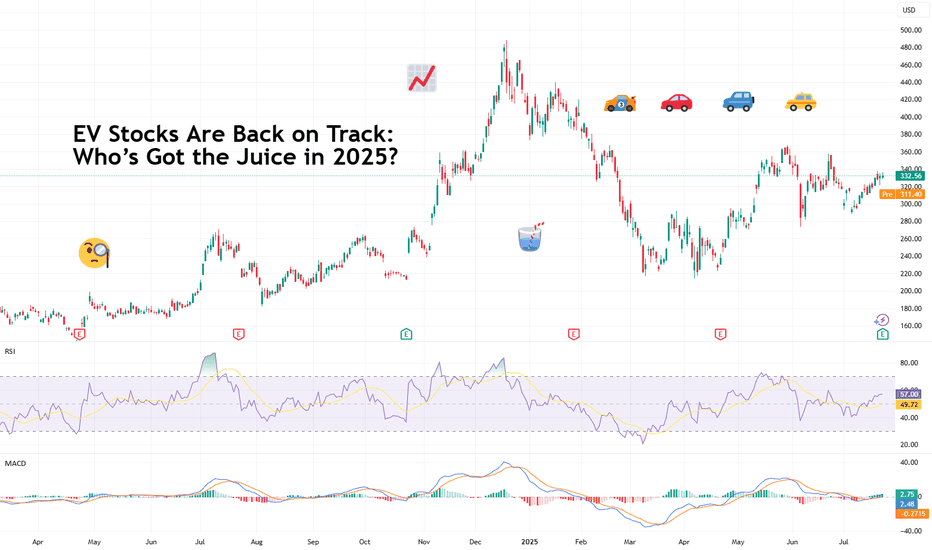

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

Lcid

LCID: Could a Saudi Buyout Send This EV Stock Back to $10?If you haven`t sold LCID before the previous earnings:

Now you need to know that Lucid Motors (LCID) is one of the most polarizing EV stocks in the market — but it’s also one of the most interesting speculative turnarounds. Yes, the company faces production challenges, cash burn, and fierce competition from Tesla, BYD, and legacy automakers. But it has some unique wildcards that most other EV startups don’t:

1) The “Musk Factor”

Musk’s public comments about Lucid being “basically controlled by the Saudis” and that they make better-looking cars than Tesla might sound like trolling, but they highlight a real truth: Lucid isn’t just another budget EV player — it’s positioned as a luxury rival with design appeal that matters to high-end buyers.

2) Saudi PIF Is Deep In — Valuation Floor

The Saudi sovereign wealth fund has put billions into LCID already — and now owns around 60%+ of the shares. They’ve made no secret of their plans to expand the kingdom’s domestic EV production and see Lucid as a flagship partner.

Rumors have swirled for years about a possible full buyout to bring Lucid fully under the PIF umbrella — or merge it with other Middle East EV initiatives like the Ceer brand. Any credible news here could double or triple the stock overnight from these depressed levels.

3) Gravity SUV & Product Pipeline

The Lucid Air remains one of the few luxury EVs that truly competes with Tesla’s Model S in both design and range. The upcoming Gravity SUV could be the next big catalyst, especially as the luxury SUV segment has fatter margins and huge global demand.

Meanwhile, the new AMP-2 factory in Saudi Arabia will help Lucid localize production, get tax incentives, and serve the Middle East and Europe more cost-effectively.

4) Technical Setup: Double Bottom Pattern

Here’s what really makes this setup tradable: LCID is showing a clear double bottom on the daily chart around the $2–$2.20 zone. The stock tested that level twice and bounced, forming a W-shaped base that can signal a reversal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$LCID - Off to the races!! 150%+ Upside🏎️ THE H5 TRADE IS NASDAQ:LCID 🏎️

It could be a very bumpy ride but, it's there if you want it!

- H5 is GREEN

- WCB forming

- Launching off Volume Shelf

- Volume GAP and Price GAPs

- Saudi Money Backing

-Downtrend breakout

-Falling wedge breakout! Could see retest before continuation higher as 60-70% of breakouts retest

Entry: $3.51

S/L: $2.34

Risk/Reward Ratio: 3

🎯$7 📏$9.75

Not financial advice

LCID , I think we just need to ride the wave to success!Hi dear traders, today we would look into Lucid Group. the luxury EV creator in the U.S. so far the company has had a very bumpy road in it's history and I am going to be honest with you I participted and caught some really good results with it , so this is why I am pointing my analysis.

Fundamental POV -

They are a leading EV company which is popular as we sad with their luxury Electric Vehicles.Recently its linep with the Gravity SUV and reported 200M Q3 revenue which surpassed expectations makes it a tasty opportunity.With confirmed production target of crossing 10,000 vehicles and a fresh funding of 1.75$ Billion Lucid is very well positioned to follow up with this bullish run.

Entry - On market open - 2.61$

Target 1: 3.46$ (covering the huge gap)

Target 2: 3.93$ going towards upper resistance level in a formulated ascending channel

Target 3: 4.40$ surpassing the Resistance Level so we can see what we can aim for next.

Keep in mind at a point in time this company's stock was 65$ per share, so we have a long road ahead of us , this overview is short/mid term.

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

Is LCID Ready to Defy Gravity?!Here I have NASDAQ:LCID on the Daily Chart.

Price has been wrestling with the ( $2.55 - $2.30 ) area all 2024, but with the new Gravity SUV finally in production:

www.tradingview.com

along with tension easing from speculation on what the Trump Administration plans to do with the EV Sector:

www.tradingview.com

We could see Price on NASDAQ:LCID take off!

Since the August High's @ ( $4.43 - $4.25 ), Price has been following a Falling Resistance but we see on Dec. 6th, Price not only became extremely Bullish testing the Falling Resistance from underneath but also:

-Built Massive Bullish Volume

-RSI Pushed Above 50

-Followed by a Bullish Candle Close outside of the Falling Resistance to start the week on Dec. 9th.

*Suggesting Market Sentiment is changing and Bulls could be getting ready to take over!

Today on the 11th we see Price has made a Pullback to the Falling Resistance to Retest the Break @ $2.28 and is currently trading up to $2.35 showing a good Bullish reaction to the Lower Prices now!

We must continue to see RSI stay Above 50 and Bullish Volume remain dominant upon Prices rise along with good output from the new product line and the company continuing to gain investing support!

Long-Term Outlook: Polestar's Potential on the 3-Day CandlesticLong-Term Outlook PSNY: Polestar's Potential on the 3-Day Candlestick Chart

Looking at the 3-day candlestick chart, we can observe some promising signs for the long term. While the price action may seem gradual, it reflects a steady build-up that could lead to significant growth in the years ahead. For those following Polestar, this chart provides a clearer picture of the broader trends and potential shifts in momentum. As always, patience is key. If the fundamentals align as expected, we could see a strong upward movement by 2026. For now, stay focused on the bigger picture and keep an eye on any key market shifts.

Lucid Group Trip Down to Lower $3's Before Uplift?! - LCIDHere I have Lucid Group, Inc - LCID on the Weekly Chart!

First, Technical. We see Price rock bottoms to its Lowest @ $2.29 on April 22 2024 and just after the Negative Earnings and Revenue report on May 6th 2024, Price creates an Equal High @ $3.35 followed by a Violation of Structure giving us a Higher Low @ $2.48 finding Support in the $2.50 Area to then make a Higher High @ $4.32!

Turning this once looking Downtrend to an Uptrend.

Prices Higher Highs and Lows are now being halted at the $4.20 - $4.40 Range where I suspect Price will need to find more Support before it can continue on to what I believe will be its next Target being the Next Swing High @ $5.31!

*Divergence in the Highs of Price relative to the Highs on RSI show Bearish Signs

The Bullish Rally in Price on August 19th left open quite a Gap to Fill from $3.83 - $3.30 and If Price is willing to fill it, the $3.46 - $3.13 Area looks very Valuable being there's:

1) - Equal High @ $3.35 being Potential Support

2) - Golden Fibonacci Zone @ $3.34 (55.9%) - $3.22 (61.8%)

(Based from HL @ $2.48 to HH @ $4.43)

3) - RSI after Breaking EQH, starts Trading Above 50

4) BBTrend Printing Smaller, Dark, Red Bars

All leading to Bullish Markers!

Now, Fundamentals. Lucid Group announced that it is set to launch not only 3 new affordable EV's but that it also plans to unveil the Gravity SUV later in the year "highlighting the company's advanced technology and mileage range on electric vehicles." In competition with Tesla's long reign.

www.tradingview.com

The "Fastest Armored Car On The Planet" is sparking investor interest with Lucid Air Sapphire is giving serious challenges to Tesla!

www.tradingview.com

The past 2 Earnings & Revenue Reports have both been Disappointing for the company but the most recent Report on August 5th compared to May 6th tell a slightly different story ..

May - Revenue Estimate (173.544M) / Reported (172.2M) = -844.404k

Aug.- Revenue Estimate (190.303M) / Reported (200.6M) = +10.279M

*Next Earnings and Revenue - November 5th 2024

LCID will be worth keeping a watch on .. Stay Tuned!!

2 Pairs, 1 Stock (AUD/USD, AUD/JPY, LCID)Hey everyone!

I wanted to take some time and put together a quick video of some pairs and a stock I've been keeping analysis on!

Interest Rate Cuts for USD will be felt in all financial markets!!

Here I point out:

AUD/USD - Weekly Pennat

AUD/JPY - Weekly Correction Pullback

LCID - Fibonacci Levels

Let me know what you think!!

Lucid Motors Price action Expectation - OpinionHere is my price action expectation and predictions for Lucid Gravity Launch.

Please note: This is just my personal opinion and not a financial advise.

I do not recommend buying or selling based on this chart. Please perform due diligence when buying or selling the stocks.

TSLA basing on its volume profile for a trade LONGTSLA on the highly reliable weekly chart is at the bottom of its volume profile in the lower

part of the high volume area. The TTM Squeeze Indicator ( TTM = Trade the Market John Carter)

has printed a signal for four weeks. The RSI faster and slower lines are near to the 50 level.

The mean relative volatility has steadily decreased and this is in an increasing squeeze state.

This is a setup for a patient trader to take a position in a swing trade. I am looking for a trade

into the upper part of the high volume area and so to the 240-280 range. I will get some shares

as well as a few call options for November (ITM). TSLA will be subjected to a number of

variables making the trade a bit risky including the Musk compensation battle, the China

economy, competition with Chinese EVs in Europe, federal rate actions and the presidential

elections as well as the evolution of self-driving. It is TSLA's volatility that makes it a great

trade. My entry signal here is a TTM indicator going black to white.

LCID CHART INTO EARNINGS TRENDS AND TARGETSIF it's bullish, here are your upper price targets.

Sharp trends leading down into a STRONG area of support.

All of which is timing out into earnings.

I would say, if the stock is in the buy zone pre earnings, it's probably a pretty solid buy where a chance of a successful trade suddenly shifts heavily in your favor.

I tried to label everything best I could on the chart.

Be careful, as I think whatever bullish move is coming, will retrace.

Sell trend is likely your exit.

Risk increases as price targets increase.

Good luck!!

LCID Anchored VWAP based swing trade LONGLCID on the 15 minute chart is shown with two sets of anchored VWAP lines overlaid being set

at the pivot low of April 22 and the pivot high of May 6th. LCID completed a trend down today

which began on May 6th. Price has reversed and is breaking up through VWAP band lines on the

chart. The faster green RSI line has crossed over the 50 level in the past trading session. Price

is now about to cross over the longer mean black VWAP line. I am taking a long trade here

targeting 2.88 for 25% of the position, 3.10 for 50% of the position and the reminder for a

runner position to extend for the uppermost band lines. The first two targets are based on the

intermediate VWAP lines as well as the upper and lower boundaries of a standard Fibonacci

retracement. The stop loss will be raised incrementally from its initial setting of

2.74 at the top on the EMA cloud. As the trend down took a few weeks. I am expecting a 2-3

week long trade following a projected trend up.

RIVN falls to fair value for swing LONGRIVN is here on a 30 minute chart with VWAP bands and a dual time frame RSI added. Price

fell from the top of the trend up after the last earnings. It is now between the mean

anchored VWAP and the first lower VWAP line which is where the reversal occurred on May 8th.

I will look for an entry long on a lower time frame chart. I am looking for a 1.75 move up

toward the second upper VWAP line in this trade while risking 0.25 making the reward for

the risk taken about 7.

FFIE in a rising channel breakout ( RIP FSR) LONGFFIE is rising in a Keltner channel with a moving average channel superimposed. On this

15 minute chart, FFIE went from a low volume trend down to a reversal with volume on the

morning onf April 8th with the continuation into April 9th. This is a volatile penny stock.

Long trades are taken when price crosses through the moving average channel especially

if there is a corresponding volume spike.

The exit when price touches or crosses the upper boundary of the Keltner channel. I

have added the ATR stop loss indicator to manage the stop loss and its advancement up as price

rises. The trend up is now 35% but could easily continue higher. I will take a long trade

here with about a 5% stop- loss targeting 0.1184 and 0.1234 as recent pivots to the left.

LCID has another falling wedge breakout LONGLCID is making its move while Fisker got halted and will be delisted. LCID has a rich uncle, a

Saudi billionaire running the national wealth fund there. Fisker lost its suitor in Nissan and tried

to raise cash by selling cars under cost. I would be afraid to buy a car from a company about

to head into bankruptcy. Anyway, time to buy LCID for now, it has a vaccine against the

contagion. I happen to be very fond of falling wedges especially when they repeat. My skills

in Elliott Wave analysis are nil but this is one to analysis. In the meanwhile, it's a buy ( no

I am not a fan of Jim Cramer.)

RIVN a trade from deeply undervalued LONGRIVN on a 60 minute chart with set of anchored VWAP lines appears to be finishing a double

bottom at the 8.5 level and making a move higher in a VWAP band breakout potnetially rising

to the mean anchored VWAP and beyond it into the upper bands. I will take a long trage here

with the targets in a textbox on the chart. I am interested in the action of the lesser EV stock

while TSLAs fundamentals are challenged by earnings constraints in the face of downward

pricing and whether discounting will stimulate demand or instead accelerate the path down as

investors may perceive the pricing scheme as a sign of weakness ( or even desperation).

LCID rises from falling wedge on news from its rich uncleLCID got news that its rich uncle the Saudi Arabia Wealth Fund will be assisting in the

manufacturing of large body parts moving forward (perhaps on the methodology of TSLA

to just massive molds to efficiently do so and at a far lower cost). Shares pumped today on the

news. Is it sustainable? Is there still time to buy a piece of the move?

On the 120-minute chart, LCID was in a falling wedge or narrowing regression channel and

broke out also on a day when other EV stocks made good moves. The MACD indicator as

well as the dual TF RSI indicator in confirmation both show bullish momentum. The algo echo

indicator ( by LuxAlgo) which looks back in time to find matching price action patterns and

then predicts the near future move, shows a predicted move to 4.05. This is confluent with the

POC line of the volume profile anchored back to November. From November 14 to December 6,

price was range bound in consolidation around the 4.05 level. My call options for 2/16 @ $3.5

did 140% today unrealized. I will add $4.00 for 2/9 expiration and watch for the anticipated

and predicted continuation.

LCID Long Trade Setup VWAP and Falling Wedge BreakoutsLCID on a 30 minute chart showed a falling wedge from mid-December to late January then with

breakout which took it 30% in one and a half days. This was a previous idea. I believe the news

catalyst from Saudi Arabia prompted a burst of trader interest. The following day, the price

began another falling wedge pattern for one week. It then broke out for a 10 % move in a short

time interval.

The chart also demonstrates the bigger moves are centered around VWAP band lines where

trading volume and volatility are the greatest. The relative volume and volatility indicators

help emphasize this point.

At this point, LCID may be turning down into another albeit smaller and lower-duration

falling wedge and is well positioned for a brief short trade. The target would be the

mean anchored VWAP at 3.25. For a better entry selection, a zoom into 3-10 minutes would

be helpful