Long-entry

BTC The best things come to those who waitWith everyone screaming long, 16k, ATH, Bull Run, Parabolic...

Pour yourself a glass of your favourite smooth bourbon on the rocks.

Sit back, zoom out and slowly take a sip.

There's no rush.

Just look at the volume profile.

Place your long orders below 5k.

The price should go a little lower than that for the entry of champions.

Check back next week.

Go enjoy your weekend.

If you don't subscribe to CryptoRhythms indicators, check them out.

On this chart is Dynamic RSI zones

Telegram: t.me

or check out the TradingView page for a whole suite of free or professional indicators

www.tradingview.com

BTC/USD monthly chart - the bottom is in!?BTC/USD looks to be potentially exiting the bear market. X marks the spot. This move could still take several weeks to months. Keep in mind that any monthly close outside of the range would be very bearish.

Blue triangle indicates the current range.

Green box is buy.

Red box is sell.

Blue line indicates major resistance.

This is a log chart.

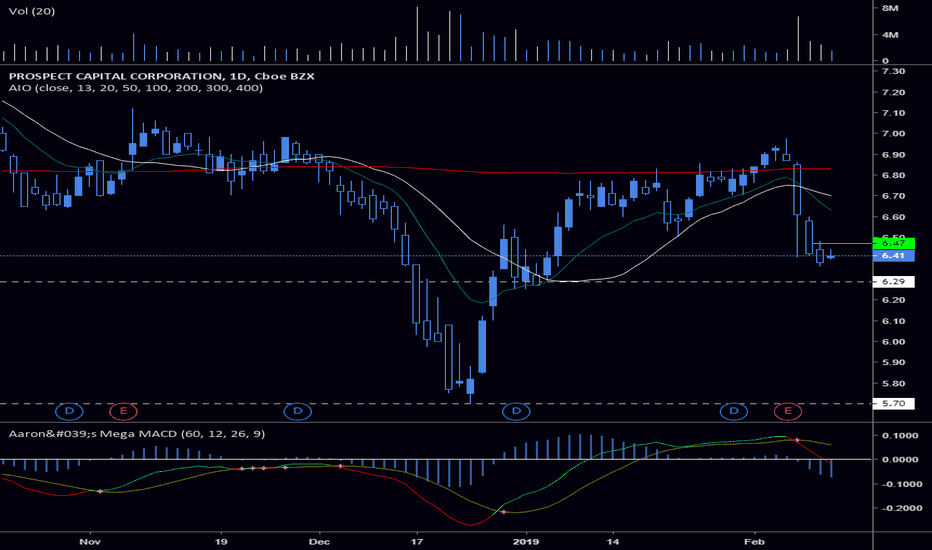

$PSEC long term dividend. This is one of my dividend holdings that I picked up on Friday (1,000 shares). It pays an 11% annual dividend, but also enjoys movements of quick bearish drops and equally quick recoveries.

Full details of this play at https://wingtrades.com!

My entry of 1,000 shares was at $6.47 on Friday, February 8, 2019.

ETC BTC XBT Long Entry Setup at .001 - .0011 ETCXBTKnowing BTC is finishing its move into the final leg E-wave of its bear flag continuation pattern, when BTC moves down to its previous yearly low around 3250ish/ ETC will also move to its yearly low- however will be in a great position to make a major move upwards.

Entry Long Limit order at these positions: .001/.00105/ .0011

SL: none/ only commit 5-20% to these positions/ If the price continues to drops then apply higher leverage and at to position up to .00089.

T1: .0014

T2: .0015

Hurricane Energy PLC - Too early to enter?This is my first post, so I'll keep it short.

My Impressions...

Fundamentally: Bullish. This company is expected to start pumping oil in early 2019. Keep an eye on oil prices.

Technically: After going below the 200MA on daily chart, I think there's strong potential to get a better entry so rather than illustrate a stop, I've attempted to include an accumulation zone in yellow.

My trade:

I'm long from 42.20 with only 10% of what I've set aside for this trade as I'm quite cautious when there's not really a strong Technical case to enter yet. If we move much lower I'll take the opportunity to lower my average cost.

Timeline:

Never can be 100% but I'm happy to sit back and see if I can improve my entry over the next few months.

Hmmmm just got alert for a green 2 trading over a green 1 on #ETLooks like we saw an aggressive 13 bout 7 days back, a completed Buy Setup on the 9 2 days back, cross on Fisher to signal bullish Price Flip day or two back, MACD preparing to converge, and pRSI coming above midway now into a bit oversold territory. Seems bullish to me, but we're not sure if this uptick across the Crypto-Verse is a solid movement or just a blip quite yet... We are trading into freshly switched to Resistance Kumo Cloud territory though... This would indicate potential downward pressure to suppress price, however this is the the type of situation were we could rise up and break through this resistance cloud like back in nov 2017, if we can get some positive steam coming into the market...

Gartley pattern failed with PIVX, but butterfly keeps me hopefulAs with PINK, the Gartley pattern we found with PIVX hit the stop-loss levels for those trades, but I was able to find near-perfect butterfly patterns in both cases after adjusting primarly just the X and D points of the Gartley patterns. Bitcoin -3.42% has hit a somewhat signficant 1.27 extension level, and I'm still hopeful of a triple bottom playing out based on a number of factors. Unless it breaks below $5900 I'll stay as optimistic as possible.

WEDGE UP OR DOWN?We've seen situations where it wedges up and it PUMPS or the classic break & retrace. I'd be more bullish on a downward wedge but, it LOOKS like we're gonna retrace a bit. Anything could happen and the market will do what it does. This is just one perspective of MANY possible outcomes. My level for entry is 6430~ but, ladder your stops and be sure to choose proper risk management. It's a rather huge wedge so if 6430 doesn't hold then, we gotta hope 6200 & 6100 hold.

NANO Long Very Good MetricsNANO looks very promising, we are in a strong support area, it has the lowest RSI and God Mode levels of all Altcoins I have observed, seems like a real strong buy in the current area.

Verge USD Bittrex entry and exitVerge performs nicely in anticipation of positive news to be announced on the 16/4 or 17/4.

On a 60min chart we can see that the price almost touched to top of the 2nd square. Therefore, I believe a correction to the bottom of the 2nd square is immanent which constitutes a possible entry point around 0.069 USDT.

Afterwards, and only if Bitcoin does not fall any further, a run up to the top of the 3rd square seems plausible where one could exit its position around 0.115 USDT.

Keep in mind that the short-term market trend seems unclear, hence posing higher risks.

No free lunch! How BTC pushes traders out..Do you sometimes get pushed out of a profitable position? Do you see the market coming back to your breakeven stop, only to then continue going in "your" direction?

The market is doing this constantly, so be aware of this. I will show you two areas where this has happened yesterday.

Traders often do get no "free lunch", which means a riskless profit. After the trade entry, you may have a nice profit but then see prices turn against your position.

Of course you do not want a profitable position to end up in a loss, so you move your stop to breakeven at some point.

Is there a solution to this dilemma?

Yes, you can exit a good position at a reasonable target, giving up more profit potential.

Or you can leave your stop in its original place and risk taking a (small) loss, but stay in your position which can still become very profitable (again).

Yesterday there where two examples of this "breakeven stop hunting":

1. The "breakout" longs

In the chart I marked the breakout area (red box), where traders entered long, after prices went above resistance levels at 7550 to 7930. Not a bad decision, prices went up to hit the resistance at 8400, nice profit.

Traders who hoped it would go higher still, like 9000, of course stayed in position and may have moved their stops to breakeven. But now BTC turned down and made several legs back to 7550. So now the bulls all have seen their stop hit, and what happens? Right, it goes up 1000 points!

2. The "early" shorts

Aggressive short traders may have entered below the resistance at 8400 when they saw the market showing weakness there. In the blue box you can see the short entry levels between 8400 and 8100.

After seeing a little profit the market then goes up again to 8400, hitting stop loss or breakeven stops of these shorts. Now of course it goes nearly straight down where everybody thought it was going (7800-7600).

After all this there was a nice long entry:

The long entry (blue circle) also was created by a short trap below 7800, which looked like this:

People saw the short term downtrend and break below support at 7800 (former resist).

Then a pullback from 7550 to 7800. When prices turned down below 7700 again, some traders would think bearish and short ("Hey, double top and strong downmove, we are going to 6200 again.")

Now the bear trap strikes, presenting a long entry:

The market makes a second entry long (second push up from 7600).

Stops of shorts are being hit and drive prices up, not looking back to this level (7800)!

Now how could you have anticipated something like that?

Think about a possible range, because prices are moving above and the below the EMA.

Think about the breakeven stops of the longs (see above my point 1). Longs are out and so the market is "free" to go up again. Longs might have to buy in again.

Think about another leg up (second big leg) and a new high.

As you can see, Bitcoin moved up to the upper side of the range in two equal legs and also made a new high!

Feel free to post questions or PM me! Or just follow me ;)

Great entry to go long on DNT!Really nice chart. This coin had its pump and was then dumped and is now back for business (lol). Anyway, volume is descending whilst the price is making higher highs which is a bullish sign. Marked possible resistance levels with the blue line. Don't take the yellow line for granted it's just there to visualize things. In fact, we will probably see a more sideways chart.

But the point is that this looks like the perfect entry to go long on DNT. They have a very active and transparent team.

XMRUSD 1H CHART MONERO ENTRY SIGNAL - SHORT-TERMMonero bounced from uptrend.

And Stoch and RSI confirm good entry point. This is a R/R 1.88 which is acceptable. XMR is bullish but price near resistance. RSI has plenty of room bellow current level. Mid-term entry are safe over ATH, with higher R/R

WNZ

Get live updates and analysis of the cryptocurrency market: t.me

BCHBTC 3H CHART BITCOIN CASH MARKET CONDITIONSAfter the rally that started 8/17, BCHBTC pair found back support at 0.1385 and 0.1576 (which is 0.5 retracement).

Since this seems to be a bullish market, a break of downtrend line could lead back to ATH. However, market is in range conditions.

Consider MA20 just crossed below MA50, which is a bearish sign.

WNZ

Get live updates and analysis of the cryptocurrency market: t.me

PAYBTC 4H CHART PAY ENTRY SIGNAL

PAYBTC on a rising channel, bouncing from uptrend line. a confirmed break of downtrend could lead to new ATH, but more concervative TP levels can be found along upper line of the channel and previous resistance levels.

WNZ

Get live updates and analysis of the cryptocurrency market: t.me

NEOBTC 4H CHART NEO ENTRY SIGNALNEO is currently on a bullish rally. And in short-term consolidation forming a symetric triangle.

Current levels are above historic uptrend (light-yellow), but still there is possibility for short-term profit according to TA.

Entry/Exit/TP levels are shown in the assumption ATH at 0.01398 will break, this could lead to the next level near 0.0187 with a R/R of 2.87.

If price does not break ATH, then this R/R gets reduced to 0.87.

Entry can be confirmed with MA20 cross and MACD heading towards signal.

A MACD cross would give you a higher entry level but perhaps less risky.

WNZ

Get live updates and analysis of the cryptocurrency market: t.me