and welcome to the new trade setup of Kusama (KSM) coin with US Dollar pair.

Our last successful trade of KSM was the below one and it was almost 20% pump:

Now on 2-hr time frame, KSM has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

#KSM/USDT#KSM

The price is moving in a bearish channel on a 4-hour frame.

The price is moving within it and adhering to it to a large extent. We have a support area in green, from which it rebounded at the $40 level.

We have a higher stability moving average of 100

We have a downtrend on the RSI indicator that supports the rise and is about to break higher

Entry price is 47.38

The first goal is 47.00

The second goal is 52.00.

The third goal is 58.00

KSM Waiting the buy zoneKusama is in a strong bear trend, and it's breaking support over support. I identified a strong accumulation zone on higher timeframe at 29-32 USD. I expect the price to slowly come there, and after some accumulation it should bounce. I'll wait the price there before open any trades