GBPJPY Will Go Up! Buy!

Please, check our technical outlook for GBPJPY.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 197.240.

Considering the today's price action, probabilities will be high to see a movement to 198.091.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

LONG

USDCAD Will Move Higher! Long!

Take a look at our analysis for USDCAD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.368.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.373 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Will Grow! Long!

Here is our detailed technical review for USDCHF.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.796.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.804 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

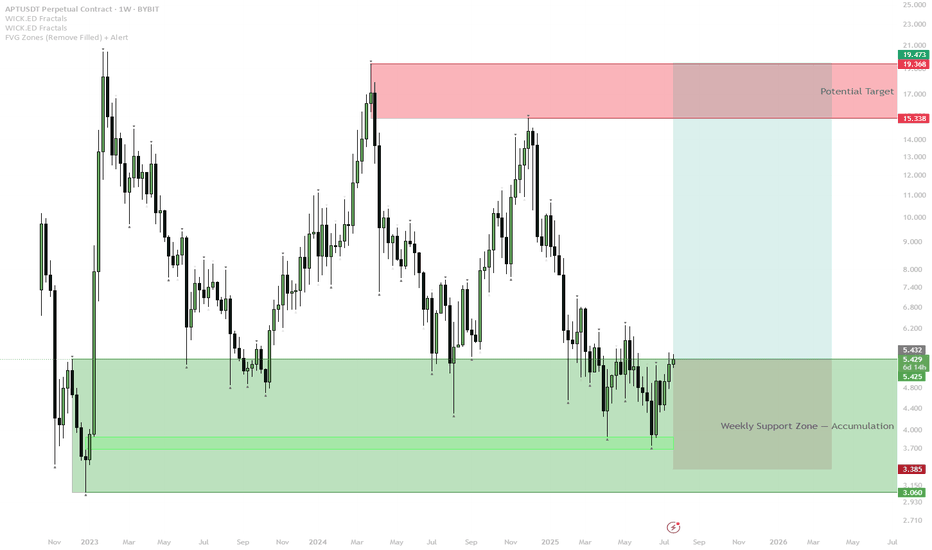

APTOS Weekly Bottom Formation — Early Signs of Reversal

APT has retested and held the long-term weekly support zone (green box) multiple times, confirming strong demand and buyer defense.

Current price action is pushing off the support with a series of higher lows, suggesting the start of a new bullish cycle.

Scenario A (Bullish):

— If APT holds above $5.40 and weekly closes stay above this green zone, expect gradual momentum toward the $15–$19 resistance (red box).

— First target is $15.30, with extension to $19.50 if trend accelerates.

Scenario B (Invalidation/Bearish):

— If price fails to hold $5.40 and breaks back below $3.40, setup is invalidated. In this case, expect retest of lower support at $3.00 or lower.

Aptos is showing a classic bottoming structure on the weekly timeframe, with clear accumulation at major support. Sellers have repeatedly failed to break the lows, while buyers step in on every dip. This increases the probability of a mid-term reversal toward the upper resistance band. Weekly structure remains bullish above support; only a major breakdown below $3.40 would invalidate the scenario.

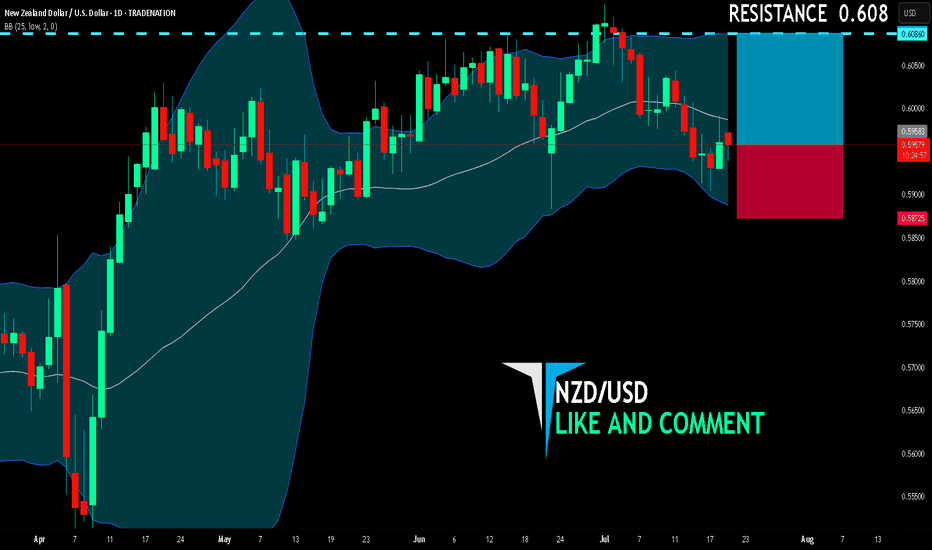

NZD/USD BUYERS WILL DOMINATE THE MARKET|LONG

NZD/USD SIGNAL

Trade Direction: long

Entry Level: 0.595

Target Level: 0.608

Stop Loss: 0.587

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

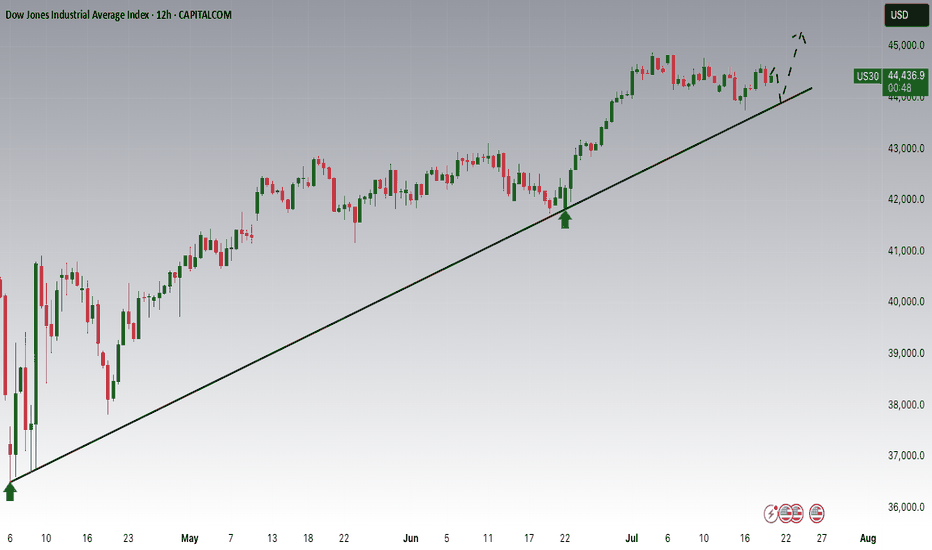

Dow Jones is Nearing an Important Support!!Hey Traders, in today's trading session we are monitoring US30 for a buying opportunity around 43,950 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 43,950 support and resistance area.

Trade safe, Joe.

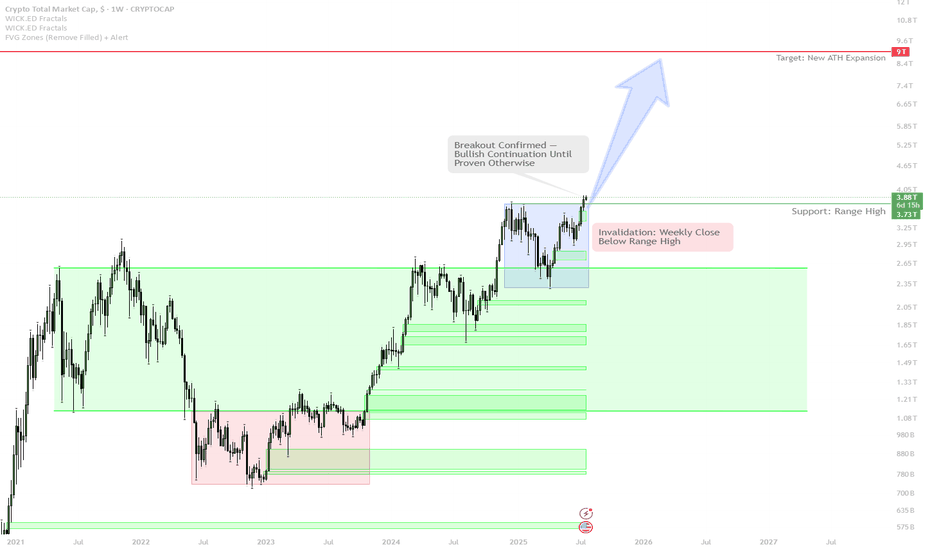

Total Crypto Market Cap: Weekly Breakout Signals Bull Run Contin

The weekly candle has closed above the key range high — this is a major bullish signal, similar to the breakout seen in early 2021.

As long as price remains above this breakout level, the scenario is a continuation uptrend — expect further expansion and strong price action.

If the market fails and closes back below the range high, the breakout will be invalidated — this would signal a potential range or pullback phase.

Current strategy is to trade with the trend:

Hold spot exposure and add on confirmed breakouts.

Do NOT short without a clear breakdown and structure reversal.

If a failed breakout occurs (weekly candle closes back below range high), take profit quickly and switch to risk-off mode.

Market psychology: Most buyers hesitate at lows, but FOMO after a strong move is classic. The disciplined approach is to buy the setup, not the hype.

This is a textbook technical breakout with historical precedence for explosive upside. As long as Total Market Cap holds above the range high, the path of least resistance is up. Attempting to fade the breakout is risky unless there is a clear weekly close back below the level. Trend continuation is favored until proven otherwise. The correct approach is to stay with the trend and manage risk only if a breakdown occurs.

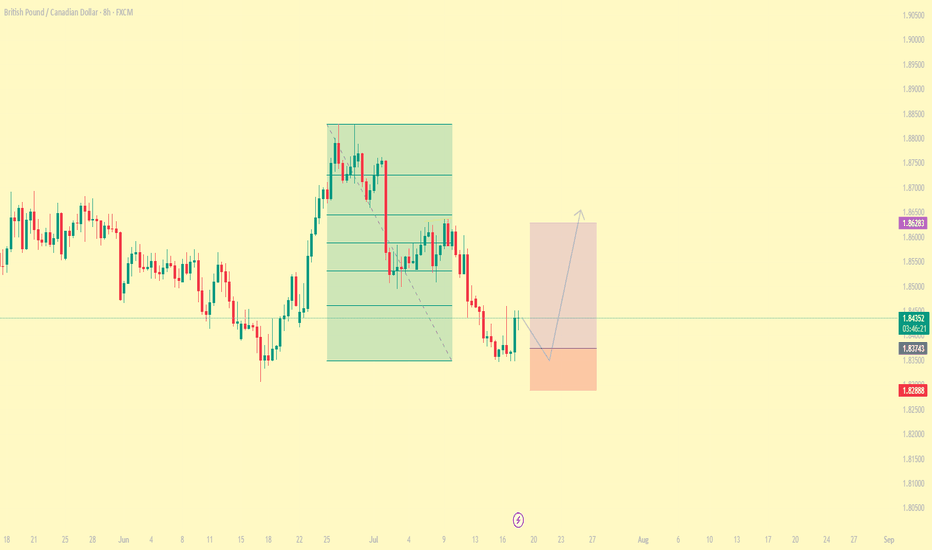

#011: Long Investment Opportunity on GBP/CAD

After weeks of compression, GBP/CAD is showing clear signs of institutional accumulation. The price recently released a false bearish breakout below 1.8400, followed by a reabsorption and spike with decreasing volumes: a typical "retail flush" structure.

Added to this are clear macro elements:

The pound is supported by a still-tight monetary policy, with the BoE maintaining a hawkish tone.

The Canadian dollar is suffering from declining oil expectations and the risk of a more rapid rate cut by the BoE.

📉 What happened?

The market attempted to "clear" the 1.838–1.840 zone with a rapid, unfollow-through bearish move. This behavior, combined with the Open Interest reading and retail positioning, suggests an institutional entry intention in the area between 1.8375 and 1.8365.

📈 Positioning

A Buy Limit was placed at 1.83740, with a wide Stop Loss at 1.82890, outside any visible hunting zone, and a Take Profit at 1.86280, where profit-taking has historically occurred on similar patterns.

🎯 Main motivations for long

Accumulation visible with stop-hunt below support at 1.8400

Net long GBP futures position

Retail short above 70%, a typical reversal signal

No significant volume obstacles until 1.8620

Psychological resistance already tested (1.846, 1.850)

⏳ Estimated timeframe

The setup could develop over several days, with the first movement as early as today (Friday) and completion by mid-next week. The intention is to follow the banking flow, without anticipating or reacting to emotional price movements.

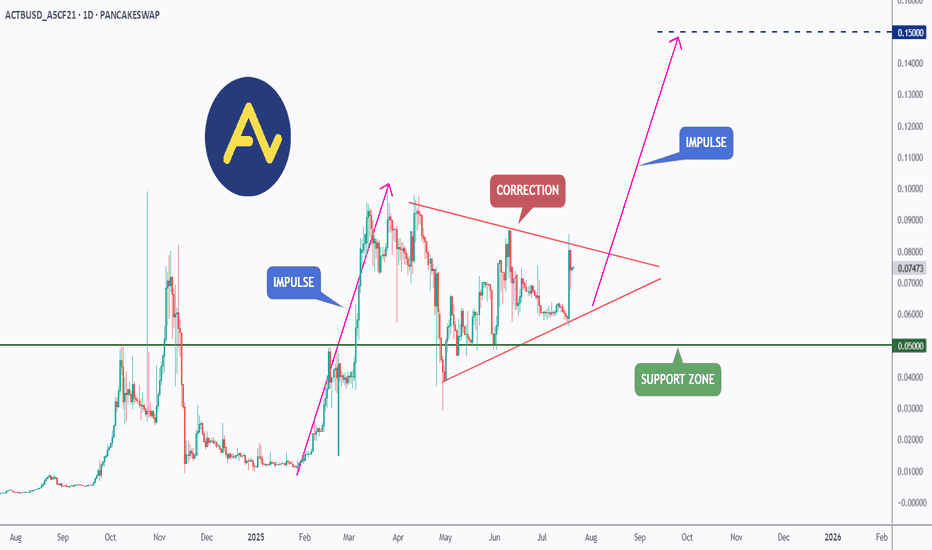

ACT (Acet) - Eyeing the Next Impulse Move?ACT has been forming a textbook bullish continuation pattern.↗️

After a strong impulse leg earlier this year, price has been consolidating within a symmetrical triangle, signaling a healthy correction phase.

🏹Today, ACT broke out of the triangle to the upside , indicating that bulls may be taking control once again.

📍If momentum continues, the next impulse move could push price toward the $0.15 resistance as a first target — a major psychological and technical level.

As long as the $0.050 support holds, ACT remains in bullish territory with upside potential in sight.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

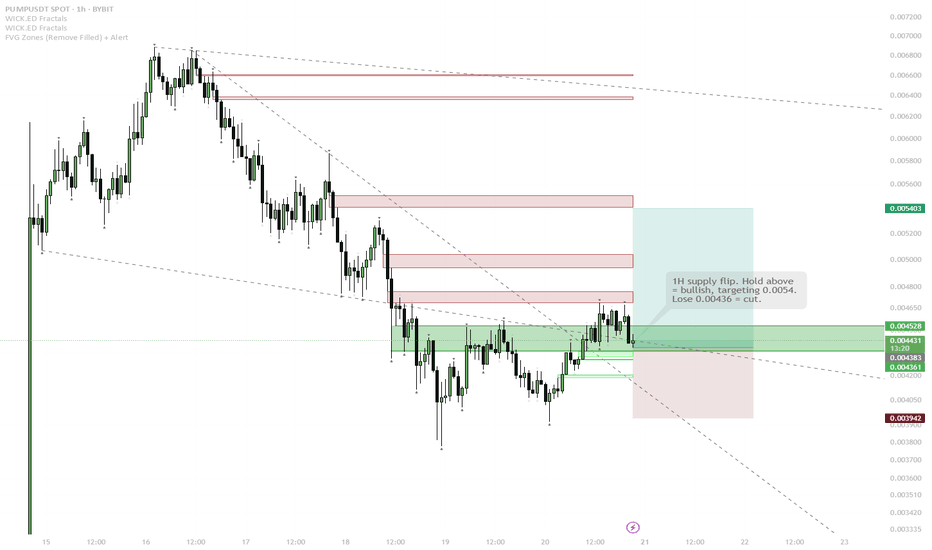

PUMP Trend Reversal – Testing 1H Supply FlipStep-by-step Price Scenario:

Price has broken the local downtrend and reclaimed the 1H supply zone, showing LTF strength.

Look for acceptance above 0.00445–0.00452 green zone for confirmation of the reversal.

If price holds above this zone, expect a move toward the next supply levels at 0.0048, then 0.0050, and 0.0054.

If price loses the green zone (close below 0.00436), scenario is invalidated—look for a retest of the previous lows near 0.00394.

Reasoning:

After a strong local downtrend, price has started to show reversal signs with a clear break and reclaim of the 1H supply zone. This area previously acted as resistance and now flipped to support, signaling the potential for a short-term rally. If buyers manage to hold above this new support, it would confirm the strength of the reversal and open up the path to test the next local supply zones above. However, failure to hold the reclaimed level (close below 0.00436) would invalidate this scenario and suggest the downtrend may continue. This setup is based on a classical supply/demand flip and early signs of bullish momentum on lower timeframes.

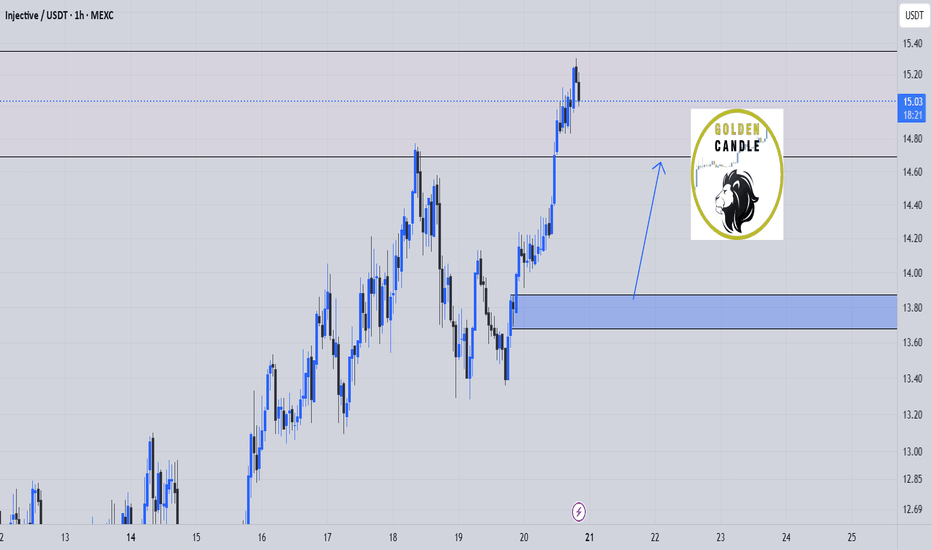

inj buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

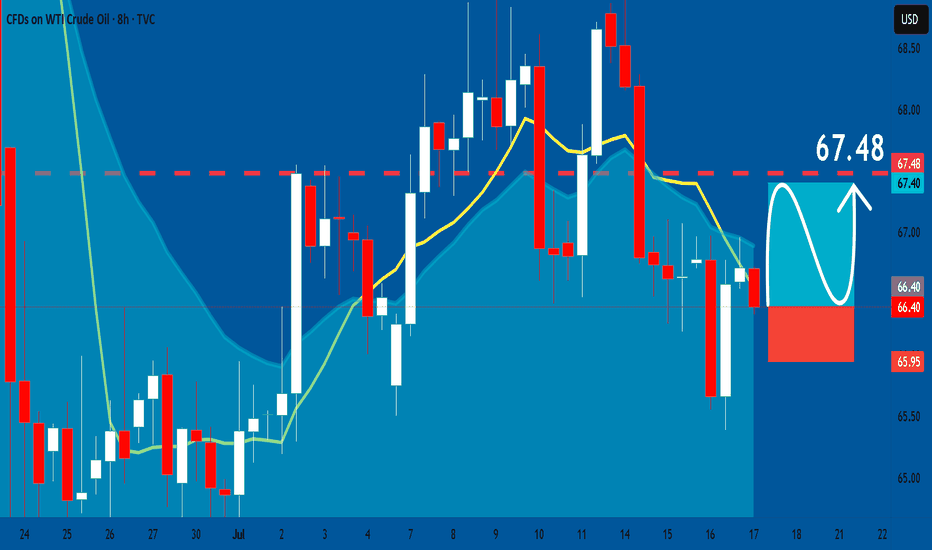

USOIL: Bullish Continuation & Long Trade

USOIL

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry - 66.40

Stop - 65.95

Take - 67.48

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

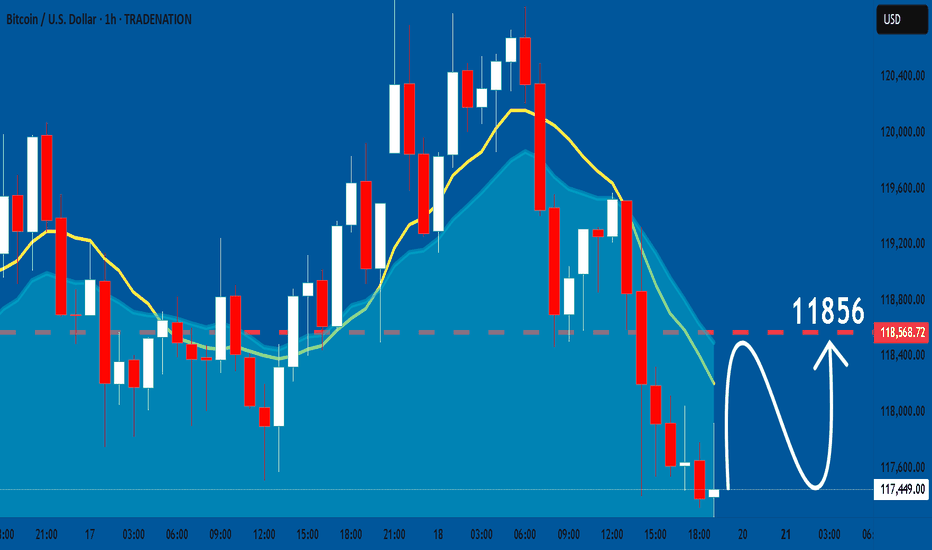

BTCUSD: Bullish Continuation

Looking at the chart of BTCUSD right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

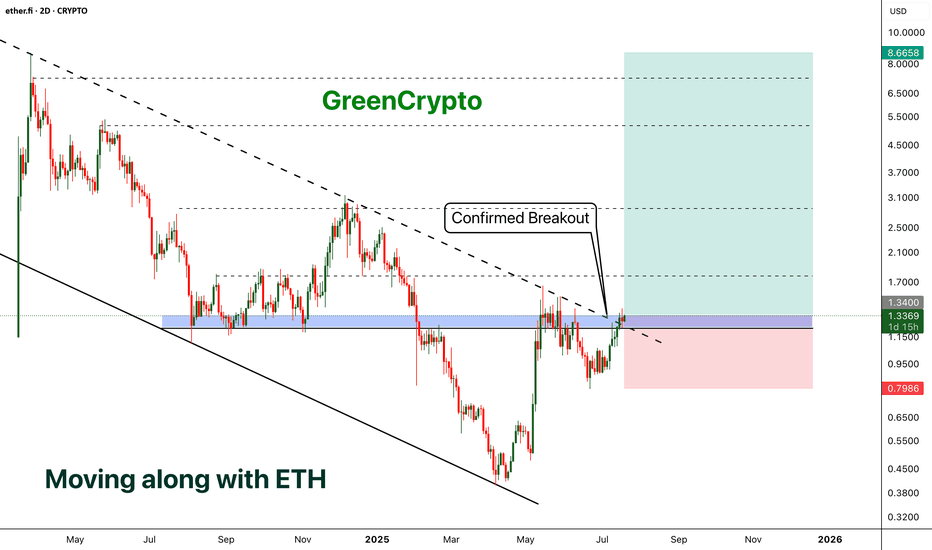

ETHFI - Moving along with the ETH- ETHFI has finally broken out from the descending channel pattern and now price is above the trending resistance line.

- We can expect a minor reversal (chances are less ) and parabolic move from here.

- I'm expecting at-least 500+% profit from this opportunity

Entry Price: 1.3384

Stop Loss: 0.7965

TP1: 1.7657

TP2: 2.5436

TP3: 4.5055

TP4: 5.6136

TP5: 8.5626

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

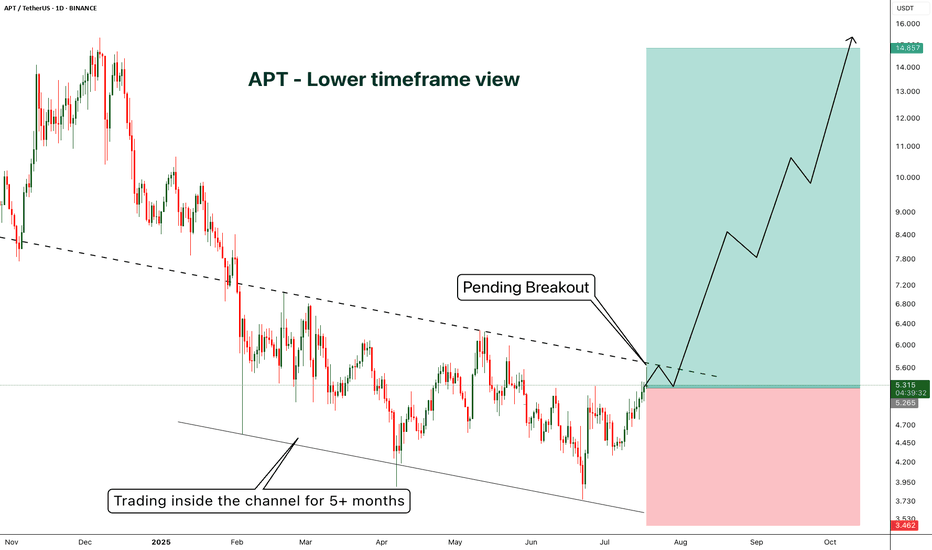

APT - A lower timeframe view - Breakout Entry- On 1D candle, APT is still trading inside the channel

- currently price is trading near the resistance and got rejected from the resistance as expected.

- I'm expecting few more candles near the resistance zone before breakout.

If we look at the higher timeframe (1W) view we shared earlier, there is huge potential for uptrend as we are expecting past pattern to repeat

if you are looking for a short term trade without focusing on weekly chart, this is a good opportunity

Entry Price: 5.313

Stop Loss: 3.462

TP1: 6.141

TP2: 7.270

TP3: 8.634

TP4: 10.583

TP5: 14.768

Don't forget to keep stoploss

Cheers

GreenCrypto

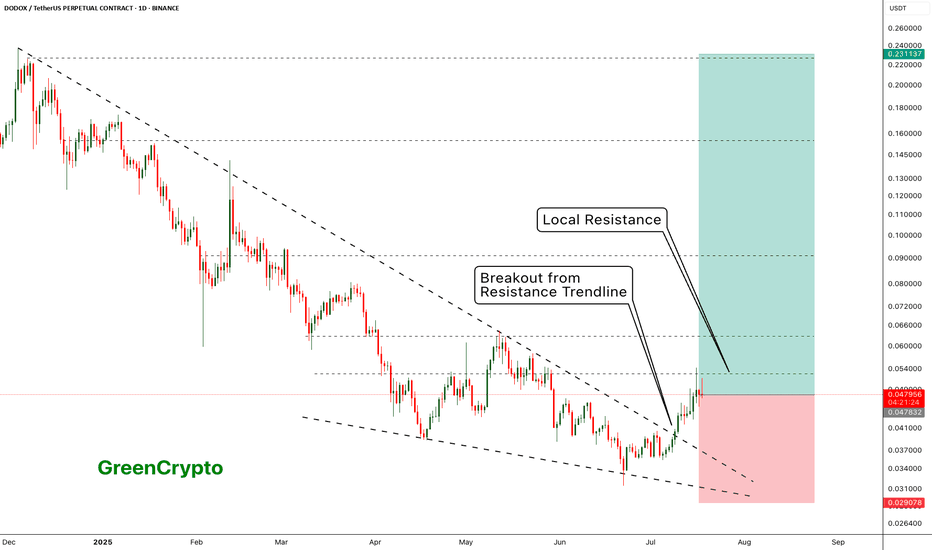

DODOX - Resistance is holding it back - Huge Potential- DODOX has successfully broken out from the resistance trendline

- Now its being pushed back back the weak local resistances

- I see a huge upward potential here.

Entry Price: 0.048271 ( Or you can wait for it breakout from the local resistance of 0.063051)

Stop Loss: 0.029078

TP1: 0.062621

TP2: 0.079766

TP3: 0.103243

TP4: 0.151853

TP5: 0.222332

Max Leverage 5x.

Don't forget to keep stoploss

Cheers!

GreenCrypto

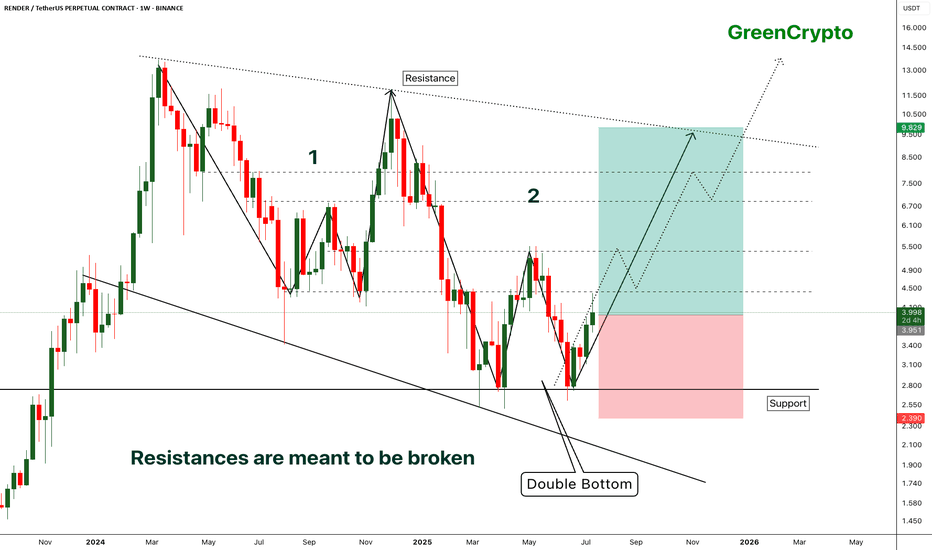

RENDER - [Double bottom] - Resistances are meant to be broken- RENDER has successfully bounced back from the support by forming the double bottom pattern.

- Double bottom pattern is bullish pattern, when it forms at the strong support it becomes extremely bullish. this is one of such scenario.

- Im expecting some minor resistance at the local resistance around 4.3

- A successfull breakout this local resistance will push the price further high.

Entry Price: 3.941

Stop Loss: 2.378

TP1: 4.413

TP2: 5.350

TP3: 6.887

TP4: 8.092

TP5: 9.810

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

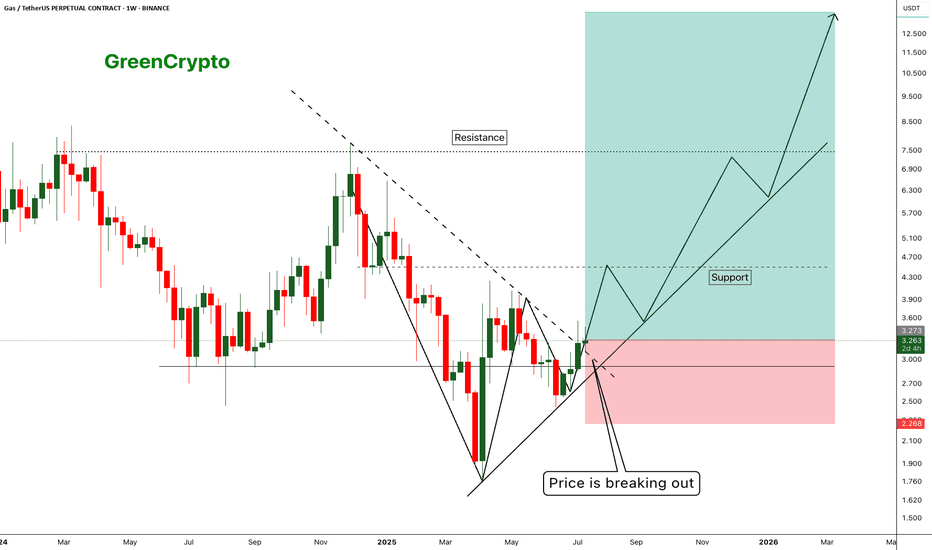

GAS - Huge Risk:Reward Trade 1:10 - Is there any Gas Left ?- Gas has finally managed to breakout from the resistance trendline and now trading just above the resistance

- I'm expecting this trend to continue along the support line shown in the chart.

Entry Price: 3.281

Stop Loss: 2.271

TP1: 3.944

TP2: 4.589

TP3: 6.775

TP4: 8.412

TP5: 13.512

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

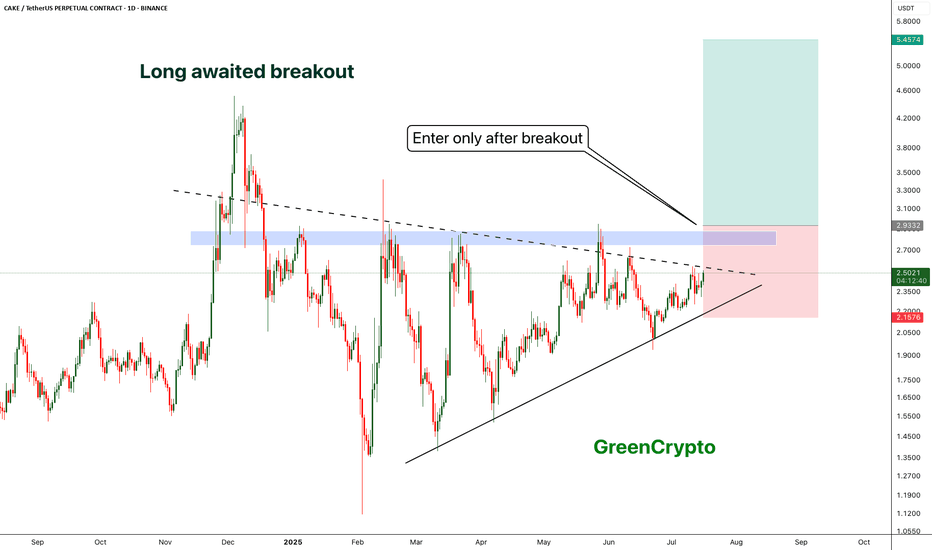

5$ is realistic target for CAKE- CAKE is trading inside the triangle since 2025

- now it seems like there is a possibility of breakout

- A clear breakout with decent volume would push the price towards 5$

- we will enter after the breakout

Entry Price: 2.9

Stop Loss: 2.15

TP1: 3.4371

TP2: 4.2671

TP3: 5.0083

Max Leverage 5x

Don't forget to keep stop loss

cheers

GreenCrypto

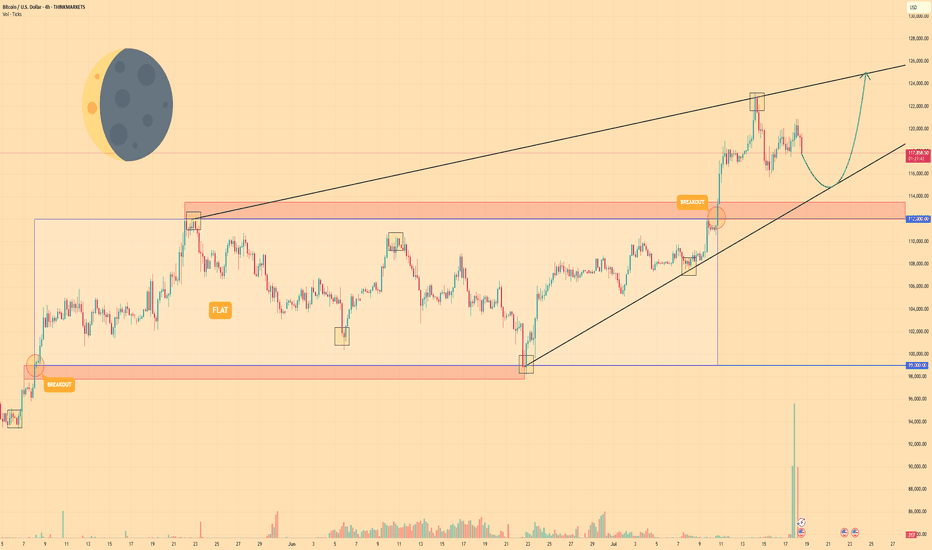

BITCOIN - Price can bounce up from support line to $125000Hi guys, this is my overview for BTCUSD, feel free to check it and write your feedback in comments👊

For a long time, the price was trading sideways inside a wide flat range between the $99000 support area and the $112000 resistance level.

After accumulating volume, bitcoin made a strong upward impulse and performed a breakout, pushing above the top of the flat.

Following this movement, the price action began to form a rising wedge pattern, moving between its clear support and resistance lines.

Recently, price tested the resistance line of the wedge and then started a predictable correction back down towards support.

Now, BTC is approaching the support line of the wedge, which aligns with the important horizontal support area around $112000-$113500.

I expect that the price can test this support line and then bounce up to the $125000 resistance line of the wedge.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

HelenP I. Gold will little correct and then rise to top of wedgeHi folks today I'm prepared for you Gold analytics. If we look at the chart, we can see a clear ascending wedge pattern that has been guiding the price action. The structure is well-defined by a lower trend line providing consistent support and an upper resistance line. I believe that the key area to watch right now is the support zone between 3310 and 3295 points. The logic is that after the recent push, the price may undergo a small, healthy correction to test this zone's strength. The condition for our bullish scenario to unfold is a successful hold of this support; a bounce or signs of buyer interest in this area would be the confirmation we are looking for. Once this condition is met, I believe that gold will have enough momentum to continue its upward movement within the confines of the wedge. Therefore, the main goal for this scenario is set at 3415 points. This target is not arbitrary; it directly coincides with the resistance line of the wedge, which represents a logical point for the current upward swing to conclude. If you like my analytics you may support me with your like/comment.❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

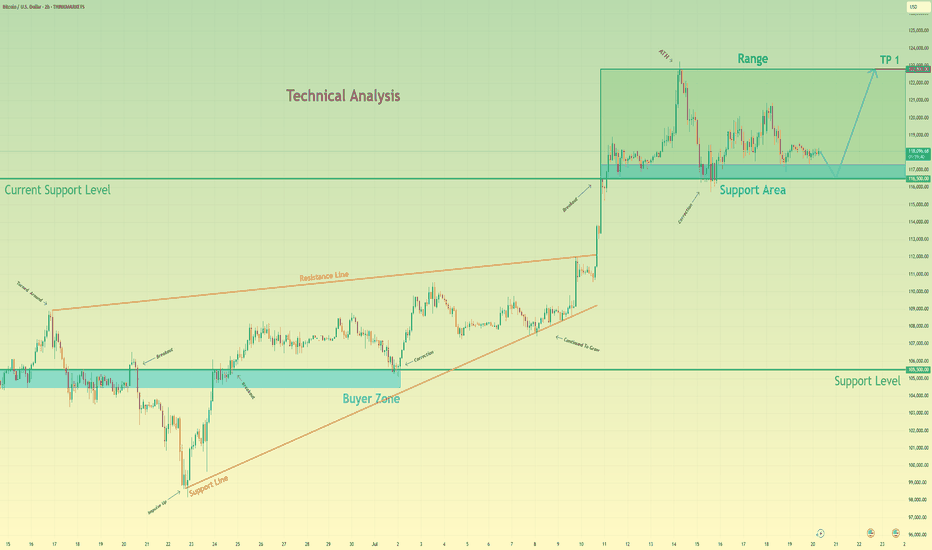

Bitcoin may bounce up from support area to 122800 pointsHello traders, I want share with you my opinion about Bitcoin. Analyzing the broader market context on the BTC chart, the past price action has carved out two significant technical structures: a wide trading range and a larger upward wedge pattern. The formation of this wedge indicates a generally positive market sentiment, though the narrowing price swings suggest a decrease in upward momentum. The foundation of the current structure was established around the buyer zone of 105500 - 104500, a level that has historically proven to be a robust floor. This historical behavior provides a critical reference for our hypothesis. Currently, we are observing bitcoin's price action closely, interacting with the current support area, located between 116500 and 117300. The character of the movement here is largely corrective and consolidative, pointing to a state of temporary equilibrium. This consolidation near the lower boundary of the wedge is a pivotal point. My thinking is that a final, brief dip to thoroughly test the 116500 - 117300 support area is a high-probability scenario. Such a move would effectively absorb remaining sell-side liquidity before a reversal. We can then anticipate an impulsive move upwards across the range. Therefore, the logical take-profit for this long position is set at 122800 points, as this level marks the upper resistance of the range and a natural target. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.