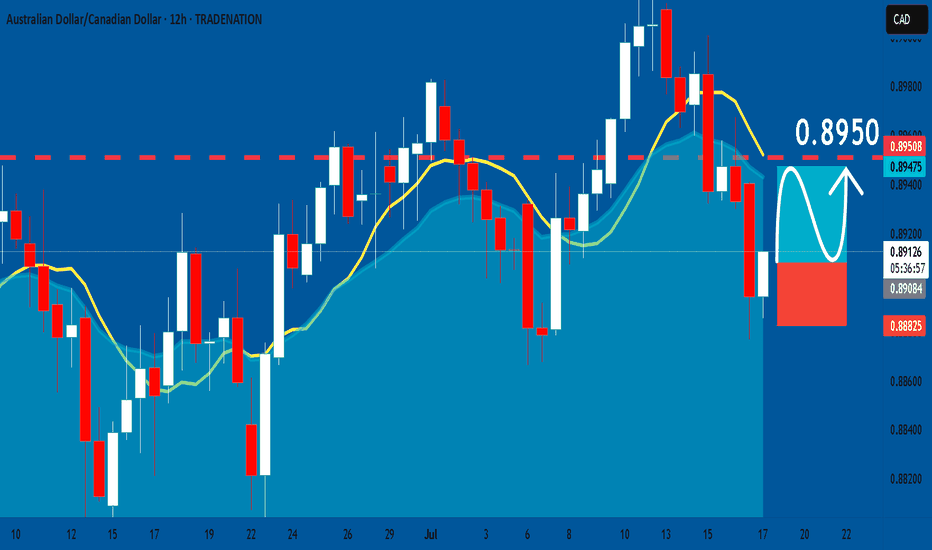

AUDCAD: Long Signal Explained

AUDCAD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long AUDCAD

Entry - 0.8908

Sl - 0.8882

Tp - 0.8950

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

LONG

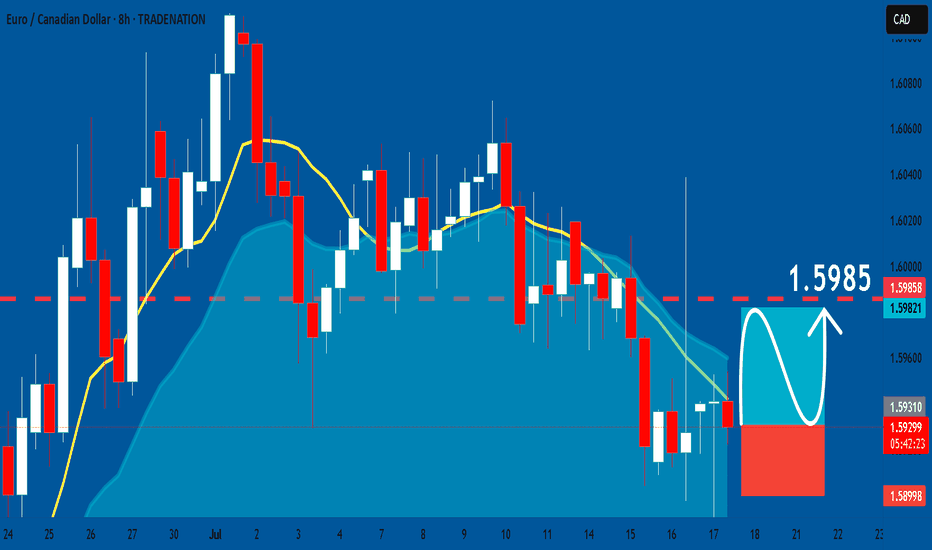

EURCAD: Long Signal with Entry/SL/TP

EURCAD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURCAD

Entry - 1.5929

Stop - 1.5899

Take - 1.5985

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

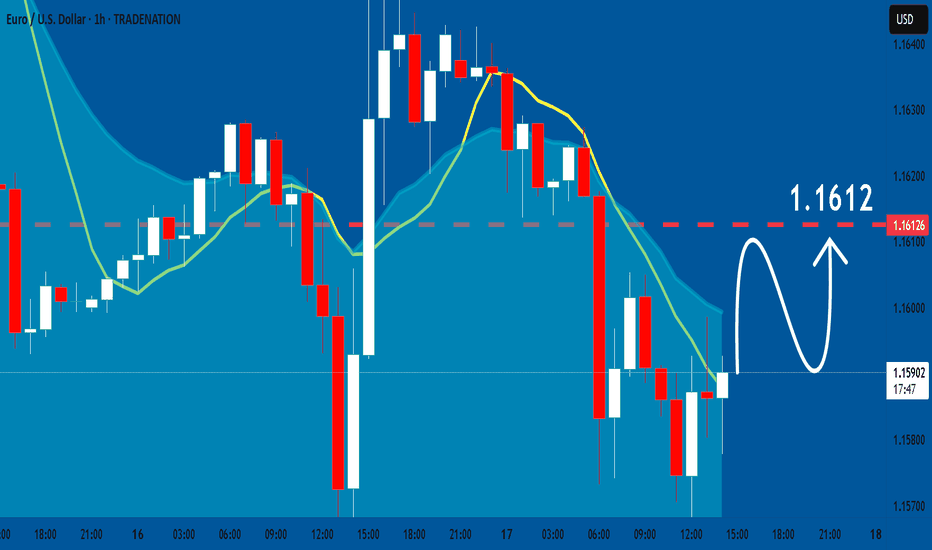

EURUSD: Bulls Will Push

Balance of buyers and sellers on the EURUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

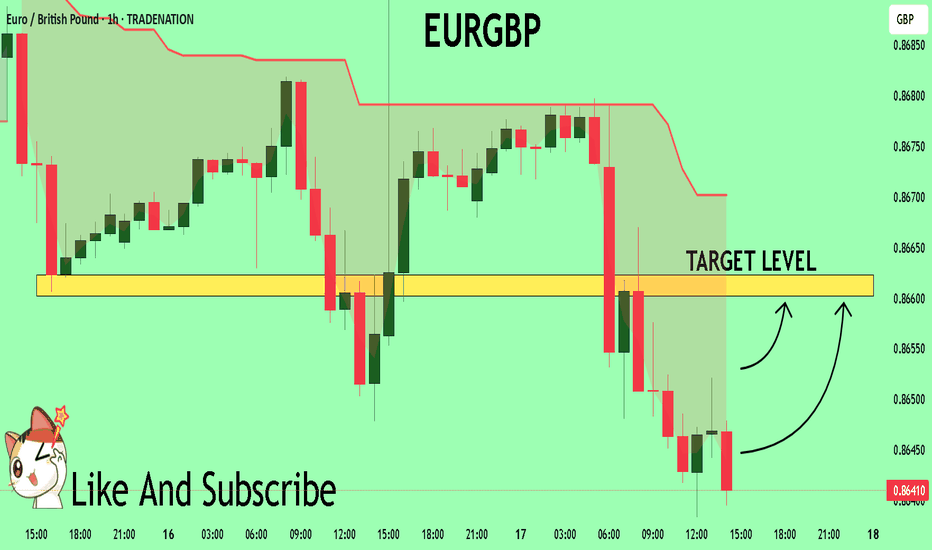

EURGBP Trading Opportunity! BUY!

My dear friends,

My technical analysis for EURGBP is below:

The market is trading on 0.8645 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.8660

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

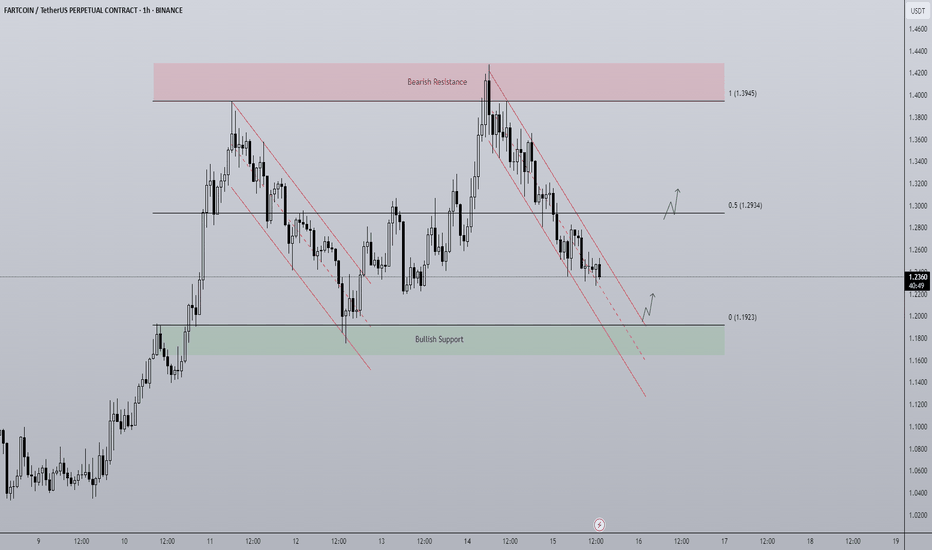

Fartcoin - Rangebound repeat? A BTC makes new highs attention has turned towards altcoins to play catch up.

FARTCOIN has been a top performer of the last month and currently on the 1D timeframe finds itself in a rangebound environment capped between $1.1923 - $1.3945. The end of last week price trended down in a bearish channel from top to bottom and it looks to be doing the same currently. As the supply zone above the range high got swept, price printed a SFP getting back inside the range and began trending down, for me there are two actionable long entries here:

- A range low bounce + breakout of trend channel would be an ideal long entry. An area of clear support coupled with a breakout is a historically strong setup with a clear invalidation if price breaks below the range and gets accepted.

- A more aggressive but potentially less ideal setup would be a breakout of the downtrend before hitting range lows. Higher risk as the level of support is not as defined but in the more risk-on environment crypto is currently in, the chance of major support levels being front run does go up as buyers become more impatient when FOMO grows.

The midpoint is key level to look out for too as a reclaim would mean a run at the highs, rejection opens the door to retest the lows.

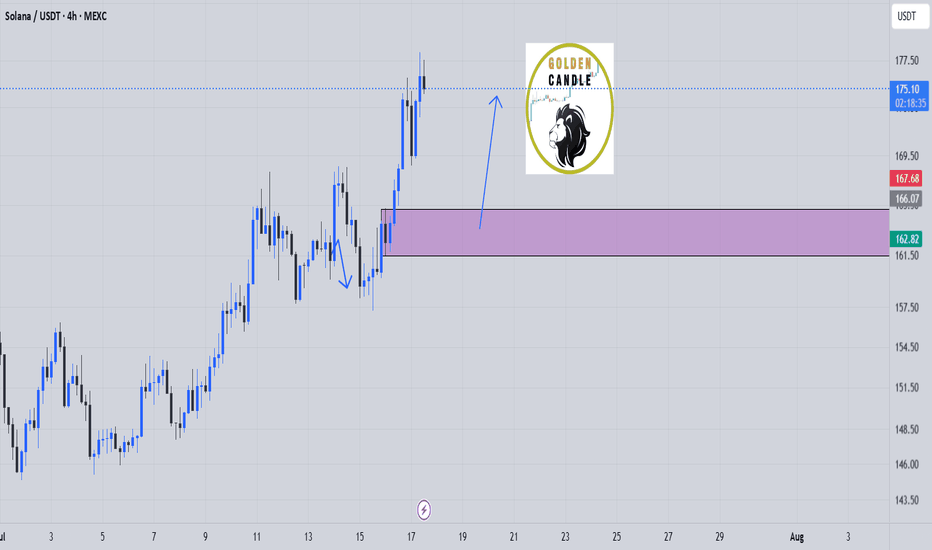

sol buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

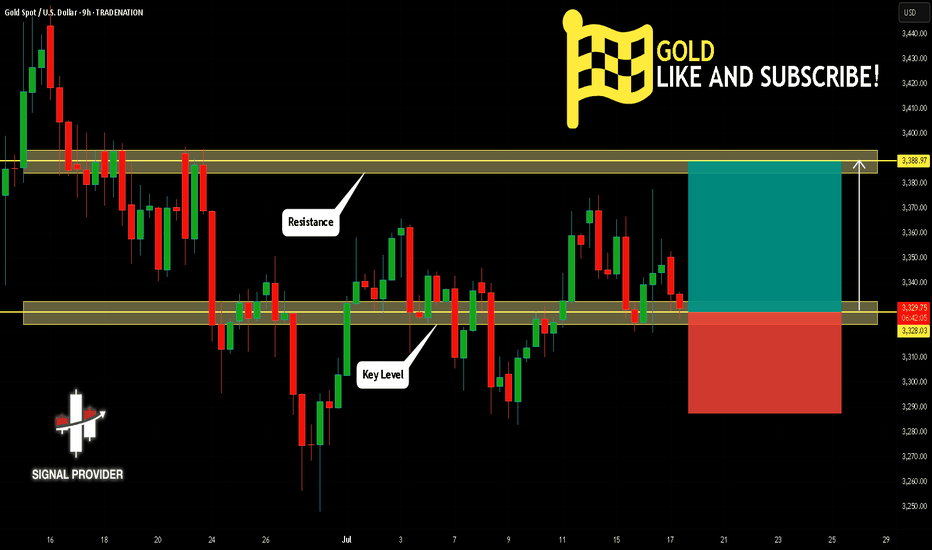

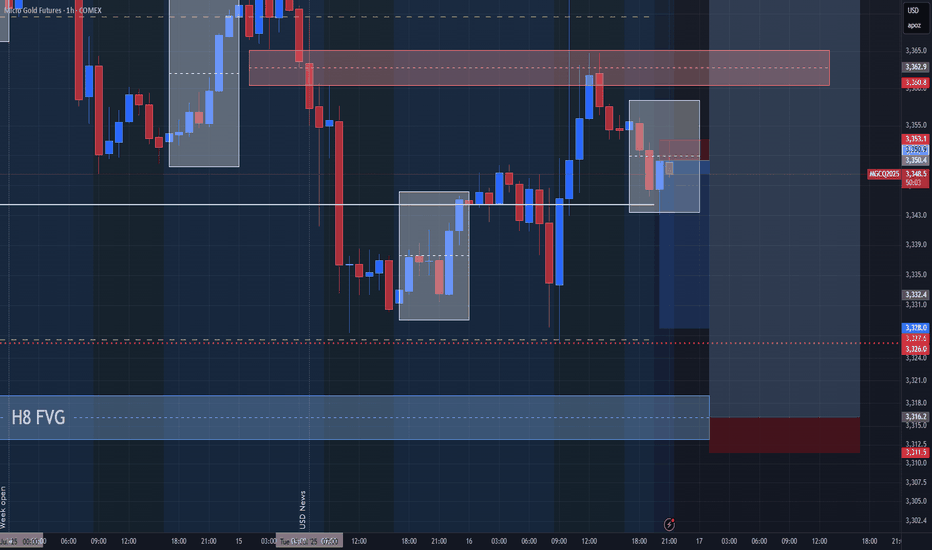

GOLD Is Very Bullish! Buy!

Please, check our technical outlook for GOLD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 3,328.03.

Considering the today's price action, probabilities will be high to see a movement to 3,388.97.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

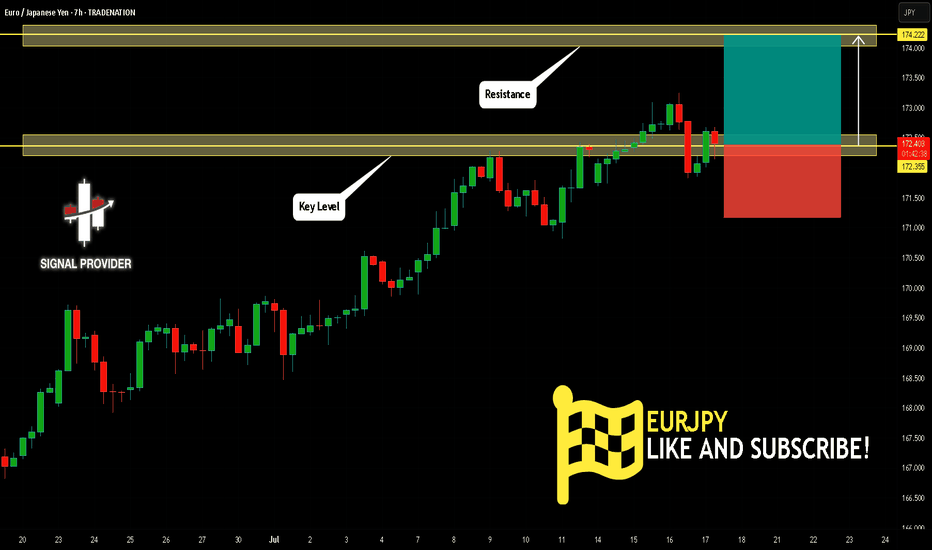

EURJPY Is Going Up! Long!

Here is our detailed technical review for EURJPY.

Time Frame: 7h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 172.355.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 174.222 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDCHF Will Grow! Buy!

Take a look at our analysis for AUDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.519.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.534 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

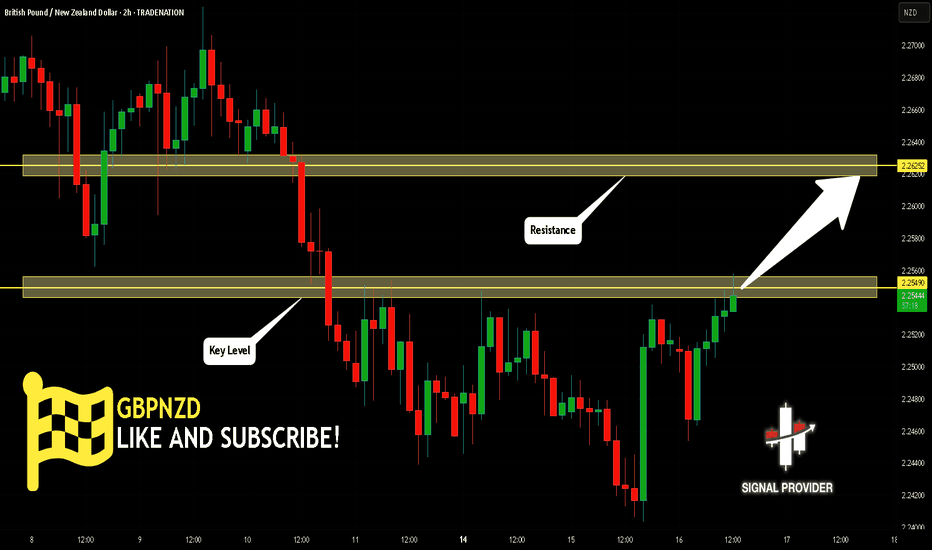

GBPNZD Is Bullish! Buy!

Here is our detailed technical review for GBPNZD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 2.254.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 2.262 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

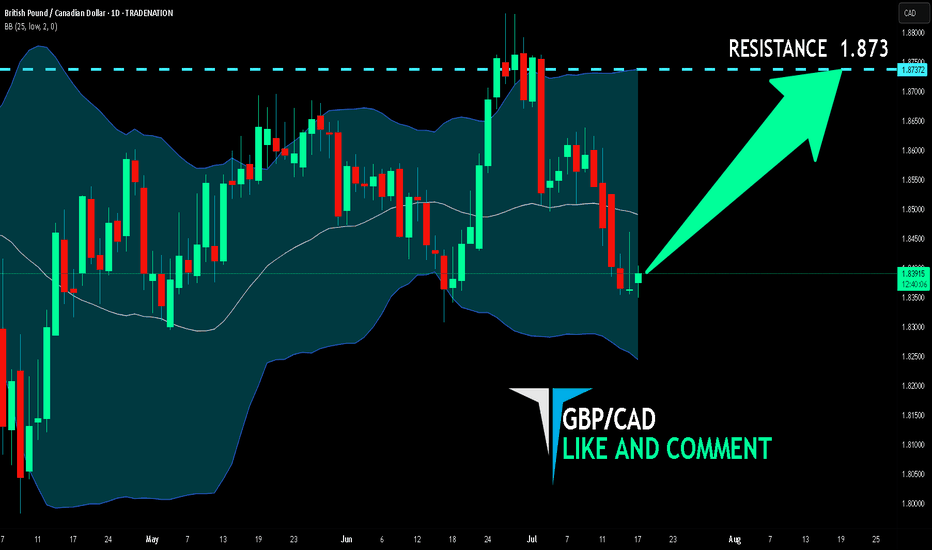

GBP/CAD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

We are now examining the GBP/CAD pair and we can see that the pair is going down locally while also being in a downtrend on the 1W TF. But there is also a powerful signal from the BB lower band being nearby indicating that the pair is oversold so we can go long from the support line below and a target at 1.873 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

#009: EUR/AUD Long Investment Opportunity

We placed a buy limit order at 1,776, waiting for a bearish spike that would allow us to enter alongside the institutions, not against them.

Why this entry?

🔻 We're waiting for a false breakout at 1,776, a key level where big players are accumulating liquidity with technical stop hunts.

🔐 The SL is below the levels where banking systems have protective orders for the future.

📊 Retailers are still heavily short and aren't exiting, confirming that the upside movement hasn't started yet.

📈 Open interest shows anticipation of an imminent breakout, with progressive loading by large players.

⏳ We're staying out now to avoid being victims of the retracement, but ready to enter on the institutional bearish spike.

A violent expansion toward 1.79, with a directional candlestick that will start as soon as the retail cleanup below 1.776 is completed.

The trade has all the hallmarks of a perfect institutional entry: early positioning, patience, and a defensive stop.

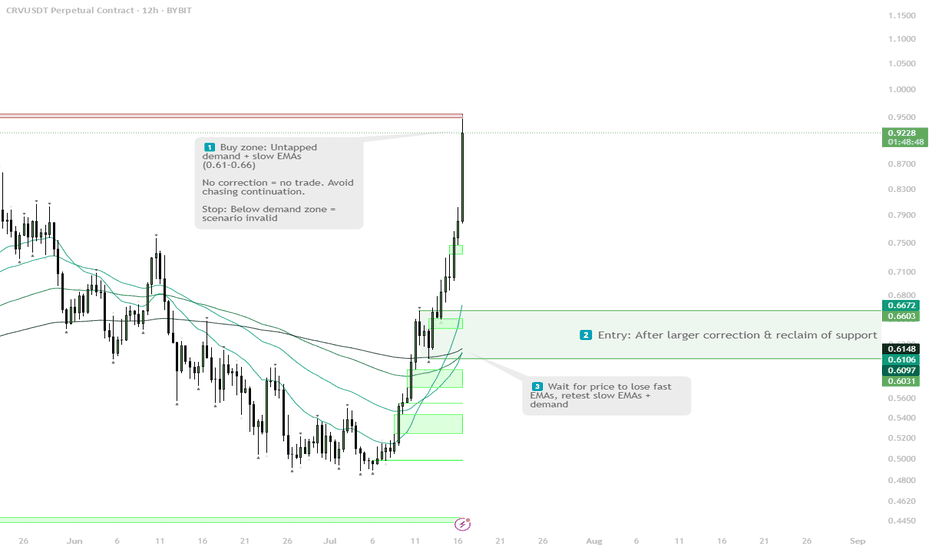

CRV - Two Scenarios for Strategic Spot BidsBINANCE:CRVUSDT

No FOMO, two clean entries.

Sweep S/R and reclaim EMA 200 — first trigger for spot longs. Equal lows at $0.61 — magnet for liquidity.

Deeper flush to demand = main buy zone ($0.40–0.56).

Stops under main demand.

Plan simple: let the market pick the entry for you.

CRV Approaching Demand — Bottom Fishing in the $0.40–$0.49 Zone🎯 BINANCE:CRVUSDT Trading Plan:

Scenario 1 (Reversal from Demand):

Look for bullish SFP, engulfing, or reclaim in $0.40–$0.49 zone

If confirmed, long with first target $0.83

Tight stop below $0.39

Scenario 2 (Breakdown):

If $0.39 breaks decisively, step aside — risk of new lows

🔔 Triggers & Confirmations:

Enter only with clear bullish trigger on LTF (H1/H4)

No trade if price grinds below $0.40

📝 Order Placement & Management:

🟩 Buy Zone: $0.40–$0.49 (alerts on wicks into zone)

🛡️ Stop: Below $0.39

🎯 Target: $0.83

🚨 Risk Warning:

Only bottom fishing with confirmation — avoid knife catching

CRV Range Reclaim — Eyes on $0.70 After Classic Deviation Setup🎯 BINANCE:CRVUSDT Trading Plan:

Active Range Setup:

Long Trigger: Deviation and reclaim below $0.5585

Target: $0.70 (mid/upper range)

Stops: Below most recent deviation

Alternative:

If $0.47–$0.50 is swept, look for LTF reversal signals for a new long entry

No Macro Shift:

Stay in range-trading mode until daily/weekly close above $0.76

🔔 Triggers & Confirmations:

Play the range: long on deviations and reclaims, take profit at range high or $0.70

Reassess for higher timeframes only after $0.70–$0.72 or $0.47–$0.50 is hit

🚨 Risk Warning:

Don’t chase mid-range — entries are only at extremes or after deviations

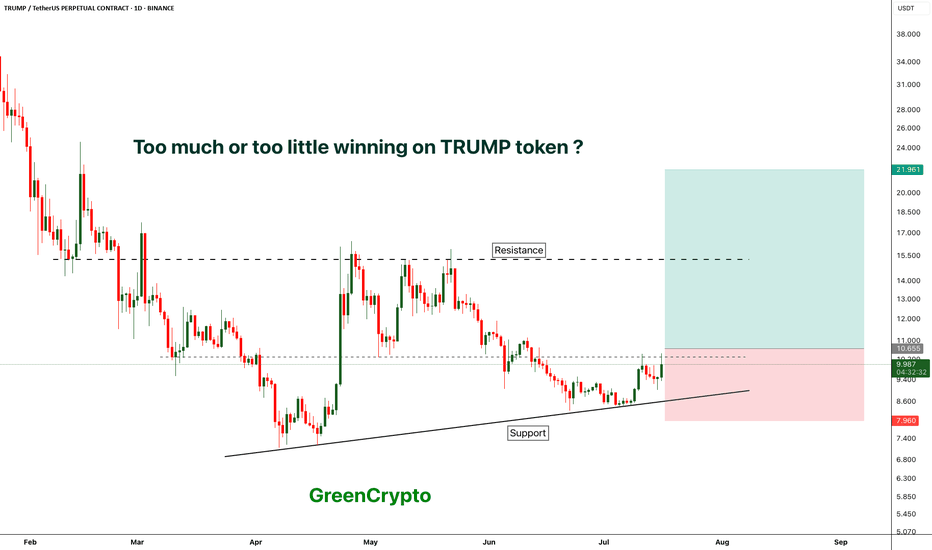

TRUMP - TOO MUCH WINNING ?Trump token is finally seeing some greens after hitting the bottom

currently price is trading near the local resistance.

We have long trade opportunity if the candle closes above local resistance.

Entry Price: Above 10.655

Stop Loss: 7.9

TP1:12.592

TP2: 15.218

TP3: 21.843

TP4++: Keep 20% of the position running with trailing stoploss.

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

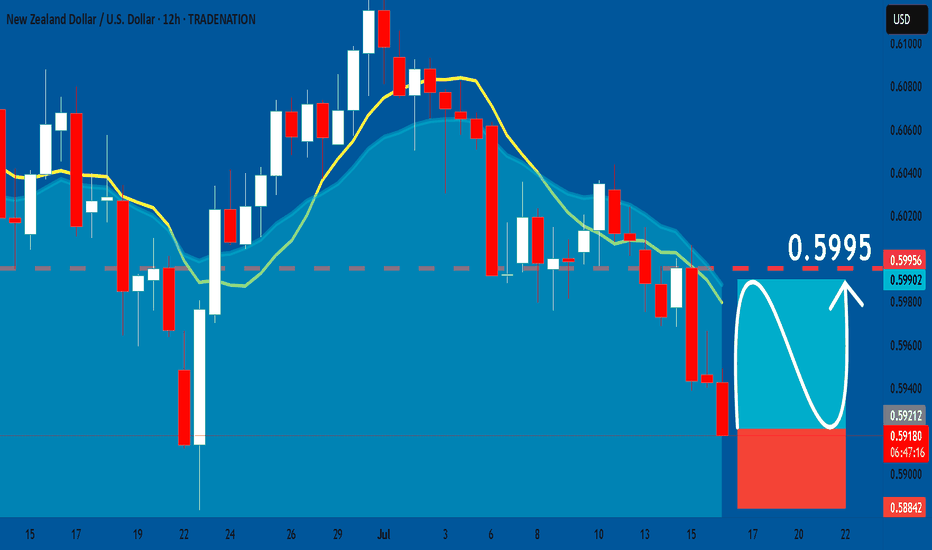

NZDUSD: Bullish Continuation & Long Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.5922

Stop Loss - 0.5884

Take Profit - 0.5995

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Euro may fall to support area and then start to growHello traders, I want share with you my opinion about Euro. The price previously moved inside a wedge formation, where it tested the buyer zone and showed a strong reaction from this area. After that, the pair broke out upward and started to trade inside an upward channel, building momentum and forming a clear bullish structure. Later, the price created a pennant pattern, often considered a continuation signal. But before continuing the upward trend, I expect the Euro to first exit from the pennant and decline toward the support area. This zone was previously resistantce, and now it may turn into a strong support. Now the price is trading near the pennant resistance, but I don’t expect a breakout right away. The market needs to correct before it resumes the uptrend. Once the price reaches the current support level or slightly lower, it may find demand again and bounce. That’s why I expect the Euro to retest the support zone and then grow further toward TP 1 - 1.1850 points. This target aligns with the upper border of the upward channel and would complete the continuation move after the pennant breakout. Given the previous structure, bullish momentum, and patterns on the chart, I remain bullish after the correction and expect the price to rise from the support zone. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

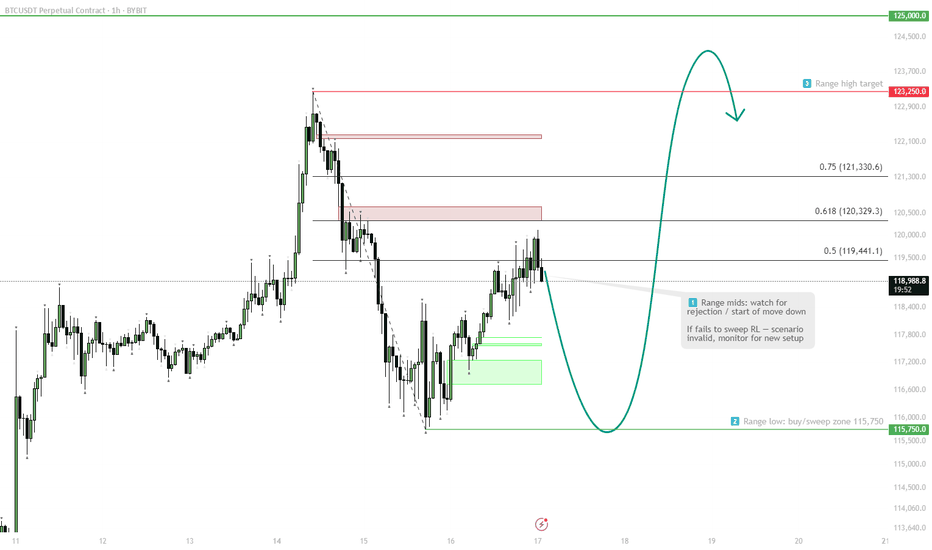

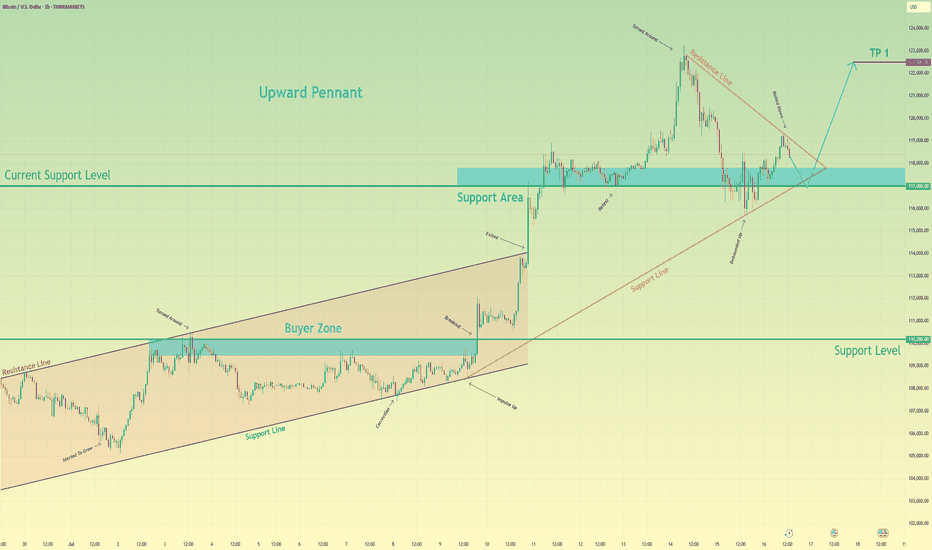

Bitcoin may exit of pennant and then rebound up of support areaHello traders, I want share with you my opinion about Bitcoin. Earlier, the price was moving inside an upward channel, respecting both the resistance and support boundaries. After reaching the buyer zone (110200–109500 points), BTC made a strong impulse up, breaking out of the channel and entering a new phase of growth. This breakout led to the formation of a bullish pennant, which often signals a continuation of the uptrend. Right now, the price is testing the support area between 117000 and 117800, which previously acted as a breakout zone and now serves as a current support level (117000). The structure shows that this level has already worked as a rebound zone multiple times. In my opinion, BTC may continue the correction toward this support area, potentially exiting the pennant to the downside for a short-term pull-back. After that, I expect a new upward movement, targeting the next local high. That’s why I set my TP at 122500 points, which is just below the recent ATH. Given the impulse move, strong support zone, breakout from the channel, and the bullish pennant pattern, I remain bullish and expect BTC to resume its upward trend soon. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.