GBPCADDate:

July 23,2025

Session:

Tokyo and London session

Pair:

GBPCAD

Bias:

Long

2 liquidity pools that are waiting to be swept this week. Looks like price is gonna be magnetized towards these levels during London and Tokyo. The trade may even stretch into NYC.

Entry: 1.83970

Stop Loss: 1.83674

Target: 1.84811

RR: 2.82

Liquidity

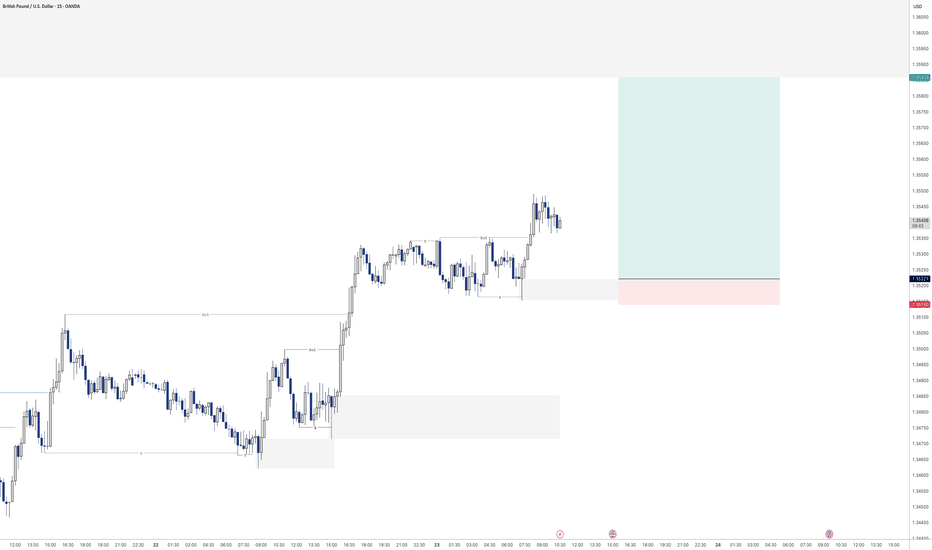

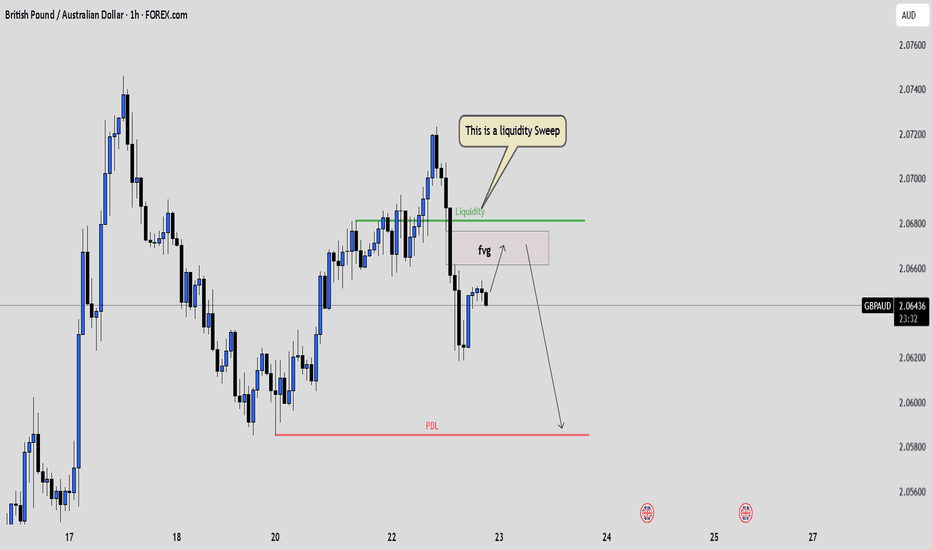

GBPAUD: Liquidity Grab and Fair Value Gap RejectionPrice recently swept liquidity above a key level, grabbing stops resting above that range. Following that, it quickly reversed and left behind a clean Fair Value Gap , suggesting a possible shift in intent.

We are now watching price retrace into the FVG zone. If price reacts from there with a strong bearish confirmation candle like a bearish engulfing or another sign of rejection, we could see a continuation move lower. Our short-term target would be the previous day’s low.

This setup reflects how important it is to wait for confirmation and not chase the first reaction. Let price come to you and show its hand. Patience leads to clarity and better entries.

A trade without confirmation is just a guess. A trade with structure, confluence, and patience is a plan. Stay sharp.

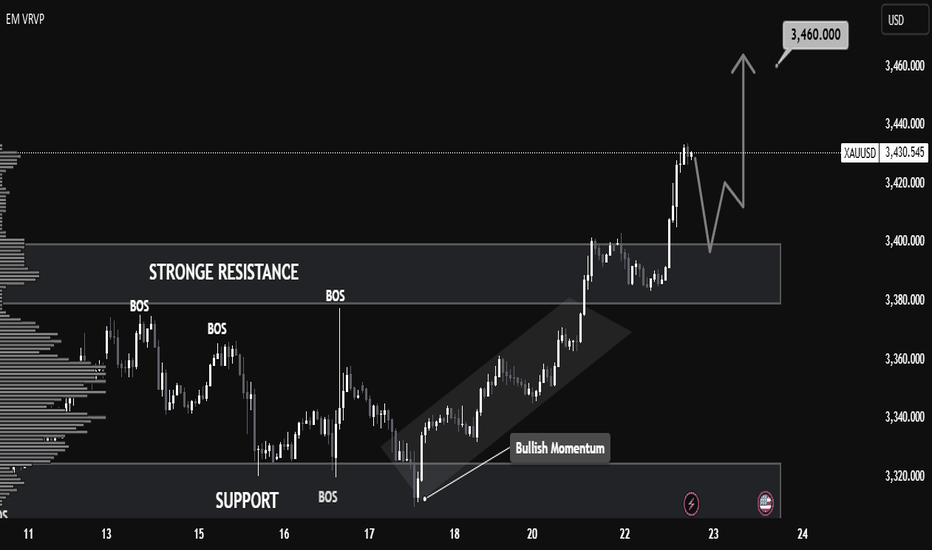

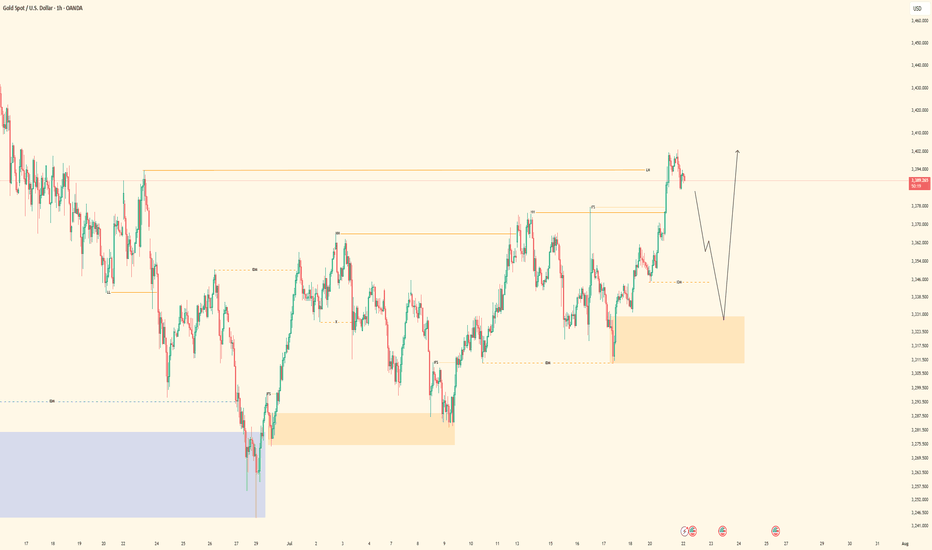

XAUUSD Technical Analysis – Resistance Turned Support, 📈 XAUUSD Technical Analysis – Resistance Turned Support, Bullish Continuation Expected

Gold (XAUUSD) has shown strong bullish momentum after breaking above the key resistance zone around $3,400, which now appears to be acting as a new support level. This structure shift signals a classic break-and-retest scenario, commonly observed in bullish continuations.

🔍 Key Observations:

Structure Shift: Previous resistance near $3,400 has been broken with strong bullish candles, suggesting buyer dominance. This level is now expected to serve as support.

Bullish Momentum: The move from the $3,320 support zone to above $3,430 was accompanied by clear trend formation and clean market structure, indicating sustained momentum.

Retest in Progress: Price is currently pulling back toward the new support zone ($3,400). If this area holds, a bullish reaction is expected.

Next Target: If support at $3,400 holds as expected, price could rally back toward the next resistance and projected target of $3,460.

📚 Educational Insight:

This setup illustrates the principle of resistance becoming support (RBS)—a foundational concept in technical analysis. After a breakout, a successful retest of former resistance often provides a high-probability entry point for trend continuation trades.

EURUSD| Back Aligned Bullish - Still in Analysis ModePair: EURUSD

Bias: Bullish

Following price closely and adapting to the market’s rhythm.

Recent structure showed that price is still respecting last week’s key zones — so I’ve realigned with the bullish bias accordingly.

No entries yet — still in analysis mode, which honestly is the best part 😉

Watching for clean LTF confirmations before engaging. No guessing. No forcing.

Price always tells the truth — you just gotta stay patient enough to listen.

#EURUSD #SMC #bullishbias #marketstructure #inducementking #smartmoneyflow

Bless Trading!

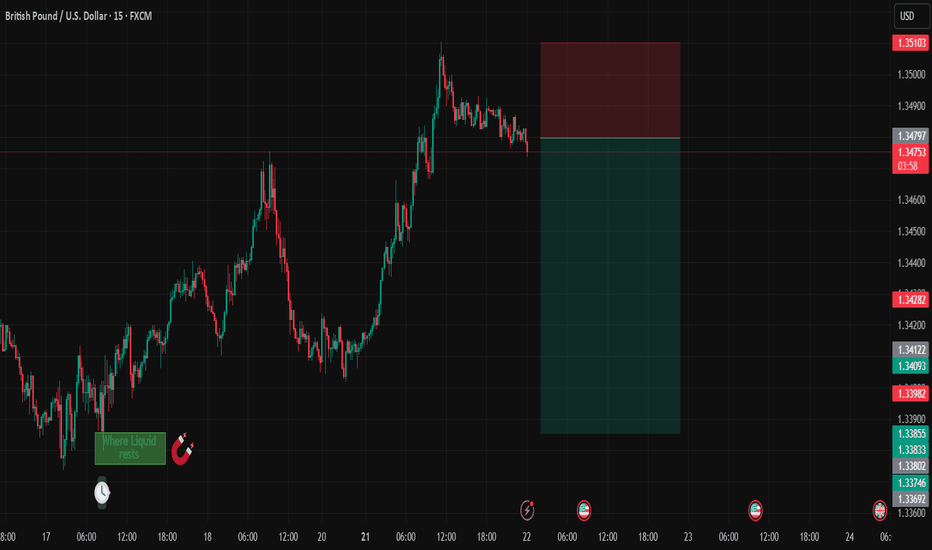

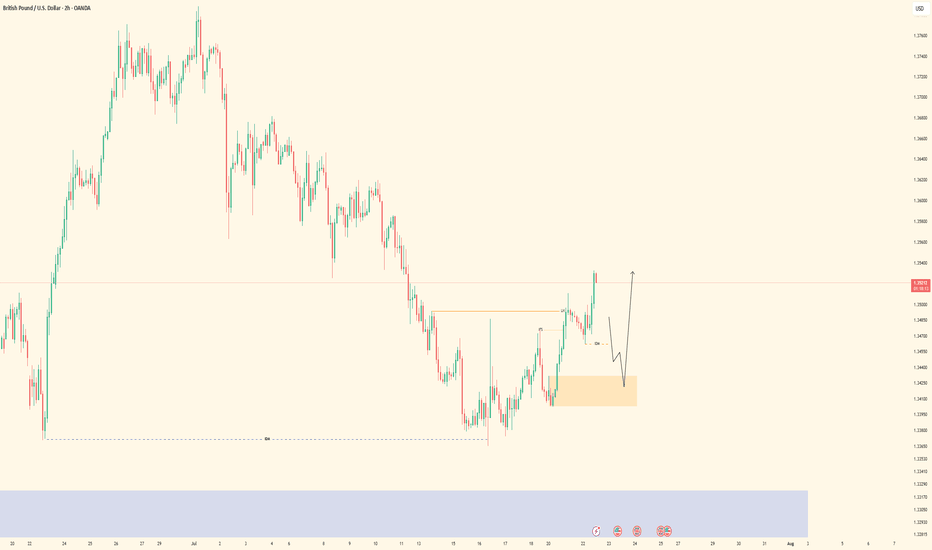

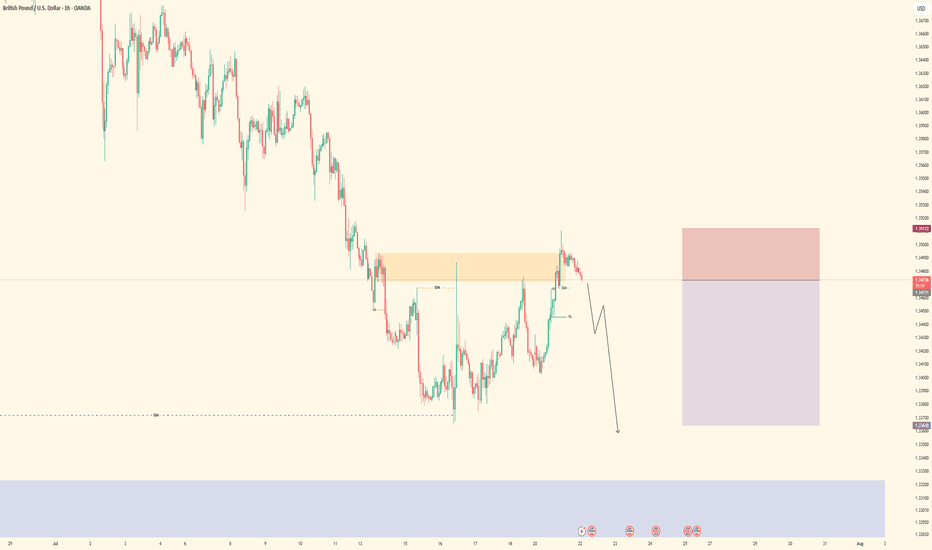

GBPUSD| Bullish Structure Intact - Waiting on BSL SweepPair: GBPUSD

Bias: Bullish

Been following price closely while staying in analysis mode — no rush.

Recent structure remains intact and aligned to the upside. Now waiting for a clean BSL sweep to clear liquidity before looking for LTF confirmations to engage in buys.

Momentum is there, structure is clean — I just need price to do its part.

Staying patient. Still in sync.

#GBPUSD #SMC #bullishstructure #orderflow #inducementking #smartmoneytrader

Bless Trading!

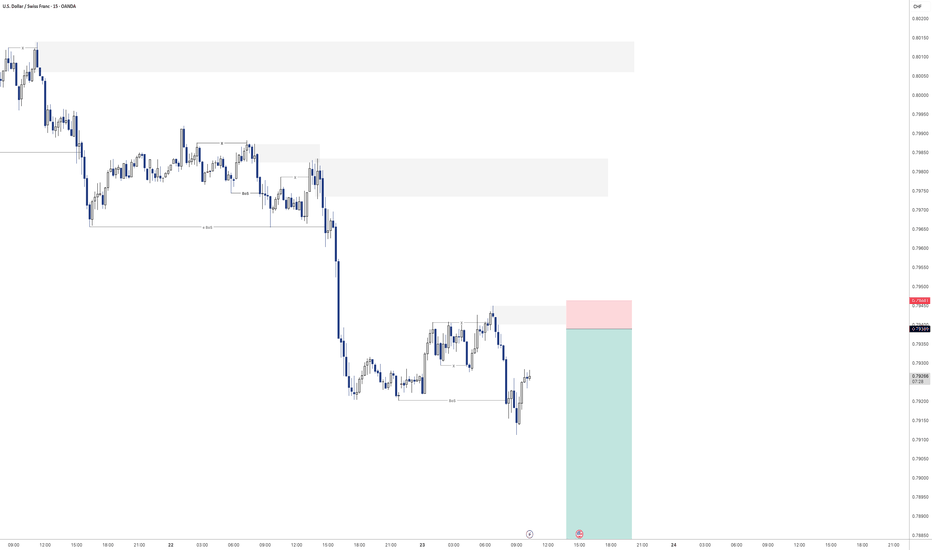

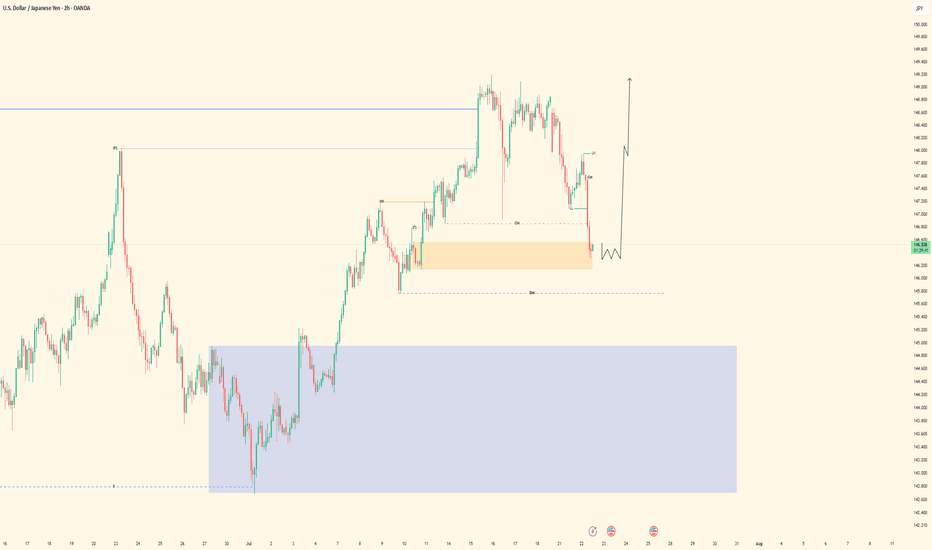

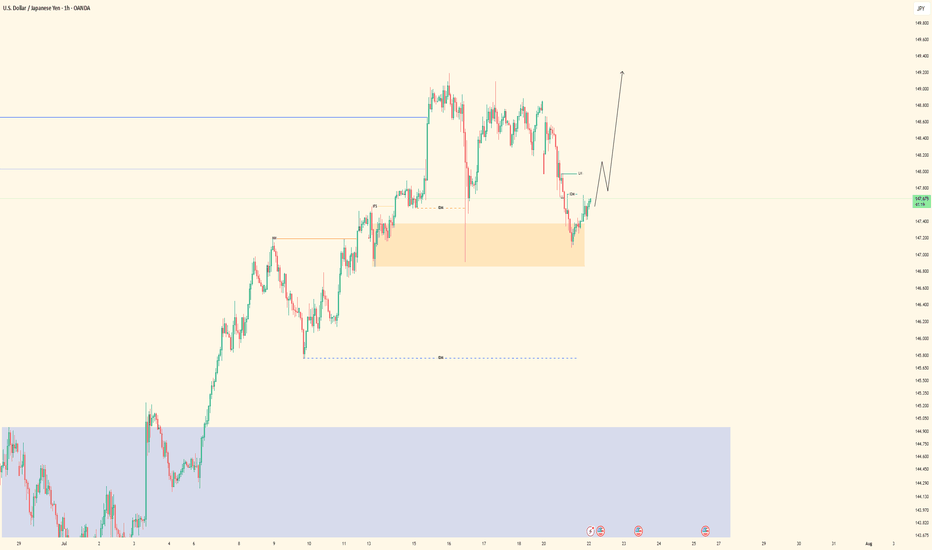

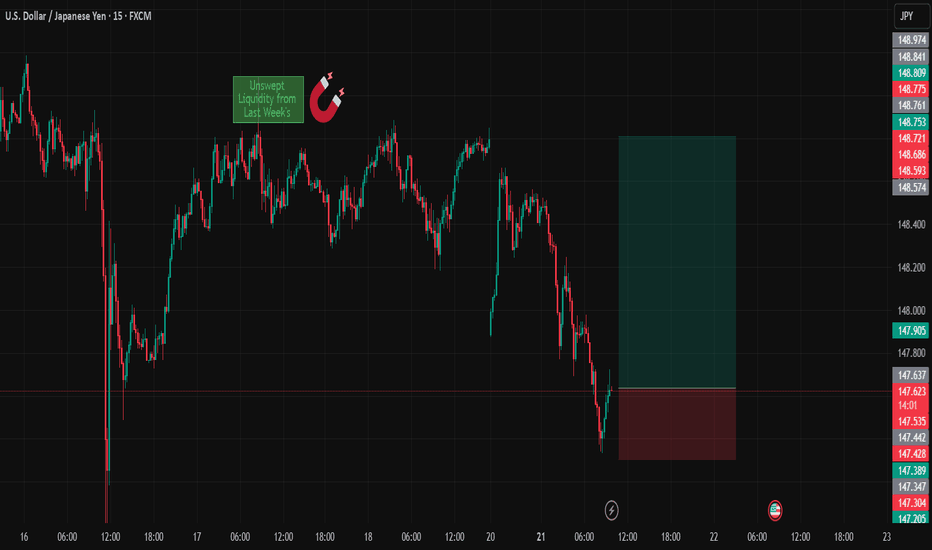

USDJPY| Bullish Bias - Mitigated OB, Waiting for LTF ConfirmsPair: USDJPY

Bias: Bullish

Price swept deeper liquidity and has now mitigated a key 30M bullish order block.

From the 2H bird’s eye view, structure is still aligned to the upside — but I remain in analysis mode until LTF confirms the shift.

No need to force anything — price is doing its job, and I’m waiting for it to speak clearly through confirmation.

Bullish structure still in play, but we wait for the perfect moment.

#USDJPY #SMC #bullishbias #orderblock #structuretrader #inducementking

Bless Trading!

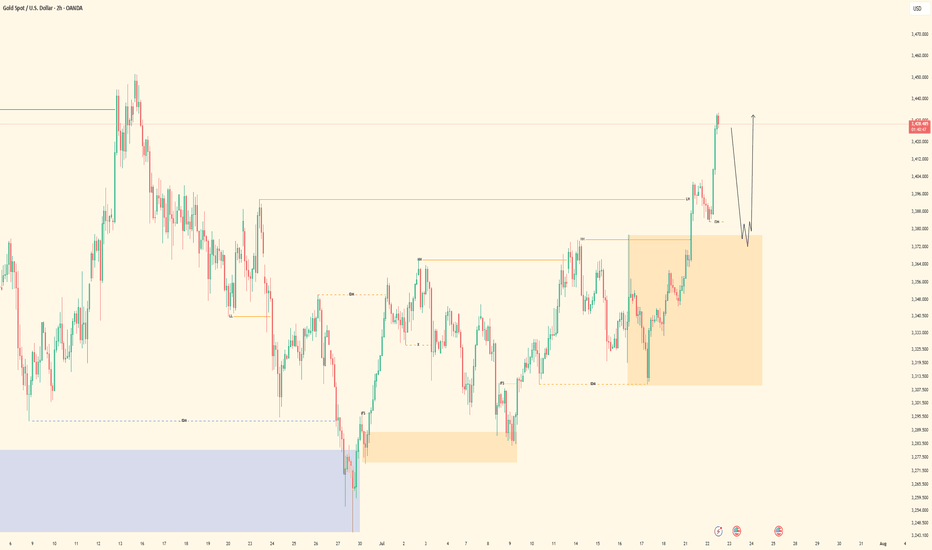

XAUUSD| Still Bullish - Waiting on BSL Sweep for EntryPair: XAUUSD

Bias: Bullish

Price remains bullish and structurally intact. This morning’s updated view confirms the bullish alignment — no change in directional bias.

Currently watching for a clean BSL sweep to clear out early liquidity, followed by LTF confirmations before engaging.

Higher time frame perspective from the 2H chart offers a solid bird’s eye view — staying patient and letting price come to me.

No rush — structure is king.

#XAUUSD #gold #smartmoney #SMC #orderblocks #inducementking #structurefirst

Bless Trading!

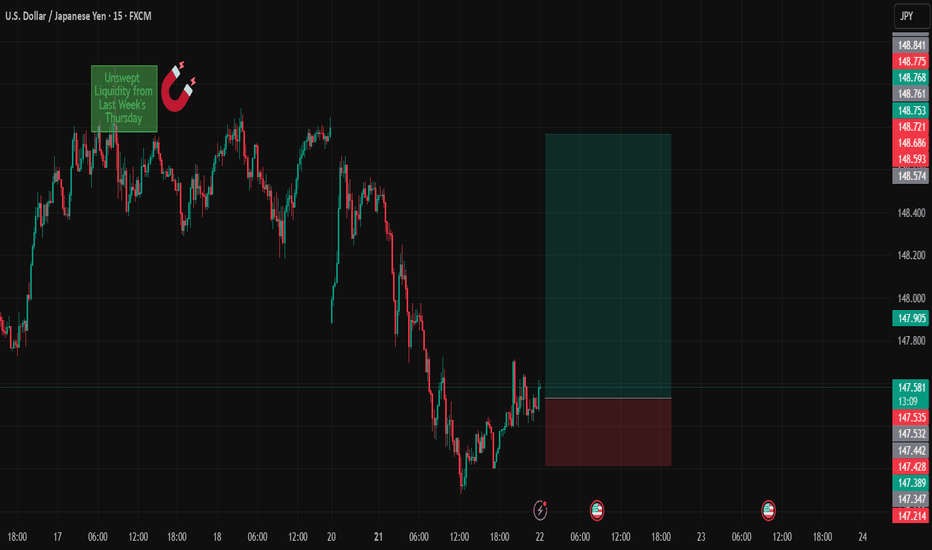

USDJPYDate:

July 22,2025

Session:

Tokyo and London session

Pair:

USDJPY

Bias:

Long

1. Clean liquidity pool left unswept from last week's NYC Open (Thursday).

Took this trade earlier today but looks like price wanted to consolidate in the liquid pool its currently in. I still hold the same idea and think the sweep will definitely take place sometime this week. Now looks like the perfect time to enter. If Asia session cant get it done its up to London and New York session.

Entry:147.534

Stop Loss:147.215

Target:148.768

RR:3.89

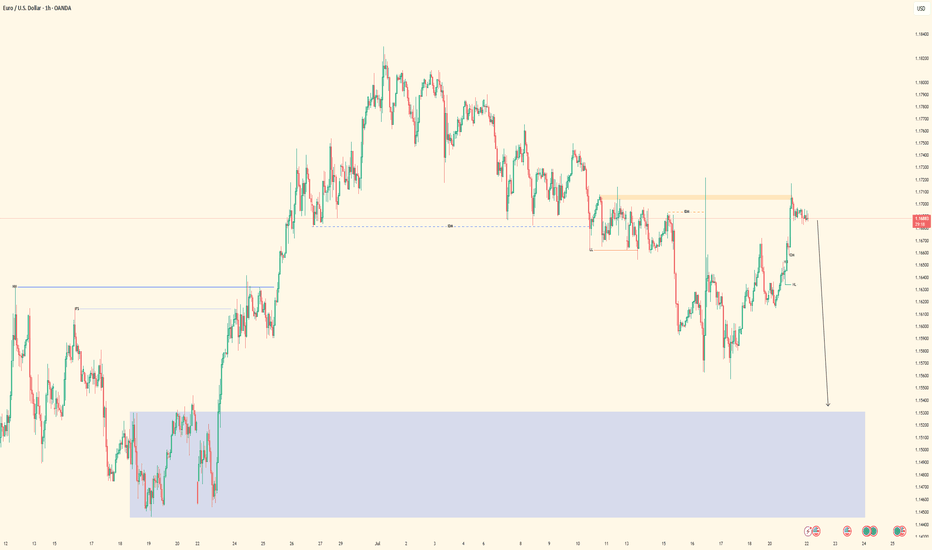

EURUSD - Sell Setup in ProgressPair: EURUSD

Bias: Bearish

HTF Overview: Structure leaning bearish — price respecting recent lower highs with room to fall into deeper 4H demand.

Current Zone: Price just mitigated the 30M sell-side OB, showing early signs of reaction.

LTF Confirmation: Still in observation mode — waiting for 5M or 1M confirmation to trigger short entries with confidence.

Entry Zone: Focused on refined LTF shift beneath the 30M OB — ideal setup includes inducement or liquidity run before executing.

Targets: First target is intraday low — ultimate target is the strong 4H demand zone below.

Mindset Note: Let the market bring the entry to you — don’t jump ahead of confirmation. Smart patience wins.

Bless Trading!

GBPUSD| - Bearish Play Setting UpPair: GBPUSD (GU)

Bias: Bearish

HTF Overview: Bearish structure intact — market has been respecting lower highs and pushing into downside pressure.

Current Zone: Price just mitigated the 30M OB, reacting as expected within the supply zone.

LTF Confirmation: Now waiting for clean confirmations on 5M or 1M — not in trader mode yet, analysis still in control.

Entry Zone: Watching for internal liquidity sweep or inducement followed by structure shift to confirm the sell.

Targets: First target is the next 30M low — extended target based on 1H continuation.

Mindset Note: No chasing — let the LTF tell the story before pulling the trigger. Control the urge, trust the system.

Bless Trading!

USDJPY - Bullish Bias, In OB ZonePair: USDJPY (UJ)

Bias: Bullish

HTF Overview: Bullish structure remains intact — price currently pushing upward, respecting higher timeframe flow.

Current Zone: Price is now sitting within the 30M OB, showing potential strength but no LTF confirmation yet.

LTF Confirmation: Still in analysis mode — sitting on hands, waiting for clean reaction on 5M or 1M before considering entries.

Entry Zone: 30M OB being monitored closely — ideal setup would include inducement and clear shift before entry.

Targets: Next 1H high remains the first target — extended targets to be trailed if momentum builds.

Mindset Note: Analysis first, execution second. Discipline is the edge — no rush until LTF gives the green light.

Bless Trading!

XAUUSD - Bullish Bias Holding StrongPair: XAUUSD (Gold)

Bias: Bullish

HTF Overview: Multi-timeframe structure aligned bullish. Market is in a clear uptrend across 4H and 1H, currently retracing toward key OB levels.

LTF Confirmation: Waiting on price to mitigate the 1H OB — once tapped, will drop to 15M and 5M for confirmation before any entries.

Entry Zone: 1H OB marked — setup strengthens if inducement or liquidity sweep occurs just before mitigation.

Targets: Short-term target is the previous high — extended target based on 4H continuation range.

Mindset Note: Alignment is there — now it’s about patience and waiting for execution clarity. Let price deliver the opportunity.

Bless Trading!

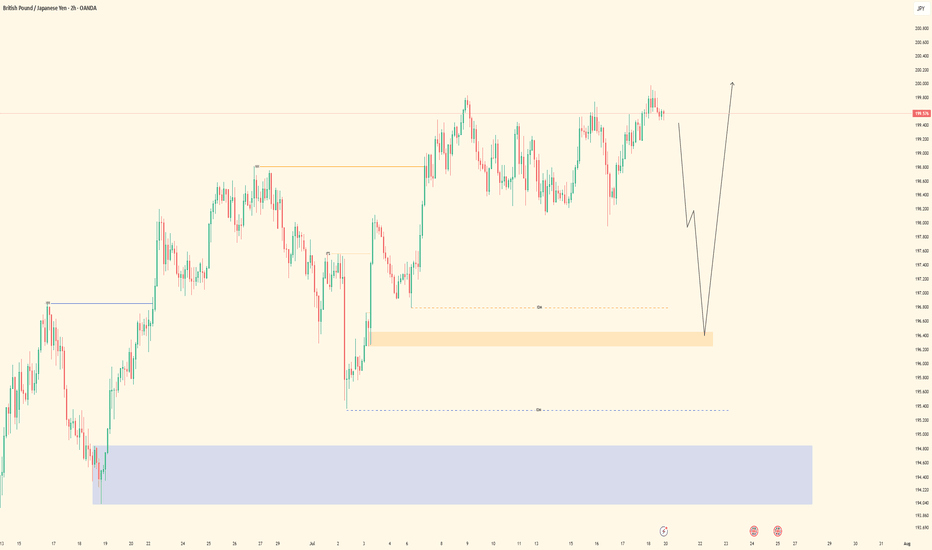

GBPJPY| - Bullish Opportunity DevelopingPair: GBPJPY (GJ)

Bias: Bullish

HTF Overview: 1H structure remains bullish with clear higher highs. Market currently pulling back toward a visible 1H Order Block.

LTF Confirmation: Waiting for price to mitigate the 1H OB, then will drop to 15M and 5M for bullish confirmation before entering.

Entry Zone: OB zone marked and active — ideal setup includes liquidity grab or inducement before confirming entry shift.

Targets: First target is recent 1H high — extended targets based on continuation structure above.

Mindset Note: No need to force the trade — the edge comes after the zone is respected and price confirms. Let the setup come to you.

Bless Trading!

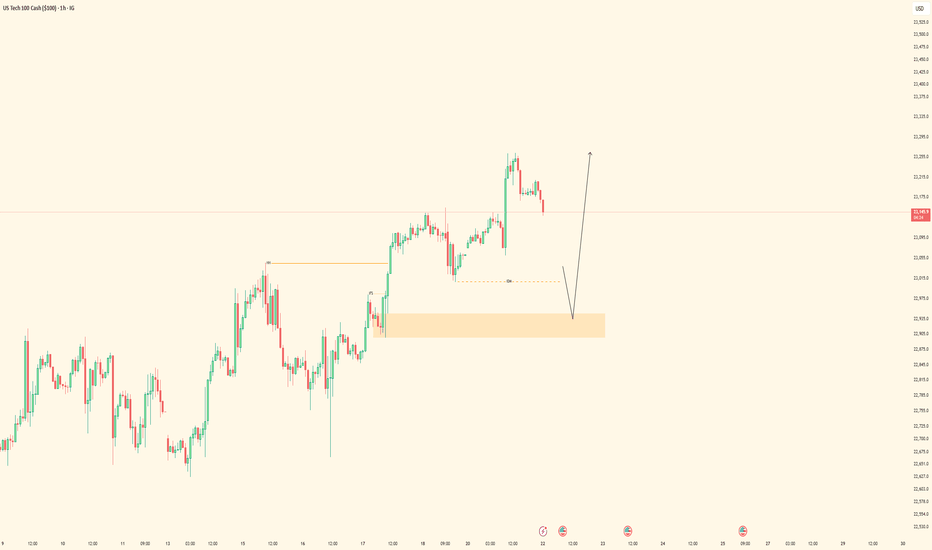

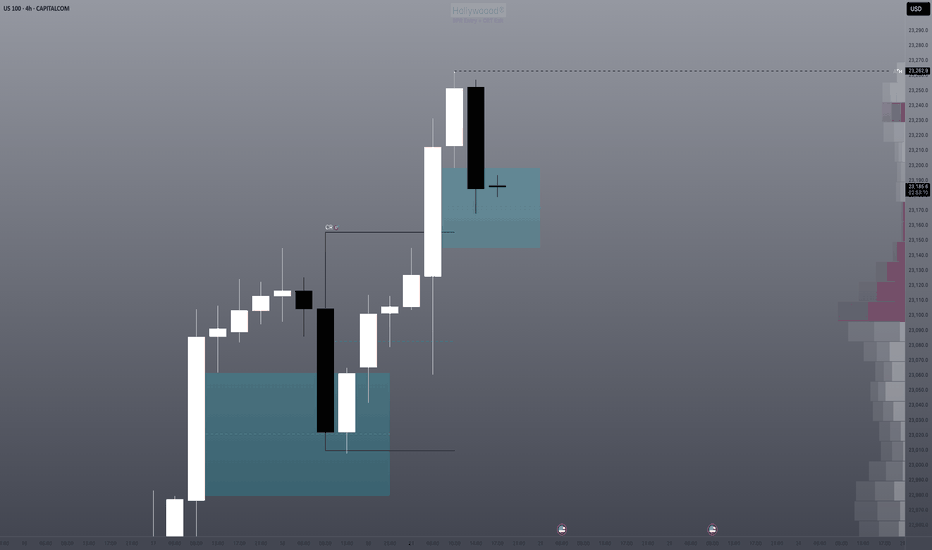

NAS100 - Bullish Setup BuildingPair: NASDAQ (NAS100)

Bias: Bullish

HTF Overview: 1H structure holding bullish after recent break of internal highs. Price pulling back toward a key demand zone.

LTF Confirmation: Waiting for price to mitigate the 1H Order Block, then drop to lower timeframes (15M → 5M) for confirmation entries.

Entry Zone: Watching for bullish reaction within OB, ideally paired with inducement or liquidity sweep before shift.

Targets: Short-term target is the next 1H high — extended targets align with overall bullish momentum continuation.

Mindset Note: Patience over prediction. Let price tap into the zone and confirm — don’t chase, just position smart.

Bless Trading!

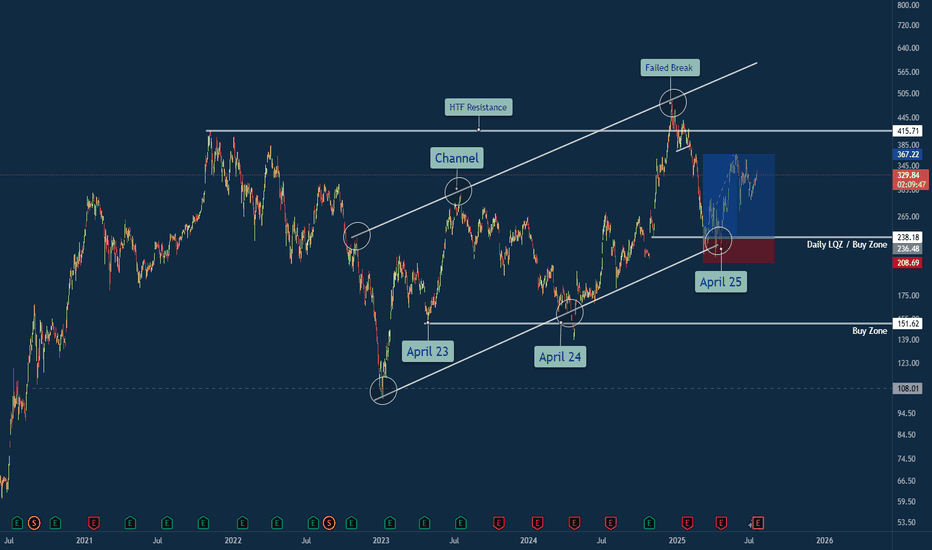

Tesla Trade Breakdown: The Power of Structure, Liquidity & ...🔍 Why This Trade Was Taken

🔹 Channel Structure + Liquidity Trap

Price rejected from a long-standing higher time frame resistance channel, making a false breakout above $500 — a classic sign of exhaustion. What followed was a sharp retracement into the lower bounds of the macro channel, aligning with my Daily LQZ (Liquidity Zone).

🔹 Buy Zone Confidence: April 25

I mapped the April 25th liquidity grab as a high-probability reversal date, especially with price landing in a confluence of:

Demand Zone

Trendline Support (from April 23 & April 24 anchor points)

Volume spike + reclaim of structure

🔹 Risk/Reward Favored Asymmetry

With a clear invalidation below $208 and targets at prior supply around $330+, the R:R on this trade was ideal (over 3:1 potential).

Lessons Reinforced

🎯 Structure Always Tells a Story: The macro channel held strong — even after a failed breakout attempt.

💧 Liquidity Zones Matter: Price gravitated toward where stops live — and then reversed sharply.

🧘♂️ Patience Beats Precision: The best trades don’t chase. They wait. This was one of them.

💬 Your Turn

How did you play TSLA this year? Were you watching the same channel? Drop your insights or charts below — let’s compare notes 👇

#TSLA #Tesla #SwingTrade #PriceAction #LiquidityZone #FailedBreakout #TechnicalAnalysis #TradingView #TradeRecap #ChannelSupport #SmartMoney

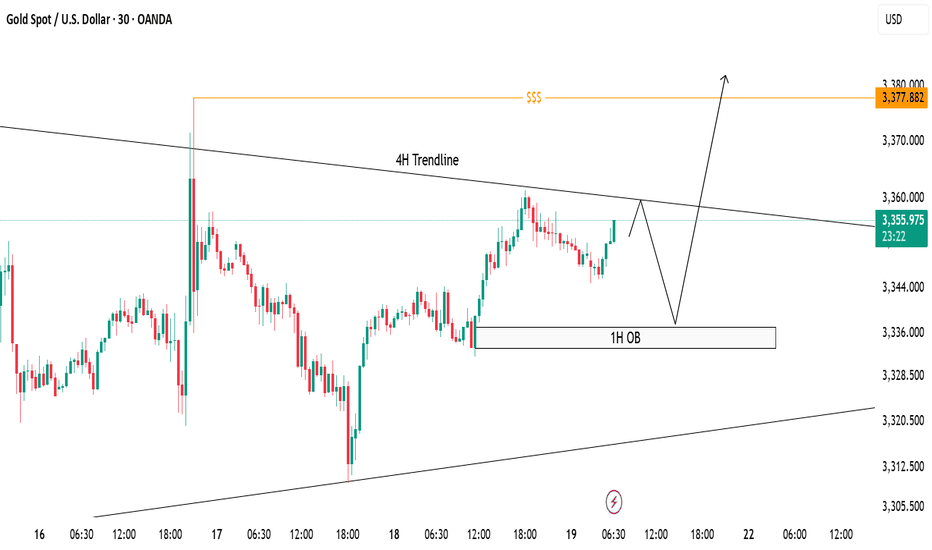

XAUUSD Trade Idea - 30m Structure with 4H ConfluenceCurrently, price is trading below the 4H descending trendline, respecting bearish structure on lower timeframe (30m).

✅ 1H Order Block (OB) marked between 3335-3340 remains a strong demand zone where price can bounce break the trendline to sweep liquidity above around 3377 to form bullish continuation.

📌 Scenarios I'm Watching:

Short-term rejection from the 4H trendline.

Potential reversal towards 1H OB.

Bullish reaction from OB could trigger a breakout above the 4H trendline.

Final upside target remains at the liquidity pool around 3377 zone ($$$).

🟣 Overall Bias: Bullish after liquidity sweep. Watching for bullish confirmation at OB before executing buys.

GBPJPY- UPDATED ANALYSIS GBPJPY Bias: Bullish HTF Overview (4H): Price remains in strong bullish structure, with higher highs continuing to break. No signs of deep pullbacks toward major SSLs, confirming strength in the current leg. LTF Confirmation (30M): Clean refined structure now visible. Market gave a textbook pullback into a fresh demand zone (30M OB) after sweeping minor liquidity. No need to expect a deeper move unless invalidated. Entry Zone: Watching for price reaction from the refined 30M OB. If price respects this level, I’ll drop to 5M for LH break → 1M for entry precision. Targets: Eyes on recent high as first TP, followed by extended targets if momentum continues. Mindset Note: Sometimes the best move is simply refining levels and letting the setup come to you. No rush, just alignment.

GBPJPY - Bullish Continuation Setup• Pair: GBPJPY

• Bias: Bullish (Buy)

• HTF Overview (4H):

• Strong bullish momentum with clear breaks to the upside.

• No signs of price reaching deeper 4H SSL — continuation more likely.

• MTF Refinement (30M):

• Watching for price to mitigate lower 30M OB zone.

• Expecting bullish continuation from that area.

• Entry Zone:

• Wait for LTF confirmation inside 30M OB.

• Switch to trader mode after valid CHoCH / intent confirmation.

• Targets:

• Structure highs / clean extension into the next liquidity pool.

• Mindset Note:

• Be patient, trust bullish structure. Let price come to you.

Bless Trading!