Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

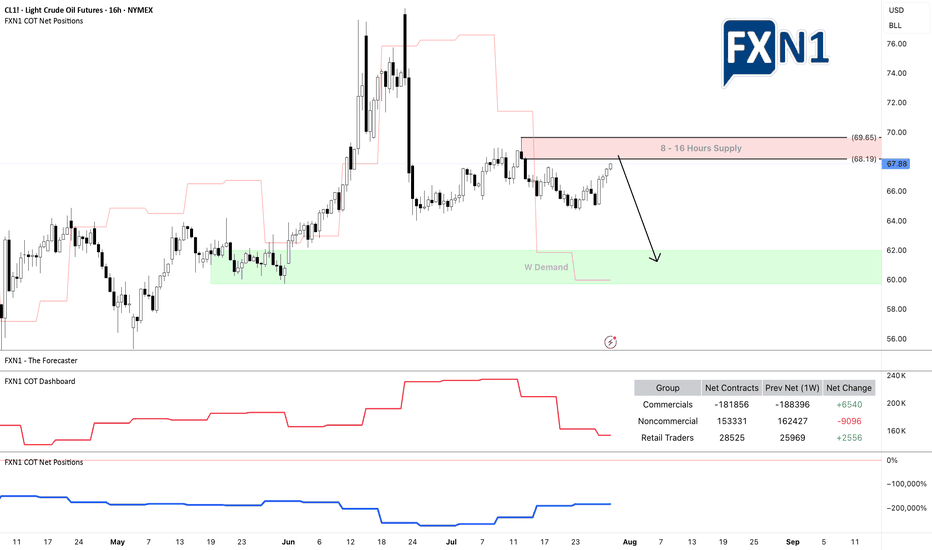

Since his post, oil prices experienced a notable bullish impulse. From both fundamental and technical perspectives, the market is now approaching a 16-hour supply zone, which could serve as a potential resistance area.

Additionally, I’ve observed a divergence in trader positioning: non-commercial traders increased their short positions significantly last week, while retail traders remain long. This divergence between price action and non-commercial positions suggests a possible shift in momentum, and I am currently eyeing a short setup.

As always, I encourage traders to conduct their own analysis. The trader featured below operates on the D1 timeframe and focuses on scalping, which can be useful for short-term entries.

Stay cautious and keep an eye on how the market reacts near the identified supply zone.

✅ Please share your thoughts about CL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Lightcrudeoil

Light Crudeoil Futures hourly trend forecast for March 24, 2025According to my analysis, this commodity is at its strong resistance at 68.46 and the likely support levels are at 67.56 and 66.83.

According to my "Advanced Market Timing" indicator, Light Crudeoil Futures is likely to see a bearish trend and then bounce back.

Those who trade are suggested to use your own technical studies for entries, stops and exits.

Support around 73.25 is the key

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(CL1! 1D chart)

The point to watch is whether it can rise above 73.25-74.62.

Since the M-Signal indicator and MS-Signal (M-Signal on the 1D chart) indicators on the 1W chart are passing around 73.25, it is expected to be the first resistance zone for the rise.

The M-Signal indicator of the 1M chart is passing around 74.62, so it is expected to be the second resistance zone.

-

If it receives resistance and falls,

1st: 70.64-71.0

2nd: 68.18-68.94

You should check whether there is support near the 1st and 2nd above.

-

(30m chart)

Resistance: M-Signal indicator of 1D, 1W chart

Support: 5EMA+StErr indicator of 1D chart (71.78)

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

CL Bearish Outlook Look like after price took out BSL at the PDH from 80.16 it has moved lower and has been targeting PDLs. There is a nice discount D BISI that I believe price will trade into and if price is truly Bearish then it will trade right through the D BISI CE level and find minimal support and then the next area of focus could be the double bottom at 72.70

Lets continue to watch price and see how it delivers.

CL Week Review 01/06/25 - 01/10/25Looks like my Directional Bias for CL was off. Instead of price coming lower to fill in the BISI and take the PDLs it rallied higher through the Volume Imbalance and raided all the BSL. Now that wick higher on Friday did not stop at a random spot. Look closely and you will notice its the Premium Daily 50% CE level of the wick and price reversed nicely off from there.

Now the question remains does price justify to continue higher and take the BSL at 78.46 or does price reverse from there and then target the SSL and the D BISI?

Currently its still looking Bullish since price closed above the Volume Imbalance and the PDH from Thu Oct 10 2024 at 76.24 but lets see how price opens on Sunday and we can definitely expect a volatile week since there is a good amount of economic news drivers.

HTF Directional Bias for CL

I like the fact that price traded higher into a premium and found rejection off the Volume Imbalance 50% CE level as it clears the BSL above the PDHs.

Currently price is trading inside the wick from the Mon 06 Jan 2025 and looks to have reached as low as the 25% quadrant level.

My bias for CL is Bearish as I am looking at the two PDLs in discount above the D BISI which should act as a draw for price to reach lower and clear that SSL at 73.11 and 72.70 From there I could expect price to dip into the D BISI and reject possibly off the high or 50% CE level.

WTI Crude Oil Outlook: Eyeing Potential Demand Zone RecoveryWTI crude oil is currently trading around $68.25 as of this Tuesday, following a significant gap-down opening to start the week. The move lower was largely influenced by easing tensions in the Middle East, as recent developments suggested a more contained military approach, which alleviated fears of a broader conflict that could disrupt oil supply.

Upcoming U.S. Economic Data: GDP and Nonfarm Payrolls in Focus

The U.S. economic calendar this week includes key data releases, beginning with the flash Gross Domestic Product (GDP) report for Q3 on Wednesday, projected to show an annualized growth rate of around 3%. A stronger-than-expected GDP figure could bolster the USD, adding pressure to USD-denominated assets like crude oil, as a stronger dollar makes oil more expensive for holders of other currencies. Following the GDP report, Friday’s Nonfarm Payrolls will provide additional insight into U.S. labor market conditions, which could further influence dollar strength and, subsequently, WTI prices.

Technical Analysis: WTI Trading in Demand Zone

From a technical perspective, WTI crude is currently positioned within a demand zone, where buyers could be eyeing a recovery of Monday's gap-down. This demand zone represents a critical area where traders are observing whether buying interest will drive prices higher to close the gap. A recovery attempt here, with a tight stop loss, could offer a favorable risk-to-reward setup, particularly if data later in the week doesn’t significantly strengthen the USD.

Conclusion

The WTI crude oil market remains vulnerable to geopolitical developments and U.S. economic data this week, with a stronger USD potentially capping any recovery attempts. However, should the upcoming data align with current estimates or underperform, there may be room for WTI to rally from its demand zone, attempting to reclaim some of the lost ground from the recent gap-down. Traders may want to monitor these key levels and events closely, as they could provide both direction and confirmation for near-term price movement in WTI crude oil.

✅ Please share your thoughts about WTI in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

US Crude Oil Prices Hover at $82: Bearish Setup in Sight?US crude oil prices continue to fluctuate within a sideways trading range, currently hovering around the $82.00 mark. This consolidation phase has presented an intriguing supply area, suggesting a potential bearish movement in the near term.

In this context, it's essential to consider the positions of various market participants. Commercial traders, who often include producers and large institutions, are maintaining a bearish stance. This bearish sentiment from the commercial side contrasts with the behavior of retail traders, who are currently in buying mode. This divergence between commercial and retail positions can be a significant indicator of potential market direction.

Given the current market conditions, we are monitoring this supply area for a bearish setup. On a daily timeframe, the possible targets for this bearish movement are the next demand areas. These zones represent potential levels where buying interest might re-emerge, providing support to the prices.

While there isn't a strong seasonal trend supporting a bearish continuation, statistical analysis suggests that there could be a bearish impulse lasting until mid-August. This potential decline aligns with historical patterns, even though the current market lacks a definitive seasonal bias for a prolonged bearish trend.

The interplay between commercial and retail traders' positions provides a nuanced view of market sentiment. Commercial traders' bearish outlook, combined with the retail traders' bullish stance, creates a dynamic environment that could lead to significant price movements. This scenario highlights the importance of closely monitoring market sentiment and positioning to identify potential trading opportunities.

In conclusion, US crude oil prices remain in a sideways range around $82.00, with an interesting supply area indicating a possible bearish movement. The contrasting positions of commercial and retail traders add complexity to the market outlook. Despite the absence of strong seasonal trends, statistical analysis suggests a potential bearish impulse until mid-August. Traders should remain vigilant and consider these factors when developing their trading strategies in the current market environment.

✅ Please share your thoughts about Crude Oil in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

WTI Oil Prices Face Selling Pressure as Fed's Hawkish Stance...WTI Oil Prices Face Selling Pressure as Fed's Hawkish Stance Dominates

Western Texas Intermediate (WTI) crude oil prices are grappling with selling pressure, hovering around the $88.80 mark. The Federal Reserve's recent meeting and its hawkish stance have cast a shadow over oil prices, complicating the outlook for the energy market.

Here are the key factors influencing WTI oil prices:

1. Fed's Influence on Oil Prices:

Following the Federal Reserve's recent meeting, WTI oil prices experienced a continuation of selling pressure. The Fed opted to keep interest rates unchanged and issued hawkish comments. Fed Chairman Jerome Powell reiterated the central bank's commitment to achieving a 2% inflation target and expressed readiness to raise rates if deemed necessary. The prospect of higher interest rates in the US has a direct impact on oil prices. Elevated interest rates can raise borrowing costs, potentially slowing economic growth and reducing oil demand.

2. Saudi Arabia's Stance on Oil Production:

Saudi Crown Prince Mohammed bin Salman clarified that OPEC's decision to reduce oil production was primarily motivated by a desire for market stability and not aimed at supporting Russia's actions in Ukraine. In recent weeks, both Saudi Arabia and Russia, the world's top two oil exporters, announced voluntary production cuts. These measures have played a role in supporting WTI prices, with both countries committing to sustaining reduced oil output until the end of 2023. Saudi Arabia is set to limit its oil production to approximately 1.3 million barrels per day through the end of 2023.

3. Crude Oil Inventory Reports:

Crude oil inventory reports have also influenced market sentiment. The American Petroleum Institute (API) reported a significant decline of nearly 5.25 million barrels in US crude oil inventories for the week ending September 15. This contrasted with the previous reading, which showed a rise of 1.174 million barrels. Market expectations had been leaning towards a 2.7 million-barrel decline. Additionally, the Energy Information Administration (EIA) reported a decrease of 2.135 million barrels in crude oil stockpiles during the same period, compared to a previous increase of 3.954 million barrels. The market had anticipated a drawdown of 2.2 million barrels.

4. Upcoming Economic Data Impact:

Looking ahead, oil traders are closely monitoring several economic data releases that could significantly influence WTI prices. These include the US weekly Jobless Claims, the Philly Fed Manufacturing Index, and Existing Home Sales, all scheduled for release later on Thursday. Furthermore, the preliminary US S&P Global PMI for September is expected to be released on Friday. These events will be of particular interest to traders as they could impact the USD-denominated WTI price.

In conclusion, WTI oil prices are currently navigating a complex landscape, with the Federal Reserve's hawkish stance and global oil production dynamics playing key roles. The energy market will closely follow economic data releases for insights into the future direction of oil prices, offering trading opportunities for investors.

Crude Oil Futures: Open Interest and Technical AnalysisPreliminary data from CME Group indicates that open interest in crude oil futures markets increased for the fourth consecutive session on Monday, registering a gain of approximately 4.3K contracts. Conversely, trading volume decreased for the third consecutive session, declining by roughly 260.5K contracts.

Technical analysis indicates that the crude oil price has retraced to the 50% Fibonacci level in combination with the previous resistance area, suggesting the possibility of another bearish leg (AB=CD pattern) with a target of approximately HKEX:62 or lower.

Alternatively, the next significant resistance level for the crude oil price could be around $80.00.

Given the rising open interest, the daily uptick in price is likely to continue the recovery in the near term. The key target to watch for is the $80.00 per barrel mark.

UKOIL🛢️ macro movesBrent Crude Oil : Multiyear(2015-2022) inverted Head and Shoulders triggered at the beginning of this year. Price broke the major downtrendline and subsequently iH&S neckline at 87 (lime) and then skyrocketed to 138. Now pulling back down to the neckline. We could actually see the backtest of the major downtrendline and dip into the S/R Zone 76-68. This would be great buying opportunity. Price shouldn't get much below right shoulder (65.8), otherwise the setup would be invalidated. Will set SL to 60, Target 157.

Check my other stuff in related ideas.

Please boost🚀, comment🗣️, follow me✒️, enjoy📺!

⚠️Disclaimer: I'm not financial advisor. This is not a financial advice. Do your own due dilingence.

WTI: It all comes down to the green… 💵🌿It all comes down to the green . This saying is especially true for WTI as it has yet to dive into the green zone between $70.12 and $35.77. To get this done, the course should push further off the upper side of the turquoise trend channel and drop below the support at $70.08. This should grant WTI direct access to the green zone, where it should finish wave 2 in green before heading northwards again. However, a 32% chance remains that WTI could turn upwards and climb above the resistance at $82.64, in which case the course would develop wave alt.(b) in blue above the upper resistance line at $93.74 first before resuming the descent.

Range Trading Light Crude Oil-Crude oil is currently trading in a ranging market environment between 83.34 and 70.08 (larger range). Price is also in a smaller range between 82.66 and 72.46 (smaller range).

-From how I see the markets, the 10AM Feb 23 candle was a retest of a fair value gap before a move higher continues aiming between 79.73 and 81.50 price levels. I would like to see the fair value gap left open and not rebalanced completely.

-Bias: Bullish (within the ranges outlined only)

-Why? Some buyside liquidity will likely be rebalanced with a possible sweep to the upside to test the 83.00 level.

-Targets: 79.73-81.5, possibly up to 82.66 for a sweep.

WTI: Safety net 🧗Although the Oil might need a little persuasion, we're expecting the course to drop below the support line at $70.08 to continue with the downwards slope of the blue wave within the green target zone. Once completed, the blue wave should pump the course back up, before it ultimately hits the corrective low of the green wave .

WTI: StretchingWTI is done recovering and has finished wave b in blue. Already, it is stretching upwards, striving to work on our primary scenario. We expect the marker crude to climb above the resistance at $97.66 and into the turquoise zone between $99.97 and $113.53, where it should complete wave b in turquoise. After this feat, WTI should relax once more and fall into the green zone between $70.12 and $35.77 to conclude the overarching downwards movement. There is a 35% chance, though, that WTI could tackle this task directly, dropping below the support at $76.25 earlier already.

WTI: Screeeeeech!Can you hear WTI’s brakes screeching from the chart? Well, we definitely can! Quite vehemently, WTI has hit the brakes just short of the bottom of the blue zone between $91.70 and $87.08 – and rightly so! There isn’t all that much room left to finish wave b in blue! In fact, WTI should complete it no later than the support at $85.73. Then, it should turn around and climb upwards, gradually crossing the resistances at $101.88 and at $105.24 to enter the turquoise zone between $107.12 and $119.94. There, it should finish wave b in turquoise, before moving downwards again. However, there is a 32% chance that WTI could drop below the support at $85.73, which would then trigger further descent.

Light Crude to jump up a notch. CL1!Technically X Wave, possibly backed by increasing demand ahead of the Winter seasons in Europe and the Russians playing games in the export market. All this might result in continued increase in gas prices locally or globally.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

WTI: Doooown…After one last surge, WTI has jumped below the support line at $92.93, its shout echoing through the chart. Now that it has begun the descent, it should continue it into the blue zone between $81.16 and $77.55, where it should finish wave 3 in blue.

Alternatively, there is a 35% chance that WTI could gain upwards momentum again and could make it not only back above $92.93 but also above the resistance at $101.88. In this case, it should pursue the ascent above $105.24 and into the turquoise zone between $107.12 and $116.59 first before moving downwards.