Linkbtclong

LINK (Y20.P2.E3).Micro.Level.BearishHi All,

Observations:

============================================================================

For the short term, we see many indicators with bearish signals on the daily.

Price is convergent on the daily... +ve

Price headed for the next fib. level on the Macro channel

MACD has bearish momentum in the shorter time period

No divergences detected

Thoughts:

==========================================================================

We can see how a pullback to the previous resistance (ATH) which can now act as support.

We can see how it fits into the overall fib. level of the macro channel, as support

We can expect this area to have a bounce but with some initial sideways movement until it hits the channel trend and gain momentum.

Just like BTC, we will ease slowly into the support level. And just like BTC, we should see LINK shadowing its movements.

Please don't forget to give me a tick\like, as I would appreciate it.

Regards,

S.Sari

(for my reference > Macro.charts)

Note ribbon on the daily, 21 and 34 EMA

Note, daily RSI approaching previous bounce area in the previous uptrend

Other indicators

MACRO target

Previous MACRO post

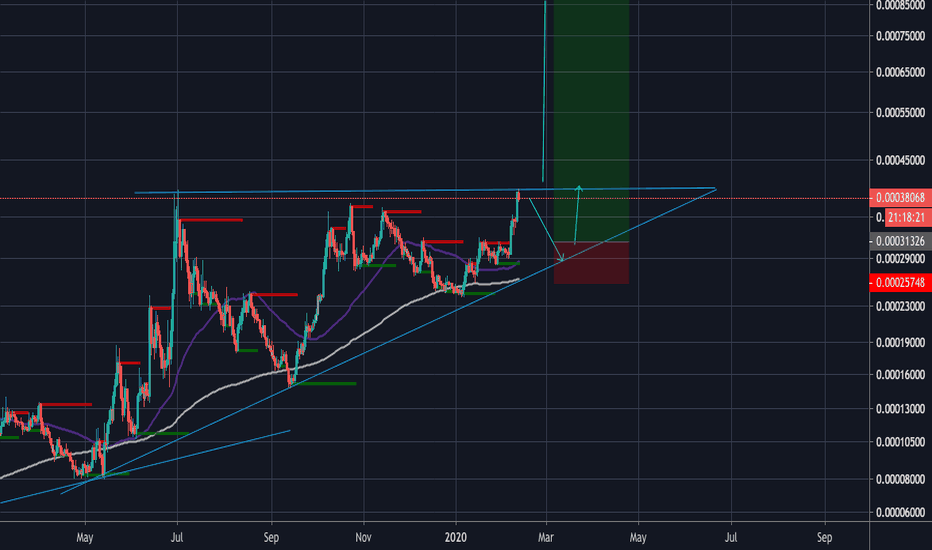

LINK/BTC Ready to explodesHello Traders

Today I am gonna be doing a quick and simple analyses o Chainlink, here is some points:

We have Reversed with bullish Engulfing candle Pattern on important Support level on Bullish long term trend, and this is all that matters for us to open a long position in this asset.

Our stop loss must be bellow the support in case this is a Bull Trap, our objective is 230% above

Please support this publication with your like. You are welcome to follow us on the Tradingview.

Best regard Sandro and Gustavo.

Consolidation under resistance and Hourly TriangleBreakout above $2.93 and we test/ break through $3 or break through $2.86 and we may see a retest of $2.80. Move really depends on how BTC reacts above 9450. LINKBTC pair also consolidating in 30k SAT range as 31K failed. Move imminent and I am long since $2.75. This is what I am seeing on the charts not financial advice. Risk reward 2:1 if stop is set at $2.85 USDT.

LINK/USDT TA Update (Bullish Pennant?)LINK/USDT

LINK has set up a new Higher Low at 1.7 and currently testing the downward trend-line of this giant pennant triangle pattern.

If the LINK pulls back and retest key support area between 2.33 - 2.14 and holds it a couple of days.

There is likely a chance of breakout in the coming few weeks.

LINK/BTC TA Update (Another Bull Rally?)LINK/BTC

LINK is potentially painting the same scenario of a bullish bounce last Sep when the price bounces back above the 200 Day MA and broke the trend-line resistance.

The market trend changes and completely sky-rocketed over 150% last time. Is LINK going to copy the same trend again? Well, technically is still possible if LINK will finish strong,

erasing this trend-line resistance. Challenging to retest the swing High at 35k sats area is the long shot for the bulls. I'm currently in favor of the Bulls as we can the 200MA is acting as dynamic support

and we have a nice RSI divergence to the upside. If you are playing a Long position, you can place your stop-loss below swing Low at 24k sats or just underneath 200MA.

LINKBTC Has Completed Bullish Setup | A Good Long OpportunityIn the month of Sep 2019 the price action of Chainlink took the power full bullish divergence and after making upto 131% bullish move now the price action has formed a falling wedge which was initiated in Oct 2019.

Now the price action is likely to bounce from the support of this falling wedge in the meanwhile the priceline is also getting bounced from the lower bands of Bollinger bands before hitting the support of pattern and Bollinger bands support the moving average convergence divergence (MACD) was strong bearish now it has turned weak bearish and Stochastic has given bull cross from oversold zone the relative strength index was also oversold and now turned bullish.

On 4hr chart the Exponential Moving Averages EMA 10 an EMA 20 are giving bullish signals by forming golden cross and lifting the price action up:

The price action might have some price correction coz it has made sudden up move after hitting the support however the price action will hit the Fibonacci projection of tail to support of the channel between 0.382 to 0.786 Fibonacci soon so we can set our sell targets between:

0.00029175 to 0.00033581

So it is upto 34% profit potential trade, however we should set our stop loss using support of this falling wedge in case of complete candle stick closes below this support area.

Regards,

Atif Akbar (moon333)

LINK/BTC - Fractals to noticeLink has been one of TOP performers last 6 months. In this chart I bring a scenario for bulls out there who think that Link is still about to grow and just looking for an accumulation zone.

There are significant fractals with the previous price action:

First thing we can notice is the (non)importance of 200D MA - Correction during a bull cycle played both previous times so, that Link went under the 200 MA and stayed there for a couple of days, or even weeks. Afterwards it bounced back up with nice momentum and volume and began a new bullish sub-cycle.

Historically speaking, the accumulation period happend UNDER the 200 MA on daily chart.

The safest thing to do is wait until it goes under the 200 MA and bounces back above it. Only then we can be somehow "sure" that it will continue up.

For all gamblers out there - there is one more option and that is katching the knife on S/R flip priced 0.x24 BTC. It is much more risky, but you can get a really good RRR here.

Before any entry, I would also like to see fractal similarity on RSI as it is marked in the chart.

LINK/BTC

LINK/BTC-

After the dump of MATIC/BTC, its is risky to enter alts but Link/BTC pair’s market structure is bullish.

Sell Zones Levels-

1.0.00036125-0.00036998

2.0.00032421-0.00033226

Buy Zone Levels:

1.0.00028473-0.00027925

2.0.00025966-0.00025602

3.0.00024157-0.00023702

Always use stop loss keeping risk at 1-2% of the account size.