Liquiditygrab

AUDCHF: Weekly Demand Zone 🧠Price has entered the weekly demand zone and slowed down in price luring in buyers.

However, many are not taking note of the incomplete compression within demand.

Because this compression is incomplete, I think we are likely to see a breakout trap followed by completed compression BEFORE we see any signs of buying pressure.

I will set alerts and sit on my hands until this pair is ready.

L et me know what you think in the comments.

ETHUSDT wants new liquidity for the reversal?the price got a rejection from the 0.618 Fibonacci and dynamic resistance after a dump from the monthly support form 1700$.

The market bounced from 886$ where we can find a demand zone and 1.271 Fibonacci Extension.

How to approach it?

The price could grab new liquidity from the demand zone on 920$ and create a local reversal trade, so According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

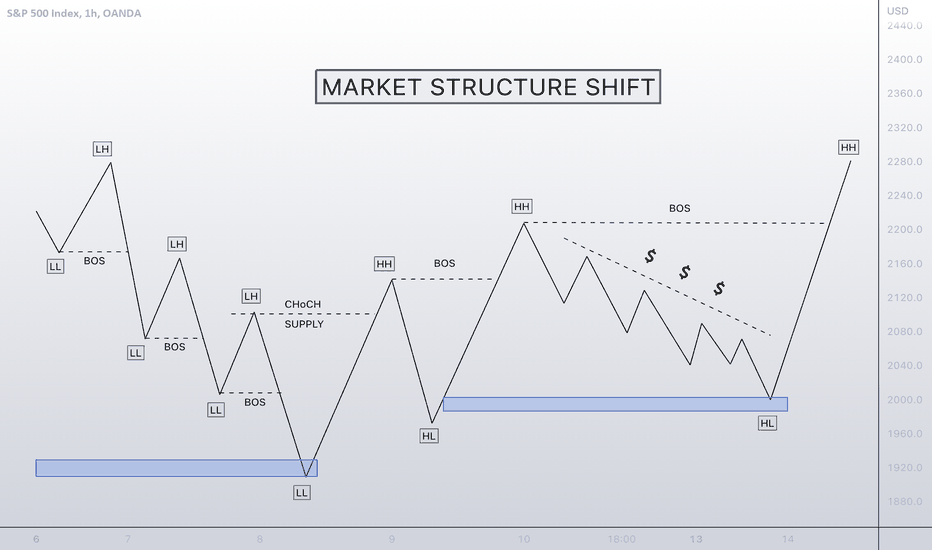

🤓 🤓 MARKET STRUCTURE SHIFT! SMCMarket structure in Forex trading or price action is how many people take advantage of the markets. No indicators, and no volume. Because the market does not have a centralised exchange. Forex traders often swing trade the market based on the structure to take advantage of the opportunity.

Structural market change is broadly defined as a shift or change in the way in which a market or economy functions or operates.

I have tried my best to show you in the easiest possible way to look out for. Save this to your notes for future reference.

🤓 🤓 DON'T TRADE FROM THIS ZONE!I have tried to make this example as simple as possible to understand for anyone that are not too familiar with liquidity hunts.

Always look for were the most liquidity is accumulating then place your trade above or below were there has been a liquidity swoop, as long as it lines up correctly with what strategy you are using.

If you add this to your trading tool belt this will improve your overall results.

BTCUSDT needs liquidityThe price had a bounce from the 18k area and got a rejection from 0.618 Fibonacci level and dynamic resistance on 20k level.

The price needs more liquidity in order to retest the daily resistance (at least) on 22k.

How to approach it?

the price needs more liquidity, so if the price is going to lose the support, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

DOTUSDT needs more liquidityThe price got a rejection from 9$, the 4h resistance where the market created a supply zone. Now the price is creating equal lows on 7$.

How to approach it?

The price needs more liquidity to create a new bullish impulse, so if The price is going to grab the new liquidity from 6.5$ region and create a new bullish impulse, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

BNBUSDT wants the new liquidity

The price is testing the 0.618 Fibonacci level on the monthly Timeframe.

As you can see this area is a key area for the market.

On the weekly timeframe the price is losing the support where the price bounced several times.

On 4h Timeframe the price is trying to have a breakout from the supply zone.

How to approach?

IF the price is going to lose the 4h support, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

FTMUSDT wants new liquidity

The price bounced from the monthly support on 0.26$ where the price created the demand zone.

The price got a rejection from the daily resistance at 0.41 and now the market is creating equal lows.

How to approach it?

IF the price is going to lose the support and retest it as new resistance, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

SPX, 1.13 then bounce? SPX first D point was completed on this shark as you can see the beautiful bounce at the .886, but now price is back at that key level testing support, normally when this happens price continues and price hits around the 1.13 before reversing (If it reverses).

The 1.13 does look like a good zone, wiping out a lot of liquidity and landing on another psychological level, I think i'll sit on my hands if we don't get a pullback and wait for this to complete, if we get confirmation it could be a very powerful trade, US30 would also follow it.

Let me know your thoughts!

* Disclaimer **

These ideas I never trade until the end target with my initial lots, I focused on high probable entries with higher lots and use a specific partial taking strategy giving me a very high win rate and take most of my profits very early, I only leave a small % of my capital to run the entire trade. On the flip side im constantly monitoring LTF momentum and will close early if things change, these analysis's are for research purposes only.

FILUSDT is getting liquidity. Ready for the breakout?

The market lost the weekly support and retested it as new resistance. The price got new liquidity and created a new bearish impulse.

Now the price is testing the 7$ area and it's creating an ascending triangle.

How to approach?

The price needs to have a new breakout from that area and retest the previous resistance as new support. According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

LTCUSDT is creating equal lowsThe price is creating a big Falling wedge on the daily timeframe and now the market is creating equal lows on the 4h timeframe.

at 55$ the price has a demand zone where the market could grab new liquidity for the reverse trade.

How to approach it?

If the price is going to have a breakdown from the 4h support and grab new liquidity, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

bearish temporarily,bullish forever Continuation of my btc' daily chart on monthly. As you can see the importance of btc grabbing liquidity at lower levels. BTC made a bearish double top and gave a perfect retest. retest might go to 52k but thats just a hopium if the current economic conditions are taken in place. btc looses 25600 on daily level annd its going to 19.4 .

NEARUSDT needs to get new liquidity for the reversal

The price lost the monthly support on 7.3$ and the daily support as well on 6.2$.

Now the price is going to create equal lows on the 4h timeframe on 5.6$ above the demand zone on 5.6$

How to approach it?

IF the price is going to have a breakdown from the 4h support and grab new liquidity, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

FILUSDT is testing the supportThe price is creating equal lows of 7.4$.

The market created a demand zone on 6.8$ where price needs to grab new liquidity.

How to approach it?

IF the price is going to get new liquidity, According to Plancton's strategy , we can set a nice order

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐