Possible upside for Lloyds bank.I've been watching an trading LLOY for the past 2/3 years. I believe the fundamentals to be excellent. 5% dividend approx and an internal revenue of 10 (forecasted to be 8 in 2019). The bank is highly profitable even with in this low interest rate environment. With the PPI repayment deadline in August 2019, this will only improve Lloyds profitability. And if a rate hike was to occur, the same would happen for the profitability of LLOY.

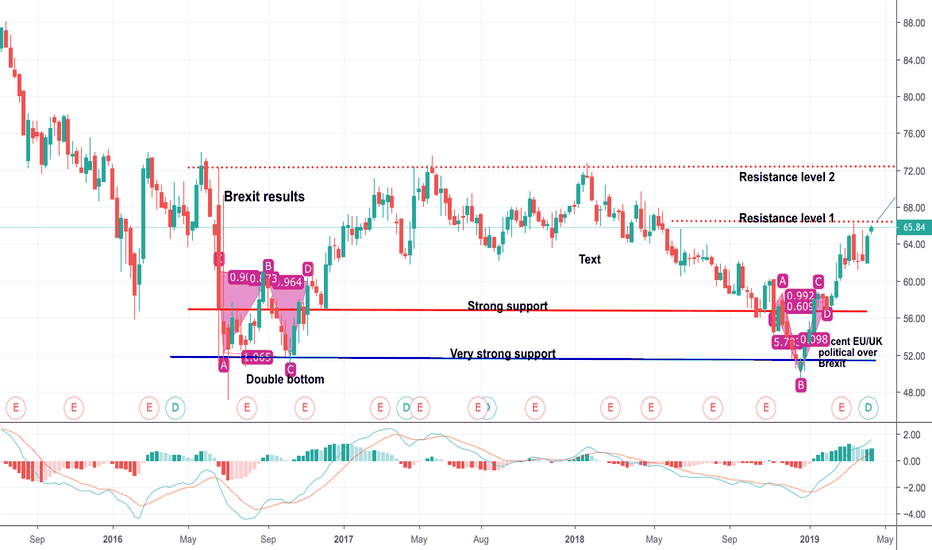

From a technical point. There has been extremely strong support at 50p. With the current price at approx 65p, there is another resistance level approaching. With the PPI repayment deadline approaching there could be further upside for LLOY.

Lloyds

Possible upside for Lloyds Bank (LLOY)I have been watching and trading lloyds for the past 2/3 years. The fundamentals are great. Its internal rate of return is excellent, especially considering it pays out a strong dividend (Approx 5%). It also has a P/E ratio of around 8. So fundamentally I believe it to be a sound investment. However, this is not advice.

LLOY has broken through 2 strong support levels and looks like it maybe approaching another and then another. With the August 2019 PPI cutoff point, which will only boost the banks profit, I personally can only see upside for LLOY. Also, considering how profitable Lloyds has been as of recent with rates this low, the profitability of the bank would increase if rates were hiked. HOWEVER.... Lloyds share price is seems to be correlated with BREXIT... yet, this may have changed as of late.

Please read this article for proof of profitability.

www.businessinsider.com

LLOY LongI am seeing this as a double bottom reversal. Green box is my buy, and red line is stop loss. This is definietly a little more risky than usual. I will keep my stop loss tight if it decides to move upwards, as it will have to break the pink triangle, and there is also all the brexit rubbish going on. In all honesty I could have found a better trade, but meh, let's see how this plays out haha.

UK banks outperform FTSE 100 before stress test resultsUK banks outperformed the benchmark for UK shares during the rout in global stock markets that began in October. UK bank share prices are down over the past two months, but by less than the FTSE 100 index.

Positive expectations for stress test results have played a role in limiting the damage to UK bank shares.

"Trade what you see not what you think" Bearish Sentiment Validated confluences

1.Support broken Resistance validated

2.Weekly trend line validated (major validation)

3.Opposing level breached by short sellers (major validation)

4.Profit margin 1:2

Could see price Potentially move down to £59.90*

resistance seen @ £61.80 need to break £61.80 without any major retracements

Lloyds Bank – Bulls score another brownie pointFirst it was the bullish price RSI divergence and now we have a confirmation of the breach of the falling trend line on the weekly chart. The weekly 50-MA is bottoming out as well.

The stock appears on track to test 70.00 levels. Bullish invalidation is seen only if the stock closes on Friday below the weekly 50-MA level of 61.53.

LLOY Share price forecastif 66.21 breaks near term target towards 70.925 will occur. However, if support term 64.55 is breached below, then near term targets of 62.8 and then potentially 61.8 will occur I don't buy the rise! Ftse Is extremely overvalued IMO on current forecast increases on no valid thesis'.