Highly speculative Ethereum logarithmic regression curveHere is why Winklevoss brothers estimated high prizes for ethereum in bullrun peak.

Do remember to start taking profits / liquidity as we approach the target bubble.

As Ethereums progression reachhes 2.0 (small steps), things are gonna get excited!

LOGARITHMIC

BTC Prize speculation using prize peaks during previous bullrunsConsider taking some profits in the coming summer.. there will be bear year after this run.

Also possible altcoin fluctuation, maybe possible to make gains after bitcoin has reached its peak.

But everything will fall drastically after semester.

Sorry strange english, my native finnish brains make Ralli-finglish sentences.

BTCUSD: Monthly Log Chart A logarithmic look at the evolution of BTC price since its very early days

The following key takeaways:

BTC tends to extend only about 1/5 of its prior impulse move measured in terms of % increase;

BTC tends to react ≈38.20% on a logarithmic scale to form a correctional bear market;

The sub $80k area is a pivotal area to look for supply inflows.

This analysis suggests an earlier-than-expected onset of bull trend maturity stage in the upcoming few months, which might correct this lower to the $20k area.

The long term bull caseI have made a lot of comments about the long term bull case for bitcoin. Really that comes in the form of a number of different angles and analysis, which I might suggest a couple more ways of looking at things.

This one goes on the assumption that the price follows historic price action, which it often doesnt. At these prices retail traders are put off, and institution plays a vital role in propping up prices. Fair value of bitcoin is under greater focus the higher the price, and hands get weaker at tops, until new supports are created. In this run we are yet to find a floor for value. Whilst this chart doesnt show a downward price discovery, one will need to happen at some point.

This simply goes on the assumption that IF price continues to match the pattern, and we assume that percentage increase also matches, the price will top at around $320,000usd per btc.

I should note, although I am personally a longterm permabull (year timeframe), I am short term trading trends and always open to short opportunities as well as long term opportunities. This is one bullish outlook, based on certain hand-picked facts. It is not my only outlook, and I could create an equally bearish chart given the time!

Thoughts on anything in this chart are welcomed

100.000 $ bitcoin in sight?Check this logarithmic monthly view for BTCUSD.

2013

Peak: 1100$

Correction middle of this channel: 300-400$

Bottom: 150-200$

2017

Peak: 19.200$

Correction middle of this channel: 6200$ (monthly EMA 50, 200, and bollinger too there)

Bottom: 3800$

2021 (2022?)

Peak: 100.000$ ?

Correction middle of this channel: 44.000$ ?

Bottom of the channel approx...: 30.000$ ?

Correction cycles around 600-800 days...

Giants like TSLA, JP, Goldman, etc... will make the 20.000$ breakout (2020) as the new 1200$ breakout? (2017) We will never see again that lows???

🔥 Bitcoin Has More Room To Grow: Logarithmic AnalysisIn my previous long term Bitcoin analysis I argued that we had much more room to grow, more than 50% actually. This post is to indicate that the current bull trend is far from over and that we, most likely, will have another couple of weeks of the current market.

Seeing this week's sharp increase, the following couple of weeks will most likely be bullish too until the price reaches the upper resistance on the chart. Around that area, be wary that the price might reverse and start a bearish trend. Do your own due diligence.

Happy trading!

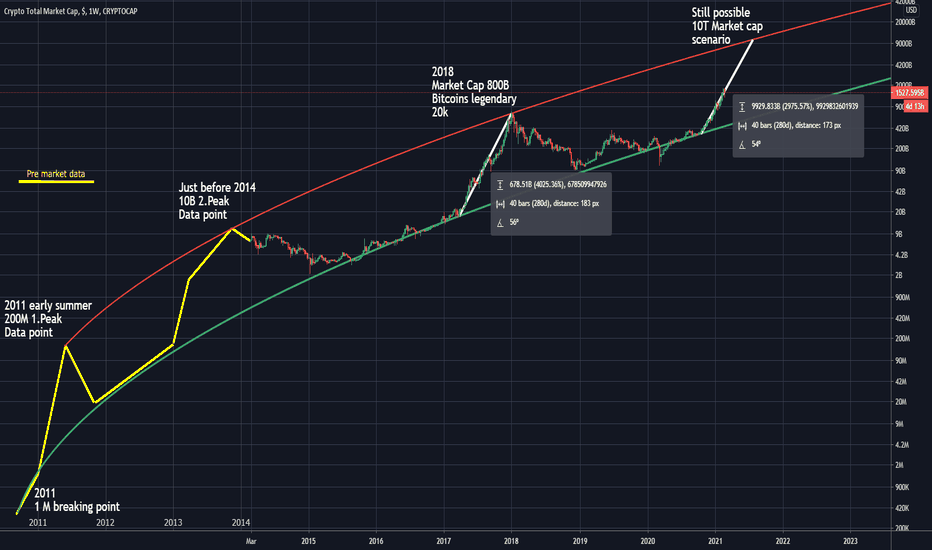

Projection: Crypto Marketcap will hit $83T by Jan 2023The macro of the crypto marketcap is strongly bullish. We broke above the line of resistance that we hit in Dec 2017 that sent us into a multi year bear market and the short term result was a break of $1T. However, we must keep in mind that we may very well come back down to test that line in the mid $700B before we continue our march toward $83T. I expect somewhere around $30T by the end of this year.

BITCOIN might be getting ready for the this cycle's FINAL RUN!!!Guys, I am comparing 2017's bullrun with the current situation using the log growth curves and I've found something interesting:

In 2017, the price corrected just after hitting the center log line. The price then went back to the lower log line and then up directly do the upper one, considering the center line as refference.

NOW, we have just hit the center line and corrected down to the lower one AND the price ran straight to the upper line ONCE AGAIN!

SOOOO, it's very likely we are having one last minor correction now before shooting straight to the moon. IF this happens, this cycle's FINAL TARGET should be around 105.000 USD !

Leave a comment and share this idea if you think it makes sense.

SEE YOU ON THE MOON

OmiseGO is about to take off 🚀OmiseGO (OMG) is ready for another impulse. Looking for a new ATH, above$10. Please not this chart is based on a logarithmic scale.

40k$ is not the high! (Bitcoin's historical growth curve)Hello traders, or this time investors,

here is my long term log Bitcoin chart with historical data.

Because of this growth curve and the fact that we "only" made

1.400% so far, since the last low at 3.000$, I believe that we can

still expect much higher price for Bitcoin this year.

But as you know it's not only about the price.

Wish you all a nice weekend.

Greetings

Jens

A thought experiment... 120k btc?Decided to dive deep into logarithmic charts for BTC for my own peace of mind.

What we are seeing quite clearly each cycle is that the angle from top to top is halving each time. We are also seeing a pattern from bottom to top in each cycle being roughly 0.619 times the previous angle from bottom to top. The effect of this is that we can accurately predict the angle from top to top and bottom to top in our current cycle! This gives us a realistic top marker as can be seen at around $120k. It also looks like this might take longer than initially thought.

Let me know what you think; could this be a realistic pattern or just scribblings of a mad man?

LINK/USDT Weekly Break-Out: Strong Momentum ExpectedLINK/USDT has made a new ATH today, beating last year's ATH with ease.

So where too now?

if we take a look at the weekly chart we can see a clear pattern here. This upward sloping channel has been holding strong for almost two years now, making LINK's crazy ride to the moon.

Realistically, the price will rise until it hits the upper trend line of the channel. That might be difficult to trade, so for the coming weeks I've marked the $30 resistance as the main target. If you're feeling fancy, ride this wave until it hits the trend line.

Happy trading!