#LDO/USDT#LDO

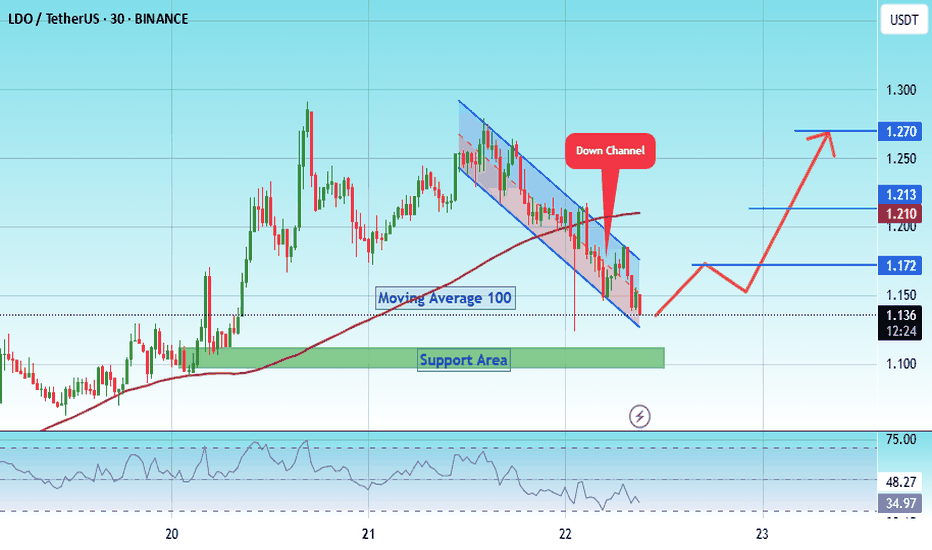

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.128.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.10, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.139.

First target: 1.172.

Second target: 1.210.

Third target: 1.270.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

LDOUSDTPERP

LDO/USDT – Symmetrical Triangle Breakout SetupLDO is trading just below a major downtrend line and forming higher lows, compressing into a symmetrical triangle. A breakout looks close!

Chart Insights:

Price approaching resistance around $0.87–$0.88

Strong structure of higher lows holding since June

A breakout above the trendline can trigger a strong move

Trade Setup:

Entry: On breakout above $0.88

Stoploss: Below $0.81

Targets:

T1: $0.943

T2: $1.009

T3: $1.076

T4: $1.166

T5: $1.265

Good volume confirmation will strengthen the move. Watch closely!

DYOR | Not financial advice

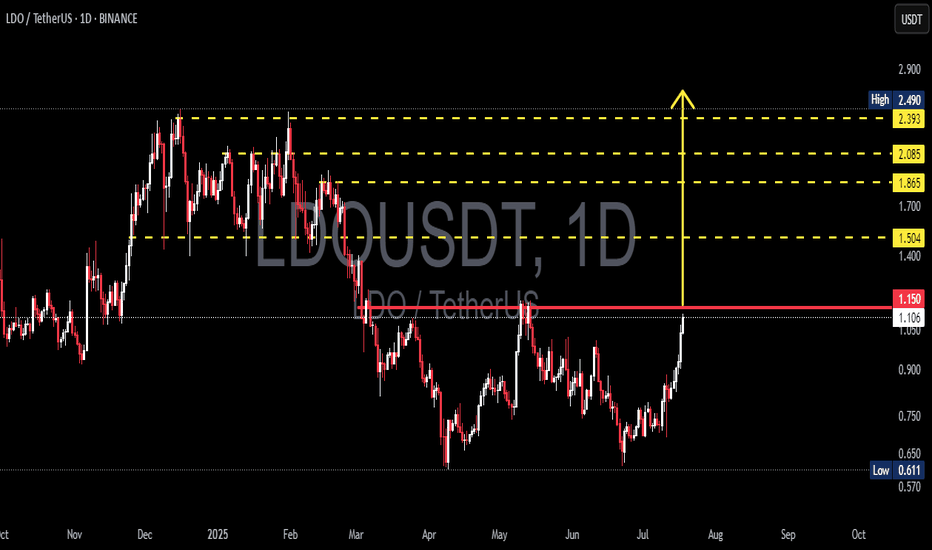

LDO/USDT Breakout Watch Ready to Fly After a Strategic Breakout?🔍 Full Technical Analysis

After months of downtrend and tight consolidation, LDO/USDT is showing clear signs of a bullish resurgence. The breakout above the key psychological resistance at $1.15 opens up a wide path toward higher resistance zones, potentially marking the beginning of a strong upward trend.

📐 Key Pattern Formed:

✅ Double Bottom Pattern

> Clearly visible from May to July 2025, with a neckline at $1.15. This is a classic bullish reversal pattern. The breakout above the neckline confirms the setup, projecting a significant upward move based on the measured height of the pattern.

✅ Horizontal Resistance Breakout

> The $1.15 level acted as a major resistance since April 2025. A clean breakout above it suggests that bulls are regaining control of the market momentum.

✅ Bullish Scenario (Primary Bias)

If the price successfully holds above the $1.15 zone and confirms it as support (successful retest), we may witness a bullish rally targeting the following levels:

🎯 Target 1: $1.504

— A minor resistance and previous consolidation area.

🎯 Target 2: $1.865

— A strong resistance level from earlier distribution zones.

🎯 Target 3: $2.085

— A technically significant level and key reaction point from past price action.

🎯 Target 4: $2.393 – $2.490

— A major supply zone and swing high from early 2025. This serves as the potential final target of the current bullish leg.

🟢 Volume increased during the breakout — a strong confirmation signal that this move is genuine, not a fakeout.

🟢 RSI likely gaining strength — though not shown on this chart, momentum indicators are likely supporting the move with a breakout from neutral levels.

❌ Bearish Scenario (If Breakout Fails)

If the price fails to hold above $1.15 and drops back below $1.05:

🔻 Potential Fakeout Risk

— A correction could send LDO back to:

Minor support at $0.90

Base support at $0.75

Major support at $0.611 (2025’s low)

📉 A breakdown below $0.611 would invalidate the bullish structure entirely, putting LDO back into a strong downtrend.

📊 Final Thoughts:

> LDO/USDT is at a critical decision point. A clean breakout from a strong medium-term structure opens the door for a significant bullish continuation. With pattern confirmation and strong volume support, this setup could mark the beginning of a mid-term uptrend.

The key lies in holding above $1.15 and watching for a healthy retest. This is a premium setup for swing traders and trend followers looking for early entries before a possible major move.

🧠 Trading Tips:

✅ Ideal Entry: On successful retest around $1.15 – $1.10

❌ Stop Loss: Below $1.00

📈 Targets: $1.50, $1.85, $2.08, and $2.49 (scaling out recommended)

#LDO #LDOUSDT #CryptoBreakout #AltcoinRally #TechnicalAnalysis #DoubleBottom #CryptoSignals #TradingViewIdeas #SwingTradeSetup #BullishPattern

#LDO PUMP TO $ 0.794 ?#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.703.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.695, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.730

First target: 0.744

Second target: 0.767

Third target: 0.794

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.741.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.780

First target: 0.805

Second target: 0.837

Third target: 0.870

#LDO/USDT#LDO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.988.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.008

First target: 1.022

Second target: 1.042

Third target: 1.067

LDO - big lie - Many influencers have been touting this coin.

- the coin is found in the side

- the exit was down and I expect the downtrend to continue

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.20

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.23

First target 1.28

Second target 1.34

Third target 1.41

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.64

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.80

Second target 1.87

Third target 1.95

Public trade #16 - #LDO price analysisUsing the "scientific poke method", we decided that it was time for the MIL:LDO price to continue its long and stable upward trend. To “round and beautiful” - $10

And since “someone” has aggressively bought back OKX:LDOUSDT twice from the $1.40-1.56 range, we'll buy some there as well)

So, will it be: one, two, three and off we go?)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

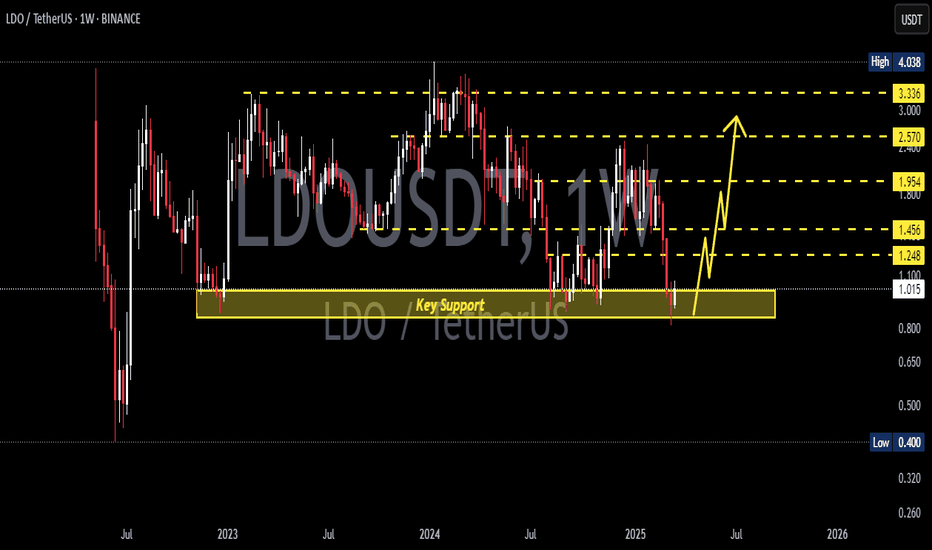

LDO/USDT Consolidates: Ready for a Breakout After 917 Days?$LDO/USDT is currently trading within a wide sideways range for the past 917 days, consolidating between the key demand/support zone and the key supply/resistance zone.

A potential bullish breakout could occur if the price breaks and sustains above the upper marked resistance zone.

This breakout may lead to a significant upward move, making it a critical level to watch.

DYOR, NFA

#LDO/USDT#LDO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.80

Entry price 1.84

First target 1.885

Second target 1.94

Third target 2.00

Lido LDO price has woken up and is ready to surprise everyone ?)Just look who has woken up - CRYPTOCAP:LDO

After almost a year-long downward trend and 3 months of consolidation, it showed an increase of +50% in 1 day !)

Does anyone know what “stimulated” it so much?

Speaking purely on the OKX:LDOUSDT chart, it is not advisable for the price to fall below $1.10-1.15 in the coming days.

If this condition is met, then we can start dreaming of continued growth to the $2.25-2.40 area.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#LDO/USDT Ready to go up#LDO

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.14

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.17

First target 1.20

Second target 1.25

Third target 1.29

Lido DAO Faces Legal and Market Turmoil: In a landmark ruling, a California court has classified Lido DAO, the decentralized organization behind the popular liquid staking protocol, as a general partnership, raising significant concerns for DAO governance structures and their participants. This decision reverberates through both the legal and crypto landscapes, highlighting vulnerabilities in decentralized governance.

Legal Developments Shake Lido DAO

The U.S. Northern District Court of California rejected Lido DAO’s claim of not being a legal entity. Instead, the court deemed it a general partnership, making identifiable participants liable for the DAO’s actions. Judge Vince Chhabria, in his ruling, emphasized the precedent-setting nature of this case:

> “ presents several new and important questions about the ability of people in the crypto world to inoculate themselves from liability by creating novel legal arrangements to profit from exotic financial instruments.”

Prominent Lido governance participants, including Paradigm Operations, Andreessen Horowitz (a16z), and Dragonfly Digital Management, were implicated as general partners. Notably, Robot Ventures was dismissed from the case due to insufficient evidence of active involvement.

Miles Jennings, General Counsel at a16z crypto, described the ruling as a severe blow to decentralized governance:

> "Under the ruling, any DAO participation (even posting in a forum) could be sufficient to hold DAO members liable for the actions of other members under general partnership laws."

This development raises pressing questions about the future of decentralized finance (DeFi) and the legal safety of participating in DAOs.

Technical Outlook for MIL:LDO

Amid the legal turmoil, Lido’s native token, MIL:LDO , has seen volatile price movements. As of writing, MIL:LDO is down 4%, trading within a falling trend channel. Here's what the technical indicators suggest:

1. Support and Resistance Levels: Current support lies near $1.133, aligning with the confluence of moving averages, indicating strong defensive support at this level. On the upside, MIL:LDO could rebound to the $2 resistance level, representing a critical juncture for a potential breakout.

2. Chart Patterns: The daily price chart reveals an enclosed rectangle pattern*, showcasing periodic up-and-down movements. A breakout from this pattern, especially in the bullish direction, could significantly impact the token's trajectory.

3. Market Sentiment and TVL: The general crypto market remains bullish, which could provide tailwinds for $LDO. Data from DeFiLlama indicates that Lido remains one of the largest players in the liquid staking space, with a promising Total Value Locked (TVL) figure that reinforces its dominance in DeFi.

What’s Next for MIL:LDO ?

This ruling sets a precedent that could deter active participation in DAOs, especially among institutional investors. However, it also serves as a wake-up call for DAOs to reassess their governance structures and liability frameworks.

Market Implications:

Despite the legal challenges, Lido’s fundamental metrics remain robust. The protocol continues to be a leader in liquid staking, holding a substantial share of the market. If MIL:LDO consolidates around the $1.133 support level and leverages the bullish sentiment in the broader crypto market, a rally to $2 or beyond is possible in the near term.

Conclusion

In conclusion, Lido DAO finds itself at a crossroads where regulatory challenges meet market potential. The coming weeks will likely determine whether the protocol can overcome legal hurdles and maintain its position as a DeFi heavyweight.

#LDO/USDT#LDO

The price is moving in a descending channel on the 4-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.00

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.07

First target 01.16

Second target 1.27

Third target 1.35

LDO target $1.984h time frame

-

Entry: $1.24

TP: $1.9875

SL: $1.0575

RR: 4.1

-

(1) Symmetrical structure is creating, high possibility to reach previous high

(2) Strong pump recently that bring LDO from $0.87 to $1.45 in two days

(3) Getting support at fib 0.618, which is $1.24

(4) $2.5 will be easy to hit if momentum is enough based on the flipped structure

(5) Stop loss once going below $1.0575