Learn How to Trade Wedge Patter | Full Strategy Explained 📚

Hey traders,

In this video, you will learn how to trade wedge pattern.

We will discuss the theoretical basics of this pattern.

Then, on a real market example, I will show you how to spot and trade it.

❤️Please, support this video with like and comment!❤️

Learntotrade

Thursday 15TH September REVERSAL SHORT EURGBP 250 pipsStop BUYING! Thursday 15TH September 2022, 12:00PM Will push up to max 0.8740-0.8770 and will DROP new short trend good for minimum 250 pips

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

Learn TOP 5 Tips For Trade Management 📖

Hey traders,

In this post, I will share with you my tips for trade management.

But first, let me elaborate on what is exactly a trade management.

Trade management is the set of rules and techniques applied for managing of an already active position.

Trade management is a very important element of any trading strategy that should never be neglected.

1. Never remove a stop loss

Being in a huge loss, many traders refuse to admit that they are wrong. Instead, watching how the price moves closer and closer to a stop loss, they remove stop loss hoping on a coming reversal.

The alternative situation may happen when the price is going sharply in the desired direction. Watching the increasing profits, traders remove a stop loss, being afraid to miss bigger profits.

Both situations may lead to substantial, higher than initially planned losses. Driven by many factors, the market can easily burn all gains and move against the desired direction much longer than traders stay solvent.

For these reasons, never remove a stop loss. It must be always set.

2. Never modify your stop loss if a position is in loss

Watching how the price moves closer and closer to a stop loss is painful. Instead of removing stop loss, some traders move it and give the market more space for reversal.

Even though such a technique is safer than the complete stop loss removal, it is still a very bad habit.

Each stop loss adjustment increases the potential loss, not giving any guarantees that the market will reverse.

It is highly recommendable to keep your stop loss fixed and let the price hit it and admit the loss.

3. Know in advance your profit protection strategy

Where do you take your profit?

Do you have a fixed tp level or do you apply trailing stop?

You should always know the answers.

Coiling around take profit level but not being able to reach it, the price makes many traders manually close the trade or move take profit closer to current price levels.

Another common situation happens when the market so quickly reaches the desired TP level so the traders remove TP hoping to make bigger than initially planned profit.

Such emotional interventions negatively affect a long-term trading performance. TP removal may even burn all profits.

Do not let your greed intervene, and always follow your rules.

4. Never add to a losing position

Watching how the price refuses to go in the intended direction and cutting a partial loss, many traders add to a losing trade in hopes that the market will reverse and all the losses will be recovered.

Again, such a fallacy usually leads to substantial losses.

Remember, you can add to a position only AFTER the market moved in the desired direction, not BEFORE.

5. Close the trades manually only following rules

Quite often, newbie traders manually close their trades because of some random factors:

they saw someone's opposite view, or they simply changed their mind.

Remember, that if you opened a trade following your trading plan, you should always have strict rules for a position manual close. Do not let random factors affect your trading.

Following these 5 simple tips, your trading will improve dramatically. Remember, that it is not enough to spot and accurate entry. Once you are in a trade, you should wisely manage that, following your plan.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Trading needs to be treated like a business 🧑💼This is spoken about a lot but what does it mean?

In starting a business you would need funding and a business plan, right?

You would have realistic goals mapped out and be focused on your cashflow.

You wouldn't blow your 'cash' in recruiting too fast, or buying too much stock or spending too much on marketing.

Yet, in trading most don't have a plan. Or focus on protecting their cash.

They also don't think long term in line with their plan.

They over estimate their expectations short term and in doing so mess up what they could achieve long term.

You just wouldn't do this in business right?

No one would open or run a business you knew nothing about.

Most come in to trading thinking this will be easy! It's not and we all come in knowing nothing.

So again would you start any other business with no training or idea?

Most can keep the trading cash flow topped up as we all start out on this journey having another job to fund trading.

There is no such thing as a sure-fire way to make money online. However, if you seriously want to make money out of forex trading it needs treating like a business.

In a lot of ways, being a trader is like being an entrepreneur. It takes more than just knowledge and a killer idea.

It also takes hard work, discipline and mental preparation.

The reason it’s a good idea to treat forex trading like a business is because as a trader, your account is your own business.

Trading isn't about the quick money it's about being consistent.

That consistency comes from having a plan and sticking to it much like you would a business plan.

Treat losses as a cost of business and factor them into the plan.

The business plan for you the trader will be the strategy and risk management you opt to run.

Set realistic targets and goals this will ensure suitability, Much how good businesses set up there own goals and aims for coming year with out being to risky.

If you lack on the knowledge front in certain areas invest in education and training, No successful business neglects training and learning.

Invest in resources that will help your business grow. Yes TradingView is free but having a higher package and more data help me just as an example.

There is no other business in the world like trading where the over heads and start up cost are low, So if paid resources can kick you on to next level factor them in as a cost of business.

Keep treating trading as a hobby and it becomes an expensive one.

Start treating trading as a business with the ethos and cultures applied the same as those of successful businesses and that profit starts to come naturally.

Thanks for taking the time to read my idea.

Hope you all have a good weekend

Darren 👍

Maybe a slight delay as our beloved Queen has passedif doesn't drop today most likely a consolidation up to and around 0.8731-0.8760 until next Thursday 15th September 2022 12:00pm but rest a sure WILL DROP!

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

GBPUSD long 500 pips!TOMORROW WE WILL HAVE LIFT OFF 12-13:00 THURSDAY 8th SEPTEMBER 2022

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

EURGBP SHORT 230 PIPS DROP!by 13:30 we will reverse and FALL

DO NOT BUY!!!!

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

EURGBP SHORT 230 PIPS DO NOT BUY!max push up to 0.8745 tomorrow will REVERSE and drop to first TP 0.8490 DO NOT GET CAUGHT UP IN THIS LONG! Look at the chart and ask yourself is it wise to buy at the top!

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

EURGBP SHORT 230 PIPS230 PIPS COMING UP THURSDAY 8th SEPTEMBER 2022 12-13:30

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

short term LONG EURGBP! Quick 40 pipsQuick pips to 0.8687

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

Fireworks coming 520 pips! GBPUSD First TP 1.1938 520 PIPS INCOMING LATER THIS WEEK! Thursday 4th September 2022 around 12-13:30

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

look into my crystal ball A STORM IS COMING Thursday 4th September 2022 12:00-13:30 we will fall First TP 0.8485

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

Nice SHORT SETUP COMING UP EURGBP DO NOT BUYFirst TP to 0.8485 be patient will FALL THURSDAY 4th SEPTEMBER 2022 between 12pm and 13:30!!

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

Learn How to Trade Fibonacci Levels | Full Guide 📚

In this short video, I will teach you to apply Fibonacci retracement tool.

We will discuss the common levels to apply.

I will show you real market examples and we will discuss important theory.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

EURGBP SHORT 80 PIPSShort for 80 pips coming up 1st TP 0.8460..... If it breaks 0.8556 then next level to short from would be 0.8578

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

EUR/USD SHORT OPPORTUNITY 0.96 INCOMINGI hate explaining myself on this bs description box but anyways ive made the word count so i dont need to explain anything now lolll. Self Explanatory Charts!

i value my time so if anyone is willing to put in the effort to learn a few things about the markets then im here to help at no costs! hit me up

EURGBP SHORT 60 PIPS DO NOT BUY!DO NOT BUY!!

SHORT FOR 60 PIPS MINIMUM ALL INFO IN IDEA

No nonsense approach simple clean price action trading all info in picture apart from the strategy (use your own SL according to your OWN risk management)

THIS IS NOT FINANCIAL ADVICE, MY OWN ANALYSIS FOR PERSONAL USE)

FOLLOW SHARE LIKE IF YOU WANT MORE clean ideas

82FX

HOW TO SET STOP LOSS | 3 STRATEGIES EXPLAINED 📚

Hey traders,

In this post, we will discuss 3 classic trading strategies and stop placement rules.

1️⃣The first trading strategy is a trend line strategy.

The technique implies buying/selling the touch of strong trend lines, expecting a strong bullish/bearish reaction from that.

If you are buying a trend line, you should identify the previous low.

Your stop loss should lie strictly below that.

If you are selling a trend line, you should identify the previous high.

Your stop loss should lie strictly above that.

2️⃣The second trading strategy is a breakout trading strategy.

The technique implies buying/selling the breakout of a structure,

expecting a further bullish/bearish continuation.

If you are buying a breakout of a resistance, you should identify the previous low. Your stop loss should lie strictly below that.

If you are selling a breakout of a support, you should identify the previous high. Your stop loss should lie strictly above that.

3️⃣The third trading strategy is a range trading strategy.

The technique implies buying/selling the boundaries of horizontal ranges, expecting bullish/bearish reaction from them.

If you are buying the support of the range, your stop loss should strictly lie below the lowest point of support.

If you are selling the resistance of the range, your stop loss should strictly lie above the highest point of resistance.

As you can see, these stop placement techniques are very simple. Following them, you will avoid a lot of stop hunts and manipulations.

How do you set stop loss?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

XAU/USD * Gold Next Possible MovementXAU / USD ( Gold / U.S Dollar ) Technical Analysis Chart Update

Time Frame - H2

According to Pattern in Long Time Frame #LTF it is Following Falling Wedge and Completed its Retest

In Short Time Frame #STF it is Following Bearish Trend Line very Strongly so its possible that it can Go till Upper Trend Line #UTL and if it breaks abd retest then its Again buy

It is Currently at Demand Zone and Rejecting from Fibonacci Level - 38.20%

It has Completed its Impulsion and it making its " C " corrective way in Long Time Frame #LTF - Daily

In Long Time Frame #LTF we have Buying Divergence #RSI as well

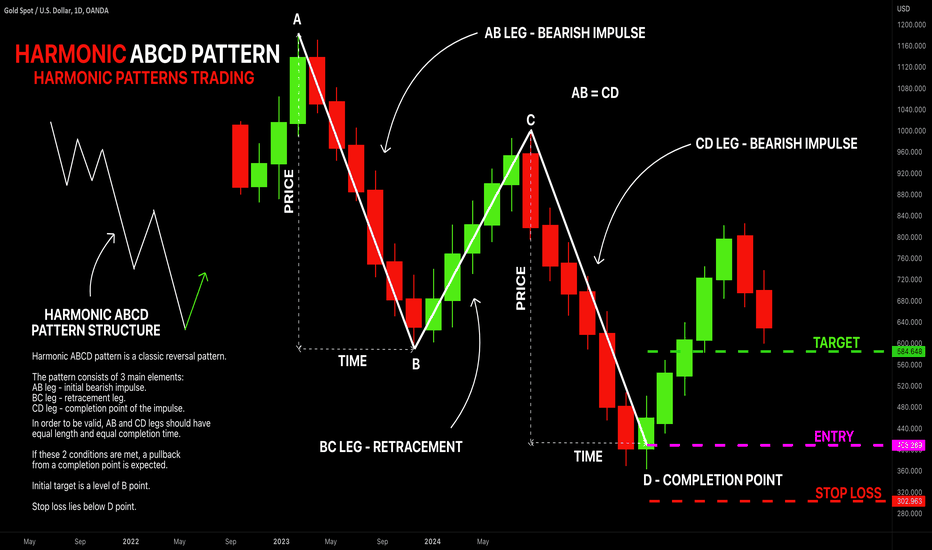

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Ethereum Classic forecast and signalLearn and Earn!

After breaking the price of 42 USDT and confirming the break.

Confirmation of the break of resistance or support in this 1-H chart; that is, the bar (or candle) closed at the top of the resistance or support price, as well as the next candle, growing at least around 5 pip ( in forex usually call it pips ) or units ( 5 pips in cryptocurrency is around: 0.10%) more than the maximum price of the last closed candle.

---------------------------------------------------------

Please pay attention!

First: Trades have a time term , and in this case, it's from now until the next 24 hours. (You can also see it in the diagram)

Second: You can see the entry price in the chart.

So for this one, the trade is activated when the price reaches and crosses $42 (USDT)

Before the price crosses the mentioned place, the trade position is not active.

---------------------------------------------------------

Please write any advice or suggestions.

Dear friends, request any cryptocurrency pair, currencies pair for forex, and any index that you want to be analyzed and ask any questions.

Thanks for your attention